- Home

- »

- Specialty Polymers

- »

-

Specialty Chemicals Market Size & Share Report, 2030GVR Report cover

![Specialty Chemicals Market Size, Share & Trends Report]()

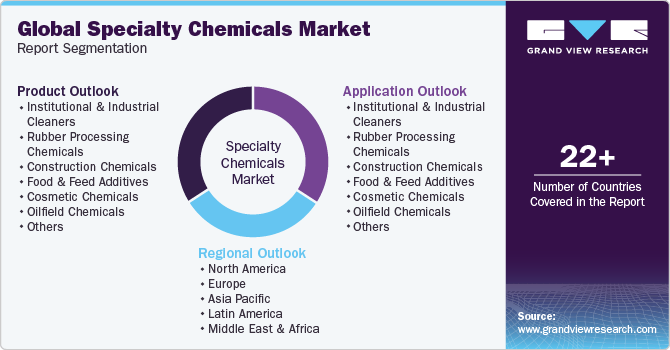

Specialty Chemicals Market Size, Share & Trends Analysis Report By Product (Institutional & Industrial Cleaners, Flavor & Fragrances, Food & Feed Additives), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-868-8

- Number of Pages: 125

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Specialty & Chemicals

Specialty Chemicals Market Size & Trends

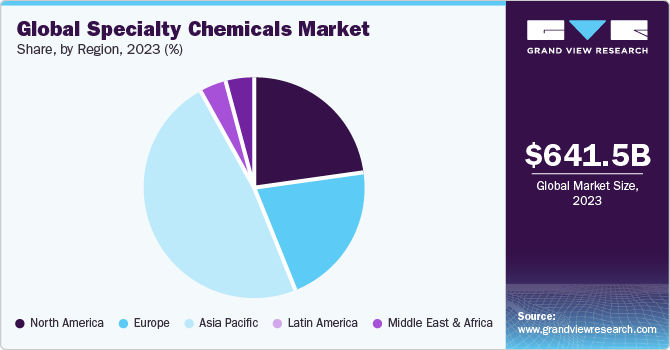

The global specialty chemicals market size was valued at USD 641.5 billion in 2023 and is anticipated to witness a compound annual growth rate (CAGR) of 5.2% from 2024 to 2030. This is attributed to growing demand for construction, water treatment, and electronics chemicals, along with advancements in process technology and trade liberalization. The growth is also attributed to growing demand from pharmaceuticals, food and feed additives, and flavors and fragrances, among others. The demand for flavoring agents has increased as processed food and beverages have become more popular in developed nations. Further, rising customer preference for novel flavors and fragrances in food products is estimated to contribute to the market growth.

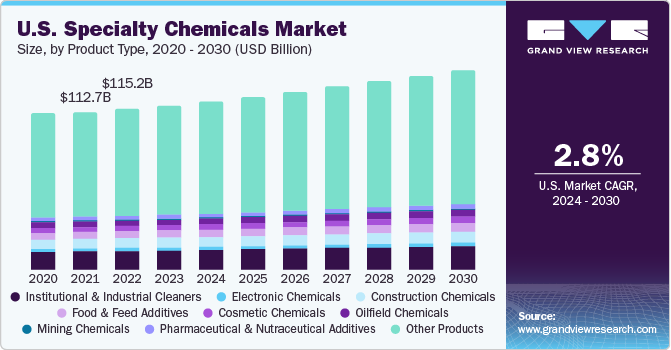

In U.S., the market is anticipated to witness notable growth over the forecast period. High opportunities for products are suspected from various end-use industries, including water treatment, automobile, and electronics. Growth in these industries is expected to have a positive impact on specialty chemicals market size over forecasted year Furthermore, rising demand for personal care products, detergents, as well as crop protection chemicals and cleaning products will fuel demand over forecast period.

European geopolitical conflict caused an increase in oil costs, which affected price of producing chemicals. Market for specialty chemicals is projected to be significantly impacted by rising oil prices. From the manufacturer’s viewpoint, impact of rising energy prices resulted in higher chemical prices and has somewhat eroded profits. The import and export of raw materials across regions, particularly in the European region, were impacted by supply interruptions, which in turn had an impact on the market as a whole.

Market Concentration & Characteristics

Market growth stage is high and pace of the market growth is accelerating. Specialty chemicals market is characterized by high research & development budget, thus players are consistently focusing on new product development. This keeps the degree of innovation in the market at moderate to high level. The specialty chemicals are function-specific products thus there is need of continuous innovation in this industry.

The market is characterized by moderate level of merger & acquisition activities. The market participants also focus on collaborations with other companies, universities and research institutes to develop a commercial product. Leading players are concentrating on merger of small companies, which deals with few products, this allows them to expand their client base as well as product portfolio.

The industry is highly influenced by the regulations from different government bodies. The concerns associated with harmful effects of chemical production has affected in demand for environment and user-friendly products. This has shifted the focus of conventional chemical manufacturers to development and promote the products, which have less impact on the environment.

Threat of substitutes is expected to remain low in the market over the coming years. Buyers are interested in product which have specific performance and application requirement, as a result formulated specialty chemical products cannot be substituted by conventional chemicals or any other products.

End-user concentration in the market is high as there are companies from different industries including automotive, electrical & electronics, oil and gas and others. The product prices are correlated with the raw materials thus volatility in the market directly affects the prices of final products. Thus customers have low to medium bargaining power in the market.

Market Dynamics

Specialty chemicals are consumed in almost every industrial sector. Among end-use industries, more than half of the globally produced specialty chemicals go into four end-use sectors— food and beverages; soap, cleaning, and cosmetics; construction, and electrical & electronics. The market is expected to possess high growth potential in emerging markets over coming years due to industrialization and rising consumer-driven economies. In terms of growth of categories, several categories of specialty chemicals, including specialty coatings, electronic chemicals, nutraceuticals, flavors and fragrances, and organic personal care market are expected to witness rapid growth owing to positive outlook for their corresponding end-use markets.

Technological advancements within oil & gas industry include rapid research & development activities conducted by multinationals such as Royal Dutch Shell, British Petroleum, and Total SA. Companies have been focusing on delivering high-performance chemicals for oil field applications, chemical processing, and more that enhance oil recovery, production, and maximize recovery of oil and gas reserves. Fluctuation in crude oil prices and availability in the global market, however, poses threat to formulators operating worldwide.

Product Insights

Industrial & institutional cleaning chemicals dominated the market with the highest revenue share of 26.9% in 2023. These cleaners are the largest industrial consumer of surfactants. They are the key components used in general-purpose cleaning, commercial floor, surface, and where ease and efficiency, hygiene, technical performance, and food safety are important characteristics.

Industrial and institutional cleaning sector is rapidly growing and diversifying owing to recurring nature of regulatory requirements, products, and services for cleanliness and hygiene. The major driver for industrial and institutional cleaning products is requirement for eco-friendly, effective, and less labor-intensive cleaning products, wherein surfactants act as wetting agents, detergents, foaming agents, dispersants, and emulsifiers.

Others segments include lubricating oil additives and surfactants, to name a few. The segment growth can be primarily attributed to the increasing awareness regarding the benefits of specialty chemicals among consumers. In addition, the growth of end-use industries is expected to further accelerate the market growth over the forecast period.

Specialty surfactants are used with commodity surfactants as surfactants, which are essential ingredients in a wide range of domestic and industrial products. Fast-growing niche applications for specialty surfactants include high-performance, small-volume products such as alkyl polyglycosides, sulfosuccinates, and others wherein they act as surfactants along with commodity surfactants. Growth of automotive, metalworking, and other end-use industries is expected to drive demand for lubricating oil additives, which, in turn, is expected to augment segment growth over the forecast period.

Regional Insights

Asia Pacific region dominated market with the highest revenue share of 49.9% in 2023. This is attributed to factors such as economic progress, industrialization, and growth of major end-use sectors. China and India are major countries contributing to the growth in Asia Pacific. Demand for additives in region is influenced by food and beverages, personal care and cosmetics, and pharmaceutical applications. China, India, and Japan are key manufacturing countries in region, with China as global manufacturing leader which also leads to product market growth.

India Specialty Chemicals Market

India is the second-largest market for specialty & fine chemicals in Asia Pacific. The market growth in this country can be attributed to the presence of companies manufacturing these chemicals at a large scale in India. AJ Chemicals, Atul, Finornic Chemicals, Karnataka Aromas, Para Fine Chem Industries, and Sami Sabinsa Group are some of the leading manufacturers of specialty & fine chemicals in the country.

Moreover, the penetration of specialty & fine chemicals in India is high owing to the presence of mature end-use industries in the country. For instance, India is among the major automotive manufacturing countries in Asia Pacific. The use of specialty chemicals such as fibers, sealants, paints, and adhesives in the automotive industry of the country is expected to fuel the growth of specialty chemicals market in India in the coming years.

Europe Specialty Chemicals Market

Europe emerged as another key market for specialty chemicals after Asia Pacific. Europe is run by major industrial economies, such as the UK, Germany, France, Italy, Spain, Russia, and others with an increasing number of manufacturers and market suppliers of electronics, cosmetics and pharmaceutical products penetrating the regional ecosystem. The presence of major cosmetic manufacturing units drives the demand for Europe specialty chemicals market.

Increasing demand for cosmetic chemicals in cosmetic industry in countries including UAE, Kuwait, and Saudi Arabia are estimated to stimulate its industry penetration. A young and dynamic population with high purchasing power is expected to contribute to market growth over forecast period.

Additionally, food and beverage sector in Middle East region has been ripe with several growth opportunities for international investors. Reliance on food trade, international tastes, changing consumer preferences and lifestyles, strategic geographic position, and gulf food programs have substantially contributed to the development of the food and beverages industry in the region, which is further estimated to trigger the demand for specialty chemicals over the predicted years.

Presence of major manufacturer such as Cargill, Incorporated, General Mills, and Kraft Foods is expected to surge the demand for specialty chemicals in Latin America region over forecast period. Automotive, transportation, chemical processing, and construction are expected to be other key consumers of specialty polymers, coatings, adhesives, sealants, plastic additives, lubricants, and others. Major manufacturers of synthetic lubricants in Latin America are Exxon Mobil Corporation, Royal Dutch Shell plc, Petrobras, and YPF.

Key Companies & Market Share Insights

Various manufacturing companies offer their specialty chemical products via suppliers and distributors directly to end-use industries such as oil and mining, catalysts, consumer chemicals, and others. These chemicals are either manufactured using batch process in batch chemical plants directly used by end-use industries to produce product as per defined quantities and specifications.

Companies such as Saudi Arabian Oil Co., SABIC, Farabi Petrochemicals Co., Total, and Chevron Corporation are key end users of specialty chemical products across regions including Asia Pacific, Europe, and North America. These finished products are supplied to major end-use markets such as automotive, construction, electronics and electrical, pulp and paper, water treatment, pharmaceuticals, and consumer products at both regional as well as national levels.Key players are focusing more on capacity/regional expansions, partnerships, new product launches, and mergers & acquisitions in order to gain a higher stake in the specialty chemicals market share. Please find recent strategies undertaken by players below:

-

In Dec 2023, Fenglihui Anjiachun, a novel biostimulant containing sugar alcohol and amino acids from the renowned US brand Brandt, has been introduced to the Chinese market and is now available through distribution by Beijing Xinhefeng Agricultural Materials

-

In July 2023, Phillips Carbon Black (PCBL) commissioned phase one of a 20,000 tons per annum specialty chemicals capacity in Mundra, Gujarat

-

In April 2023, GELITA AG, a leading player in the industry, launched a fast-setting gelatin which allows a breakthrough in fortified gummy manufacturing. CONFIXX, the new gelatin brand, enables the starch-free manufacture of gummies with a sensorial profile that was previously possible only with a starch-based production process. This innovation creates ample opportunities for producers of on-trend supplements to incorporate various active ingredients, make significant cost savings and streamline the production process

-

In February 2023, ADM opened its new state-of-the-art production facility in Valencia, Spain, with an investment of USD 30 million. This investment was made to meet global demand for probiotics, from various end-uses such as animal feed, human nutrition & wellbeing

-

In February 2023, MEGGLE GmbH & Co. KG expanded its distribution network through agreements with exclusive distributors. For instance, it partnered with Barents for the distribution of its west European PGM catalyst in the U.S. These strategic initiatives are anticipated to collectively enable the company to continue playing a major role in west European PGM catalyst market

Key Specialty Chemicals Companies:

- Solvay

- Evonik Industries AG

- Clariant AG

- Akzo Nobel N.V.

- DuPont

- Kemira Oyj

- Lanxess

- Croda International Plc

- Huntsman International LL

- The Lubrizol Corporation

- Albemarle Corporation

Specialty Chemicals Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 671.0 billion

Revenue forecast in 2030

USD 914.4 billion

Growth rate

CAGR of 5.2% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; France;Italy; Spain China; India; Japan;South Korea; Brazil; Mexico; Argentina South Africa; Saudi Arabia

Key companies profiled

Solvay; Evonik Industries AG; Clariant AG; Akzo Nobel N.V.; DuPont; Kemira Oyj; Lanxess; Croda International Plc; Huntsman International LL; The Lubrizol Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Specialty Chemicals Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global specialty chemicals market report on the basis of product, application and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Institutional & Industrial Cleaners

-

General Purpose Cleaners

-

Disinfectants and Sanitizers

-

Laundry Care Products

-

Vehicle Wash Products

-

Others

-

-

Rubber Processing Chemicals

-

Anti-degradants

-

Accelerators

-

Flame Retardants

-

Processing Aid/ Promoters

-

Others

-

-

Construction Chemicals

-

Concrete Admixtures

-

Others

-

-

Food & Feed Additives

-

Flavors & Enhancers

-

Sweeteners

-

Enzymes

-

Emulsifiers

-

Preservatives

-

Fat Replacers

-

Others

-

-

Cosmetic Chemicals

-

Surfactants

-

Emollients & Moisturizers

-

Film-Formers

-

Colorants & Pigments

-

Preservatives

-

Emulsifying & Thickening Agents

-

Single-Use Additives

-

Others

-

-

Oilfield Chemicals

-

Inhibitors

-

Demulsifiers

-

Rheology Modifiers

-

Friction Reducers

-

Biocides

-

Surfactants

-

Foamers

-

Others

-

-

Specialty Pulp & Paper Chemicals

-

Basic Chemicals

-

Functional Chemicals

-

Bleaching Chemicals

-

Process Chemicals

-

-

Specialty Textile Chemicals

-

Coating & Sizing Chemicals

-

Colorants & Auxiliaries

-

Finishing Agents

-

Surfactants

-

Denim Finishing Agents

-

-

Water Treatment Chemicals

-

Coagulants & Flocculants

-

Biocide & Disinfectant

-

Defoamer & Defoaming Agent

-

pH & Adjuster & Softener

-

Scale & Corrosion Inhibitor

-

Others

-

-

Electronic Chemicals

-

Mining Chemicals

-

Pharmaceutical & Nutraceutical Additives

-

CASE (Coatings, Adhesives, Sealants & Elastomers)

-

Other Products

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Institutional & Industrial Cleaners

-

Commercial

-

Food Service

-

Retail

-

Healthcare

-

Laundry Care

-

Institutional Buildings

-

Others

-

-

Manufacturing

-

Food & Beverage Processing

-

Metal Manufacturing & Fabrication

-

Electronic Components

-

Others

-

-

-

Rubber Processing Chemicals

-

Tire

-

Non-Tire

-

-

Construction Chemicals

-

Residential

-

Non-residential & Infrastructure

-

-

Food & Feed Additives

-

Bakery & Confectionery

-

Beverages

-

Convenience Foods

-

Dairy & Frozen Desserts

-

Spices, Condiments, Sauces & Dressings

-

Livestock Feed

-

Others

-

-

Cosmetic Chemicals

-

Skin Care

-

Hair Care

-

Makeup

-

Oral Care

-

Fragrances

-

Others

-

-

Oilfield Chemicals

-

Drilling

-

Production

-

Cementing

-

Workover & Completion

-

-

Specialty Pulp & Paper Chemicals

-

Packaging

-

Labeling

-

Printing

-

Others

-

-

Specialty Textile Chemicals

-

Apparel

-

Home Furnishing

-

Technical Textiles

-

Others

-

-

Water Treatment Chemicals

-

Power

-

Oil & Gas

-

Chemical Manufacturing

-

Mining & Mineral Processing

-

Municipal

-

Food & Beverage

-

Pulp & Paper

-

Others

-

-

Electronic Chemicals

-

Mining Chemicals

-

Mineral Processing

-

Explosives and Drilling

-

Water Treatment

-

Others

-

-

Pharmaceutical & Nutraceutical Additives

-

CASE (Coatings, Adhesives, Sealants & Elastomers)

-

Other Products

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global speciality chemicals market size was estimated at USD 641.47 billion in 2023 and is expected to reach USD 670.97 billion in 2030.

b. The global specialty chemicals market is expected to grow at a compound annual growth rate of 5.2% from 2024 to 2030 to reach USD 914.4 billion by 2030.

b. Asia Pacific dominated the specialty chemicals market with a share of 49.9% in 2023. This is attributable to rising demand from China & India from prominent end-use industries including pharmaceuticals & nutraceuticals, personal care & cosmetics, automotive and electrical & electronics.

b. Some key players operating in the specialty chemicals market include Solvay AG, Evonik Industries AG, Clariant AG, Akzo Nobel N.V., BASF SE, Kemira Oyj, LANXESS AG, Croda International Plc, Huntsman International LLC, The Lubrizol Corporation, Albemarle Corporation.

b. Key factors that are driving the market growth include growing consumer preference for tailored specific products coupled with significant investments in technological advancements and product innovations for the development of custom-made products for target applications.

Table of Contents

Chapter 1 Methodology and Scope

1.1 Market Segmentation & Scope

1.2 Market Definition

1.3 In Production Procurement

1.3.1 Purchased Database

1.3.2 GVR’s Internal Database

1.4 Information Analysis

1.5 Market Production & Data Visualization

1.6 Data Validation & Publishing

1.6.1 Research Scope And Assumptions

1.6.2 List To Data Sources

Chapter 2 Executive Summary

2.2 Market Snapshot

2.3 Segmental Outlook

2.4 Competitive Insights

Chapter 3 Specialty Chemicals: Market Variables, Trends & Scope

3.1 Market Lineage Outlook

3.1.1 Global Chemicals Market Outlook

3.2 Penetration & Growth Prospect Mapping, 2018-2030

3.3 Industry Value Chain Analysis

3.3.1 Raw Material Trends

3.3.2 Manufacturing Trends

3.4 Impact Of Covid-19 Pandemic

3.5 Impact Of European Geopolitical Conflict

3.6 Regulatory & Policy Landscape

3.6.1 Flavors & Fragrances Industry - Regulatory Framework

3.6.2 Specialty Pulp & Paper Chemicals Industry - Regulatory Framework

3.7 Market Dynamics

3.7.1 Market Driver Analysis

3.7.1.1 High Demand From The Consumer Industry

3.7.1.2 Growth Of Major End-Use Industries

3.7.1.3 Increasing Investment And R&D Activities

3.7.2 Market Restraint Analysis

3.7.2.1 Volatile Raw Material Prices

3.7.2.2 Limited Feedstock Availability For Bio-Based Specialty Chemicals

3.7.2.3 Stringent Environmental Regulations

3.7.3 Industry Challenges

3.8 Business Environment Analysis

3.8.1 Porter’s Analysis

3.8.2 Macro Economic Analysis

Chapter 4 Specialty Chemicals Market: Product Estimates & Trend Analysis

4.1 Specialty Chemicals Market Size & Forecasts And Trend Analysis By Product, 2018–2030 (USD Billion)

4.1.1 Institutional & Industrial Cleaners

4.1.1.1 General Purpose Cleaners

4.1.1.2 Disinfectants and Sanitizers

4.1.1.3 Laundry Care Products

4.1.1.4 Vehicle Wash Products

4.1.1.5 Others

4.1.2 Rubber Processing Chemicals

4.1.2.1 Anti-degradants

4.1.2.2 Accelerators

4.1.2.3 Flame Retardants

4.1.2.4 Processing Aid/ Promoters

4.1.2.5 Others

4.1.3 Food & Feed Additives

4.1.3.1 Flavors & Enhancers

4.1.3.2 Sweeteners

4.1.3.3 Enzymes

4.1.3.4 Emulsifiers

4.1.3.5 Preservatives

4.1.3.6 Fat Replacers

4.1.3.7 Others

4.1.4 Cosmetic Chemicals

4.1.4.1 Surfactants

4.1.4.2 Emollients & Moisturizers

4.1.4.3 Film-Formers

4.1.4.4 Colorants & Pigments

4.1.4.5 Preservatives

4.1.4.6 Emulsifying & Thickening Agents

4.1.4.7 Single-Use Additives

4.1.4.8 Others

4.1.5 Oilfield Chemicals

4.1.5.1 Inhibitors

4.1.5.2 Demulsifiers

4.1.5.3 Rheology Modifiers

4.1.5.4 Friction Reducers

4.1.5.5 Biocides

4.1.5.6 Surfactants

4.1.5.7 Foamers

4.1.5.8 Others

4.1.6 Specialty Pulp & Paper Chemicals

4.1.6.1 Basic Chemicals

4.1.6.2 Functional Chemicals

4.1.6.3 Bleaching Chemicals

4.1.6.4 Process Chemicals

4.1.7 Specialty Textile Chemicals

4.1.7.1 Coating & Sizing Chemicals

4.1.7.2 Colorants & Auxiliaries

4.1.7.3 Finishing Agents

4.1.7.4 Surfactants

4.1.7.5 Denim Finishing Agents

4.1.8 Water Treatment Chemicals

4.1.8.1 Coagulants & Flocculants

4.1.8.2 Biocide & Disinfectant

4.1.8.3 Defoamer & Defoaming Agent

4.1.8.4 pH & Adjuster & Softener

4.1.8.5 Scale & Corrosion Inhibitor

4.1.8.6 Others

4.1.9 Construction Chemicals

4.1.10 Electronic Chemicals

4.1.11 Mining Chemicals

4.1.12 Pharmaceutical & Nutraceutical Additives

4.1.13 CASE (Coatings, Adhesives, Sealants & Elastomers)

4.1.14 Other Products

Chapter 5 Specialty Chemicals Market: Application Estimates & Trend Analysis

5.1 Specialty Chemicals Market Size & Forecasts And Trend Analysis By Application, 2018–2030 (USD Billion)

5.1.1 Institutional & Industrial Cleaners

5.1.1.1 Commercial

5.1.1.1.1 Food Service

5.1.1.1.2 Retail

5.1.1.1.3 Healthcare

5.1.1.1.4 Laundry Care

5.1.1.1.5 Institutional Buildings

5.1.1.1.6 Others

5.1.1.2 Manufacturing

5.1.1.2.1 Food & Beverage Processing

5.1.1.2.2 Metal Manufacturing & Fabrication

5.1.1.2.3 Electronic Components

5.1.1.2.4 Others

5.1.2 Rubber Processing Chemicals

5.1.2.1 Tire

5.1.2.2 Non-Tire

5.1.3 Food & Feed Additives

5.1.3.1 Bakery & Confectionery

5.1.3.2 Beverages

5.1.3.3 Convenience Foods

5.1.3.4 Dairy & Frozen Desserts

5.1.3.5 Spices, Condiments, Sauces & Dressings

5.1.3.6 Livestock Feed

5.1.3.7 Others

5.1.4 Cosmetic Chemicals

5.1.4.1 Skin Care

5.1.4.2 Hair Care

5.1.4.3 Makeup

5.1.4.4 Oral Care

5.1.4.5 Fragrances

5.1.4.6 Others

5.1.5 Oilfield Chemicals

5.1.5.1 Drilling

5.1.5.2 Production

5.1.5.3 Cementing

5.1.5.4 Workover & Completion

5.1.6 Specialty Pulp & Paper Chemicals

5.1.6.1 Packaging

5.1.6.2 Labeling

5.1.6.3 Printing

5.1.6.4 Others

5.1.7 Specialty Textile Chemicals

5.1.7.1 Apparel

5.1.7.2 Home Furnishing

5.1.7.3 Technical Textiles

5.1.7.4 Others

5.1.8 Water Treatment Chemicals

5.1.8.1 Power

5.1.8.2 Oil & Gas

5.1.8.3 Chemical Manufacturing

5.1.8.4 Mining & Mineral Processing

5.1.8.5 Municipal

5.1.8.6 Food & Beverage

5.1.8.7 Pulp & Paper

5.1.8.8 Others

5.1.9 Construction Chemicals

5.1.9.1 Residential

5.1.9.2 Non-residential

5.1.10 Electronic Chemicals

5.1.11 Mining Chemicals

5.1.11.1 Mineral Processing

5.1.11.2 Explosives & Drilling

5.1.11.3 Water Treatment

5.1.11.4 Others

5.1.12 Pharmaceutical & Nutraceutical Additives

5.1.13 CASE (Coatings, Adhesives, Sealants & Elastomers)

5.1.14 Other Applications

Chapter 6 Specialty Chemicals Market: Regional Estimates & Trend Analysis

6.1 Global Specialty Chemicals Movement Analysis & Market Share, 2023 & 2030 (%)

6.1.1 Global Specialty Chemicals Market Estimates And Forecasts, By Product, 2018–2030 (USD Billion)

6.1.2 Global Specialty Chemicals Market Estimates And Forecasts, By Application, 2018–2030 (USD Billion)

6.2 North America

6.2.1 North America Specialty Chemicals Market Estimates And Forecasts, By Product, 2018–2030 (USD Billion)

6.2.2 North America Specialty Chemicals Market Estimates And Forecasts, By Application, 2018–2030 (USD Billion)

6.2.2 U.S.

6.2.2.1 U.S. Specialty Chemicals Market Estimates And Forecasts, By Product, 2018–2030 (USD Billion)

6.2.2.2 U.S. Specialty Chemicals Market Estimates And Forecasts, By Application, 2018–2030 (USD Billion)

6.2.3 Canada

6.2.3.1 Canada Specialty Chemicals Market Estimates And Forecasts, By Product, 2018–2030 (USD Billion)

6.2.3.2 Canada Specialty Chemicals Market Estimates And Forecasts, By Application, 2018–2030 (USD Billion)

6.3 Europe

6.3.1 Europe Specialty Chemicals Market Estimates And Forecasts, By Product, 2018–2030 USD Billion)

6.3.2 Europe Specialty Chemicals Market Estimates And Forecasts, By Application, 2018–2030 USD Billion)

6.3.3 Germany

6.3.3.1 Germany Specialty Chemicals Market Estimates And Forecasts, By Product, 2018–2030 (USD Billion)

6.3.3.2 Germany Specialty Chemicals Market Estimates And Forecasts, By Application, 2018–2030 (USD Billion)

6.3.4 UK

6.3.4.1 UK Specialty Chemicals Market Estimates And Forecasts, By Product, 2018–2030 (USD Billion)

6.3.4.2 UK Specialty Chemicals Market Estimates And Forecasts, By Application, 2018–2030 (USD Billion)

6.3.5 France

6.3.5.1 France Specialty Chemicals Market Estimates And Forecasts, By Product, 2018–2030 (USD Billion)

6.3.5.2 France Specialty Chemicals Market Estimates And Forecasts, By Application, 2018–2030 (USD Billion)

6.3.6 Italy

6.3.6.1 Italy Specialty Chemicals Market Estimates And Forecasts, By Product, 2018–2030 (USD Billion)

6.3.6.2 Italy Specialty Chemicals Market Estimates And Forecasts, By Application, 2018–2030 (USD Billion)

6.3.7 Spain

6.3.7.1 Spain Specialty Chemicals Market Estimates And Forecasts, By Product, 018–2030 (USD Billion)

6.3.7.2 Spain Specialty Chemicals Market Estimates And Forecasts, By Application, 2018–2030 (USD Billion)

6.4 Asia Pacific

6.4.1 Asia Pacific Specialty Chemicals Market Estimates And Forecasts, By Product, 2018–2030 (USD Billion)

6.4.2 Asia Pacific Specialty Chemicals Market Estimates And Forecasts, By Application, 2018–2030 (USD Billion)

6.4.3 China

6.4.3.1 China Pacific Specialty Chemicals Market Estimates And Forecasts, By Product, 2018–2030 (USD Billion)

6.4.3.2 China Pacific Specialty Chemicals Market Estimates And Forecasts, By Application, 2018–2030 (USD Billion)

6.4.4 India

6.4.4.1 India Specialty Chemicals Market Estimates And Forecasts, By Product, 2018–2030 (USD Billion)

6.4.4.2 India Specialty Chemicals Market Estimates And Forecasts, By Application, 2018–2030 (USD Billion)

6.4.5 Japan

6.4.5.1 Japan Specialty Chemicals Market Estimates And Forecasts, By Product, 2018–2030 (USD Billion)

6.4.5.2 Japan Specialty Chemicals Market Estimates And Forecasts, By Application, 2018–2030 (USD Billion)

6.4.6 South Korea

6.4.6.1 South Korea Specialty Chemicals Market Estimates And Forecasts, By Product, 2018–2030 (USD Billion)

6.4.6.2 South Korea Specialty Chemicals Market Estimates And Forecasts, By Application, 2018–2030 (USD Billion)

6.5 Latin America

6.5.1 Latin America Specialty Chemicals Market Estimates And Forecasts, By Product, 2018–2030 (USD Billion)

6.5.2 Latin America Specialty Chemicals Market Estimates And Forecasts, By Application, 2018–2030 (USD Billion)

6.5.3 Brazil

6.5.3.1 Brazil Specialty Chemicals Market Estimates And Forecasts, By Product, 2018–2030 (USD Billion)

6.5.3.2 Brazil Specialty Chemicals Market Estimates And Forecasts, By Application, 2018–2030 (USD Billion)

6.5.4 Argentina

6.5.4.1 Argentina Specialty Chemicals Market Estimates And Forecasts, By Product, 2018–2030 (USD Billion)

6.5.4.2 Argentina Specialty Chemicals Market Estimates And Forecasts, By Application, 2018–2030 (USD Billion)

6.5.5 Mexico

6.5.5.1 Mexico Specialty Chemicals Market Estimates And Forecasts, By Product, 2018–2030 (USD Billion)

6.5.5.2 Mexico Specialty Chemicals Market Estimates And Forecasts, By Application, 2018–2030 (USD Billion)

6.6 Middle East & Africa

6.6.1 Middle East & Africa Specialty Chemicals Market Estimates And Forecasts, By Product, 2018–2030 (USD Billion)

6.6.2 Middle East & Africa Specialty Chemicals Market Estimates And Forecasts, By Application, 2018–2030 (USD Billion)

6.6.3 South Africa

6.6.3.1 South Africa Specialty Chemicals Market Estimates And Forecasts, By Product, 2018–2030 (USD Billion)

6.6.3.2 South Africa Specialty Chemicals Market Estimates And Forecasts, By Application, 2018–2030 (USD Billion)

6.6.4 Saudi Arabia

6.6.4.1 Saudi Arabia Specialty Chemicals Market Estimates And Forecasts, By Product, 2018–2030 (USD Billion)

6.6.4.2 Saudi Arabia Specialty Chemicals Market Estimates And Forecasts, By Application, 2018–2030 (USD Billion)

Chapter 7 Specialty Chemicals Market: Competitive Landscape

7.1 Recent Development by Key Players, & Its Impact

7.2 Company Heat Map Analysis

7.3 Company Categorization

7.4 Strategy Framework

Chapter 8 Specialty Chemicals Market: Company Profile

8.1 Solvay

8.1.1 Company Overview

8.1.2 Financial Performance

8.1.3 Product Portfolio

8.1.4 Strategic Initiatives

8.2 Evonik Industries AG

8.2.1 Company Overview

8.2.2 Financial Performance

8.2.3 Product Portfolio

8.2.4 Strategic Initiatives

8.3 Clariant

8.3.1 Company Overview

8.3.2 Financial Performance

8.3.3 Product Portfolio

8.3.4 Strategic Initiatives

8.4 Akzo Nobel N.V.

8.4.1 Company Overview

8.4.2 Financial Performance

8.4.3 Financial Performance

8.4.4 Product Portfolio

8.4.5 Strategic Initiatives

8.5 Dupont De Nemours, Inc.

8.5.1 Company Overview

8.5.2 Financial Performance

8.5.3 Product Benchmarking

8.5.4 Strategic Initiatives

8.6 BASF SE

8.6.1 Company Overview

8.6.2 Financial Performance

8.6.3 Product Portfolio

8.6.4 Strategic Initiatives

8.7 Kemira

8.7.1 Company Overview

8.7.2 Financial Performance

8.7.3 Product Portfolio

8.7.4 Strategic Initiatives

8.8 LANXESS

8.8.1 Company Overview

8.8.2 Financial Performance

8.8.3 Product Portfolio

8.8.4 Strategic Initiatives

8.9 Croda International Plc

8.9.1 Company Overview

8.9.2 Financial Performance

8.9.3 Product Portfolio

8.9.4 Strategic Initiatives

8.10 Huntsman International LLC

8.10.1 Company Overview

8.10.2 Financial Performance

8.10.3 Product Portfolio

8.10.4 Strategic Initiatives

8.11 The Lubrizol Corporation

8.11.1 Company Overview

8.11.2 Financial Performance

8.11.3 Product Portfolio

8.11.4 Strategic Initiatives

8.12 Albemarle Corporation

8.12.1 Company Overview

8.12.2 Financial Performance

8.12.3 Product Portfolio

8.12.4 Strategic Initiatives

List of Tables

Table 1 Global Specialty Chemicals Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Billion)

Table 2 Global Specialty Chemicals Market Estimates And Forecasts, By Application, 2018 - 2030 (USD Billion)

Table 3 Global Specialty Chemicals Market Estimates And Forecasts, By Region, 2018 - 2030 (USD Billion)

Table 4 North America Specialty Chemicals Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Billion)

Table 5 North America Specialty Chemicals Market Estimates And Forecasts, By Application, 2018 - 2030 (USD Billion)

Table 6 U.S. Specialty Chemicals Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Billion)

Table 7 U.S. Specialty Chemicals Market Estimates And Forecasts, By Application, 2018 - 2030 (USD Billion)

Table 8 Canada Specialty Chemicals Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Billion)

Table 8 Canada Specialty Chemicals Market Estimates And Forecasts, By Application, 2018 - 2030 (USD Billion)

Table 9 Europe Specialty Chemicals Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Billion)

Table 9 Europe Specialty Chemicals Market Estimates And Forecasts, By Application, 2018 - 2030 (USD Billion)

Table 10 Germany Specialty Chemicals Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Billion)

Table 11 Germany Specialty Chemicals Market Estimates And Forecasts, By Application, 2018 - 2030 (USD Billion)

Table 12 UK Specialty Chemicals Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Billion)

Table 13 UK Specialty Chemicals Market Estimates And Forecasts, By Application, 2018 - 2030 (USD Billion)

Table 14 France Specialty Chemicals Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Billion)

Table 15 France Specialty Chemicals Market Estimates And Forecasts, By Application, 2018 - 2030 (USD Billion)

Table 16 Italy Specialty Chemicals Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Billion)

Table 17 Italy Specialty Chemicals Market Estimates And Forecasts, By Application, 2018 - 2030 (USD Billion)

Table 18 Spain Specialty Chemicals Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Billion)

Table 19 Spain Specialty Chemicals Market Estimates And Forecasts, By Application, 2018 - 2030 (USD Billion)

Table 20 Asia Pacific Specialty Chemicals Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Billion)

Table 21 Asia Pacific Specialty Chemicals Market Estimates And Forecasts, By Application, 2018 - 2030 (USD Billion)

Table 22 China Specialty Chemicals Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Billion)

Table 23 China Specialty Chemicals Market Estimates And Forecasts, By Application, 2018 - 2030 (USD Billion)

Table 24 India Specialty Chemicals Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Billion)

Table 25 India Specialty Chemicals Market Estimates And Forecasts, By Application, 2018 - 2030 (USD Billion)

Table 26 Japan Specialty Chemicals Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Billion)

Table 27 Japan Specialty Chemicals Market Estimates And Forecasts, By Application, 2018 - 2030 (USD Billion)

Table 28 South Korea Specialty Chemicals Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Billion)

Table 29 South Korea Specialty Chemicals Market Estimates And Forecasts, By Application, 2018 - 2030 (USD Billion)

Table 30 Latin America Specialty Chemicals Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Billion)

Table 31 Latin America Specialty Chemicals Market Estimates And Forecasts, By Application, 2018 - 2030 (USD Billion)

Table 32 Brazil Specialty Chemicals Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Billion)

Table 33 Brazil Specialty Chemicals Market Estimates And Forecasts, By Application, 2018 - 2030 (USD Billion)

Table 34 Argentina Specialty Chemicals Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Billion)

Table 35 Argentina Specialty Chemicals Market Estimates And Forecasts, By Application, 2018 - 2030 (USD Billion)

Table 36 Mexico Specialty Chemicals Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Billion)

Table 37 Mexico Specialty Chemicals Market Estimates And Forecasts, By Application, 2018 - 2030 (USD Billion)

Table 38 Middle East & Africa Specialty Chemicals Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Billion)

Table 39 Middle East & Africa Specialty Chemicals Market Estimates And Forecasts, By Application, 2018 - 2030 (USD Billion)

Table 40 South Africa Specialty Chemicals Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Billion)

Table 41 South Africa Specialty Chemicals Market Estimates And Forecasts, By Application, 2018 - 2030 (USD Billion)

Table 42 Saudi Arabia Specialty Chemicals Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Billion)

Table 43 Saudi Arabia Specialty Chemicals Market Estimates And Forecasts, By Application, 2018 - 2030 (USD Billion)

Table 44 Participants Overview

Table 45 Financial Performance

Table 46 Product Benchmarking

Table 47 Recent Development by Key Players & Its Impact

Table 48 Strategy Mapping

List of Figures

Fig. 1 Specialty Chemicals Market Segmentation

Fig. 2 In Production Procurement

Fig. 3 Data Analysis Models

Fig. 4 Market Production And Validation

Fig. 5 Data Validating & Publishing

Fig. 6 Specialty Chemicals Market Snapshot

Fig. 7 Specialty Chemicals Market Segmental Outlook, 2023 (USD Billion)

Fig. 8 Specialty Chemicals Market: Competitive Insights

Fig. 9 Specialty Chemicals Market, 2018-2030 (USD Billion)

Fig. 10 Global Specialty Chemicals Market Value Chain Analysis

Fig. 11 Specialty Chemicals Market Dynamics

Fig. 12 Revenue Of Key Food Processing Companies, 2018-2022 (USD Billion)

Fig. 13 Global Organic Personal Care Market, 2012 - 2022 (USD Billion)

Fig. 14 Market Size Of Indian Chemical Sector 2018-2022 (USD Billion)

Fig. 15 Crude Oil Prices, 2016-2022 (USD/Bbl.)

Fig. 16 Specialty Chemicals Market: Porter’s Analysis

Fig. 17 Specialty Chemicals Market: Pestel Analysis

Fig. 18 Specialty Chemicals Market, Key Takewayas, By Product, 2023 & 2030 (%)

Fig. 18 Specialty Chemicals Market, Key Takewayas, By Application, 2023 & 2030 (%)

Fig. 19 Specialty Chemicals Market, Key Takewayas, By Region, 2023 & 2030 (%)

Fig. 20 Specialty chemicals Market: Strategy MappingWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Specialty Chemicals Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Institutional & Industrial Cleaners

- General Purpose Cleaners

- Disinfectants and Sanitizers

- Laundry Care Products

- Vehicle Wash Products

- Others

- Rubber Processing Chemicals

- Anti-degradants

- Accelerators

- Flame Retardants

- Processing Aid/ Promoters

- Others

- Food & Feed Additives

- Flavors & Enhancers

- Sweeteners

- Enzymes

- Emulsifiers

- Preservatives

- Fat Replacers

- Others

- Cosmetic Chemicals

- Surfactants

- Emollients & Moisturizers

- Film-Formers

- Colorants & Pigments

- Preservatives

- Emulsifying & Thickening Agents

- Single-Use Additives

- Others

- Oilfield Chemicals

- Inhibitors

- Demulsifiers

- Rheology Modifiers

- Friction Reducers

- Biocides

- Surfactants

- Foamers

- Others

- Specialty Pulp & Paper Chemicals

- Basic Chemicals

- Functional Chemicals

- Bleaching Chemicals

- Process Chemicals

- Specialty Textile Chemicals

- Coating & Sizing Chemicals

- Colorants & Auxiliaries

- Finishing Agents

- Surfactants

- Denim Finishing Agents

- Water Treatment Chemicals

- Coagulants & Flocculants

- Biocide & Disinfectant

- Defoamer & Defoaming Agent

- pH & Adjuster & Softener

- Scale & Corrosion Inhibitor

- Others

- Construction Chemicals

- Electronic Chemicals

- Mining Chemicals

- Pharmaceutical & Nutraceutical Additives

- CASE (Coatings, Adhesives, Sealants & Elastomers)

- Other Products

- Institutional & Industrial Cleaners

- Specialty Chemicals Application Outlook (Revenue, USD Billion, 2018 - 2030)

- Institutional & Industrial Cleaners

- Commercial

- Food Service

- Retail

- Healthcare

- Laundry Care

- Institutional Buildings

- Others

- Manufacturing

- Food & Beverage Processing

- Metal Manufacturing & Fabrication

- Electronic Components

- Others

- Commercial

- Rubber Processing Chemicals

- Tire

- Non-Tire

- Construction Chemicals

- Residential

- Non-residential & Infrastructure

- Food & Feed Additives

- Bakery & Confectionery

- Beverages

- Convenience Foods

- Dairy & Frozen Desserts

- Spices, Condiments, Sauces & Dressings

- Livestock Feed

- Others

- Cosmetic Chemicals

- Skin Care

- Hair Care

- Makeup

- Oral Care

- Fragrances

- Others

- Oilfield Chemicals

- Drilling

- Production

- Cementing

- Workover & Completion

- Specialty Pulp & Paper Chemicals

- Packaging

- Labeling

- Printing

- Others

- Specialty Textile Chemicals

- Apparel

- Home Furnishing

- Technical Textiles

- Others

- Water Treatment Chemicals

- Power

- Oil & Gas

- Chemical Manufacturing

- Mining & Mineral Processing

- Municipal

- Food & Beverage

- Pulp & Paper

- Others

- Mining Chemicals

- Mineral Processing

- Explosives and Drilling

- Water Treatment

- Others

- Electronic Chemicals

- Pharmaceutical & Nutraceutical Additives

- CASE (Coatings, Adhesives, Sealants & Elastomers)

- Other Applications

- Institutional & Industrial Cleaners

- Specialty Chemicals Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- Specialty Chemicals Market, By Product

- Institutional & Industrial Cleaners

- General Purpose Cleaners

- Disinfectants and Sanitizers

- Laundry Care Products

- Vehicle Wash Products

- Others

- Rubber Processing Chemicals

- Anti-degradants

- Accelerators

- Flame Retardants

- Processing Aid/ Promoters

- Others

- Food & Feed Additives

- Flavors & Enhancers

- Sweeteners

- Enzymes

- Emulsifiers

- Preservatives

- Fat Replacers

- Others

- Cosmetic Chemicals

- Surfactants

- Emollients & Moisturizers

- Film-Formers

- Colorants & Pigments

- Preservatives

- Emulsifying & Thickening Agents

- Single-Use Additives

- Others

- Oilfield Chemicals

- Inhibitors

- Demulsifiers

- Rheology Modifiers

- Friction Reducers

- Biocides

- Surfactants

- Foamers

- Others

- Specialty Pulp & Paper Chemicals

- Basic Chemicals

- Functional Chemicals

- Bleaching Chemicals

- Process Chemicals

- Specialty Textile Chemicals

- Coating & Sizing Chemicals

- Colorants & Auxiliaries

- Finishing Agents

- Surfactants

- Denim Finishing Agents

- Water Treatment Chemicals

- Coagulants & Flocculants

- Biocide & Disinfectant

- Defoamer & Defoaming Agent

- pH & Adjuster & Softener

- Scale & Corrosion Inhibitor

- Others

- Construction Chemicals

- Electronic Chemicals

- Mining Chemicals

- Pharmaceutical & Nutraceutical Additives

- CASE (Coatings, Adhesives, Sealants & Elastomers)

- Other Products

- Institutional & Industrial Cleaners

- Specialty Chemicals Market, By Application

- Institutional & Industrial Cleaners

- Commercial

- Food Service

- Retail

- Healthcare

- Laundry Care

- Institutional Buildings

- Others

- Manufacturing

- Food & Beverage Processing

- Metal Manufacturing & Fabrication

- Electronic Components

- Others

- Commercial

- Rubber Processing Chemicals

- Tire

- Non-Tire

- Construction Chemicals

- Residential

- Non-residential & Infrastructure

- Food & Feed Additives

- Bakery & Confectionery

- Beverages

- Convenience Foods

- Dairy & Frozen Desserts

- Spices, Condiments, Sauces & Dressings

- Livestock Feed

- Others

- Cosmetic Chemicals

- Skin Care

- Hair Care

- Makeup

- Oral Care

- Fragrances

- Others

- Oilfield Chemicals

- Drilling

- Production

- Cementing

- Workover & Completion

- Specialty Pulp & Paper Chemicals

- Packaging

- Labeling

- Printing

- Others

- Specialty Textile Chemicals

- Apparel

- Home Furnishing

- Technical Textiles

- Others

- Water Treatment Chemicals

- Power

- Oil & Gas

- Chemical Manufacturing

- Mining & Mineral Processing

- Municipal

- Food & Beverage

- Pulp & Paper

- Others

- Mining Chemicals

- Mineral Processing

- Explosives and Drilling

- Water Treatment

- Others

- Electronic Chemicals

- Pharmaceutical & Nutraceutical Additives

- CASE (Coatings, Adhesives, Sealants & Elastomers)

- Other Applications

- Institutional & Industrial Cleaners

- U.S.

- Specialty Chemicals Market, By Product

- Institutional & Industrial Cleaners

- General Purpose Cleaners

- Disinfectants and Sanitizers

- Laundry Care Products

- Vehicle Wash Products

- Others

- Rubber Processing Chemicals

- Anti-degradants

- Accelerators

- Flame Retardants

- Processing Aid/ Promoters

- Others

- Food & Feed Additives

- Flavors & Enhancers

- Sweeteners

- Enzymes

- Emulsifiers

- Preservatives

- Fat Replacers

- Others

- Cosmetic Chemicals

- Surfactants

- Emollients & Moisturizers

- Film-Formers

- Colorants & Pigments

- Preservatives

- Emulsifying & Thickening Agents

- Single-Use Additives

- Others

- Oilfield Chemicals

- Inhibitors

- Demulsifiers

- Rheology Modifiers

- Friction Reducers

- Biocides

- Surfactants

- Foamers

- Others

- Specialty Pulp & Paper Chemicals

- Basic Chemicals

- Functional Chemicals

- Bleaching Chemicals

- Process Chemicals

- Specialty Textile Chemicals

- Coating & Sizing Chemicals

- Colorants & Auxiliaries

- Finishing Agents

- Surfactants

- Denim Finishing Agents

- Water Treatment Chemicals

- Coagulants & Flocculants

- Biocide & Disinfectant

- Defoamer & Defoaming Agent

- pH & Adjuster & Softener

- Scale & Corrosion Inhibitor

- Others

- Construction Chemicals

- Electronic Chemicals

- Mining Chemicals

- Pharmaceutical & Nutraceutical Additives

- CASE (Coatings, Adhesives, Sealants & Elastomers)

- Other Products

- Institutional & Industrial Cleaners

- Specialty Chemicals Market, By Application

- Institutional & Industrial Cleaners

- Commercial

- Food Service

- Retail

- Healthcare

- Laundry Care

- Institutional Buildings

- Others

- Manufacturing

- Food & Beverage Processing

- Metal Manufacturing & Fabrication

- Electronic Components

- Others

- Commercial

- Rubber Processing Chemicals

- Tire

- Non-Tire

- Construction Chemicals

- Residential

- Non-residential & Infrastructure

- Food & Feed Additives

- Bakery & Confectionery

- Beverages

- Convenience Foods

- Dairy & Frozen Desserts

- Spices, Condiments, Sauces & Dressings

- Livestock Feed

- Others

- Cosmetic Chemicals

- Skin Care

- Hair Care

- Makeup

- Oral Care

- Fragrances

- Others

- Oilfield Chemicals

- Drilling

- Production

- Cementing

- Workover & Completion

- Specialty Pulp & Paper Chemicals

- Packaging

- Labeling

- Printing

- Others

- Specialty Textile Chemicals

- Apparel

- Home Furnishing

- Technical Textiles

- Others

- Water Treatment Chemicals

- Power

- Oil & Gas

- Chemical Manufacturing

- Mining & Mineral Processing

- Municipal

- Food & Beverage

- Pulp & Paper

- Others

- Mining Chemicals

- Mineral Processing

- Explosives and Drilling

- Water Treatment

- Others

- Electronic Chemicals

- Pharmaceutical & Nutraceutical Additives

- CASE (Coatings, Adhesives, Sealants & Elastomers)

- Other Applications

- Institutional & Industrial Cleaners

- Specialty Chemicals Market, By Product

- Canada

- Specialty Chemicals Market, By Product

- Institutional & Industrial Cleaners

- General Purpose Cleaners

- Disinfectants and Sanitizers

- Laundry Care Products

- Vehicle Wash Products

- Others

- Rubber Processing Chemicals

- Anti-degradants

- Accelerators

- Flame Retardants

- Processing Aid/ Promoters

- Others

- Food & Feed Additives

- Flavors & Enhancers

- Sweeteners

- Enzymes

- Emulsifiers

- Preservatives

- Fat Replacers

- Others

- Cosmetic Chemicals

- Surfactants

- Emollients & Moisturizers

- Film-Formers

- Colorants & Pigments

- Preservatives

- Emulsifying & Thickening Agents

- Single-Use Additives

- Others

- Oilfield Chemicals

- Inhibitors

- Demulsifiers

- Rheology Modifiers

- Friction Reducers

- Biocides

- Surfactants

- Foamers

- Others

- Specialty Pulp & Paper Chemicals

- Basic Chemicals

- Functional Chemicals

- Bleaching Chemicals

- Process Chemicals

- Specialty Textile Chemicals

- Coating & Sizing Chemicals

- Colorants & Auxiliaries

- Finishing Agents

- Surfactants

- Denim Finishing Agents

- Water Treatment Chemicals

- Coagulants & Flocculants

- Biocide & Disinfectant

- Defoamer & Defoaming Agent

- pH & Adjuster & Softener

- Scale & Corrosion Inhibitor

- Others

- Construction Chemicals

- Electronic Chemicals

- Mining Chemicals

- Pharmaceutical & Nutraceutical Additives

- CASE (Coatings, Adhesives, Sealants & Elastomers)

- Other Products

- Institutional & Industrial Cleaners

- Specialty Chemicals Market, By Application

- Institutional & Industrial Cleaners

- Commercial

- Food Service

- Retail

- Healthcare

- Laundry Care

- Institutional Buildings

- Others

- Manufacturing

- Food & Beverage Processing

- Metal Manufacturing & Fabrication

- Electronic Components

- Others

- Commercial

- Rubber Processing Chemicals

- Tire

- Non-Tire

- Construction Chemicals

- Residential

- Non-residential & Infrastructure

- Food & Feed Additives

- Bakery & Confectionery

- Beverages

- Convenience Foods

- Dairy & Frozen Desserts

- Spices, Condiments, Sauces & Dressings

- Livestock Feed

- Others

- Cosmetic Chemicals

- Skin Care

- Hair Care

- Makeup

- Oral Care

- Fragrances

- Others

- Oilfield Chemicals

- Drilling

- Production

- Cementing

- Workover & Completion

- Specialty Pulp & Paper Chemicals

- Packaging

- Labeling

- Printing

- Others

- Specialty Textile Chemicals

- Apparel

- Home Furnishing

- Technical Textiles

- Others

- Water Treatment Chemicals

- Power

- Oil & Gas

- Chemical Manufacturing

- Mining & Mineral Processing

- Municipal

- Food & Beverage

- Pulp & Paper

- Others

- Mining Chemicals

- Mineral Processing

- Explosives and Drilling

- Water Treatment

- Others

- Electronic Chemicals

- Pharmaceutical & Nutraceutical Additives

- CASE (Coatings, Adhesives, Sealants & Elastomers)

- Other Applications

- Institutional & Industrial Cleaners

- Specialty Chemicals Market, By Product

- Specialty Chemicals Market, By Product

- Europe

- Specialty Chemicals Market, By Product

- Institutional & Industrial Cleaners

- General Purpose Cleaners

- Disinfectants and Sanitizers

- Laundry Care Products

- Vehicle Wash Products

- Others

- Rubber Processing Chemicals

- Anti-degradants

- Accelerators

- Flame Retardants

- Processing Aid/ Promoters

- Others

- Food & Feed Additives

- Flavors & Enhancers

- Sweeteners

- Enzymes

- Emulsifiers

- Preservatives

- Fat Replacers

- Others

- Cosmetic Chemicals

- Surfactants

- Emollients & Moisturizers

- Film-Formers

- Colorants & Pigments

- Preservatives

- Emulsifying & Thickening Agents

- Single-Use Additives

- Others

- Oilfield Chemicals

- Inhibitors

- Demulsifiers

- Rheology Modifiers

- Friction Reducers

- Biocides

- Surfactants

- Foamers

- Others

- Specialty Pulp & Paper Chemicals

- Basic Chemicals

- Functional Chemicals

- Bleaching Chemicals

- Process Chemicals

- Specialty Textile Chemicals

- Coating & Sizing Chemicals

- Colorants & Auxiliaries

- Finishing Agents

- Surfactants

- Denim Finishing Agents

- Water Treatment Chemicals

- Coagulants & Flocculants

- Biocide & Disinfectant

- Defoamer & Defoaming Agent

- pH & Adjuster & Softener

- Scale & Corrosion Inhibitor

- Others

- Construction Chemicals

- Electronic Chemicals

- Mining Chemicals

- Pharmaceutical & Nutraceutical Additives

- CASE (Coatings, Adhesives, Sealants & Elastomers)

- Other Products

- Institutional & Industrial Cleaners

- Specialty Chemicals Market, By Application

- Institutional & Industrial Cleaners

- Commercial

- Food Service

- Retail

- Healthcare

- Laundry Care

- Institutional Buildings

- Others

- Manufacturing

- Food & Beverage Processing

- Metal Manufacturing & Fabrication

- Electronic Components

- Others

- Commercial

- Rubber Processing Chemicals

- Tire

- Non-Tire

- Construction Chemicals

- Residential

- Non-residential & Infrastructure

- Food & Feed Additives

- Bakery & Confectionery

- Beverages

- Convenience Foods

- Dairy & Frozen Desserts

- Spices, Condiments, Sauces & Dressings

- Livestock Feed

- Others

- Cosmetic Chemicals

- Skin Care

- Hair Care

- Makeup

- Oral Care

- Fragrances

- Others

- Oilfield Chemicals

- Drilling

- Production

- Cementing

- Workover & Completion

- Specialty Pulp & Paper Chemicals

- Packaging

- Labeling

- Printing

- Others

- Specialty Textile Chemicals

- Apparel

- Home Furnishing

- Technical Textiles

- Others

- Water Treatment Chemicals

- Power

- Oil & Gas

- Chemical Manufacturing

- Mining & Mineral Processing

- Municipal

- Food & Beverage

- Pulp & Paper

- Others

- Mining Chemicals

- Mineral Processing

- Explosives and Drilling

- Water Treatment

- Others

- Electronic Chemicals

- Pharmaceutical & Nutraceutical Additives

- CASE (Coatings, Adhesives, Sealants & Elastomers)

- Other Applications

- Institutional & Industrial Cleaners

- Germany

- Specialty Chemicals Market, By Product

- Institutional & Industrial Cleaners

- General Purpose Cleaners

- Disinfectants and Sanitizers

- Laundry Care Products

- Vehicle Wash Products

- Others

- Rubber Processing Chemicals

- Anti-degradants

- Accelerators

- Flame Retardants

- Processing Aid/ Promoters

- Others

- Food & Feed Additives

- Flavors & Enhancers

- Sweeteners

- Enzymes

- Emulsifiers

- Preservatives

- Fat Replacers

- Others

- Cosmetic Chemicals

- Surfactants

- Emollients & Moisturizers

- Film-Formers

- Colorants & Pigments

- Preservatives

- Emulsifying & Thickening Agents

- Single-Use Additives

- Others

- Oilfield Chemicals

- Inhibitors

- Demulsifiers

- Rheology Modifiers

- Friction Reducers

- Biocides

- Surfactants

- Foamers

- Others

- Specialty Pulp & Paper Chemicals

- Basic Chemicals

- Functional Chemicals

- Bleaching Chemicals

- Process Chemicals

- Specialty Textile Chemicals

- Coating & Sizing Chemicals

- Colorants & Auxiliaries

- Finishing Agents

- Surfactants

- Denim Finishing Agents

- Water Treatment Chemicals

- Coagulants & Flocculants

- Biocide & Disinfectant

- Defoamer & Defoaming Agent

- pH & Adjuster & Softener

- Scale & Corrosion Inhibitor

- Others

- Construction Chemicals

- Electronic Chemicals

- Mining Chemicals

- Pharmaceutical & Nutraceutical Additives

- CASE (Coatings, Adhesives, Sealants & Elastomers)

- Other Products

- Institutional & Industrial Cleaners

- Specialty Chemicals Market, By Application

- Institutional & Industrial Cleaners

- Commercial

- Food Service

- Retail

- Healthcare

- Laundry Care

- Institutional Buildings

- Others

- Manufacturing

- Food & Beverage Processing

- Metal Manufacturing & Fabrication

- Electronic Components

- Others

- Commercial

- Rubber Processing Chemicals

- Tire

- Non-Tire

- Construction Chemicals

- Residential

- Non-residential & Infrastructure

- Food & Feed Additives

- Bakery & Confectionery

- Beverages

- Convenience Foods

- Dairy & Frozen Desserts

- Spices, Condiments, Sauces & Dressings

- Livestock Feed

- Others

- Cosmetic Chemicals

- Skin Care

- Hair Care

- Makeup

- Oral Care

- Fragrances

- Others

- Oilfield Chemicals

- Drilling

- Production

- Cementing

- Workover & Completion

- Specialty Pulp & Paper Chemicals

- Packaging

- Labeling

- Printing

- Others

- Specialty Textile Chemicals

- Apparel

- Home Furnishing

- Technical Textiles

- Others

- Water Treatment Chemicals

- Power

- Oil & Gas

- Chemical Manufacturing

- Mining & Mineral Processing

- Municipal

- Food & Beverage

- Pulp & Paper

- Others

- Mining Chemicals

- Mineral Processing

- Explosives and Drilling

- Water Treatment

- Others

- Electronic Chemicals

- Pharmaceutical & Nutraceutical Additives

- CASE (Coatings, Adhesives, Sealants & Elastomers)

- Other Applications

- Institutional & Industrial Cleaners

- Specialty Chemicals Market, By Product

- UK

- Specialty Chemicals Market, By Product

- Institutional & Industrial Cleaners

- General Purpose Cleaners

- Disinfectants and Sanitizers

- Laundry Care Products

- Vehicle Wash Products

- Others

- Rubber Processing Chemicals

- Anti-degradants

- Accelerators

- Flame Retardants

- Processing Aid/ Promoters

- Others

- Food & Feed Additives

- Flavors & Enhancers

- Sweeteners

- Enzymes

- Emulsifiers

- Preservatives

- Fat Replacers

- Others

- Cosmetic Chemicals

- Surfactants

- Emollients & Moisturizers

- Film-Formers

- Colorants & Pigments

- Preservatives

- Emulsifying & Thickening Agents

- Single-Use Additives

- Others

- Oilfield Chemicals

- Inhibitors

- Demulsifiers

- Rheology Modifiers

- Friction Reducers

- Biocides

- Surfactants

- Foamers

- Others

- Specialty Pulp & Paper Chemicals

- Basic Chemicals

- Functional Chemicals

- Bleaching Chemicals

- Process Chemicals

- Specialty Textile Chemicals

- Coating & Sizing Chemicals

- Colorants & Auxiliaries

- Finishing Agents

- Surfactants

- Denim Finishing Agents

- Water Treatment Chemicals

- Coagulants & Flocculants

- Biocide & Disinfectant

- Defoamer & Defoaming Agent

- pH & Adjuster & Softener

- Scale & Corrosion Inhibitor

- Others

- Construction Chemicals

- Electronic Chemicals

- Mining Chemicals

- Pharmaceutical & Nutraceutical Additives

- CASE (Coatings, Adhesives, Sealants & Elastomers)

- Other Products

- Institutional & Industrial Cleaners

- Specialty Chemicals Market, By Application

- Institutional & Industrial Cleaners

- Commercial

- Food Service

- Retail

- Healthcare

- Laundry Care

- Institutional Buildings

- Others

- Manufacturing

- Food & Beverage Processing

- Metal Manufacturing & Fabrication

- Electronic Components

- Others

- Commercial

- Rubber Processing Chemicals

- Tire

- Non-Tire

- Construction Chemicals

- Residential

- Non-residential & Infrastructure

- Food & Feed Additives

- Bakery & Confectionery

- Beverages

- Convenience Foods

- Dairy & Frozen Desserts

- Spices, Condiments, Sauces & Dressings

- Livestock Feed

- Others

- Cosmetic Chemicals

- Skin Care

- Hair Care

- Makeup

- Oral Care

- Fragrances

- Others

- Oilfield Chemicals

- Drilling

- Production

- Cementing

- Workover & Completion

- Specialty Pulp & Paper Chemicals

- Packaging

- Labeling

- Printing

- Others

- Specialty Textile Chemicals

- Apparel

- Home Furnishing

- Technical Textiles

- Others

- Water Treatment Chemicals

- Power

- Oil & Gas

- Chemical Manufacturing

- Mining & Mineral Processing

- Municipal

- Food & Beverage

- Pulp & Paper

- Others

- Mining Chemicals

- Mineral Processing

- Explosives and Drilling

- Water Treatment

- Others

- Electronic Chemicals

- Pharmaceutical & Nutraceutical Additives

- CASE (Coatings, Adhesives, Sealants & Elastomers)

- Other Applications

- Institutional & Industrial Cleaners

- Specialty Chemicals Market, By Product

- France

- Specialty Chemicals Market, By Product

- Institutional & Industrial Cleaners

- General Purpose Cleaners

- Disinfectants and Sanitizers

- Laundry Care Products

- Vehicle Wash Products

- Others

- Rubber Processing Chemicals

- Anti-degradants

- Accelerators

- Flame Retardants

- Processing Aid/ Promoters

- Others

- Food & Feed Additives

- Flavors & Enhancers

- Sweeteners

- Enzymes

- Emulsifiers

- Preservatives

- Fat Replacers

- Others

- Cosmetic Chemicals

- Surfactants

- Emollients & Moisturizers

- Film-Formers

- Colorants & Pigments

- Preservatives

- Emulsifying & Thickening Agents

- Single-Use Additives

- Others

- Oilfield Chemicals

- Inhibitors

- Demulsifiers

- Rheology Modifiers

- Friction Reducers

- Biocides

- Surfactants

- Foamers

- Others

- Specialty Pulp & Paper Chemicals

- Basic Chemicals

- Functional Chemicals

- Bleaching Chemicals

- Process Chemicals

- Specialty Textile Chemicals

- Coating & Sizing Chemicals

- Colorants & Auxiliaries

- Finishing Agents

- Surfactants

- Denim Finishing Agents

- Water Treatment Chemicals

- Coagulants & Flocculants

- Biocide & Disinfectant

- Defoamer & Defoaming Agent

- pH & Adjuster & Softener

- Scale & Corrosion Inhibitor

- Others

- Construction Chemicals

- Electronic Chemicals

- Mining Chemicals

- Pharmaceutical & Nutraceutical Additives

- CASE (Coatings, Adhesives, Sealants & Elastomers)

- Other Products

- Institutional & Industrial Cleaners

- Specialty Chemicals Market, By Application

- Institutional & Industrial Cleaners

- Commercial

- Food Service

- Retail

- Healthcare

- Laundry Care

- Institutional Buildings

- Others

- Manufacturing

- Food & Beverage Processing

- Metal Manufacturing & Fabrication

- Electronic Components

- Others

- Commercial

- Rubber Processing Chemicals

- Tire

- Non-Tire

- Construction Chemicals

- Residential

- Non-residential & Infrastructure

- Food & Feed Additives

- Bakery & Confectionery

- Beverages

- Convenience Foods

- Dairy & Frozen Desserts

- Spices, Condiments, Sauces & Dressings

- Livestock Feed

- Others

- Cosmetic Chemicals

- Skin Care

- Hair Care

- Makeup

- Oral Care

- Fragrances

- Others

- Oilfield Chemicals

- Drilling

- Production

- Cementing

- Workover & Completion

- Specialty Pulp & Paper Chemicals

- Packaging

- Labeling

- Printing

- Others

- Specialty Textile Chemicals

- Apparel

- Home Furnishing

- Technical Textiles

- Others

- Water Treatment Chemicals

- Power

- Oil & Gas

- Chemical Manufacturing

- Mining & Mineral Processing

- Municipal

- Food & Beverage

- Pulp & Paper

- Others

- Mining Chemicals

- Mineral Processing

- Explosives and Drilling

- Water Treatment

- Others

- Electronic Chemicals

- Pharmaceutical & Nutraceutical Additives

- CASE (Coatings, Adhesives, Sealants & Elastomers)

- Other Applications

- Institutional & Industrial Cleaners

- Specialty Chemicals Market, By Product

- Italy

- Specialty Chemicals Market, By Product

- Institutional & Industrial Cleaners

- General Purpose Cleaners

- Disinfectants and Sanitizers

- Laundry Care Products

- Vehicle Wash Products

- Others

- Rubber Processing Chemicals

- Anti-degradants

- Accelerators

- Flame Retardants

- Processing Aid/ Promoters

- Others

- Food & Feed Additives

- Flavors & Enhancers

- Sweeteners

- Enzymes

- Emulsifiers

- Preservatives

- Fat Replacers

- Others

- Cosmetic Chemicals

- Surfactants

- Emollients & Moisturizers

- Film-Formers

- Colorants & Pigments

- Preservatives

- Emulsifying & Thickening Agents

- Single-Use Additives

- Others

- Oilfield Chemicals

- Inhibitors

- Demulsifiers

- Rheology Modifiers

- Friction Reducers

- Biocides

- Surfactants

- Foamers

- Others

- Specialty Pulp & Paper Chemicals

- Basic Chemicals

- Functional Chemicals

- Bleaching Chemicals

- Process Chemicals

- Specialty Textile Chemicals

- Coating & Sizing Chemicals

- Colorants & Auxiliaries

- Finishing Agents

- Surfactants

- Denim Finishing Agents

- Water Treatment Chemicals

- Coagulants & Flocculants

- Biocide & Disinfectant

- Defoamer & Defoaming Agent

- pH & Adjuster & Softener

- Scale & Corrosion Inhibitor

- Others

- Construction Chemicals

- Electronic Chemicals

- Mining Chemicals

- Pharmaceutical & Nutraceutical Additives

- CASE (Coatings, Adhesives, Sealants & Elastomers)

- Other Products

- Institutional & Industrial Cleaners

- Specialty Chemicals Market, By Application

- Institutional & Industrial Cleaners

- Commercial

- Food Service

- Retail

- Healthcare

- Laundry Care

- Institutional Buildings

- Others

- Manufacturing

- Food & Beverage Processing

- Metal Manufacturing & Fabrication

- Electronic Components

- Others

- Commercial

- Rubber Processing Chemicals

- Tire

- Non-Tire

- Construction Chemicals

- Residential

- Non-residential & Infrastructure

- Food & Feed Additives

- Bakery & Confectionery

- Beverages

- Convenience Foods

- Dairy & Frozen Desserts

- Spices, Condiments, Sauces & Dressings

- Livestock Feed

- Others

- Cosmetic Chemicals

- Skin Care

- Hair Care

- Makeup

- Oral Care

- Fragrances

- Others

- Oilfield Chemicals

- Drilling

- Production

- Cementing

- Workover & Completion

- Specialty Pulp & Paper Chemicals

- Packaging

- Labeling

- Printing

- Others

- Specialty Textile Chemicals

- Apparel

- Home Furnishing

- Technical Textiles

- Others

- Water Treatment Chemicals

- Power

- Oil & Gas

- Chemical Manufacturing

- Mining & Mineral Processing

- Municipal

- Food & Beverage

- Pulp & Paper

- Others

- Mining Chemicals

- Mineral Processing

- Explosives and Drilling

- Water Treatment

- Others

- Electronic Chemicals

- Pharmaceutical & Nutraceutical Additives

- CASE (Coatings, Adhesives, Sealants & Elastomers)

- Other Applications

- Institutional & Industrial Cleaners

- Specialty Chemicals Market, By Product

- Spain

- Specialty Chemicals Market, By Product

- Institutional & Industrial Cleaners

- General Purpose Cleaners

- Disinfectants and Sanitizers

- Laundry Care Products

- Vehicle Wash Products

- Others

- Rubber Processing Chemicals

- Anti-degradants

- Accelerators

- Flame Retardants

- Processing Aid/ Promoters

- Others

- Food & Feed Additives

- Flavors & Enhancers

- Sweeteners

- Enzymes

- Emulsifiers

- Preservatives

- Fat Replacers

- Others

- Cosmetic Chemicals

- Surfactants

- Emollients & Moisturizers

- Film-Formers

- Colorants & Pigments

- Preservatives

- Emulsifying & Thickening Agents

- Single-Use Additives

- Others

- Oilfield Chemicals

- Inhibitors

- Demulsifiers

- Rheology Modifiers

- Friction Reducers

- Biocides

- Surfactants

- Foamers

- Others

- Specialty Pulp & Paper Chemicals

- Basic Chemicals

- Functional Chemicals

- Bleaching Chemicals

- Process Chemicals

- Specialty Textile Chemicals

- Coating & Sizing Chemicals

- Colorants & Auxiliaries

- Finishing Agents

- Surfactants

- Denim Finishing Agents

- Water Treatment Chemicals

- Coagulants & Flocculants

- Biocide & Disinfectant

- Defoamer & Defoaming Agent

- pH & Adjuster & Softener

- Scale & Corrosion Inhibitor

- Others

- Construction Chemicals

- Electronic Chemicals

- Mining Chemicals

- Pharmaceutical & Nutraceutical Additives

- CASE (Coatings, Adhesives, Sealants & Elastomers)

- Other Products

- Institutional & Industrial Cleaners

- Specialty Chemicals Market, By Application

- Institutional & Industrial Cleaners

- Commercial

- Food Service

- Retail

- Healthcare

- Laundry Care

- Institutional Buildings

- Others

- Manufacturing

- Food & Beverage Processing

- Metal Manufacturing & Fabrication

- Electronic Components

- Others

- Commercial

- Rubber Processing Chemicals

- Tire

- Non-Tire

- Construction Chemicals

- Residential

- Non-residential & Infrastructure

- Food & Feed Additives

- Bakery & Confectionery

- Beverages

- Convenience Foods

- Dairy & Frozen Desserts

- Spices, Condiments, Sauces & Dressings

- Livestock Feed

- Others

- Cosmetic Chemicals

- Skin Care

- Hair Care

- Makeup

- Oral Care

- Fragrances

- Others

- Oilfield Chemicals

- Drilling

- Production

- Cementing

- Workover & Completion

- Specialty Pulp & Paper Chemicals

- Packaging

- Labeling

- Printing

- Others

- Specialty Textile Chemicals

- Apparel

- Home Furnishing

- Technical Textiles

- Others

- Water Treatment Chemicals

- Power

- Oil & Gas

- Chemical Manufacturing

- Mining & Mineral Processing

- Municipal

- Food & Beverage

- Pulp & Paper

- Others

- Mining Chemicals

- Mineral Processing