- Home

- »

- Medical Devices

- »

-

Sperm Bank Market Size, Share And Growth Report, 2030GVR Report cover

![Sperm Bank Market Size, Share & Trends Report]()

Sperm Bank Market Size, Share & Trends Analysis Report By Donor Type (Known Donor, Anonymous Donor), By Service, By Fertilization Techniques, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-423-9

- Number of Pages: 190

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Sperm Bank Market Size & Trends

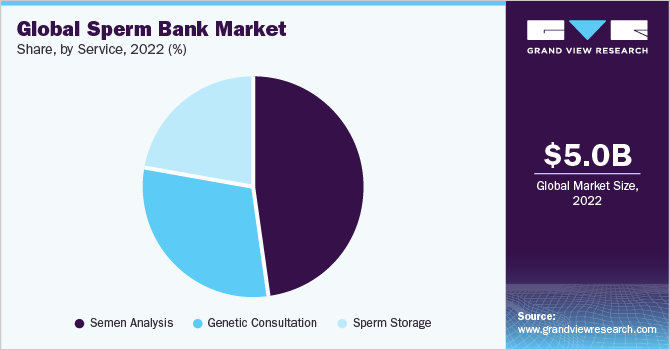

The global sperm bank market size was valued at USD 5.0 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 3.56% over the forecast period from 2023 to 2030. Innovations in cryopreservation techniques, rising awareness, the emergence of fertility tourism, and increasing access to infertility treatment are the key factors driving the growth. An increase in the risk of miscarriages is also among a few key factors boosting the demand. Moreover, the market is witnessing lucrative growth opportunities owing to the growing acceptance of single-parent or same-sex families in many societies. Growing acceptance of the Lesbian, Gay, Bisexual, and Transgender (LGBT) community is one of the factors driving sperm donations across various countries.

The demand for sperm bank services is expected to continue to increase due to increasing concerns about male infertility caused by abnormal and insufficient sperm volume and ejaculatory problems. According to the American Association of Pregnancy, male infertility alone accounts for up to 50% of all cases of infertility. Male infertility can also result from smoking, using illegal drugs, being exposed to hazardous substances, excessive alcohol consumption, and genetic issues. As a result, the prevalence of male and female infertility is rising globally, which is driving demand for infertility treatments including donor insemination and IVF procedures and this fueling the market growth.

A rise in funding and supportive government initiatives across various countries is anticipated to boost the adoption of fertility treatments, thereby driving the demand for sperm banks. The Singapore government offers around 75% co-funding for various Assisted Reproductive Technology (ART) procedures, such as IVF, Gamete Intrafallopian Transfer (GIFT), and Intracytoplasmic Sperm Injection (ICSI). The National Health Service (NHS) also funds up to 3 cycles of IVF across the U.K.

In response to the COVID-19 pandemic, scientific and professional fertility societies around the world, such as, the International Federation for Fertility Societies (IFFS), American Society of Reproductive Medicine (ASRM), European Society for Human Reproduction and Embryology (ESHRE), and the Canadian Fertility and Andrology Society (CFAS) issued guidelines for intended couples who are undergoing or will undergo treatments such as IVF. All guidelines issued by aforementioned societies recommended suspension of new fertility treatments - intrauterine insemination, ovulation, and non-urgent gamete cryopreservation.

Donor Type Insights

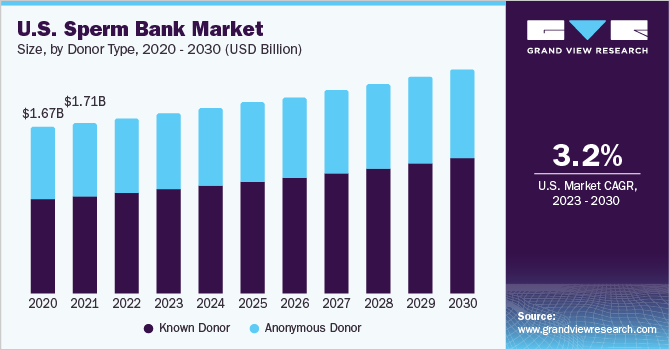

In 2022, the known donor segment held the largest market share of 57.6%. Changing legal landscape in many countries mandating the right to the offspring to know their biological parent is a key factor for the highest revenue share. Austria, Switzerland, New Zealand, Sweden, U.K., and Australia are the examples of such countries with stringent laws against donor anonymity. Use of known donors ensures availability of the medical and behavioral background of the donor. The price of a known donor is much higher, which can also contribute to the segment growth.

Anonymous donors do not disclose their identity in any official records. However, in some countries it is disclosed to the recipient, by a confidentiality contract between the donor and recipient. The process of using an anonymous donor is less complex as compared to that of known donor. However, a growing number of countries adopting the policy of disclosing the biological identity of the offspring is one of the factors that can negatively impact the segment growth.

Fertilization Techniques Insights

The donor insemination segment accounted for a major market share of 73.7% in 2022. Due to its low cost and simple procedure, donor insemination has a large client base, which is a major contributor in the market growth. It is recommended for people to try at least 3 cycles of artificial insemination first before IVF, as it involves more cost.

In vitro fertilization is projected to register the fastest CAGR during the forecast period. Growing awareness regarding the benefits of IVF procedures over insemination procedures is one of the crucial factors boosting the sperm bank market. High cost of the procedure is also one of the key factors driving growth.

Increased prevalence of infertility among male population and high maternal age in countries such as Japan are few other factors driving the demand for IVF. Abolishment of China’s one-child policy and increasing incidence of Polycystic Ovary Syndrome (PCOS) are few other market drivers. Rise in access to IVF due to supportive reimbursement framework or funding also contributes to creating favorable growth opportunities.

Service Type Insights

Semen analysis accounted for the maximum share of 47.8% in 2022. This is due to increased demand for ART operations as well as increased need for sperm analysis. For instance, the Sperm Bank of California (TSBC) evaluates fertility using standards defined by the World Health Organization. Extensive semen analysis is necessary before any ART procedure, and basic screening is essential to keep sperm safe. The demand for sperm analysis is therefore the highest among all services.

Furthermore, the trend of fertility tourism in countries such as Spain, Czech Republic, Turkey, Hungary, and India has further propelled the demand for semen analysis services. Key factors driving fertility tourism in these countries are supportive legal framework and cost-effectiveness. According to National Association for Fertility Problems, Spain is the preferred destination for fertility treatments, which represents 40% European fertility tourism.

Sperm storage segment is projected to register a lucrative CAGR over the forecast period, attributed to several factors such as innovations in cryopreservation techniques, increasing prevalence of infertility, and demand for IVF procedures. Sperm storage is beneficial for storing fertility in case of medical treatments, surgery, exposure to toxic environment, or high-risk occupations such as military.

Regional Insights

North America dominated the market with a share of 36.9% in 2022. This is majorly attributed to growing prevalence of infertility among the American population. For instance, according to the U.S. Department of Health and Human Services statistics Infertility affects roughly 1 in 5 married women in the United States between the ages of 15 and 49 who have never given birth. Additionally, roughly one in four (26%) of the women in this category have impaired fertility, which affects their ability to conceive and carry pregnancies to term.

Europe held the second largest share in 2022, mainly due to factors such as lower treatment cost compared to U.S. and Canada and rise in the number of IVF centers. Denmark has the largest sperm bank, which contribute to the region’s market growth. Cryos International - Denmark is the world's largest sperm bank, with the largest donor pool and free online donor search. The emergence of fertility tourism is also driving the regional demand.

Asia pacific market is expected to witness lucrative growth over the forecast period. Growing demand for ART and low-cost treatment is some of the factors that are expected drive the regional growth. Furthermore, a supportive legislative framework and increase in demand for fertility treatment among Chinese population is another factor boosting the market.

Key Companies & Market Share Insights

The market is highly competitive due to presence of large number of multinational as well as local market players. Companies operating in the market are adopting various strategies, such as service launches, facility expansion, and partnerships & collaborations, to gain higher market share. For instance, in June 2022, Perwyn, a private equity investor announced the acquisition of European Sperm Bank from Axcel. Some of the prominent players in the sperm bank market include:

-

Cryos International

-

New England Cryogenic Center

-

European Sperm Bank

-

Fairfax Cryobank, Inc

-

The London Sperm Bank

-

Indian Spermtech

-

ReproTech LLC

-

Xytex Corporation

-

Cryobank America LLC

- The Sperm Bank of California

Sperm Bank Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 5.2 billion

Revenue forecast in 2030

USD 6.6 billion

Growth rate

CAGR of 3.56% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

June 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Donor type, service type, fertilization techniques, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Cryos International; New England Cryogenic Center; European Sperm Bank; Fairfax Cryobank, Inc.; The London Sperm Bank; Indian Spermtech, ReproTech LLC; Xytex Corporation; Cryobank America LLC; The Sperm Bank of California

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sperm Bank Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sperm bank market report on the basis of donor type, services, fertilization techniques, and region:

-

Donor Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Known Donor

-

Anonymous donor

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Sperm storage

-

Semen analysis

-

Genetic consultation

-

-

Fertilization Techniques Outlook (Revenue, USD Million, 2018 - 2030)

-

Donor insemination

-

In vitro fertilization

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global sperm bank market size was estimated at USD 5.0 billion in 2022 and is expected to reach USD 5.2 billion in 2023.

b. The global sperm bank market is expected to grow at a compound annual growth rate of 3.56% from 2030 to reach USD 6.0 billion by 2030.

b. North America dominated the sperm bank market with a share of 36.9% in 2022. This is attributable to the growing prevalence of infertility among the American population.

b. Some key players operating in the sperm bank market include Cryos International, New England Cryogenic Center, European Sperm Bank, Fairfax Cryobank, Inc, The London Sperm Bank, Indian Spermtech, ReproTech LLC, Xytex Corporation, Cryobank America LLC, The Sperm Bank of California.

b. Key factors that are driving the market growth include increasing incidence of male and female infertility, rising acceptance of sperm banking services, and government initiatives in Assisted Reproductive Techniques (ART).

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."