- Home

- »

- Biotechnology

- »

-

Spine Biologics Market Size, Share & Growth Report, 2030GVR Report cover

![Spine Biologics Market Size, Share & Trends Report]()

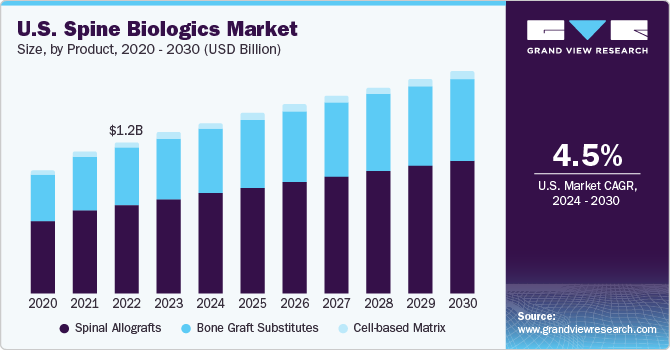

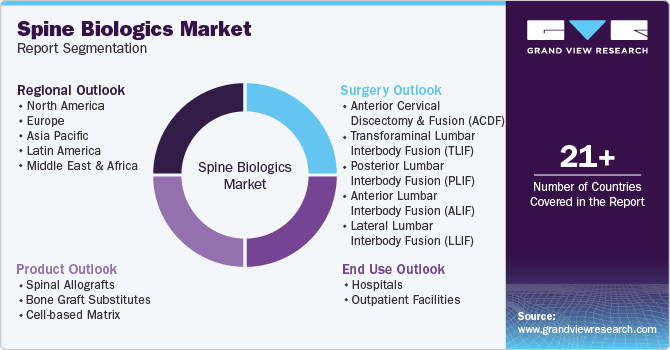

Spine Biologics Market Size, Share & Trends Analysis Report By Product (Spinal Allografts, Bone Graft Substitutes, Cell-based Matrix), By End-use (Hospitals, Outpatient Facilities), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-588-5

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Healthcare

Spine Biologics Market Size & Trends

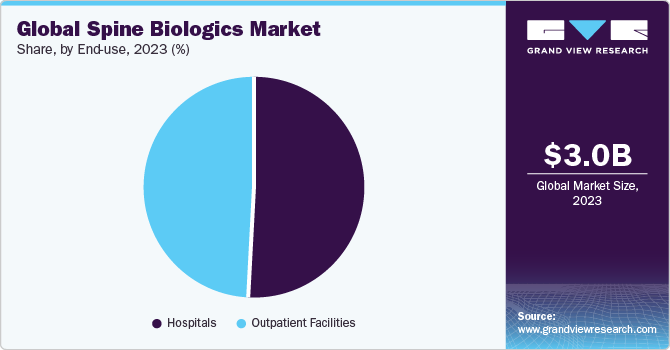

The global spine biologics market size was valued at USD 3.05 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.08% from 2024 to 2030. The increasing prevalence of degenerative spine disorders and a subsequent increase in treatment rates, advancements in bone grafting procedures, and high demand for minimally invasive procedures are key contributing factors to market growth. According to the study published by ScienceDirect in April 2023, spinal degeneration is a common process in humans. In addition, the study reports that the prevalence of spinal degeneration is around 266 million (3.63 %) in 1 year across the globe.

Spine biologics comprises biomaterials that can be used to treat spinal cord injuries, degenerative disc disorders, and bone fusion surgeries. The usage of these products has always been crucial in spine surgery. Spinal fusion is a procedure used to correct defects in small bones (vertebrae) in the spine.

Surgeons are using advanced biological mechanisms to treat spine deformities, such as direct lateral interbody fusion and extreme lateral interbody fusion. According to an article published by the Barrow Neurological Institute in May 2023, extreme lateral interbody fusion (XLIF) is a minimally invasive approach to lumbar spinal fusion surgery, and it has numerous advantages, including less surgery time, minimal blood loss, shorter hospital stays, and less post-operative pain. It can be used to treat numerous spinal disorders like Lumbar spinal stenosis, mild scoliosis, and degenerative disc disease with instability. Advancements in biomaterials make it easy for surgeons to treat people suffering from spine-related disorders, and such advancements are expected to drive the market demand over the forecast period.

Industry players have been focusing on the development of technologically advanced to gain a competitive advantage. For instance, in July 2022, AlloSource introduced new AlloFuse micro fibres demineralized bone allograft for use in foot, ankle, spinal or orthopedic procedures.

Market Concentration & Characteristics

The market growth stage is medium, and the pace of the market growth is accelerating. The market is characterized by a moderate degree of innovation due to rapid technological advancements and increasing launches of novel products. Companies are entering the market and bringing advanced products into the market, which are expected to drive innovation in the industry. For instance, in October 2023 Biogennix, a manufacturer of osteobiologic products for spine surgery, introduced a new allograft, OsteoSPAN Fiber Matrix. When hydrated with bone marrow or blood, this product is cohesive and moldable and expands to conform to irregular bone voids. Such developments are expected to bring innovative products to the market.

The market is characterized by a moderate level of merger and acquisition (M&A) activity by leading players operating in the industry. This is due to numerous factors, including the desire to gain a competitive advantage in the industry and the need to consolidate in a rapidly growing market. Major industry participants are acquiring firms providing products for spinal surgeries. For instance, in October 2023, Biologica Technologies merged with the provider of allografts and products for spinal fusion, Isto Biologics. The merger has expanded Isto’s growing portfolio of bone grafts. Such acquisitions and mergers are expected to propel industry growth in the coming years.

Furthermore, the industry participants operating across the industry are focusing on increasing their presence in several regions and improving access to the product and solutions needed during spinal surgeries across the globe.

Product Insights

The spinal allografts segment dominated the market and accounted for 58.62% of the global revenue in 2023. This dominance can be attributed to the numerous benefits associated with the usage of allografts. The adoption of allografts over autografts is swiftly increasing owing to properties such as osteoconductivity and immediate structural support. In addition, allografts do not need another surgery to harvest the bone, which results in decreased surgery time and wound healing. The spinal allografts segment is further bifurcated into two types, i.e., machined bones allograft and demineralized bone matrix.

On the other hand, the cell-based matrix segment is anticipated to witness the fastest growth over the forecast period. The availability of cell-based matrix from numerous companies like DePuySynthes, NuVasive, and Stryker is expected to support the segment growth. Some of the commercially available cell-based matrix include ViviGen, Osteocel Pro, and Bio4 among others.

End-use Insights

The hospital segment dominated the market in 2023. The segment is primarily driven by an increased number of spine fusion surgeries performed in these facilities. In addition, the availability of several hospitals like the George Washington University Hospital and Massachusetts General Hospital offering services for spinal surgeries is expected to boost the segment growth over the forecast period.

The outpatient facilities segment is projected to witness significant growth over the forecast period. Outpatient facilities include an ambulatory surgery center (ASC) or an outpatient surgery center (OSC). Increasing demand for minimally invasive surgeries, technological developments in surgical devices and equipment, and surgeons' control over the choice of such equipment are some of the factors projected to propel segment growth. In addition, several outpatient facilities are present which provide spine surgeries. According to the article published by Cardinal Health in 2021, more than 160 outpatient spine surgery facilities in the U.S. Furthermore, as per the article published by the University Pain Centers in September 2023, there are more than 5,000 Medicare-certified ambulatory surgery centers across the U.S. in all the major surgical specialties including orthopedic and spine surgeries. Thus, the large number of outpatient facilities providing spine surgeries is expected to support the segment's growth.

Regional Insights

North America dominated the market and accounted for a 48.36% share in 2023. The growth of the market can be attributed to stable economic growth, increased adoption of minimally invasive surgeries, and rising prevalence of spine disorders such as disc-related issues, spinal stenosis, and spondylolisthesis. According to the article published by the American Medical Association in May 2022, around lumbar spinal stenosis is common problem, affecting approximately 11% of older adults in the U.S. Furthermore, the presence of several key players like Orthofix Holdings, Inc., Stryker, and NuVasive, Inc. across the U.S. is expected to support the regional expansion.

Asia Pacific is anticipated to witness the fastest growth in the market due to the presence of a large patient pool and growing awareness among patients and surgeons about the advantages of biologics. Advancements in healthcare infrastructure in the region, growing healthcare expenditure, and increasing prevalence of spine injuries, particularly due to road accidents, are some of the aspects driving the regional market. Sedentary life and changing lifestyle patterns have resulted in a rising prevalence of obesity, which is also expected to fuel the industry over the coming years.

Key Spine Biologics Company Insights

Key players in the market are offering innovative products, focus highly on R&D and have a wide geographic presence. The leading companies focus on strategies such as acquisition & merger, partnership, collaboration, and development of innovative products.

Exactech, Inc. and Kuros Biosciences., Inc are some of the emerging market participants in the market. Emerging companies in market adopt several strategies to establish themselves and gain a competitive edge. They focus on expanding into new geographic markets, developing a product that stands out and strategies for customer acquisition.

Key Spine Biologics Companies:

The following are the leading companies in the spine biologics market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these spine biologics companies are analyzed to map the supply network.

- Stryker

- NuVasive, Inc.

- Orthofix

- DePuy Synthes (Johnson & Johnson)

- Exactech, Inc.

- Zimmer Biomet

- Arthrex, Inc.

- Medtronic

- Organogenesis Inc.

- Kuros Biosciences.

Recent Developments

-

In October 2023, Orthofix Medical Inc., a major provider of spine and orthopedics products, announced the full commercial launch and 510k clearance of an advanced bioactive synthetic graft, OsteoCove, for use in orthopedic and spine procedures. The product is available in both strip and putty configurations.

-

In July 2023, Cerapedics Inc., a major provider of bone grafts, expanded its headquarters in the Denver metro area. This expansion is expected to support the company’s portfolio of various products, including i-FACTOR bone grafts that can be used for cervical spinal fusion.

-

In April 2023, PUR Biologics, a subsidiary of HippoFi, Inc., introduced a bioactive moldable synthetic, PURcore. This product is useful for spinal surgeries.

Spine Biologics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.25 billion

Revenue forecast in 2030

USD 4.38 billion

Growth rate

CAGR of 5.08% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Stryker; NuVasive, Inc.; Orthofix; DePuy Synthes (Johnson & Johnson); Exactech, Inc.; Zimmer Biomet; Arthrex, Inc.; Medtronic; Organogenesis Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Spine Biologics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global spine biologics market report based on product, end-use and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Spinal Allografts

-

Machined Bones Allograft

-

Demineralized Bone Matrix

-

-

Bone Graft Substitutes

-

Bone Morphogenetic Proteins

-

Synthetic Bone Grafts

-

-

Cell-based Matrix

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global spine biologics market size was valued at USD 3.05 billion in 2023 and is expected to reach USD 3.25 billion in 2024.

b. The global spine biologics market is expected to grow at a compound annual growth rate (CAGR) of 5.08% from 2024 to 2030 to reach USD 4.38 billion by 2030.

b. North America dominated the spine biologics market with a share of 48.36% in 2023. This is attributable to stable economic growth, increased adoption of minimally invasive surgeries, and rising prevalence of spine disorders such as spinal stenosis, disc-related issues, and spondylolisthesis.

b. Some key players operating in the spine biologics market include Stryker; Orthofix Holdings, Inc.; NuVasive, Inc.; K2M Inc.; DePuy Synthes; Wright Medical Group N.V.; Exactech, Inc.; Zimmer Biomet; Arthrex, Inc.; Medtronic Inc.; Organogenesis; and Lattice Biologics Ltd.

b. Key factors that are driving the market growth include increasing prevalence of degenerative spine disorders, and a subsequent increase in treatment rates, advancements in bone grafting procedures, and high demand for minimally invasive procedures.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."