- Home

- »

- Advanced Interior Materials

- »

-

Structural Steel Market Size, Share & Trends Report, 2030GVR Report cover

![Structural Steel Market Size, Share & Trend Report]()

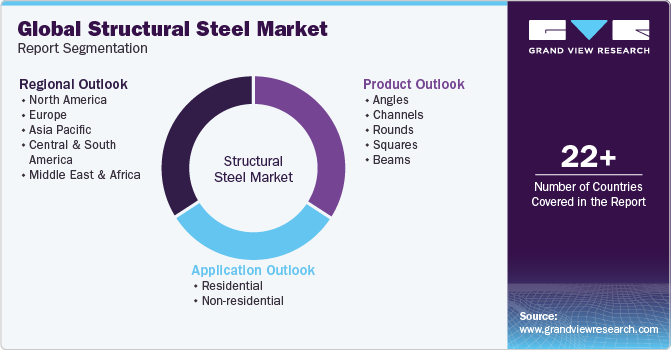

Structural Steel Market Size, Share & Trend Analysis Report By Product (Angles, Channels, Rounds), By Application (Non-residential (Industrial, Commercial, Institutional), Residential), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-503-8

- Number of Pages: 123

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Advanced Materials

Structural Steel Market Size & Trends

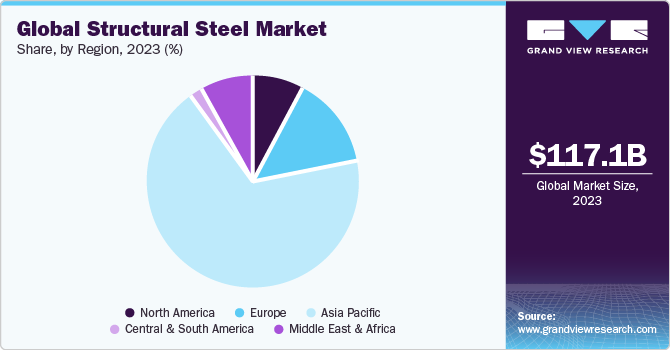

The global structural steel market size was valued at USD 117.12 billion in 2023 and is likely to register a compound annual growth rate (CAGR) of 5.9% from 2024 to 2030. Infrastructural developments, in both developing as well as developed countries, are anticipated to remain the primary factors driving the demand for structural steel.

The growing housing needs, as a result of the increasing population across the globe, are also among the key factors driving product demand. As per the projections estimated by the United Nations, the global population will reach 11.2 billion by 2100, which, in turn, is anticipated to bolster housing demand, thus, boosting consumption for structural steel.

Structural steel is considered a green construction material due to its recyclability and thus, a rising number of green buildings is anticipated to propel market growth in the coming years. According to the World Green Building Council, LEED-certified buildings use 11% less water and 25% less energy in the U.S. Green buildings help reduce harmful impacts on the environment, hence, focus on their construction is increasing in the country. California holds the major share in the overall green buildings segment in the U.S., in terms of area, and the state is expected to achieve zero net energy by 2030.

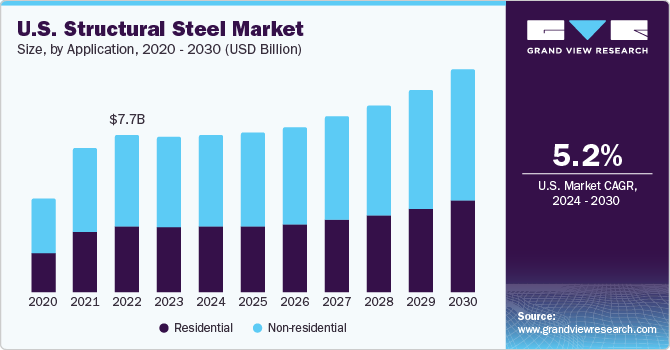

The U.S. construction industry was impacted in 2020 on account of the COVID-19 pandemic. The country is putting efforts toward reaching stable economic growth through several investments. For instance, the overall construction activities in the U.S. is estimated to have grown by 6.1% in 2023. The major growth was witnessed in the manufacturing segment for nearly 37.0%, followed by commercial and residential with over 22.0% and 13.0%, respectively.

Increasing construction of high-rise buildings is another key driving factor for the structural steel market. The product possesses a high strength-to-weight ratio, allowing it to bear heavy loads and resist compression, tension, and bending forces, making it an ideal material ideal for supporting the weight of tall buildings and transferring the load to the foundation. There are 97 under-construction tall buildings in the world, of which 1 is above 600m, 25 are above 400m, and the remaining above 300m. The majority of these buildings are in Asia.

The market however faces restrictions from the supply aspect. Steel commodities have experienced daily price swings in most countries along with fluctuations in the prices of raw materials such as iron, coal, and scrap. Any disruption in demand supply leads to extreme volatility in the prices. Production costs also influence prices and storage capacity, which directly impact the costs of structural steel.

Market Concentration & Characteristics

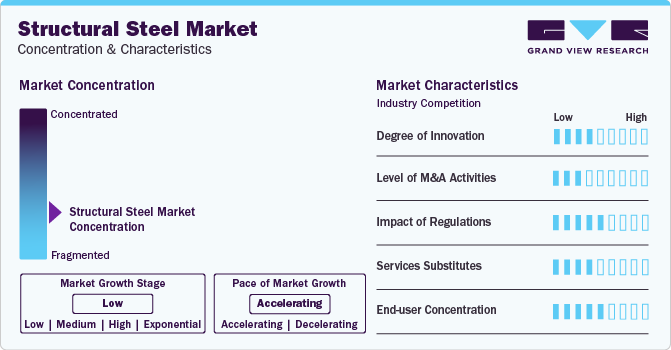

The structural steel market is fragmented and is characterized by the presence of numerous players located across regions. Key players cater to the export markets as well, while mid- to small-scale players cater mainly to domestic demand.

The market is characterized by a moderate degree of innovation to optimize the production process and produce aesthetic products. Manufacturers have been focusing on developing and innovating new products by improving their production process in order to cater to the voluminous building & construction segment.

The market observed a low level of merger and acquisition (M&A) activity owing to challenges such as liquidity and cash flow. Also, various players await for a full swing of revival of construction activity to expand their geographic reach through strategic moves such as M&As.

The market is also subject to moderate levels of regulatory scrutiny. Various regulatory authorities across the world provide standards and guidelines for proper safety measures and waste disposal mechanisms. End user concentration is a significant factor in the market, and in order to minimize logistics cost, manufacturers are located in close vicinity to cities where construction activity is an ongoing process.

Product Insights

Based on product, angles (L shape) accounted for the highest revenue share of over 30.0% in 2023. Steel Angles are available both as "equal angles" where both legs are of the same size, and "unequal angles", that have legs of different sizes. Infrastructural spending in key developing countries such as India and Indonesia are anticipated to cater to growth in this segment.

Application Insights

Based on application, the non-residential held the largest revenue share of 52.0% in 2023, of the global market. It is estimated to expand further at the fastest CAGR over the forecast period owing to the increasing spending on manufacturing plants, airports, commercial centers, healthcare facilities, and malls. The segment is further divided into industrial, commercial, offices, and institutional.

The others sub-segment(including industrial & infrastructure) accounts for the maximum share, which consists of the non-residential segment. Structural steel is majorly used in industrial buildings due to its extreme strength, which is beneficial not only for structural integrity but also for subsiding the potential impact of repairs. It is also ideal for building large bridges owing to its high durability and excellent strength-to-weight ratio, which ensures withstanding the weight of cars and pedestrians.

The residential application segment accounted for the second-highest revenue share in 2023. The product is widely utilized in housing and residential buildings. Its exceptional flexibility and adaptability make it suitable for modular construction, allowing for easy disassembly and relocation while maintaining the building's asset value. This versatile material can be employed in various residential building types, ranging from single-family houses to large mixed-use structures. Moreover, it also provides environmental benefits as it is 100% recyclable with no degradation.

Regional Insights

Asia Pacific held the largest revenue share of about 69.0% of the global market in 2023 and is anticipated to maintain its dominance at the fastest CAGR in the forecast period. Increased investments in the housing and commercial sectors of the developing economies, such as China and India, are anticipated to prove fruitful for market growth.

Furthermore, Southeast Asia is one of the emerging regions in the global market. There is a need for huge investments to reduce the infrastructure gap in this region. From 2000, Japan has financed projects worth USD 230 billion, while China invested around USD 155 billion for the improvement of infrastructure in the Southeast Asian region. Such investments are expected to augment the product demand over the coming years.

North America is anticipated to register a CAGR of 4.7%, in terms of revenue, over the forecast period. The region suffered a heavy economic loss, especially in the U.S. and Mexico, due to the COVID-19 pandemic. The aging of infrastructure is expected to remain a key factor for rising product demand in the region.

Middle East & Africa is expected to grow at a considerable CAGR over the forecast period. The region is anticipated to witness a plethora of projects in the coming years, which is expected to augment market growth. Some of the projects include Abrahamic Family House, Abu Dhabi; URB: The Loop, Dubai; Baynouna Solar Park, Jordan; Mega Urban Housing Project, South Africa; Wind Power Project, Egypt; and Bridge on Lake Victoria, Tanzania.

Key Companies & Market Share Insights

The market is fragmented with the presence of various small- and large-scale companies operating in different parts of the world. Companies focus on acquisitions and capacity expansions to broaden their presence worldwide.

Some of the key players operating in the market include ArcelorMittal, Gerdau S.A., and Baosteel Group.

-

ArcelorMittal has several business segments, namely - NAFTA, Brazil, Europe, ACIS, and mining. The NAFTA segment produces flat products such as slab, hot rolled coil, cold-rolled coil, coated steel, and plate. The products are sold to industries such as automotive, energy, construction, packaging, and appliances. The Brazil segment produces flat products and long products. Flat products include slabs, hot-rolled coils, cold-rolled coils, and coated steel, while long products include wire rods, sections, bars & rebar, billets, blooms, and wire drawing. The Europe segment produces hotrolled coils, cold-rolled coils, coated products, tinplate, plates, and slabs. The ACIS segment produces flat, long, and tubular products.

-

Gerdau S.A. specializes in manufacturing billets, blooms, slabs, wire rods, rebar, heavy slabs, hot- and cold-rolled coils, and seamless tubes. The company offers its products to various end-use industries such as metallurgy, farming & livestock, construction, automotive, petrochemical, railway, and marine industries.

-

Baosteel Group manufactures various iron and steel products. It operates under major product categories including stainless steel, carbon steel, and special steel. It has a presence in 40 countries across Asia Pacific, North & South America, Africa, and Europe.

HBIS Group and Anyang Iron & Steel Group Co., Ltd. are some of the emerging market participants.

-

HBIS Group specializes in manufacturing bars, wires, profiles, hot-rolled strips, hot- & cold-rolled plates, galvanized plates, pipes, vanadium-nitrogen alloys, and twisted ribbed steel bars. The company also manufactures coke, industrial gas, and chemical products. It offers its products for various applications such as automotive, nuclear power, marine engineering, bridges, construction, and home appliances.

-

Anyang Iron & Steel Group Co., Ltd. operations include coking, sintering, smelting, rolling, and scientific research & development; it exports its products to Germany, the UK, Japan, South Korea, and South Africa. It also specializes in manufacturing high-speed wire rods, structural steel, galvanized steel, cold-rolled steel, heavy section, color coated steel, seamless pipes, pipe fittings, and hot-rolled steel products.

Key Structural Steel Companies:

- Arcelor Mittal S.A.

- Baogang Group

- Evraz plc

- Gerdau S.A

- Nippon Steel Corporation

- JSW Steel Limited

- Tata Steel Limited

- SAIL

Recent Developments

-

In August 2023, Hybar LLC, a metal scrap recycling company commenced the construction of its steel rebar mill project in Arkansas, U.S. Machinery is being supplied by SMS group GmbH, and will utilize steel scrap as feedstock.

-

In March 2023, JSPL announced its plans to produce the first-ever fire-resistant steel structures in India at its facility located in Raigarh, Chhattisgarh, India.

Structural Steel Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 117.12 billion

Revenue forecast in 2030

USD 174.51 billion

Growth Rate

CAGR of 4.5% from 2023 to 2030

Market size volume in 2023

129,348.2 kilotons

Volume forecast in 2030

193,616.8 kilotons

Growth Rate

CAGR of 5.5 % from 2023 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative Units

Volume in Kilotons, Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application and region

Regional scope

North America, Europe, Asia Pacific, Central & South Africa, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, U.K., France, Spain, Russia, Turkey, Poland, China, Japan, Taiwan, India, Hong Kong, Thailand, Malaysia, Singapore, Vietnam, Philippines, Australia, New Zealand, Indonesia, Brazil, Chile, Colombia, UAE, Saudi Arabia, Iran, South Africa

Key companies profiled

Arcelor Mittal S.A., Baogang Group, Evraz plc, Gerdau S.A, Nippon Steel Corporation, JSW Steel Limited, Tata Steel Limited, SAIL, Wuhan Iron & Steel (Group) Corp, Hebei Steel Group, Baosteel Group Corporation, Bohai Steel Group Co. Ltd., andAnshan Iron & Steel Group Co., Ltd. among others

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Structural Steel Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global structural steel market report on the basis of product, application and region.

-

Product Outlook (Volume, Kil0tons; Revenue, USD Million; 2018 - 2030)

-

Angles

-

Channels

-

Rounds

-

Squares

-

Beams

-

-

Application Outlook (Volume, Kil0tons; Revenue, USD Million; 2018 - 2030)

-

Residential

-

Non-residential

-

Institutional

-

Commercial

-

Offices

-

Others

-

-

-

Regional Outlook (Volume, Kil0tons; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Russia

-

Turkey

-

Poland

-

-

Asia Pacific

-

China

-

Japan

-

Taiwan

-

Hong Kong

-

Thailand

-

Malaysia

-

Singapore

-

Indonesia

-

Vietnam

-

Philippines

-

India

-

Australia

-

New Zealand

-

-

Central & South America

-

Brazil

-

Chile

-

Colombia

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

Iran

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global structural steel market size was estimated at USD 105.57 billion in 2022 and is expected to reach USD 110.74 billion in 2023.

b. The global structural steel market is expected to grow at a compound annual growth rate of 5.5% from 2023 to 2030 to reach USD 162.46 billion by 2030.

b. Based on the application segment, non-residential held the largest revenue share of more than 54.0% in 2022 owing to increasing demand for high-quality construction material in industrial, commercial, offices, and institutional buildings.

b. Some of the key players operating in the structural steel market include ArcelorMittal, Baosteel Group, Evraz plc, Gerdau S.A., JSW Steel, POSCO, Nippon Steel Corporation, Tata Steel, and SAIL.

b. Growing efforts towards infrastructural developments coupled with rising spending in the residential sector across various countries are anticipated to augment structural steel market growth over the forecast period.

Table of Contents

Chapter 1. Structural Steel Market: Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Information Analysis

1.3.2. Market Formulation & Data Visualization

1.3.3. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Structural Steel Market: Executive Summary

2.1. Market Snapshot

2.2. Segmental Outlook

2.3. Competitive Outlook

Chapter 3. Structural Steel Market: Variables, Trends, and Scope

3.1. Market Lineage Outlook

3.1.1. Global Steel Market Outlook

3.2. Value Chain Analysis

3.2.1. Raw Material Trends

3.3. Manufacturing Overview

3.4. Regulatory Framework

3.5. Market Dynamics

3.5.1. Market Driver Analysis

3.5.2. Market Restraint Analysis

3.5.3. Market Opportunity Analysis

3.5.4. Market Challenges

3.6. Porter’s Five Forces Analysis

3.6.1. Bargaining Power of Suppliers

3.6.2. Bargaining Power of Buyers

3.6.3. Threat of Substitution

3.6.4. Threat of New Entrants

3.6.5. Competitive Rivalry

3.7. PESTLE Analysis

3.7.1. Political

3.7.2. Economic

3.7.3. Social Landscape

3.7.4. Technology

3.7.5. Environmental

3.7.6. Legal

Chapter 4. Structural Steel Market: Product Estimates & Trend Analysis

4.1. Structural Steel Market: Product Movement Analysis, 2023 & 2030

4.2. Angles

4.2.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

4.3. Channels

4.3.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

4.4. Rounds

4.4.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

4.5. Squares

4.5.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

4.6. Beams

4.6.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Chapter 5. Structural Steel Market: Application Estimates & Trend Analysis

5.1. Structural Steel Market: Application Movement Analysis, 2023 & 2030

5.2. Residential

5.2.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

5.3. Non-Residential

5.3.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

5.3.2. Market estimates and forecasts, by non-residential applications, 2018 - 2030 (Kilotons) (USD Million)

Chapter 6. Structural Steel Market: Regional Estimates & Trend Analysis

6.1. Regional Analysis, 2023 & 2030

6.2. North America

6.2.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.2.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.2.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.2.4. U.S.

6.2.4.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.2.4.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.2.4.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.2.5. Canada

6.2.5.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.2.5.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.2.5.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.2.6. Mexico

6.2.6.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.2.6.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.2.6.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.3. Europe

6.3.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.3.1.1. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.3.2. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.3.3. Germany

6.3.3.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.3.3.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.3.3.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.3.4. UK

6.3.4.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.3.4.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.3.4.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.3.5. Russia

6.3.5.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.3.5.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.3.5.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.3.6. Turkey

6.3.6.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.3.6.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.3.6.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.3.7. France

6.3.7.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.3.7.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.3.7.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.3.8. Spain

6.3.8.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.3.8.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.3.8.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.3.9. Poland

6.3.9.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.3.9.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.3.9.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.4. Asia Pacific

6.4.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.4.1.1. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.4.2. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.4.3. China

6.4.3.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.4.3.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.4.3.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.4.4. Taiwan

6.4.4.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.4.4.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.4.4.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.4.5. Japan

6.4.5.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.4.5.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.4.5.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.4.6. Thailand

6.4.6.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.4.6.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.4.6.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.4.7. Malaysia

6.4.7.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.4.7.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.4.7.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.4.8. Singapore

6.4.8.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.4.8.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.4.8.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.4.9. Hong Kong

6.4.9.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.4.9.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.4.9.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.4.10. Vietnam

6.4.10.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.4.10.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.4.10.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.4.11. Philippines

6.4.11.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.4.11.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.4.11.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.4.12. India

6.4.12.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.4.12.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.4.12.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.4.13. Australia

6.4.13.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.4.13.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.4.13.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.4.14. New Zealand

6.4.14.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.4.14.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.4.14.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.4.15. Indonesia

6.4.15.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.4.15.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.4.15.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.5. Central & South America

6.5.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.5.1.1. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.5.2. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.5.3. Brazil

6.5.3.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.5.3.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.5.3.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.5.4. Colombia

6.5.4.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.5.4.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.5.4.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.5.5. Chile

6.5.5.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.5.5.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.5.5.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.6. Middle East & Africa

6.6.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.6.1.1. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.6.2. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.6.3. Saudi Arabia

6.6.3.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.6.3.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.6.3.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.6.4. UAE

6.6.4.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.6.4.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.6.4.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.6.5. Iran

6.6.5.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.6.5.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.6.5.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.6.6. South Africa

6.6.6.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.6.6.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.6.6.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Chapter 7. Competitive Landscape

7.1. Global Recent Developments, By Key Market Participants

7.2. Company Ranking Analysis, 2023

7.3. Heat Map Analysis

7.4. Vendor Landscape

7.4.1. List of Raw Material Suppliers

7.4.2. List of Distributors

7.4.3. List of Other Prominent Manufacturers

7.4.4. List of Structural Steel Fabricators

7.4.5. List of Prospective End-Users

7.5. Strategy Mapping

7.6. Company Profiles/Listing

7.6.1. Anshan Iron & Steel Group Co., Ltd.

7.6.1.1. Company Overview

7.6.1.2. Financial Performance

7.6.1.3. Product Benchmarking

7.6.2. Anyang Iron & Steel Group Co., Ltd.

7.6.2.1. Company Overview

7.6.2.2. Financial Performance

7.6.2.3. Product Benchmarking

7.6.3. ArcelorMittal

7.6.3.1. Company Overview

7.6.3.2. Financial Performance

7.6.3.3. Product Benchmarking

7.6.4. Baogang Group

7.6.4.1 Company Overview

7.6.4.2. Financial Performance

7.6.4.3. Product Benchmarking

7.6.5. Benxi Steel Group

7.6.5.1. Company Overview

7.6.5.2. Financial Performance

7.6.5.3. Product Benchmarking

7.6.6. Baosteel Group

7.6.6.1. Company Overview

7.6.6.2. Financial Performance

7.6.6.3. Product Benchmarking

7.6.7. Evraz plc

7.6.7.1. Company Overview

7.6.7.2. Financial Performance

7.6.7.3. Product Benchmarking

7.6.8. Gerdau S.A.

7.6.8.1. Company Overview

7.6.8.2. Financial Performance

7.6.8.3. Product Benchmarking

7.6.9. HBIS Group

7.6.9.1. Company Overview

7.6.9.2. Financial Performance

7.6.9.3. Product Benchmarking

7.6.10. Hyundai Steel

7.6.10.1. Company Overview

7.6.10.2. Financial Performance

7.6.10.3. Product Benchmarking

7.6.11. JSW Steel

7.6.11.1. Company Overview

7.6.11.2. Financial Performance

7.6.11.3. Product Benchmarking

7.6.12. Nippon Steel Corporation

7.6.12.1. Company Overview

7.6.12.2. Financial Performance

7.6.12.3. Product Benchmarking

7.6.13. Tata Steel

7.6.13.1. Company Overview

7.6.13.2. Financial Performance

7.6.13.3. Product Benchmarking

7.6.14. Hunan Valin Iron & Steel Group Co., Ltd.

7.6.14.1. Company Overview

7.6.14.2. Financial Performance

7.6.14.3. Product Benchmarking

7.6.15. Wuhan Iron and Steel Corp.

7.6.15.1. Company Overview

7.6.15.2. Financial Performance

7.6.15.3. Product Benchmarking

7.6.16. Steel Authority of India Limited

7.6.16.1. Company Overview

7.6.16.2. Financial Performance

7.6.16.3. Product Benchmarking

List of Tables

TABLE 1 Structural steel market estimates & forecasts, 2018 - 2030 (Kilotons) (USD Million)

TABLE 2 Structural steel market estimates & forecasts, by angles, 2018 - 2030 (Kilotons) (USD Million)

TABLE 3 Structural steel market estimates & forecasts, by channels, 2018 - 2030 (Kilotons) (USD Million)

TABLE 4 Structural steel market estimates & forecasts, by rounds, 2018 - 2030 (Kilotons) (USD Million)

TABLE 5 Structural steel market estimates & forecasts, by squares, 2018 - 2030 (Kilotons) (USD Million)

TABLE 6 Structural steel market estimates & forecasts, by beams, 2018 - 2030 (Kilotons) (USD Million)

TABLE 7 Structural steel market estimates & forecasts, by residential, 2018 - 2030 (Kilotons) (USD Million)

TABLE 8 Structural steel market estimates & forecasts, by non-residential, 2018 - 2030 (Kilotons) (USD Million)

TABLE 9 Structural steel market estimates & forecasts, by institutional, 2018 - 2030 (Kilotons) (USD Million)

TABLE 10 Structural steel market estimates & forecasts, by commercial, 2018 - 2030 (Kilotons) (USD Million)

TABLE 11 Structural steel market estimates & forecasts, by offices, 2018 - 2030 (Kilotons) (USD Million)

TABLE 12 Structural steel market estimates & forecasts, by other non-residential segments, 2018 - 2030 (Kilotons) (USD Million)

TABLE 13 North America structural steel market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

TABLE 14 North America structural steel market estimates & forecasts, by product, 2018 - 2030 (Kilotons)

TABLE 15 North America structural steel market estimates & forecasts, by product, 2018-2030, (USD Million)

TABLE 16 North America structural steel market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

TABLE 17 North America structural steel market estimates & forecasts, by application, 2018-2030, (USD Million)

TABLE 18 North America structural steel market estimates & forecasts by non-residential segments, 2018 - 2030 (Kilotons)

TABLE 19 North America structural steel market estimates & forecasts by non-residential segments, 2018-2030, (USD Million)

TABLE 20 U.S. structural steel market estimates & forecasts, 2018 - 2030 (Kilotons) (USD Million)

TABLE 21 U.S. structural steel market estimates & forecasts, by product, 2018 - 2030 (Kilotons)

TABLE 22 U.S. structural steel market estimates & forecasts, by product, 2018-2030, (USD Million)

TABLE 23 U.S. structural steel market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

TABLE 24 U.S. structural steel market estimates & forecasts, by application, 2018-2030, (USD Million)

TABLE 25 U.S. structural steel market estimates & forecasts, by non-residential segments, 2018 - 2030 (Kilotons)

TABLE 26 U.S. structural steel market estimates & forecasts, by non-residential segments, 2018-2030, (USD Million)

TABLE 27 Canada structural steel market estimates & forecasts, 2018 - 2030 (Kilotons) (USD Million)

TABLE 28 Canada structural steel market estimates & forecasts, by grade, 2018 - 2030 (Kilotons)

TABLE 29 Canada structural steel market estimates & forecasts, by grade, 2018-2030, (USD Million)

TABLE 30 Canada structural steel market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

TABLE 31 Canada structural steel market estimates & forecasts, by application, 2018-2030, (USD Million)

TABLE 32 Canada structural steel market estimates & forecasts, by non-residential segments, 2018 - 2030 (Kilotons)

TABLE 33 Canada structural steel market estimates & forecasts, by non-residential segments, 2018-2030, (USD Million)

TABLE 34 Mexico structural steel market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

TABLE 35 Mexico structural steel market estimates & forecasts, by product, 2018 - 2030 (Kilotons)

TABLE 36 Mexico structural steel market estimates & forecasts, by product, 2018-2030, (USD Million)

TABLE 37 Mexico structural steel market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

TABLE 38 Mexico structural steel market estimates & forecasts, by application, 2018-2030, (USD Million)

TABLE 39 Mexico structural steel market estimates & forecasts, by non-residential segments, 2018 - 2030 (Kilotons)

TABLE 40 Mexico structural steel market estimates & forecasts, by non-residential segments, 2018-2030, (USD Million)

TABLE 41 Europe structural steel market estimates & forecasts, 2018 - 2030 (Kilotons) (USD Million)

TABLE 42 Europe structural steel market estimates & forecasts, by grade, 2018 - 2030 (Kilotons)

TABLE 43 Europe structural steel market estimates & forecasts, by grade, 2018-2030, (USD Million)

TABLE 44 Europe structural steel market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

TABLE 45 Europe structural steel market estimates & forecasts, by application, 2018-2030, (USD Million)

TABLE 46 Europe structural steel market estimates & forecasts, by non-residential segments, 2018 - 2030 (Kilotons)

TABLE 47 Europe structural steel market estimates & forecasts, by non-residential segments, 2018-2030, (USD Million)

TABLE 48 Germany structural steel market estimates & forecasts, 2018 - 2030 (Kilotons) (USD Million)

TABLE 49 Germany structural steel market estimates & forecasts, by grade, 2018 - 2030 (Kilotons)

TABLE 50 Germany structural steel market estimates & forecasts, by grade, 2018-2030, (USD Million)

TABLE 51 Germany structural steel market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

TABLE 52 Germany structural steel market estimates & forecasts, by application, 2018-2030, (USD Million)

TABLE 53 Germany structural steel market estimates & forecasts, by non-residential segments, 2018 - 2030 (Kilotons)

TABLE 54 Germany structural steel market estimates & forecasts, by non-residential segments, 2018-2030, (USD Million)

TABLE 55 UK structural steel market estimates & forecasts, 2018 - 2030 (Kilotons) (USD Million)

TABLE 56 UK structural steel market estimates & forecasts, by grade, 2018 - 2030 (Kilotons)

TABLE 57 UK structural steel market estimates & forecasts, by grade, 2018-2030, (USD Million)

TABLE 58 UK structural steel market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

TABLE 59 UK structural steel market estimates & forecasts, by application, 2018-2030, (USD Million)

TABLE 60 UK structural steel market estimates & forecasts, by non-residential segments, 2018 - 2030 (Kilotons)

TABLE 61 UK structural steel market estimates & forecasts, by non-residential segments, 2018-2030, (USD Million)

TABLE 62 France structural steel market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

TABLE 63 France structural steel market estimates & forecasts, by grade, 2018 - 2030 (Kilotons)

TABLE 64 France structural steel market estimates & forecasts, by grade, 2018-2030, (USD Million)

TABLE 65 France structural steel market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

TABLE 66 France structural steel market estimates & forecasts, by application, 2018-2030, (USD Million)

TABLE 67 France structural steel market estimates & forecasts, by non-residential segments, 2018 - 2030 (Kilotons)

TABLE 68 France structural steel market estimates & forecasts, by non-residential segments, 2018-2030, (USD Million)

TABLE 69 Spain structural steel market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

TABLE 70 Spain structural steel market estimates & forecasts, by grade, 2018 - 2030 (Kilotons)

TABLE 71 Spain structural steel market estimates & forecasts, by grade, 2018-2030, (USD Million)

TABLE 72 Spain structural steel market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

TABLE 73 Spain structural steel market estimates & forecasts, by application, 2018-2030, (USD Million)

TABLE 74 Spain structural steel market estimates & forecasts, by non-residential segments, 2018 - 2030 (Kilotons)

TABLE 75 Spain structural steel market estimates & forecasts, by non-residential segments, 2018-2030, (USD Million)

TABLE 76 Russia structural steel market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

TABLE 77 Russia structural steel market estimates & forecasts, by grade, 2018 - 2030 (Kilotons)

TABLE 78 Russia structural steel market estimates & forecasts, by grade, 2018-2030, (USD Million)

TABLE 79 Russia structural steel market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

TABLE 80 Russia structural steel market estimates & forecasts, by application, 2018-2030, (USD Million)

TABLE 81 Russia structural steel market estimates & forecasts, by non-residential segments, 2018 - 2030 (Kilotons)

TABLE 82 Russia structural steel market estimates & forecasts, by non-residential segments, 2018-2030, (USD Million)

TABLE 83 Turkey structural steel market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

TABLE 84 Turkey structural steel market estimates & forecasts, by grade, 2018 - 2030 (Kilotons)

TABLE 85 Turkey structural steel market estimates & forecasts, by grade, 2018-2030, (USD Million)

TABLE 86 Turkey structural steel market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

TABLE 87 Turkey structural steel market estimates & forecasts, by application, 2018-2030, (USD Million)

TABLE 88 Turkey structural steel market estimates & forecasts, by non-residential segments, 2018 - 2030 (Kilotons)

TABLE 89 Turkey structural steel market estimates & forecasts, by non-residential segments, 2018-2030, (USD Million)

TABLE 90 Poland structural steel market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

TABLE 91 Poland structural steel market estimates & forecasts, by product, 2018 - 2030 (Kilotons)

TABLE 92 Poland structural steel market revenue, by product, 2018-2030, (USD Million)

TABLE 93 Poland structural steel market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

TABLE 94 Poland structural steel market revenue, by application, 2018-2030, (USD Million)

TABLE 95 Poland structural steel market estimates & forecasts, by non-residential segments, 2018 - 2030 (Kilotons)

TABLE 96 Poland structural steel market estimates & forecasts, by non-residential segments, 2018-2030, (USD Million)

TABLE 97 Asia Pacific structural steel market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

TABLE 98 Asia Pacific structural steel market estimates & forecasts, by product, 2018 - 2030 (Kilotons)

TABLE 99 Asia Pacific structural steel market estimates & forecasts, by product, 2018-2030, (USD Million)

TABLE 100 Asia Pacific structural steel market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

TABLE 101 Asia Pacific structural steel market estimates & forecasts, by application, 2018-2030, (USD Million)

TABLE 102 Asia Pacific structural steel market estimates & forecasts, by non-residential segments, 2018 - 2030 (Kilotons)

TABLE 103 Asia Pacific structural steel market estimates & forecasts, by non-residential segments, 2018-2030, (USD Million)

TABLE 104 China structural steel market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

TABLE 105 China structural steel market estimates & forecasts, by product, 2018 - 2030 (Kilotons)

TABLE 106 China structural steel market estimates & forecasts, by product, 2018-2030, (USD Million)

TABLE 107 China structural steel market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

TABLE 108 China structural steel market estimates & forecasts, by application, 2018-2030, (USD Million)

TABLE 109 China structural steel market estimates & forecasts, by non-residential segments, 2018 - 2030 (Kilotons)

TABLE 110 China structural steel market estimates & forecasts, by non-residential segments, 2018-2030, (USD Million)

TABLE 111 Taiwan structural steel market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

TABLE 112 Taiwan structural steel market estimates & forecasts, by product, 2018 - 2030 (Kilotons)

TABLE 113 Taiwan structural steel market estimates & forecasts, by product, 2018-2030, (USD Million)

TABLE 114 Taiwan structural steel market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

TABLE 115 Taiwan structural steel market estimates & forecasts, by application, 2018-2030, (USD Million)

TABLE 116 Taiwan structural steel market estimates & forecasts, by non-residential segments, 2018 - 2030 (Kilotons)

TABLE 117 Taiwan structural steel market estimates & forecasts, by non-residential segments, 2018-2030, (USD Million)

TABLE 118 Japan structural steel market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

TABLE 119 Japan structural steel market estimates & forecasts, by product, 2018 - 2030 (Kilotons)

TABLE 120 Japan structural steel market estimates & forecasts, by product, 2018-2030, (USD Million)

TABLE 121 Japan structural steel market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

TABLE 122 Japan structural steel market estimates & forecasts, by application, 2018-2030, (USD Million)

TABLE 123 Japan structural steel market estimates & forecasts, by non-residential segments, 2018 - 2030 (Kilotons)

TABLE 124 Japan structural steel market estimates & forecasts, by non-residential segments, 2018-2030, (USD Million)

TABLE 125 Hong Kong structural steel market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

TABLE 126 Hong Kong structural steel market estimates & forecasts, by product, 2018 - 2030 (Kilotons)

TABLE 127 Hong Kong structural steel market estimates & forecasts, by product, 2018-2030, (USD Million)

TABLE 128 Hong Kong structural steel market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

TABLE 129 Hong Kong structural steel market estimates & forecasts, by application, 2018-2030, (USD Million)

TABLE 130 Hong Kong structural steel market estimates & forecasts, by non-residential segments, 2018 - 2030 (Kilotons)

TABLE 131 Hong Kong structural steel market estimates & forecasts, by non-residential segments, 2018-2030, (USD Million)

TABLE 132 Thailand structural steel market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

TABLE 133 Thailand structural steel market estimates & forecasts, by product, 2018 - 2030 (Kilotons)

TABLE 134 Thailand structural steel market estimates & forecasts, by product, 2018-2030, (USD Million)

TABLE 135 Thailand structural steel market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

TABLE 136 Thailand structural steel market estimates & forecasts, by application, 2018-2030, (USD Million)

TABLE 137 Thailand structural steel market estimates & forecasts, by non-residential segments, 2018 - 2030 (Kilotons)

TABLE 138 Thailand structural steel market estimates & forecasts, by non-residential segments, 2018-2030, (USD Million)

TABLE 139 Malaysia structural steel market estimates & forecasts, 2018 - 2030 (Kilotons) (USD Million)

TABLE 140 Malaysia structural steel market estimates & forecasts, by product, 2018 - 2030 (Kilotons)

TABLE 141 Malaysia structural steel market estimates & forecasts, by product, 2018-2030, (USD Million)

TABLE 142 Malaysia structural steel market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

TABLE 143 Malaysia structural steel market estimates & forecasts, by application, 2018-2030, (USD Million)

TABLE 144 Malaysia structural steel market estimates & forecasts, by non-residential segments, 2018 - 2030 (Kilotons)

TABLE 145 Malaysia structural steel market estimates & forecasts, by non-residential segments, 2018-2030, (USD Million)

TABLE 146 Singapore structural steel market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

TABLE 147 Singapore structural steel market estimates & forecasts, by product, 2018 - 2030 (Kilotons)

TABLE 148 Singapore structural steel market estimates & forecasts, by product, 2018-2030, (USD Million)

TABLE 149 Singapore structural steel market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

TABLE 150 Singapore structural steel market estimates & forecasts, by application, 2018-2030, (USD Million)

TABLE 151 Singapore structural steel market estimates & forecasts, by non-residential segments, 2018 - 2030 (Kilotons)

TABLE 152 Singapore structural steel market estimates & forecasts, by non-residential segments, 2018-2030, (USD Million)

TABLE 153 Vietnam structural steel market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

TABLE 154 Vietnam structural steel market estimates & forecasts, by product, 2018 - 2030 (Kilotons)

TABLE 155 Vietnam structural steel market estimates & forecasts, by product, 2018-2030, (USD Million)

TABLE 156 Vietnam structural steel market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

TABLE 157 Vietnam structural steel market estimates & forecasts, by application, 2018-2030, (USD Million)

TABLE 158 Vietnam structural steel market estimates & forecasts, by non-residential segments, 2018 - 2030 (Kilotons)

TABLE 159 Vietnam structural steel market estimates & forecasts, by non-residential segments, 2018-2030, (USD Million)

TABLE 160 Philippines structural steel market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

TABLE 161 Philippines structural steel market estimates & forecasts, by product, 2018 - 2030 (Kilotons)

TABLE 162 Philippines structural steel market estimates & forecasts, by product, 2018-2030, (USD Million)

TABLE 163 Philippines structural steel market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

TABLE 164 Philippines structural steel market estimates & forecasts, by application, 2018-2030, (USD Million)

TABLE 165 Philippines structural steel market estimates & forecasts, by non-residential segments, 2018 - 2030 (Kilotons)

TABLE 166 Philippines structural steel market estimates & forecasts, by non-residential segments, 2018-2030, (USD Million)

TABLE 167 India structural steel market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

TABLE 168 India structural steel market estimates & forecasts, by product, 2018 - 2030 (Kilotons)

TABLE 169 India structural steel market estimates & forecasts, by product, 2018-2030, (USD Million)

TABLE 170 India structural steel market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

TABLE 171 India structural steel market estimates & forecasts, by application, 2018-2030, (USD Million)

TABLE 172 India structural steel market estimates & forecasts, by non-residential segments, 2018 - 2030 (Kilotons)

TABLE 173 India structural steel market estimates & forecasts, by non-residential segments, 2018-2030, (USD Million)

TABLE 174 Australia structural steel market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

TABLE 175 Australia structural steel market estimates & forecasts, by product, 2018 - 2030 (Kilotons)

TABLE 176 Australia structural steel market estimates & forecasts, by product, 2018-2030, (USD Million)

TABLE 177 Australia structural steel market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

TABLE 178 Australia structural steel market estimates & forecasts, by application, 2018-2030, (USD Million)

TABLE 179 Australia structural steel market estimates & forecasts, by non-residential segments, 2018 - 2030 (Kilotons)

TABLE 180 Australia structural steel market estimates & forecasts, by non-residential segments, 2018-2030, (USD Million)

TABLE 181 New Zealand structural steel market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

TABLE 182 New Zealand structural steel market estimates & forecasts, by product, 2018 - 2030 (Kilotons)

TABLE 183 New Zealand structural steel market estimates & forecasts, by product, 2018-2030, (USD Million)

TABLE 184 New Zealand structural steel market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

TABLE 185 New Zealand structural steel market estimates & forecasts, by application, 2018-2030, (USD Million)

TABLE 186 New Zealand structural steel market estimates & forecasts, by non-residential segments, 2018 - 2030 (Kilotons)

TABLE 187 New Zealand structural steel market estimates & forecasts, by non-residential segments, 2018-2030, (USD Million)

TABLE 188 Indonesia structural steel market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

TABLE 189 Indonesia structural steel market estimates & forecasts, by product, 2018 - 2030 (Kilotons)

TABLE 190 Indonesia structural steel market estimates & forecasts, by product, 2018-2030, (USD Million)

TABLE 191 Indonesia structural steel market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

TABLE 192 Indonesia structural steel market estimates & forecasts, by application, 2018-2030, (USD Million)

TABLE 193 Indonesia structural steel market estimates & forecasts, by non-residential segments, 2018 - 2030 (Kilotons)

TABLE 194 Indonesia structural steel market estimates & forecasts, by non-residential segments, 2018-2030, (USD Million)

TABLE 195 Central & South America structural steel market estimates & forecasts, 2018 - 2030 (Kilotons) (USD Million)

TABLE 196 Central & South America structural steel market estimates & forecasts, by product, 2018 - 2030 (Kilotons)

TABLE 197 Central & South America structural steel market estimates & forecasts, by product, 2018-2030, (USD Million)

TABLE 198 Central & South America structural steel market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

TABLE 199 Central & South America structural steel market estimates & forecasts, by application, 2018-2030, (USD Million)

TABLE 200 Central & South America structural steel market estimates & forecasts, by non-residential segments, 2018 - 2030 (Kilotons)

TABLE 201 Central & South America structural steel market estimates & forecasts, by non-residential segments, 2018-2030, (USD Million)

TABLE 202 Brazil structural steel market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

TABLE 203 Brazil structural steel market estimates & forecasts, by product, 2018 - 2030 (Kilotons)

TABLE 204 Brazil structural steel market estimates & forecasts, by product, 2018-2030, (USD Million)

TABLE 205 Brazil structural steel market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

TABLE 206 Brazil structural steel market estimates & forecasts, by application, 2018-2030, (USD Million)

TABLE 207 Brazil structural steel market estimates & forecasts, by non-residential segments, 2018 - 2030 (Kilotons)

TABLE 208 Brazil structural steel market estimates & forecasts, by non-residential segments, 2018-2030, (USD Million)

TABLE 209 Chile structural steel market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

TABLE 210 Chile structural steel market estimates & forecasts, by product, 2018 - 2030 (Kilotons)

TABLE 211 Chile structural steel market estimates & forecasts, by product, 2018-2030, (USD Million)

TABLE 212 Chile structural steel market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

TABLE 213 Chile structural steel market estimates & forecasts, by application, 2018-2030, (USD Million)

TABLE 214 Chile structural steel market estimates & forecasts, by non-residential segments, 2018 - 2030 (Kilotons)

TABLE 215 Chile structural steel market estimates & forecasts, by non-residential segments, 2018-2030, (USD Million)

TABLE 216 Colombia structural steel market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

TABLE 217 Colombia structural steel market estimates & forecasts, by product, 2018 - 2030 (Kilotons)

TABLE 218 Colombia structural steel market estimates & forecasts, by product, 2018-2030, (USD Million)

TABLE 219 Colombia structural steel market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

TABLE 220 Colombia structural steel market estimates & forecasts, by application, 2018-2030, (USD Million)

TABLE 221 Colombia structural steel market estimates & forecasts, by non-residential segments, 2018 - 2030 (Kilotons)

TABLE 222 Colombia structural steel market estimates & forecasts, by non-residential segments, 2018-2030, (USD Million)

TABLE 223 Middle East & Africa structural steel market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

TABLE 224 Middle East & Africa structural steel market estimates & forecasts, by product, 2018 - 2030 (Kilotons)

TABLE 225 Middle East & Africa structural steel market estimates & forecasts, by product, 2018-2030, (USD Million)

TABLE 226 Middle East & Africa structural steel market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

TABLE 227 Middle East & Africa structural steel market estimates & forecasts, by application, 2018-2030, (USD Million)

TABLE 228 Middle East & Africa structural steel market estimates & forecasts, by non-residential segments, 2018 - 2030 (Kilotons)

TABLE 229 Middle East & Africa structural steel market estimates & forecasts, by non-residential segments, 2018-2030, (USD Million)

TABLE 230 Saudi Arabia structural steel market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

TABLE 231 Saudi Arabia structural steel market estimates & forecasts, by product, 2018 - 2030 (Kilotons)

TABLE 232 Saudi Arabia structural steel market estimates & forecasts, by product, 2018-2030, (USD Million)

TABLE 233 Saudi Arabia structural steel market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

TABLE 234 Saudi Arabia structural steel market estimates & forecasts, by application, 2018-2030, (USD Million)

TABLE 235 Saudi Arabia structural steel market estimates & forecasts, by non-residential segments, 2018 - 2030 (Kilotons)

TABLE 236 Saudi Arabia structural steel market estimates & forecasts, by non-residential segments, 2018-2030, (USD Million)

TABLE 237 UAE structural steel market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

TABLE 238 UAE structural steel market estimates & forecasts, by product, 2018 - 2030 (Kilotons)

TABLE 239 UAE structural steel market estimates & forecasts, by product, 2018-2030, (USD Million)

TABLE 240 UAE structural steel market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

TABLE 241 UAE structural steel market estimates & forecasts, by application, 2018-2030, (USD Million)

TABLE 242 UAE structural steel market volume market estimates & forecasts, by non-residential segments, 2018 - 2030 (Kilotons)

TABLE 243 UAE structural steel market estimates & forecasts, by non-residential segments, 2018-2030, (USD Million)

TABLE 244 Iran structural steel market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

TABLE 245 Iran structural steel market estimates & forecasts, by product, 2018 - 2030 (Kilotons)

TABLE 246 Iran structural steel market estimates & forecasts, by product, 2018-2030, (USD Million)

TABLE 247 Iran structural steel market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

TABLE 248 Iran structural steel market estimates & forecasts, by application, 2018-2030, (USD Million)

TABLE 249 Iran structural steel market estimates & forecasts, by non-residential segments, 2018 - 2030 (Kilotons)

TABLE 250 Iran structural steel market estimates & forecasts, by non-residential segments, 2018-2030, (USD Million)

TABLE 251 South Africa structural steel market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

TABLE 252 South Africa structural steel market estimates & forecasts, by product, 2018 - 2030 (Kilotons)

TABLE 253 South Africa structural steel market estimates & forecasts, by product, 2018-2030, (USD Million)

TABLE 254 South Africa structural steel market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

TABLE 255 South Africa structural steel market estimates & forecasts, by application, 2018-2030, (USD Million)

TABLE 256 South Africa structural steel market estimates & forecasts, by non-residential segments, 2018 - 2030 (Kilotons)

TABLE 257 South Africa structural steel market estimates & forecasts, by non-residential segments, 2018-2030, (USD Million)

List of Figures

FIG. 1 Market segmentation

FIG. 2 Information procurement

FIG. 3 Data Analysis Models

FIG. 4 Market Formulation and Validation

FIG. 5 Market snapshot

FIG. 6 Segmental outlook - Product

FIG. 7 Segmental outlook - Application

FIG. 8 Competitive Outlook

FIG. 9 Structural steel market outlook, 2018 - 2030 (USD Million) (Kilotons)

FIG. 10 Value chain analysis

FIG. 11 Market dynamics

FIG. 12 Porter’s Analysis

FIG. 13 PESTEL Analysis

FIG. 14 Structural steel market, by product: Key takeaways

FIG. 15 Structural steel market, by product: Market share, 2023 & 2030

FIG. 16 Structural steel market, by application: Key takeaways

FIG. 17 Structural steel market, by application: Market share, 2023 & 2030

FIG. 18 Structural steel market: Regional analysis, 2023

FIG. 19 Structural steel market, by region: Key takeawaysWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Structural Steel Product Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

- Angles

- Channels

- Rounds

- Squares

- Beams

- Structural Steel Application Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

- Residential

- Non-residential

- Institutional

- Commercial

- Offices

- Others

- Structural Steel Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

- North America

- North America Structural Steel Market, By Product

- Angles

- Channels

- Rounds

- Squares

- Beams

- North America Structural Steel Market, By Application

- Residential

- Non-residential

- Institutional

- Commercial

- Offices

- Others

- U.S.

- U.S. Structural Steel Market, By Product

- Angles

- Channels

- Rounds

- Squares

- Beams

- U.S. Structural Steel Market, By Application

- Residential

- Non-residential

- Institutional

- Commercial

- Offices

- Others

- U.S. Structural Steel Market, By Product

- Canada

- Canada Structural Steel Market, By Product

- Angles

- Channels

- Rounds

- Squares

- Beams

- Canada Structural Steel Market, By Application

- Residential

- Non-residential

- Institutional

- Commercial

- Offices

- Others

- Canada Structural Steel Market, By Product

- Mexico

- Mexico Structural Steel Market, By Product

- Angles

- Channels

- Rounds

- Squares

- Beams

- Mexico Structural Steel Market, By Application

- Residential

- Non-residential

- Institutional

- Commercial

- Offices

- Others

- North America Structural Steel Market, By Product

- North America

- Europe

- Europe Structural Steel Market, By Product

- Angles

- Channels

- Rounds

- Squares

- Beams

- Europe Structural Steel Market, By Application

- Residential

- Non-residential

- Institutional

- Commercial

- Offices

- Others

- Germany

- Germany Structural Steel Market, By Product

- Angles

- Channels

- Rounds

- Squares

- Beams

- Germany Structural Steel Market, By Application

- Residential

- Non-residential

- Institutional

- Commercial

- Offices

- Others

- Germany Structural Steel Market, By Product

- UK

- UK Structural Steel Market, By Product

- Angles

- Channels

- Rounds

- Squares

- Beams

- UK Structural Steel Market, By Application

- Residential

- Non-residential

- Institutional

- Commercial

- Offices

- Others

- UK Structural Steel Market, By Product

- France

- France Structural Steel Market, By Product

- Angles

- Channels

- Rounds

- Squares

- Beams

- France Structural Steel Market, By Application

- Residential

- Non-residential

- Institutional

- Commercial

- Offices

- Others

- France Structural Steel Market, By Product

- Spain

- Spain Structural Steel Market, By Product

- Angles

- Channels

- Rounds

- Squares

- Beams

- Spain Structural Steel Market, By Application

- Residential

- Non-residential

- Institutional

- Commercial

- Offices

- Others

- Spain Structural Steel Market, By Product

- Russia

- Russia Structural Steel Market, By Product

- Angles

- Channels

- Rounds

- Squares

- Beams

- Russia Structural Steel Market, By Application

- Residential

- Non-residential

- Institutional

- Commercial

- Offices

- Others

- Russia Structural Steel Market, By Product

- Turkey

- Turkey Structural Steel Market, By Product

- Angles

- Channels

- Rounds

- Squares

- Beams

- Turkey Structural Steel Market, By Application

- Residential

- Non-residential

- Institutional

- Commercial

- Offices

- Others

- Turkey Structural Steel Market, By Product

- Poland

- Poland Structural Steel Market, By Product

- Angles

- Channels

- Rounds

- Squares

- Beams

- Poland Structural Steel Market, By Application

- Residential

- Non-residential

- Institutional

- Commercial

- Offices

- Others

- Europe Structural Steel Market, By Product

- Asia Pacific

- Asia Pacific Structural Steel Market, By Product

- Angles

- Channels

- Rounds

- Squares

- Beams

- Asia Pacific Structural Steel Market, By Application

- Residential

- Non-residential

- Institutional

- Commercial

- Offices

- Others

- China

- China Structural Steel Market, By Product

- Angles

- Channels

- Rounds

- Squares

- Beams

- China Structural Steel Market, By Application

- Residential

- Non-residential

- Institutional

- Commercial

- Offices

- Others

- China Structural Steel Market, By Product

- Taiwan

- Taiwan Structural Steel Market, By Product

- Angles

- Channels

- Rounds

- Squares

- Beams

- Taiwan Structural Steel Market, By Application

- Residential

- Non-residential

- Institutional

- Commercial

- Offices

- Others

- Taiwan Structural Steel Market, By Product

- Japan

- Japan Structural Steel Market, By Product

- Angles

- Channels

- Rounds

- Squares

- Beams

- Japan Structural Steel Market, By Application

- Residential

- Non-residential

- Institutional

- Commercial

- Offices

- Others

- Japan Structural Steel Market, By Product

- Hong Kong

- Hong Kong Structural Steel Market, By Product

- Angles

- Channels

- Rounds

- Squares

- Beams

- Hong Kong Structural Steel Market, By Application

- Residential

- Non-residential

- Institutional

- Commercial

- Offices

- Others

- Hong Kong Structural Steel Market, By Product

- Thailand

- Thailand Structural Steel Market, By Product

- Angles

- Channels

- Rounds

- Squares

- Beams

- Thailand Structural Steel Market, By Application

- Residential

- Non-residential

- Institutional

- Commercial

- Offices

- Others

- Thailand Structural Steel Market, By Product

- Malaysia

- Malaysia Structural Steel Market, By Product

- Angles

- Channels

- Rounds

- Squares

- Beams

- Malaysia Structural Steel Market, By Application

- Residential

- Non-residential

- Institutional

- Commercial

- Offices

- Others

- Malaysia Structural Steel Market, By Product

- Singapore

- Singapore Structural Steel Market, By Product

- Angles

- Channels

- Rounds

- Squares

- Beams

- Singapore Structural Steel Market, By Application

- Residential

- Non-residential

- Institutional

- Commercial

- Offices

- Others

- Singapore Structural Steel Market, By Product

- Vietnam

- Vietnam Structural Steel Market, By Product

- Angles

- Channels

- Rounds

- Squares

- Beams

- Vietnam Structural Steel Market, By Application

- Residential

- Non-residential

- Institutional

- Commercial

- Offices

- Others

- Vietnam Structural Steel Market, By Product

- Philippines

- Philippines Structural Steel Market, By Product

- Angles

- Channels

- Rounds

- Squares

- Beams

- Philippines Structural Steel Market, By Application

- Residential

- Non-residential

- Institutional

- Commercial

- Offices

- Others

- Philippines Structural Steel Market, By Product

- India

- India Structural Steel Market, By Product

- Angles

- Channels

- Rounds

- Squares

- Beams

- India Structural Steel Market, By Application

- Residential

- Non-residential

- Institutional

- Commercial

- Offices

- Others

- India Structural Steel Market, By Product

- Australia

- Australia Structural Steel Market, By Product

- Angles

- Channels

- Rounds

- Squares

- Beams

- Australia Structural Steel Market, By Application

- Residential

- Non-residential

- Institutional

- Commercial

- Offices

- Others

- Australia Structural Steel Market, By Product

- New Zealand

- New Zealand Structural Steel Market, By Product

- Angles

- Channels

- Rounds

- Squares

- Beams

- New Zealand Structural Steel Market, By Application

- Residential

- Non-residential

- Institutional

- Commercial

- Offices

- Others

- New Zealand Structural Steel Market, By Product

- Indonesia

- Indonesia Structural Steel Market, By Product

- Angles

- Channels

- Rounds

- Squares

- Beams

- Indonesia Structural Steel Market, By Application

- Residential

- Non-residential

- Institutional

- Commercial

- Offices

- Others

- Asia Pacific Structural Steel Market, By Product

- Central & South America

- Central & South America Structural Steel Market, By Product

- Angles

- Channels

- Rounds

- Squares

- Beams

- Central & South America Structural Steel Market, By Application

- Residential

- Non-residential

- Institutional

- Commercial

- Offices

- Others

- Brazil

- Brazil Structural Steel Market, By Product

- Angles

- Channels

- Rounds

- Squares

- Beams

- Brazil Structural Steel Market, By Application

- Residential

- Non-residential

- Institutional

- Commercial

- Offices

- Others

- Brazil Structural Steel Market, By Product

- Chile

- Chile Structural Steel Market, By Product

- Angles

- Channels

- Rounds

- Squares

- Beams

- Chile Structural Steel Market, By Application

- Residential

- Non-residential

- Institutional

- Commercial

- Offices

- Others

- Chile Structural Steel Market, By Product

- Colombia

- Colombia Structural Steel Market, By Product

- Angles

- Channels

- Rounds

- Squares

- Beams

- Colombia Structural Steel Market, By Application

- Residential

- Non-residential

- Institutional

- Commercial

- Offices

- Others

- Central & South America Structural Steel Market, By Product

- Middle East & Africa

- Middle East & Africa Structural Steel Market, By Product

- Angles

- Channels

- Rounds

- Squares

- Beams

- Middle East & Africa Structural Steel Market, By Application

- Residential

- Non-residential

- Institutional

- Commercial

- Offices

- Others

- UAE

- UAE Structural Steel Market, By Product

- Angles

- Channels

- Rounds

- Squares

- Beams

- UAE Structural Steel Market, By Application

- Residential

- Non-residential

- Institutional

- Commercial

- Offices

- Others

- UAE Structural Steel Market, By Product

- Saudi Arabia

- Saudi Arabia Structural Steel Market, By Product

- Angles

- Channels

- Rounds

- Squares

- Beams

- Saudi Arabia Structural Steel Market, By Application

- Residential

- Non-residential

- Institutional

- Commercial

- Offices

- Others

- Saudi Arabia Structural Steel Market, By Product

- Iran

- Iran Structural Steel Market, By Product

- Angles

- Channels

- Rounds

- Squares

- Beams

- Iran Structural Steel Market, By Application

- Residential

- Non-residential

- Institutional

- Commercial

- Offices

- Others

- Iran Structural Steel Market, By Product

- South Africa

- South Africa Structural Steel Market, By Product

- Angles

- Channels

- Rounds

- Squares

- Beams

- South Africa Structural Steel Market, By Application

- Residential

- Non-residential

- Institutional

- Commercial

- Offices

- Others

- South Africa Structural Steel Market, By Product

- Middle East & Africa Structural Steel Market, By Product

Structural Steel Market Dynamics

Driver: Increasing Construction Spending In Emerging Economies

Construction is one of the largest end-use industries of steel products. As per the World Steel Association, construction accounts for more than 50% of the global demand. Various infrastructure and construction sites require a massive amount of steel to enhance the strength of structures. Growing housing need owing to increasing population is one of the key factors triggering the steel demand.

As per a 2017 World Population Prospects published by the United Nations, the global population is projected to reach 8.6 billion in 2030. This, in turn, is projected to fuel the demand for new houses, thus indirectly contributing to the growth of the structural steel market. Steel is affordable and easily available. It exhibits versatility, durability, and strength and is 100% recyclable in nature. Structural steel has wide applications in residential construction, commercial construction, and infrastructure. It can be used in warehouses, high-rise buildings, industrial buildings, bridges, etc.

Driver: Positive Construction Outlook In Developed Countries

The construction industry in the developed economies of North America and Europe slumped during the economic recession of 2008-09. However, the construction industry in some of the major countries, including the U.S. and Germany, has recovered and is expected to lead the respective regional markets and further the global structural steel market over the forecast period. Increasing residential & non-residential construction development in the U.S. and Europe is anticipated to fuel the demand for structural steel. Multifamily and single-family houses in upscale neighborhoods and metropolitan cities are expected to grow rapidly in the region owing to high-income levels.

An increase in nonresidential construction spending is expected owing to stabilization in the overall U.S. economy. Commercial and office construction is expected to grow highly over the next seven years. Factors such as the increasing number of food & stores and office construction benefiting from a drop in unemployment levels are expected to complement the growth of the construction industry.

Restraint: Volatility In Raw Material Prices

The global structural steel market is expected to be affected by raw material price volatility. Major raw materials consumed for steel production include iron ore, coking coal, and ferrous scrap. Coking coal traded at an average price of around USD 200 per ton in 2018. The year witnessed volatility in iron ore prices due to operational failures. For instance, the dispute between Aurizon, a rail freight operator, and Queensland, a coal regulator, in Australia created an impact on rail deliveries in the second and third quarters of 2018. Fire at a mine in Shandong province, China, and a Peabody mine in Australia also created an impact on the prices of coking coal in 2018. The prices of iron ore observed significant volatility owing to environmental disasters such as the collapsed dam at Vale’s mine in Brazil, trade disputes between the U.S. and China, and the reduction of steel capacity in China.

What Does This Report Include?

This section will provide insights into the contents included in this structural steel market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Structural steel market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking