- Home

- »

- HVAC & Construction

- »

-

Submarine Cables Market Size, Share & Trends Report 2030GVR Report cover

![Submarine Cables Market Size, Share & Trends Report]()

Submarine Cables Market Size, Share & Trends Analysis Report By Application (Submarine Power Cables, Submarine Communication Cables), By Voltage, By End-user, By Offerings, By Component, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-880-0

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Technology

Report Overview

The global submarine cables market size was estimated at USD 27.57 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.9% from 2023 to 2030. The major factors driving the market growth are increasing investments in offshore wind farms, increasing data traffic, and investments by OTT providers to suffice the requirements. Submarine cables are widely used for power and communication applications. The submarine power cables are used for power transmission to oil rigs, from offshore wind farms to power stations, inter-country, and island connections. Increasing demand for interconnecting countries' power grids is a key factor influencing the demand for low-power cables.

Submarine communication cables are used for inter-region/country communications. Around 97% of worldwide internet traffic is entirely dependent on submarine cables, and with the rising demand for the internet, the demand for submarine cables is increasing drastically as well. The rising focus on offshore renewable energy generation and increased energy security has driven the expansion of the market across the globe. These communication cables help in faster communication and carry a large amount of data across the globe.

The submarine communication cables carry around 90% of the data across the world. In addition, their total carrying capacity is in terabits per second. As a result, they are the most valued cable for OTT and communication providers such as Google; Amazon; Facebook; and Microsoft. For instance, in October 2021, NEC, a Japanese IT company announced plans to build a large submarine cable network with four core fiber optics for Facebook.

The submarine will hold a capacity of up to 500mbps across 24 fiber pairs. Most countries consider submarine cables a vital component of the economy and have set regulations to protect them from threats. For instance, the Australian Communications and Media Authority (ACMA) has created safety zones to prohibit activities that can damage the cables that link Australia & the Rest of the World. In addition, it sets up the legal framework to encourage the installation of new submarine projects.

The communication cables have undergone a surge in demand due to increased data traffic. Regions such as Europe, the Middle East, Asia Pacific, and Latin America have witnessed rising investments in submarine communication cables. Companies such as Google, Facebook, Amazon, and Microsoft are the primary influencers of submarine cables. Google owns 10,433 miles of submarine cable internationally and 63,605 miles in consortium with Facebook, Amazon, and Microsoft. Facebook owns 57,709 miles, Amazon owns 18,987 miles, and Microsoft owns 4,104 miles of submarine cable. Amazon’s cables run from the U.S. to the Asia Pacific region, connecting Singapore, Japan, California, and Oregon.

The efficient power transmission and distribution systems from renewable energy sources and the growth of offshore wind farms are expected to fuel the submarine cables industry's growth. For instance, the Government of Japan is constructing a floating wind farm 12 miles away from the seacoast and is expected to install 140 floating wind turbines by 2020. Growing demand has led manufacturers to actively participate in the installation & commissioning, upgrades, and maintenance of submarine cables. For instance, in February 2020, The Europe India Gateway (EIG) submarine cable system was upgraded to fast-track and reinforce the connectivity among businesses in Europe, the Middle East, and India by Ciena Corporation.

Application Insights

The submarine power cable segment accounted for the largest revenue share of around 62.45% in 2022. Increased demand for inter-country and island connections and new capacity expansions in the offshore wind industry are driving the submarine cables industry. Furthermore, the increasing number of offshore wind farms and the increasing electrification of offshore oil and gas networks have increased research and development activities, further increasing the requirement for submarine power cables.

The submarine communication cable segment accounted for a significant share and thus, is expected to grow at the fastest CAGR of 6.8% from 2023 to 2030. There has been a rapid increase in urbanization and economic activities, which will drive the growth in infrastructure and construction segments in both developing and developed countries. The demand from various sectors such as commercial, telecom, energy, and power is leading to expansion and up-gradation of infrastructure, which is anticipated to drive the demand for the submarine cables industry.

Also, the rising focus on offshore renewable energy generation to meet renewable energy targets and increase energy security make way for new opportunities. Furthermore, providing energy access to remote landmasses, and interlinking national grids to optimize energy use has driven the market expansion across the globe.

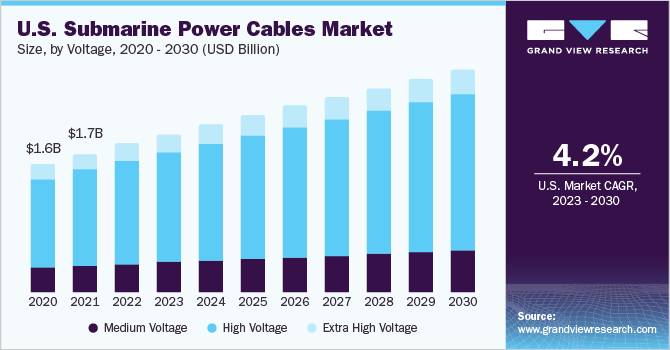

Voltage Insights

The high voltage segment accounted for the largest revenue share of around 65.5% in 2022. High voltage cables ranging above 33kV are widely used for the power transmission and distribution of power. Thus, the increasing demand for HVDC submarine power cables and rising investments in offshore wind power generation is the primary factor driving the growth of the high-voltage cable segment.

In addition, HV cables reduce transmission losses and thus, enable efficient power transmission. The HVDC power system is evolving rapidly and permits the transfer of electricity from high-capacity high-power sources to the mainland. Several companies and development centers support the growth of HVDC power systems, such as DESERTEC, North Seas Countries Offshore Grid Initiative, CIGRE, and others.

The medium voltage cables segment is expected to grow at a CAGR of 5.3% from 2023 to 2030. The growth is attributable to the utilization of MV cables in the offshore oil & gas infrastructure application for power transmission. The demand from overseas oil & gas operations has been increasing, thus, driving the growth of the MV submarine cables industry.

Component Insight

Based on component type, the dry plant products segment led the submarine cables market and accounted for 73.4% of the revenue share. The dry plant products segment is expected to account for the largest market revenue share and provide robust growth opportunities. This is due to its cost-effectiveness and recent advancements in dry plants, such as SDM cables with more fibers and capacity, aluminum conductors, smart cables: emergency alerts for earthquake and tsunami, repeater pump farming, virtualized submarine networks, artificial intelligence, and machine learning in submarine systems.

The wet plant products segment is expected to expand at the fastest CAGR of 7.0% over the forecast period. A wet plant refers to the actual undersea portion of the cable that lies on the seabed, submerged in water. The wet plant is the physical cable itself, which typically consists of fiber optic strands surrounded by protective layers to withstand the harsh underwater environment. Submarine cables, tilt equalizers, OADMs, repeaters, branching units, gain equalizers, filters, and beach manholes are all components of the wet plant.

Offering Insights

The installation & commissioning segment dominated the market in 2022 and accounted for over 39% of the revenue share. This is due to their high cost, installation equipment, and technological procedures required. Submarine cable deployment equipment includes cable vessels, jointing and testing equipment, operation control software, and underwater installation equipment. Underwater installation equipment for submarine optical cables consists of beach burying equipment, burial machines, underwater robot remotely operating vehicles, and an automatic control system. The segment is expected to witness promising growth opportunities over the forecast period.

Over the forecast years, the upgrade segment is expected to grow at a promising CAGR of 7.0%. Installed cables are a valuable asset, and new technologies typically allow them to be used well beyond their original design specifications, both in terms of capacity and design. Upgrades to SLTE at cable landing stations usually take less than eight months to acquire and implement, compared to an average of 3 years to build a brand-new long-haul cable system (depending on the size).

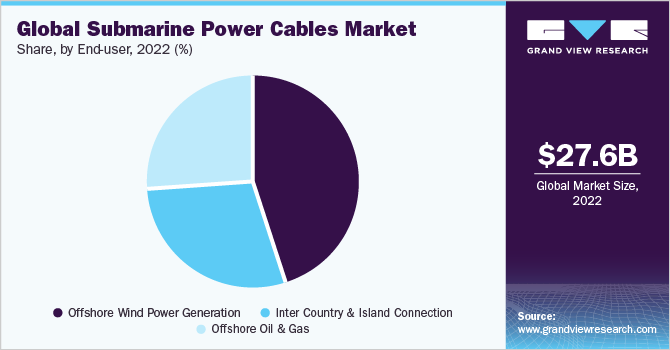

End-user Insights

The offshore wind power generation segment accounted for the largest revenue share of over 45.4% of the overall market in 2022. Increasing investments in offshore wind power generation and usage of submarine power cables for long-distance power transmissions from these plants is the primary factor in flourishing the submarine cable industry growth. For instance, in August 2018, Northwestern NV awarded a contract to NSW (a subsidiary of Prysmian S.p.A) to develop the submarine cable system necessary for an offshore wind farm.

With the advancement of wind turbine technology, inter-array cables are designed to accommodate higher electrical capacities. This enables efficient power transmission from larger and more powerful wind turbines, maximizing the energy output of the offshore wind farm. Favorable regulatory frameworks and financial incentives encourage investments in offshore wind farms, driving the demand for inter-array cables. Furthermore, there is a trend toward deploying higher voltage levels in export cables to minimize electrical losses over long distances and improve transmission efficiency. Higher voltages enable the transmission of greater amounts of power with reduced losses, optimizing the performance of offshore wind projects.

The global shift toward renewable energy sources, coupled with the declining wind power generation costs, has led to significant growth in offshore wind farms. Many governments worldwide have set ambitious renewable energy targets and provided incentives to promote offshore wind development. Favorable regulatory frameworks and financial incentives encourage investments in offshore wind farms, driving the demand for array cables and export cables for offshore wind power generation stations.

The offshore oil & gas segment is expected to grow at a significant CAGR of 4.7% from 2023 to 2030. Increasing deep-water drilling activities and subsea operations are expected to drive the market over the forecast period. Developing countries in Latin America, the Middle East, and Africa are undertaking new offshore oil & gas investments, influencing market growth. For instance, in March 2019, GTT established an oil & gas unit that is serving oil & gas companies for the secure transmission of data through its submarine cable.

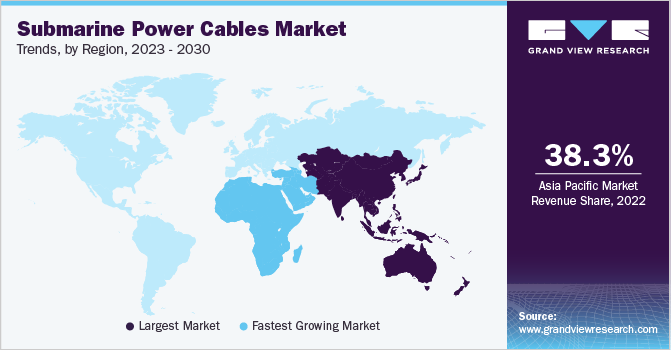

Regional Insights

The Asia Pacific region accounted for the largest share of around 38.3% of the overall market in 2022. The region has the highest adoption and deployment of wind farms in the region, among which China holds the leading position. According to IEEFA, China had 4.6 GW1 of operational offshore wind power capacity in 2018. It installed 1.8GW of offshore wind capacity in 2018 alone, which is 40% of the total 4.5GW added globally during the year. In January 2019, China approved 24 offshore wind power projects off the coast of Jiangsu Province with a total capacity of 6.7GW and an investment injection worth USD 18 billion. The projects are expected to be operational by 2020.

China's largest utility organizations including China Energy Group, China General Nuclear Power Corp., China Huaneng Group, and the State Power Investment Corp., are backing these offshore wind projects. In addition, in April 2020, Facebook acquired USD 5.7 billion stake in Reliance Jio (India). Hence, contributing to the rise in demand for submarine cables in the region. The Asia Pacific region is rapidly becoming a center for direct investment in submarine cable infrastructure. The major participants in this are Google, Microsoft, and Facebook. For instance, Google has already invested in Asia's existing submarine cable space. Also, in 2021 Google invested in the new subsea cable system initiated to connect Japan to Australia via Guam.

The market in the Latin America region is anticipated to grow at the second-highest CAGR of 5.2% from 2023 to 2030, owing to the increasing investments in wind farms and inter-country & island connections in the region. Also, several submarine cable projects started operations in 2021. For instance, in June 2021, Google announced plans to create Firmina, an open subsea cable that will connect the US East Coast to Las Toninas, Argentina, with landings in Brazil and Uruguay. With the new connection, the company expects to improve internet connectivity for Latin American subscribers while also bolstering its existing cable investments in the region.

Regional Insights

In 2021, EMEA led the market, accounting for about 25.18% of total submarine communication cable revenue. Increasing investments in EMEA have spurred the demand. For instance, In March 2020, Altibox Carrier and Xtera, a submarine network technology, announced the construction of the Euroconnect-1 submarine cable from Norway to the UK. The network will have a capacity of up to 216 Tbps and will run between Stavanger in Norway and Newcastle in the UK.

Furthermore, governments around the world are taking initiatives to rebuild the economy after the COVID-19 pandemic. Between Denmark and the United Kingdom, a 760-kilometer cable is being installed beneath the North Sea, which will supply 1.4 million UK homes with green electricity from Denmark. An increase in the installation of submarine cables in Saudi Arabia will also surge the market demand. For instance, in 2020, Google announced plans to install a fiber-optic network to connect Saudi Arabia and Israel using submarine cables for opening a new corridor for global internet traffic. The submarine cable would cost about USD 400 million and will expand more than 5,000 miles.

The Americas regional market is anticipated to gain significant traction and expand at a CAGR of 7.8% over the forecast period. The upsurge is due to the fast-rising demand for digital services backed by submarine cable or data center infrastructure. For instance, in February 2020, Microsoft announced its first set of cloud data centers in Mexico as part of a $1.1 billion investment over the next five years.

Key Companies & Market Share Insights

The key players that dominated the global market in 2022 include Alcatel-Lucent, TE SubCom, and NEC Corporation. The other small and mid-size submarine cable providers focus on smaller projects in various regions. Many submarine cable suppliers are also involved in offshore oil and gas projects, undersea electrical cables, and other marine infrastructure projects across the globe. Furthermore, the leading players are also keen on strategic acquisitions and collaborations with regional players to expand their channel reach in untapped markets. For instance, in April 2023, Nexans acquired Reka Cables, a manufacturer of cables in Finland. The collaboration aims to provide safe and high-quality cables to Nordic customers and beyond through this acquisition.

Google holds the most extended submarine cable system, named Curie Cable, linking Chile and Los Angeles. Thus, the majority of the companies offer and connect submarine cables with partnerships and contracts/consortiums. Therefore, these firms do not resell the capacity of cables as they finance cable investments. Some prominent players in the global submarine cables market include:

-

ALE International, ALE USA Inc.

-

SubCom, LLC

-

NEC Corporation

-

Prysmian S.p.A

-

Nexans

-

Google LLC

-

Amazon.com, Inc.

-

Microsoft

-

NKT A/S

-

ZTT

Submarine Cables Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 29.63 billion

Revenue forecast in 2030

USD 44.33 billion

Growth rate

CAGR of 5.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

July 2023

Quantitative units

Revenue in USD billion, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, trends

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa;

Transatlantic; Transpacific; Indian Ocean; Americas; EMEA; AustralAsia

Country scope

U.S.; Canada; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; UAE; Saudi Arabia; South Africa

Segments covered

Application; voltage; end-user; component; offerings; region

Key companies profiled

ALE International ALE USA Inc.; SubCom, LLC; NEC Corporation; Prysmian S.p.A; Nexans; Google LLC; Amazon.com, Inc.; Microsoft; NKT A/S; ZTT.

Customization scope

Free report customization (equivalent Up to 0–8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Submarine Cables Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global submarine cables market report based on application, voltage, end-user, offerings, component, and region:

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Submarine Power Cables

-

Submarine Communication Cables

-

-

Submarine Power Cables Voltage Outlook (Revenue, USD Billion, 2017 - 2030)

-

Medium Voltage

-

High Voltage

-

Extra High Voltage

-

-

Submarine Power Cables End-user Outlook (Revenue, USD Billion, 2017 - 2030)

-

Offshore Wind Power Generation

-

Array Cables

-

Export Cables

-

-

Inter Country & Island Connection

-

Offshore Oil & Gas

-

-

Submarine Communication Cables Offerings Outlook (Revenue, USD Billion, 2017 - 2030)

-

Installation & Commissioning

-

Upgrade

-

Maintenance

-

-

Submarine Communication Cables Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Dry Plant Products

-

Wet Plant Products

-

-

Submarine Power Cables Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

-

Submarine Communication Cables Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

Transatlantic

-

Transpacific

-

Indian Ocean

-

Americas

-

EMEA

-

AustralAsia

-

Frequently Asked Questions About This Report

b. The global submarine cables market size was estimated at USD 27.57 billion in 2022 and is expected to reach USD 29.63 billion in 2023.

b. The global submarine cables market is expected to grow at a compound annual growth rate of 5.9% from 2023 to 2030 to reach USD 44.33 billion by 2030.

b. Asia Pacific dominated the submarine cables market with a share of 38.5% in 2022. This is attributable to increased demand from offshore wind farm investments.

b. Some key players operating in the submarine cables market include ALE International, ALE USA Inc.; SubCom, LLC; NEC Corporation; Prysmian S.p.A; Nexans; Google LLC; Amazon.com, Inc.; Microsoft; NKT A/S; ZTT

b. Key factors driving the submarine cables market growth include increasing data traffic, investments by OTT providers to suffice the requirements, growing demand for inter-country and island power connections, and increasing number of offshore wind farms

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."