- Home

- »

- Plastics, Polymers & Resins

- »

-

Supplements And Nutrition Packaging Market Size Report 2030GVR Report cover

![Supplements And Nutrition Packaging Market Size, Share & Trends Report]()

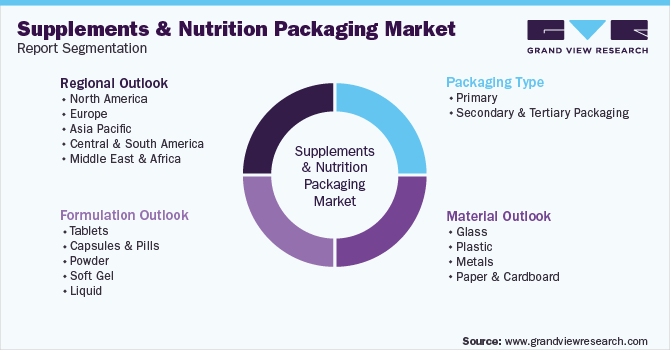

Supplements And Nutrition Packaging Market Size, Share & Trends Analysis Report By Type (Primary Packaging, Secondary & Tertiary Packaging) By Material, By Formulation (Tablets, Capsules & Pills), By Segments And Region Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-771-1

- Number of Pages: 134

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Bulk Chemicals

Industry Insights

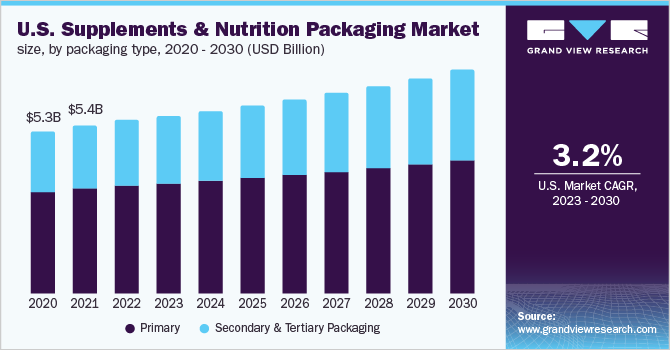

The global supplements and nutrition packaging market size was estimated at USD 25.35 billion in 2022 and is expected to expand at a compounded annual growth rate (CAGR) of 4.1% from 2023 to 2030. The factors attributed to driving the market are the growing adoption of immunity-boosting supplements, rising demand for sports nutrition, and increasing consumer awareness regarding nutrition, health, and wellness. However, increasing packaging costs and fluctuating raw material prices are major challenges in the market.

Supplements and nutrition materials are offered in the form of tablets, capsules, soft gels, gummies, liquids, and powder. Various packaging types, including rigid bottles, standup pouches, flat pouches, sachets, and blister packs, are used for the packaging of supplements and nutrition. Packaging companies are increasingly focusing on incorporating dispensing mechanisms, administration aids, sustainable materials, tamper evidence properties, and counterfeiting measures into the packaging to enhance their functionality and safety.

Packaging Type Insights

Based on packaging type, the primary type commanded the largest share of 61.1% in terms of revenue in the supplement & nutrition packaging market as of 2022. Primary packaging remains in direct contact with the packed supplement and nutrition materials. It protects the formulation from environmental influences, helps the smooth distribution and evacuation of the material, and aids in delivering marketing information to the end consumer of nutrition materials.

The bottles & jars sub-segment accounted for the highest share in the primary packaging segment in 2020. These are majorly used for the packaging of protein powders, multivitamin tablets, weight management nutrition materials, herbal materials, and gummies & chewable supplements. Bottles and jars are typically made up of either glass or plastic materials such as PET and HDPE. Plastic-based bottles & jars are majorly preferred by supplement manufacturers owing to their lightweight, high functionality, non-fragility, and lower prices as compared to glass bottles & jars.

Material Insights

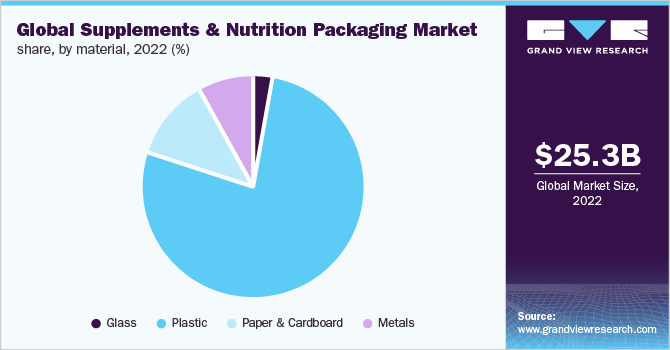

The plastic segment held the largest share of 77.4%, in terms of revenue, of the supplements & nutrition primary packaging market in 2022 and is expected to progress at a considerable CAGR in the forecast period. Various plastic resins, including HDPE, PET, and PP, are commonly used to make packaging bottles, jars, sachets, pouches, and blister packs for supplements. Properties such as lightness, chemical inertness, and ease of molding along with low cost and wide availability of plastic materials are the key factors contributing to their high adoption for the manufacturing of supplements & nutrition packaging materials.

PET plastic is 100% recyclable and is the most recycled plastic in the world; this factor contributes to the high adoption of pet-based plastic containers in the market. Moreover, the material offers robust tensile strength, high impact resistance, and clarity, which make PET containers ideal for the packaging of protein powders, vitamins, and other nutritional materials. Increasing preference for recyclable plastic materials due to sustainability concerns associated with non-recyclable plastics is expected to benefit the PET plastic-type segment in the forecast period.

Formulation Insights

Based on formulation, powder accounts for the largest share in terms of revenue in the year 2022. Sports nutrition materials such as whey protein, plant protein, and weight loss or gain supplements are widely offered in powder form. Increasing sporting activities and a rising preference for a healthy lifestyle are fueling the demand for protein supplements. Moreover, the growing introduction of plant-based protein supplements is projected to drive the growth of the segment.

However, the outbreak of COVID-19 has resulted in a closedown of fitness and sports clubs across the world. In addition, a wider population had avoided visiting public places such as gyms, fitness centers, and sports clubs in 2020 as a precaution from disease spread. This trend is expected to continue owing to the continuous mutation of the virus that led to a surge in daily cases across the globe. This is likely to lower the demand for sports nutrition and, in turn, hamper the growth of the powder segment over a shorter period.

Regional Insights

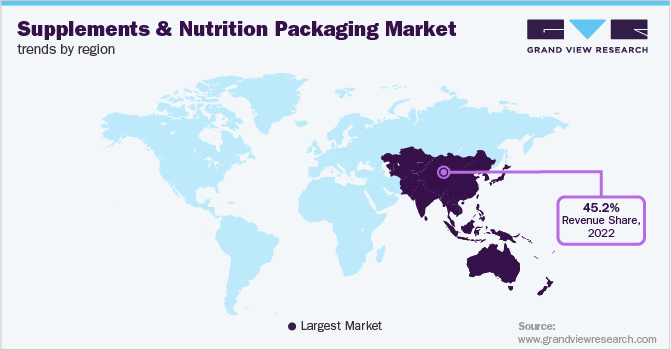

The Asia Pacific emerged as the largest market for supplement & nutrition packaging in 2022 with a revenue share of 45.2%. Growing demand for nutrition materials and supplements, availability of raw materials, presence of numerous processing plants, and cheap labor rates in the region are some of the factors driving the Asia Pacific supplements & nutrition packaging market. Moreover, lenient regulations in most countries make the region lucrative for multinational companies to set up their material ion plants and corporate offices

China is home to many small and medium-sized enterprises operating in the Materialion of supplements and nutrition materials. China is also a major hub for a packaging solution for these materials. Due to cheap labor costs and ease of doing business, major multinational companies have set up their plants and corporate offices in the country. This is likely to boost the demand for supplements and nutrition packaging over the forecast period.

The demand for supplements and nutrition materials has been growing in European countries for the past three years. With the outbreak of coronavirus disease in Europe in 2020, the consumption of aforementioned materials has surged further, especially in the countries such as Germany, the UK, Italy, and Spain. This growth in the supplements industry is expected to have a positive impact on the supplements & nutrition packaging industry in the regions.

Key Companies & Market Share Insights

The market is steadily moving toward sustainability packaging owing to rising stringent regulations regarding the use of excessive plastic packaging coupled with the growing sustainability awareness among consumers. In line with this, in May 2019, Graham Packaging Company announced its plan of 100% incorporation of reusable, recyclable, or compostable packaging by 2025. In February 2018, Comar, LLC optimized its manufacturing tools and developed light PET bottles to enhance its sustainability profile.

ePac Holdings, LLC has been offering packaging made of post-consumer recycled (PCR) plastic and also developing packaging pouches made of compostable material. However, the COVID-19 outbreak from the beginning of 2020 is expected to slow down the shift toward sustainable packaging over the short term as consumers and governments across the world are increasingly focusing on hygiene and safety of packed materials in order to minimize the spread of the disease and this shift in consumer behavior is expected to be observed until 2022. Some of the prominent players in the global supplement and nutrition packaging market include:

-

Glenroy, Inc.

-

Alpha Packaging

-

Comar, LLC.

-

Graham Packaging Company

-

Gerresheimer AG

-

ePac Holdings, LLC

-

Law Print & Packaging Management Ltd

-

MPS (Molded Packaging Solutions)

-

OPM Labels

-

Container & Packaging Supply, Inc.

Supplements And Nutrition Packaging Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 26.24 billion

Revenue forecast in 2030

USD 35.07 billion

Growth rate

CAGR of 4.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Packaging type, material, formulation, region

Regional scope

North America; Europe; Asia Pacific; South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Glenroy, Inc.; Comar, LLC.; Alpha Packaging; Graham Packaging Company; Gerresheimer AG; ePac Holdings, LLC; Law Print & Packaging Management Ltd.; MPS; OPM Labels; Container and Packaging Supply, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Supplements And Nutrition Packaging Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global supplements and nutrition packaging market report based on packaging type, material, formulation, and region:

-

Packaging Type (Revenue, USD Million, 2017 - 2030)

-

Primary

-

Bottles & Jar

-

Tin & Cans

-

Stand Up Pouch

-

Sachets & Other Pouches

-

Blister & Strips

-

Others

-

-

Secondary & Tertiary Packaging

-

Paper & Paperboard

-

Flexible Paper/ Plastics/ Metals

-

-

-

Material Outlook (Revenue, USD Million, 2017 - 2030)

-

Glass

-

Plastic

-

PET

-

HDPE

-

PP

-

Others

-

-

Metals

-

Paper & Cardboard

-

-

Formulation Outlook (Revenue, USD Million, 2017 - 2030)

-

Tablets

-

Capsules & Pills

-

Powder

-

Soft Gel

-

Liquid

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Central & South America (CSA)

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global supplements and nutrition packaging market was estimated at USD 25.35 billion in the year 2022 and is expected to reach USD 26.24 billion in the year 2023.

b. The global supplements and nutrition packaging market is expected to witness a moderate CAGR of 4.1% in terms of revenue. Owing to the rising demand for immunity-boosting supplements due to the COVID-19 outbreak and increasing accessibility due to the emergence of e-commerce.

b. The factors attributed to driving the market are the growing adoption of immunity-boosting supplements, rising demand for sports nutrition, and increasing consumer awareness regarding nutrition, health, and wellness.

b. The primary type commanded the largest share of 61.1% in terms of revenue in 2022. It protects the formulation from environmental influences and helps smooth the distribution and evacuation of the product.

b. Glenroy, Inc.; Comar, LLC.; Alpha Packaging; Graham Packaging Company; Gerresheimer AG; ePac Holdings, LLC; Law Print & Packaging Management Ltd.; MPS; OPM Labels; and Container and Packaging Supply, Inc

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."