- Home

- »

- Disinfectants & Preservatives

- »

-

Surface Disinfectant Market Size, Share, Growth Report 2030GVR Report cover

![Surface Disinfectant Market Size, Share & Trends Report]()

Surface Disinfectant Market Size, Share & Trends Analysis Report By Composition (Chemical, Biobased), By Form (Liquid, Wipes), By End-use, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-721-6

- Number of Pages: 130

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Bulk Chemicals

Surface Disinfectant Market Size & Trends

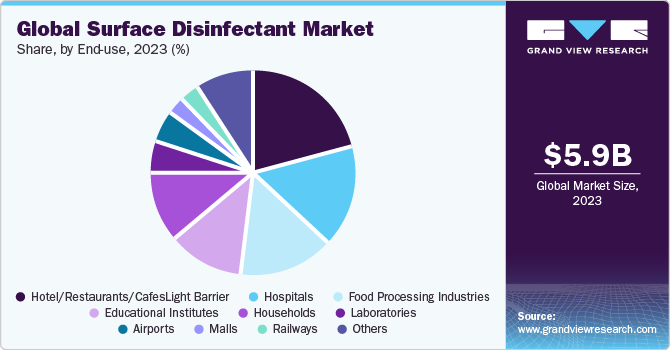

The global surface disinfectant market size was valued at USD 5.85 billion in 2023 and is expecte to grow at a compound annual growth rate (CAGR) of 7.2% from 2024 to 2030. The growth is attributed to several factors such as changing lifestyles in developing economies and the rising awareness among livestock farmers concerning animal diseases and disinfections in livestock farms.

There has been a significant rise in demand for cleaning products, sanitizers, and disinfectants as surface disinfectant market is experiencing a resurgence globally, fueled by a heightened awareness of hygiene and sanitation post-pandemic. This has led to a surge in demand for products that combat germs and viruses on surfaces and positively impacted market growth.

The raw materials used in the production of surface disinfectants are primarily the by-products of the petroleum sector. Local manufacturers in the developed economies of Europe, North America, and China mainly source these raw material ingredients. Recently, the industry observed a shift in the trend toward the usage of biodegradable surface disinfectants for preventing chemical-related toxicity. The raw materials required for biodegradable surface disinfectants are cheaper in comparison to chemicals and are easily available. As a result, bio-based surface disinfectant demand is expected to overtake conventional petroleum-based surface disinfectants in the coming future.

Surface disinfectant products market has witnessed a low to moderate rise in prices post pandemic. Sudden upsurge in demand for surface disinfectants post COVID-19 and rising prevalence of chronic diseases, prevalence of HAIs, encouraging government initiatives, and stringent regulations on disinfection and sterilization. These factors have led to a rise in demand for the product especially in developed economies of North America and Europe.

Surface disinfectants have various chemical substances. When used as per guidelines yield magnificent results. They help prevent the occurrence and transmission of various diseases. However, these substances can be harmful to humans and animals and ultimately leads to environmental problems. Incomplete knowledge regarding the proper use of surface disinfectants and the health hazards associated with these products can pose a potential threat to the market growth.

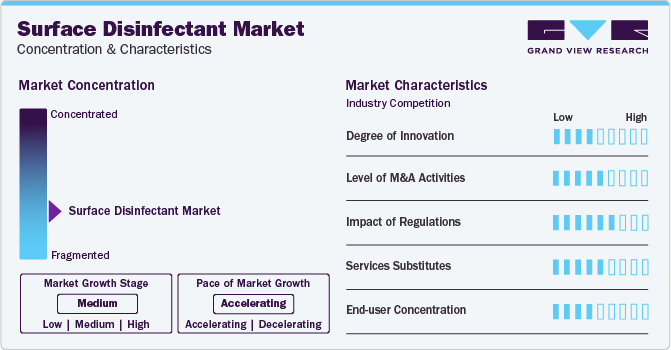

Market Concentration & Characteristics

Market growth stage is moderate, and pace of the market growth is accelerating. The market is characterized by increasing awareness among consumers about hygiene and preventive healthcare. The market is also characterized by a high level of merger and acquisition activity by leading manufacturers to consolidate market share. Emerging players resort to long-term agreements and collaboration in a competitive environment. The competitive nature of the market encourages companies to explore synergies and target players with innovative technologies and complementary products.

The market is also heavily influenced by stringent rules & regulations. Regulations pertaining to product safety, environmental impact, and production standards. Further, companies have to be compliant with regulatory requirements in end-use sectors, such as food & healthcare industry, that have a negative impact on the market. Key players are concentrating on using advanced technologies and adopting new marketing strategies to strengthen their base to generate more revenue in the near future.

Increasing awareness among consumers regarding the toxicity of chemical-based products, coupled with the growing disposable incomes of majority of population in developed economies, has compelled several manufacturers to produce biobased surface disinfectants. This poses challenge for surface disinfectant products & services. Therefore, industry players focused on optimizing and managing supply efficiency and being competitive in the market by enhancing their operational efficiency, increasing productivity, and reducing lead time. Also, differentiate their products by highlighting unique features with respect to their applications.

Composition Insights

Chemical products dominated the surface disinfectant market with a high revenue share of more than 90.0% in 2023.This is attributed to the rising utilization of hydrogen peroxide in industries such as food packaging, and in hospitals to disinfect various surfaces. Also, the rising utilization of quaternary ammonium compounds, as well as alcohols is anticipated to have a positive impact on the market growth.

Chemical surface disinfectants are primarily classified into two types, oxidizing and non-oxidizing disinfectants. Non-oxidizing disinfectants comprise aldehydes, amphoteric phenolics, alcohol, and quaternary ammonium compounds (QACs). These disinfectants are majorly segmented into three types which are, low level (QAC, Phenolic), intermediate level (iodine, alcohols, iodophore, hypochlorites), and high-level (ortho-phthalaldehyde, hydrogen peroxide, peracetic acid, formaldehyde, glutaraldehyde) disinfectants.

Biobased surface disinfectants are viewed as alternatives to chemical surface disinfectants owing to their non-toxic, biodegradable, and environment-friendly characteristics. The FDA approval to use biobased products in commercialization and formulations of surface disinfectants is expected to create huge opportunities for market participants. Also, the increasing application scope of biobased surface disinfectants along with a high potential to replace chemical surface disinfectants at economical levels is anticipated to create lucrative opportunities for existing as well as new market participants.

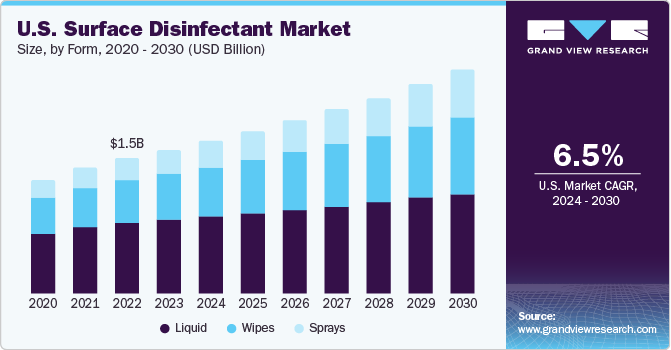

Form Insights

Liquid form dominated the global surface disinfectants market with a high revenue share of more than 62.0% in 2023. This high share is attributed to their variety of applications in industrial as well as household usage like kitchen fixtures, glazed ceramic tile, windows, plastics, exterior surfaces of applications, vinyl, and glass.

Liquid surface disinfectants are found in liquids and gels forms with minimum viscosity. Liquid disinfectants are toxic antimicrobial or biocidal, strong chemicals that can be used on contaminated surfaces. Biobased surface disinfectants are generally used in liquid form. Sodium hypochlorite is one of the commonly used liquid disinfectants in the livestock industry. It is an aqueous solution, which is not affected by water hardness. Such liquid disinfectants are used to omit the risk of several diseases as well as treat livestock infections.

Furthermore, wipes are moistened pieces of plastic or cloth. Surface disinfectant wipes are anticipated to witness growth because of their minimum probabilities of cross-contamination, convenience, and nil water consumption. Wipes are used for disinfecting equipment, especially in hospitals, where the use of liquids and sprays is not that easy.

Application Insights

In house application dominated the surface disinfectant market with a revenue share of over 68.0% in 2023.Its high share is attributable to the sharp increase in the product demand for regular cleaning activities and disinfecting the interior of houses, especially after the ongoing pandemic situation.

In-house surface applications include industrial, commercial, and household surfaces. The Centers for Disease Control and Prevention (CDC) has laid some regulations and recommendations for the disinfecting and cleaning processes to be followed. This process does not necessarily kill or clean all germs but lowers the risk of spreading diseases and infections caused by viruses, fungi, and bacteria.

Other applications of surface disinfectants include transportation and outdoor disinfection. The product demand from these applications has increased significantly. Chemical-based surface disinfectants are most likely to dominate the market as they are easy to apply, economical, and widely available.

End-use Insights

Hotel/Restaurants/Cafes dominated the surface disinfectant market with a revenue share of more than 20.0% in 2023. Its high share is attributable to the growing need to sanitize and disinfect the common areas, swimming pools, bedrooms, and lobbies to maintain hygiene.

Hospitals are also one of the important end-users as they are the most vulnerable to infections caused by viruses, bacteria, and fungi. Regular and periodic disinfection of equipment, surfaces, and PPE kits are on top priority in hospitals, and this acts as a major factor for driving the market.

Air travel plays a crucial role in spreading infectious diseases. A high number of passengers from all over the globe come together in an enclosed area with comparatively high contact rates with chances of leading to more risk of infections. An infected person can easily spread the pathogens to co-passengers and airport staff through luggage, direct contact, and by touching several places at the airport. Thus, airports need to be disinfected by spraying disinfectants at the common places, airport lounge, jet bridge, and gates.

Regional Insights

North America region dominated the surface disinfectant market with a revenue share of more than 33.0% in 2023.This is attributed to the number of approvals by regulatory authorities such as Health Canada and the U.S. Environmental Protection Agency (EPA) to use these disinfectant products in their own countries. In North America, the ever-evolving regulations, healthcare spending, hygiene and health-related awareness, and increased R&D activities across surface disinfectant formulators, raw material manufacturers, and end-users are expected to continue driving the growth of the industry.

Europe witnessed a severe surge in the demand amid the ongoing pandemic spread. Many big international companies are constantly expanding their presence by setting up multiple production and manufacturing facilities in the region, so as to meet the rising demand and serve the European healthcare facilities locally. Technological and R&D advancement in terms of production technologies have further advanced the market in the region.

Consumption of surface disinfectants in Asia Pacific is highly benefitted from its heightened demand, especially since the COVID-19 pandemic. The availability of cost-effective active ingredients for the market has accelerated market growth at the domestic as well as international level. China is expected to be the prominent value shareholder throughout the forecast period, driven by the spread of COVID-19 across the country.

India Surface Disinfectant Market: Surface disinfectant market in India is expected to witness significant growth owing to its rising hygiene standards, massive population, and growing awareness of health and hygiene in urban & rural areas of the country.

Key Surface Disinfectant Market Company Insights

Some of the key players operating in the market include Proctor & Gamble, Clorox Company, The 3M Company, and Ecolab Inc.

-

Proctor & Gamble is a global manufacturer of consumer goods and a service provider for janitorial cleaning, buildings, restaurants, hospitality, healthcare, drug retail, and education. It provides solutions for cleaning & disinfection of bathrooms, carpets, kitchen & dishes, laundry & linen, and surface & air. Spic Span, Swiffer, Febreze, Bounty, P&G Proline. Comet, and Safeguard are some of the company’s prominent product brands. It further focuses on product innovation, advanced formulations, addressing emerging pathogens, and R&D for product efficiency.

-

3M provides solutions for cleaning & disinfection of bathrooms, carpets, kitchen & dishes, laundry & linen, and surface & air. Spic Span, Swiffer, Febreze, Bounty, P&G Proline. Comet, and Safeguard are some of the company’s prominent product brands. Technology, manufacturing, global expansion and brand value are the key strengths of the company. It operates via 80 manufacturing facilities located across the U.S. and 125 manufacturing facilities outside the U.S. with sales in around 200 countries globally.

-

BODE Chemie GmbH and Star Brands Ltd are some of the emerging market participants in surface disinfectant market.

-

Star Brands Ltd is a company that produces a wide variety of household cleaning products. It offers products such as laundry detergent, dish soap, stain removers, and others. The company sells its products under the brands named the pink stuff and star drops. The pink stuff utilizes 100% natural cleaning particles for effective cleaning. It has an employee strength of more than 110.

-

BODE Chemie GmbH is a company that manufactures disinfection, skin protection, and hygiene products. It has a presence in the Americas, Europe, Asia, Africa, and the Middle East. The company manufactures more than 400 products in Germany at the Hamburg-Stellingen site. The products are sold in more than 50 countries. It offers five product categories namely hands, skin, instruments, surface, and equipment.

Key Surface Disinfectant Companies:

The following are the leading companies in the surface disinfectant market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these surface disinfectant companies are analyzed to map the supply network.

- PDI, Inc.

- GOJO Industries, Inc.

- W.M. Barr

- Spartan Chemical Company, Inc.

- W.W. Grainger, Inc.

- Carenowmedical

- Reckitt Benckiser Group PLC

- PaxChem Ltd.

- BODE Chemie GmbH

- Star Brands Ltd.

- The 3M Company

- Ecolab

- Procter & Gamble

- The Clorox Company

- Whiteley Corporation

- Lonza

- SC Johnson Professional

- BASF SE

- Evonik Industries AG

- Kimberley-Clark Corporation (KCWW)

- Medline Industries, Inc.

Recent Developments

-

In June 2023, Lysol, a Reckitt Benckiser Group PLC brand announced the launch of Lysol air sanitizer in U.S. It is the first air sanitizer spray that is being approved by U.S. Environmental Protection Agency (EPA).

-

In March 2022, PDI launched Sani-24® Germicidal Disposable Wipe, Sani-HyPerCide® Germicidal Disposable Wipe, and Sani-HyPerCide® Germicidal Spray. The disinfectants are designed to empower infection prevention professionals in their efforts to combat the escalating rates of healthcare-associated infections (HAIs) and effectively address the challenges posed by COVID-19 in healthcare settings.

-

In February 2022, SC Johnson Professional introduced the Quaternary Disinfectant Cleaner, featuring an innovative, easy-to-measure, squeeze, and pour bottle design. This product streamlines cleaning processes by offering one-stop solution for cleaning, disinfecting, and deodorizing, effectively reducing labor time and effort previously spent on measuring and diluting concentrated chemistry.

Global Surface Disinfectant Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.25 billion

Revenue forecast in 2030

USD 9.49 billion

Growth rate

CAGR of 7.2% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million, Volume in Tons and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Composition, Form, Application, End-use, and Region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, Germany, UK, France, Spain, Italy, China, India, Japan, Australia, Brazil, Mexico, GCC Countries, South Africa

Key companies profiled

PDI, Inc., GOJO Industries, Inc., W.M. Barr, Spartan Chemical Company, Inc., W.W. Grainger, Inc., Carenowmedical, Reckitt Benckiser Group PLC, PaxChem Ltd., BODE Chemie GmbH, Star Brands Ltd., The 3M Company, Ecolab, Procter & Gamble, The Clorox Company, Whiteley Corporation, Lonza, SC Johnson Professional, BASF SE, Evonik Industries AG, Kimberley-Clark Corporation (KCWW), Medline Industries, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Surface Disinfectant Market Report Segmentation

This report forecasts volume and revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global surface disinfectant market report based on composition, form, application, end-use, and region:

-

Composition Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Chemical

-

Alcohol

-

Ammonium Compounds

-

Oxidizing Agents

-

Phenolics

-

Aldehydes

-

Others

-

-

Biobased

-

-

Form Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Liquid

-

Wipes

-

Sprays

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

In House

-

Instruments

-

Others

-

-

End-use Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Laboratories

-

Households

-

Hotel/Restaurants/Cafes

-

Educational Institutes

-

Malls

-

Railways

-

Airports

-

Food Processing Industries

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

GCC Countries

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global surface disinfectant market size was estimated at USD 5.49 billion in 2022 and is expected to reach USD 5.85 billion in 2023.

b. The global surface disinfectant market is expected to grow at a compound annual growth rate of 7.1% from 2023 to 2030 to reach USD 9.49 billion by 2030.

b. The chemical product type segment dominated the global surface disinfectant market with a revenue share of 91.37% in 2022.

b. The liquid form segment led the global surface disinfectant market and accounted for the largest revenue share of 64.54% in 2022.

b. The in-house application segment dominated the global surface disinfectant market and accounted for the largest revenue share of 25.98% in 2022.

Table of Contents

Chapter 1 Surface Disinfectant Market: Methodology and Scope

1.1 Market Segmentation & Scope

1.2 Market Definition

1.3 Information Procurement

1.3.1 Purchased Database

1.3.2 GVR’s Internal Database

1.3.3 Secondary Sources & THIRD-PARTY Perspectives

1.4 Information Analysis

1.4.1 Data Analysis Models

1.5 Market formulation & data visualization

1.6 Data validation & publishing

1.7 Research Scope and Assumptions

Chapter 2 Surface Disinfectant Market: Executive Summary

2.1 Market Snapshot

2.2 Segment Snapshot

2.3 Competitive Landscape Snapshot

Chapter 3 Surface Disinfectant Market: Variables, Trends & Scope

3.1 Market Lineage Outlook

3.2 Industry Value Chain Analysis

3.2.1 Manufacturing/Technology Trends

3.2.2 Sales Channel Analysis

3.2.3 List of Potential End-Users

3.3 Price Trend Analysis, 2018-2030

3.3.1 Factors Affecting Prices

3.4 Regulatory Framework, By Regions

3.5 Market Dynamics

3.5.1 Market driver analysis

3.5.2 Market restraint analysis

3.5.3 Market Challenges Analysis

3.5.4 Market Opportunity Analysis

3.6 Business Environment Analysis

3.6.1 Porter’s Analysis

3.6.2 PESTEL Analysis

Chapter 4 Surface Disinfectants Market: Supplier Portfolio Analysis

4.1 List of Key Raw Material Suppliers

4.2 Raw Material Trends

4.3 Portfolio Analysis/Kraljic Matrix

4.4 Engagement Model

4.5 Negotiation Strategies

4.6 Sourcing Best Practices

Chapter 5 Surface Disinfectant Market: Raw Material Estimates & Trend Analysis

5.1 Raw Material movement analysis & market share, 2023 & 2030

5.1.1 Chemical

5.1.1.1 Alcohol

5.1.1.2 Ammonium Compound

5.1.1.3 Oxidizing Agents

5.1.1.4 Phenolics

5.1.1.5 Aldehydes

5.1.1.6 Others

5.1.2 Biobased

Chapter 6 Surface Disinfectant Market: Form Estimates & Trend Analysis

6.1 Form movement analysis & market share, 2023 & 2030

6.1.1 Liquids

6.1.2 Wipes

6.1.3 Sprays

Chapter 7 Surface Disinfectant Market: Application Estimates & Trend Analysis

7.1 Application movement analysis & market share, 2023 & 2030

7.1.1 In-House Surfaces

7.1.2 Instruments

7.1.3 Others

Chapter 8 Surface Disinfectant Market: End-use Estimates & Trend Analysis

8.1 End-use movement analysis & market share, 2023 & 2030

8.1.1 Hospitals

8.1.2 Laboratories

8.1.3 Households

8.1.4 Hotel/Restaurant/Café (HORECA)

8.1.5 Educational Institutions (including schools, etc.)

8.1.6 Malls

8.1.7 Railways

8.1.8 Airports

8.1.9 Food Processing Industries

8.1.10 Others

Chapter 9 Surface Disinfectant Market: Regional Estimates & Trend Analysis

9.1 Surface Disinfectants Market: Regional Outlook

9.2 North America

9.2.1 North America Surface Disinfectant Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

9.2.2 U.S.

9.2.2.1 Key Country Dynamics

9.2.2.2 U.S. Surface Disinfectant Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

9.2.3 Canada

9.2.3.1 Key Country Dynamics

9.2.3.2 Canada Surface Disinfectant Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

9.3 Europe

9.3.1 Europe Surface Disinfectant Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

9.3.2 Germany

9.3.2.1 Key Country Dynamics

9.3.2.2 Germany Surface Disinfectant Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

9.3.3 U.K.

9.3.3.1 Key Country Dynamics

9.3.3.2 U.K. Surface Disinfectant Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

9.3.4 France

9.3.4.1 Key Country Dynamics

9.3.4.2 France Surface Disinfectant Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

9.3.5 Spain

9.3.5.1 Key Country Dynamics

9.3.4.2 Spain Surface Disinfectrant Market Estimates and Forecasts, 2018–2030 (Tons) (USD Million)

9.3.6 Italy

9.3.6.1 Key Country Dynamics

9.3.6.2 Italy Surface Disinfectrant Market Estimates and Forecasts, 2018–2030 (Tons) (USD Million)

9.4 Asia Pacific

9.4.1 Asia Pacific Surface Disinfectant Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

9.4.2 China

9.4.2.1 Key Country Dynamics

9.4.2.2 China Surface Disinfectant Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

9.4.3 India

9.4.3.1 Key Country Dynamics

9.4.3.2 India Surface Disinfectant Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

9.4.4 Japan

9.4.4.1 Key Country Dynamics

9.4.4.2 Japan Surface Disinfectant Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

9.4.5 Australia

9.4.5.1 Key Country Dynamics

9.4.5.2 Australia Surface Disinfectrant Market Estimates and Forecasts, 2018–2030 (Tons) (USD Million)

9.5 Latin America

9.5.1 Latin America Surface Disinfectant Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

9.5.2 Brazil

9.5.2.1 Key Country Dynamics

9.5.2.2 Brazil Surface Disinfectant Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

9.5.3 Mexico

9.5.3.1 Key Country Dynamics

9.5.3.2 Mexico Surface Disinfectant Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

9.6 Middle East & Africa

9.6.1 Middle East & Africa Surface Disinfectant Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

9.6.2 GCC Countries

9.6.2.1 Key Country Dynamics

9.6.2.2 GCC Countries Surface Disinfectant Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

9.6.3 South Africa

9.6.3.1 Key Country Dynamics

9.6.3.2 South Africa Surface Disinfectant Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

Chapter 10 Competitive Landscape

10.1 Participant’s Overview

10.2 Financial Performance

10.3 Product Benchmarking

10.4 Recent Development & Impact Analysis, By Key Market Participants

10.5 Company Categorization

10.6 Company Market Positioning

10.7 Company Heat Map Analysis

10.8 Strategy Mapping

10.9 Company Listing

10.9.1 PDI, Inc.

10.10 GOJO Industries, Inc.

10.11 W.M. Barr

10.12 Spartan Chemical Company, Inc.

10.13 W.W. Grainger, Inc.

10.14 Carenowmedical

10.15 Reckitt Benckiser Group PLC

10.16 PaxChem Ltd

10.17 BODE Chemie GmbH

10.18 Star Brands Ltd

10.19 The 3M Company

10.20 Ecolab

10.21 Procter & Gamble

10.22 The Clorox Company

10.23 Whiteley Corporation

10.24 Lonza

10.25 SC Johnson Professional

10.26 BASF SE

10.27 Evonik Industries AG

10.28 Kimberly-Clark Corporation (KCWW)

10.29 Medline Industries, Inc.

List of Tables

Table 1 List of key end users

Table 2 U.S. macro-economic outlay

Table 3 Canada macro-economic outlay

Table 4 Germany macro-economic outlay

Table 5 UK macro-economic outlay

Table 6 France macro-economic outlay

Table 7 Spain macro-economic outlay

Table 8 Italy macro-economic outlay

Table 9 China macro-economic outlay

Table 10 India macro-economic outlay

Table 11 Japan macro-economic outlay

Table 12 Australia macro-economic outlay

Table 13 Brazil macro-economic outlay

Table 14 Mexico macro-economic outlay

Table 15 GCC Countries macro-economic outlay

Table 16 South Africa macro-economic outlay

Table 17 Participant’s Overview

Table 18 Financial Performance

Table 19 Product Benchmarking

Table 20 Recent Developments & Impact Analysis, By Key Market Participants

Table 21 Company Heat Map Analysis

List of Figures

Fig. 1 Surface Disinfectants Market Segmentation & Scope

Fig. 2 Information procurement

Fig. 3 Data analysis models

Fig. 4 Market formulation and validation

Fig. 5 Data validating & publishing

Fig. 6 Surface Disinfectants Market Snapshot

Fig. 7 Surface Disinfectants Market Segment Snapshot

Fig. 8 Surface Disinfectants Market Segment Snapshot

Fig. 9 Surface Disinfectants Market Competitive Landscape Snapshot

Fig. 10 Surface Disinfectants Market Value, 2023 (USD Million)

Fig. 11 Surface Disinfectants Market - Value Chain Analysis

Fig. 12 Surface Disinfectants Market - Price Trend Analysis 2018 - 2030 (USD/kg)

Fig. 13 Surface Disinfectants Market - Market Dynamics

Fig. 14 PORTER’S Analysis

Fig. 15 PESTEL Analysis

Fig. 16 Surface Disinfectants Market Estimates & Forecasts, by Composition: Key Takeaways

Fig. 17 Surface Disinfectants Market Share, By Composition, 2023 & 2030

Fig. 18 Chemical based Surface Disinfectants Market Estimates & Forecasts, 2018 - 2030 (Tons) (USD Million)

Fig. 19 Alcohol based Surface Disinfectants Market Estimates & Forecasts, 2018 - 2030 (Tons) (USD Million)

Fig. 20 Ammonium Compounds based Surface Disinfectants Market Estimates & Forecasts, 2018 - 2030 (Tons) (USD Million)

Fig. 21 Oxidizing Agents based Surface Disinfectants Market Estimates & Forecasts, 2018 - 2030 (Tons) (USD Million)

Fig. 22 Phenolics based Surface Disinfectants Market Estimates & Forecasts, 2018 - 2030 (Tons) (USD Million)

Fig. 23 Aldehydes based Surface Disinfectants Market Estimates & Forecasts, 2018 - 2030 (Tons) (USD Million)

Fig. 24 Other based Surface Disinfectants Market Estimates & Forecasts, 2018 - 2030 (Tons) (USD Million)

Fig. 25 Surface Disinfectants Market Estimates & Forecasts, by Form: Key Takeaways

Fig. 26 Surface Disinfectants Market Share, By Form, 2023 & 2030

Fig. 27 Liquid Surface Disinfectants Market Estimates & Forecasts, 2018 - 2030 (Tons) (USD Million)

Fig. 28 Surface Disinfectants Wipes Market Estimates & Forecasts, 2018 - 2030 (Tons) (USD Million)

Fig. 29 Surface Disinfectants Spray Market Estimates & Forecasts, 2018 - 2030 (Tons) (USD Million)

Fig. 30 Surface Disinfectants Market Estimates & Forecasts, by Application: Key Takeaways

Fig. 31 Surface Disinfectants Market Share, By Application, 2023 & 2030

Fig. 32 Surface Disinfectants Market Estimates & Forecasts, in In House, 2018 - 2030 (Tons) (USD Million)

Fig. 33 Surface Disinfectants Market Estimates & Forecasts, in Intrumemts, 2018 - 2030 (Tons) (USD Million)

Fig. 34 Surface Disinfectants Market Estimates & Forecasts, in Others, 2018 - 2030 (Tons) (USD Million)

Fig. 35 Surface Disinfectants Market Estimates & Forecasts, by End-use: Key Takeaways

Fig. 36 Surface Disinfectants Market Share, By End-use, 2023 & 2030

Fig. 37 Surface Disinfectants Market Estimates & Forecasts, in Hospitals, 2018 - 2030 (Tons) (USD Million)

Fig. 38 Surface Disinfectants Market Estimates & Forecasts, in Laboratories, 2018 - 2030 (Tons) (USD Million)

Fig. 39 Surface Disinfectants Market Estimates & Forecasts, in Households, 2018 - 2030 (Tons) (USD Million)

Fig. 40 Surface Disinfectants Market Estimates & Forecasts, in Hotel/Restaurants/Cafes (HORECA), 2018 - 2030 (Tons) (USD Million)

Fig. 41 Surface Disinfectants Market Estimates & Forecasts, in Educational Institutes, 2018 - 2030 (Tons) (USD Million)

Fig. 42 Surface Disinfectants Market Estimates & Forecasts, in Malls, 2018 - 2030 (Tons) (USD Million)

Fig. 43 Surface Disinfectants Market Estimates & Forecasts, in Railways, 2018 - 2030 (Tons) (USD Million)

Fig. 44 Surface Disinfectants Market Estimates & Forecasts, in Airports, 2018 - 2030 (Tons) (USD Million)

Fig. 45 Surface Disinfectants Market Estimates & Forecasts, in Food Processing Industries, 2018 - 2030 (Tons) (USD Million)

Fig. 45 Surface Disinfectants Market Estimates & Forecasts, in Others, 2018 - 2030 (Tons) (USD Million)

Fig. 46 Surface Disinfectants Market Revenue, by Region, 2023 & 2030, (USD Million)

Fig. 47 North America Surface Disinfectants Market Estimates & Forecasts, 2018 - 2030 (Tons) (Tons) (USD Million)

Fig. 48 U.S. Surface Disinfectants Market Estimates & Forecasts, 2018 - 2030 (Tons) (USD Million)

Fig. 49 Canada Surface Disinfectants Market Estimates & Forecasts, 2018 - 2030 (Tons) (USD Million)

Fig. 50 Europe Surface Disinfectants Market Estimates & Forecasts, 2018 - 2030 (Tons) (USD Million)

Fig. 51 Germany Surface Disinfectants Market Estimates & Forecasts, 2018 - 2030 (Tons) (USD Million)

Fig. 52 UK Surface Disinfectants Market Estimates & Forecasts, 2018 - 2030 (Tons) (USD Million)

Fig. 53 France Surface Disinfectants Market Estimates & Forecasts, 2018 - 2030 (Tons) (USD Million)

Fig. 54 Spain Surface Disinfectants Market Estimates & Forecasts, 2018 - 2030 (Tons) (USD Million)

Fig. 55 Italy Surface Disinfectants Market Estimates & Forecasts, 2018 - 2030 (Tons) (USD Million)

Fig. 56 Asia Pacific Surface Disinfectants Market Estimates & Forecasts, 2018 - 2030 (Tons) (USD Million)

Fig. 57 China Surface Disinfectants Market Estimates & Forecasts, 2018 - 2030 (Tons) (USD Million)

Fig. 58 India Surface Disinfectants Market Estimates & Forecasts, 2018 - 2030 (Tons) (USD Million)

Fig. 59 Japan Surface Disinfectants Market Estimates & Forecasts, 2018 - 2030 (Tons) (USD Million)

Fig. 60 Australia Surface Disinfectants Market Estimates & Forecasts, 2018 - 2030 (Tons) (USD Million)

Fig. 61 Latin America Surface Disinfectants Market Estimates & Forecasts, 2018 - 2030 (Tons) (USD Million)

Fig. 62 Brazil Surface Disinfectants Market Estimates & Forecasts, 2018 - 2030 (Tons) (USD Million)

Fig. 63 Mexico Surface Disinfectants Market Estimates & Forecasts, 2018 - 2030 (Tons) (USD Million)

Fig. 64 Middle East & Africa Surface Disinfectants Market Estimates & Forecasts, 2018 - 2030 (Tons) (USD Million)

Fig. 65 GCC Countries Surface Disinfectants Market Estimates & Forecasts, 2018 - 2030 (Tons) (USD Million)

Fig. 66 South Africa Surface Disinfectants Market Estimates & Forecasts, 2018 - 2030 (Tons) (USD Million)

Fig. 67 Key Company Categorization

Fig. 68 Company Market Positioning

Fig. 69 Strategy mappingWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Surface Disinfectant Composition Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

- Chemical

- Alcohol

- Ammonium Compounds

- Oxidizing Agents

- Phenolics

- Aldehydes

- Others

- Biobased

- Chemical

- Surface Disinfectant Form Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

- Liquid

- Wipes

- Sprays

- Surface Disinfectant Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

- In House

- Instruments

- Others

- Surface Disinfectant End-use Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

- Hospitals

- Laboratories

- Households

- Hotel/Restaurants/Cafes

- Educational Institutes

- Malls

- Railways

- Airports

- Food Processing Industries

- Others

- Surface Disinfectant Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

- North America

- North America Surface Disinfectant Market, By Composition

- Chemical

- Alcohol

- Ammonium Compounds

- Oxidizing Agents

- Phenolics

- Aldehydes

- Others

- Biobased

- Chemical

- North America Surface Disinfectant Market, By Form

- Liquid

- Wipes

- Sprays

- North America Surface Disinfectant Market, by Application

- In House

- Instruments

- Others

- North America Surface Disinfectant Market, by End-use

- Hospitals

- Laboratories

- Households

- Hotel/Restaurants/Cafes

- Educational Institutes

- Malls

- Railways

- Airports

- Food Processing Industries

- Others

- U.S.

- U.S. Surface Disinfectant Market, By Composition

- Chemical

- Alcohol

- Ammonium Compounds

- Oxidizing Agents

- Phenolics

- Aldehydes

- Others

- Biobased

- Chemical

- U.S. Surface Disinfectant Market, By Form

- Liquid

- Wipes

- Sprays

- U.S. Surface Disinfectant Market, by Application

- In House

- Instruments

- Others

- U.S. Surface Disinfectant Market, by End-use

- Hospitals

- Laboratories

- Households

- Hotel/Restaurants/Cafes

- Educational Institutes

- Malls

- Railways

- Airports

- Food Processing Industries

- Others

- U.S. Surface Disinfectant Market, By Composition

- Canada

- Canada Surface Disinfectant Market, By Composition

- Chemical

- Alcohol

- Ammonium Compounds

- Oxidizing Agents

- Phenolics

- Aldehydes

- Others

- Biobased

- Chemical

- Canada Surface Disinfectant Market, By Form

- Liquid

- Wipes

- Sprays

- Canada Surface Disinfectant Market, by Application

- In House

- Instruments

- Others

- Canada Surface Disinfectant Market, by End-use

- Hospitals

- Laboratories

- Households

- Hotel/Restaurants/Cafes

- Educational Institutes

- Malls

- Railways

- Airports

- Food Processing Industries

- Others

- Canada Surface Disinfectant Market, By Composition

- North America Surface Disinfectant Market, By Composition

- Europe

- Europe Surface Disinfectant Market, By Composition

- Chemical

- Alcohol

- Ammonium Compounds

- Oxidizing Agents

- Phenolics

- Aldehydes

- Others

- Biobased

- Chemical

- Europe Surface Disinfectant Market, By Form

- Liquid

- Wipes

- Sprays

- Europe Surface Disinfectant Market, by Application

- In House

- Instruments

- Others

- Europe Surface Disinfectant Market, by End-use

- Hospitals

- Laboratories

- Households

- Hotel/Restaurants/Cafes

- Educational Institutes

- Malls

- Railways

- Airports

- Food Processing Industries

- Others

- Germany

- Germany Surface Disinfectant Market, By Composition

- Chemical

- Alcohol

- Ammonium Compounds

- Oxidizing Agents

- Phenolics

- Aldehydes

- Others

- Biobased

- Chemical

- Germany Surface Disinfectant Market, By Form

- Liquid

- Wipes

- Sprays

- Germany Surface Disinfectant Market, by Application

- In House

- Instruments

- Others

- Germany Surface Disinfectant Market, by End-use

- Hospitals

- Laboratories

- Households

- Hotel/Restaurants/Cafes

- Educational Institutes

- Malls

- Railways

- Airports

- Food Processing Industries

- Others

- Germany Surface Disinfectant Market, By Composition

- U.K.

- U.K. Surface Disinfectant Market, By Composition

- Chemical

- Alcohol

- Ammonium Compounds

- Oxidizing Agents

- Phenolics

- Aldehydes

- Others

- Biobased

- Chemical

- U.K. Surface Disinfectant Market, By Form

- Liquid

- Wipes

- Sprays

- U.K. Surface Disinfectant Market, by Application

- In House

- Instruments

- Others

- U.K. Surface Disinfectant Market, by End-use

- Hospitals

- Laboratories

- Households

- Hotel/Restaurants/Cafes

- Educational Institutes

- Malls

- Railways

- Airports

- Food Processing Industries

- Others

- U.K. Surface Disinfectant Market, By Composition

- France

- France Surface Disinfectant Market, By Composition

- Chemical

- Alcohol

- Ammonium Compounds

- Oxidizing Agents

- Phenolics

- Aldehydes

- Others

- Biobased

- Chemical

- France Surface Disinfectant Market, By Form

- Liquid

- Wipes

- Sprays

- France Surface Disinfectant Market, by Application

- In House

- Instruments

- Others

- France Surface Disinfectant Market, by End-use

- Hospitals

- Laboratories

- Households

- Hotel/Restaurants/Cafes

- Educational Institutes

- Malls

- Railways

- Airports

- Food Processing Industries

- Others

- France Surface Disinfectant Market, By Composition

- Spain

- Spain Surface Disinfectant Market, By Composition

- Chemical

- Alcohol

- Ammonium Compounds

- Oxidizing Agents

- Phenolics

- Aldehydes

- Others

- Biobased

- Chemical

- Spain Surface Disinfectant Market, By Form

- Liquid

- Wipes

- Sprays

- Spain Surface Disinfectant Market, by Application

- In House

- Instruments

- Others

- Spain Surface Disinfectant Market, by End-use

- Hospitals

- Laboratories

- Households

- Hotel/Restaurants/Cafes

- Educational Institutes

- Malls

- Railways

- Airports

- Food Processing Industries

- Others

- Spain Surface Disinfectant Market, By Composition

- Italy

- Italy Surface Disinfectant Market, By Composition

- Chemical

- Alcohol

- Ammonium Compounds

- Oxidizing Agents

- Phenolics

- Aldehydes

- Others

- Biobased

- Chemical

- Italy Surface Disinfectant Market, By Form

- Liquid

- Wipes

- Sprays

- Italy Surface Disinfectant Market, by Application

- In House

- Instruments

- Others

- Italy Surface Disinfectant Market, by End-use

- Hospitals

- Laboratories

- Households

- Hotel/Restaurants/Cafes

- Educational Institutes

- Malls

- Railways

- Airports

- Food Processing Industries

- Others

- Italy Surface Disinfectant Market, By Composition

- Europe Surface Disinfectant Market, By Composition

- Asia Pacific

- Asia Pacific Surface Disinfectant Market, By Composition

- Chemical

- Alcohol

- Ammonium Compounds

- Oxidizing Agents

- Phenolics

- Aldehydes

- Others

- Biobased

- Chemical

- Asia Pacific Surface Disinfectant Market, By Form

- Liquid

- Wipes

- Sprays

- Asia Pacific Surface Disinfectant Market, by Application

- In House

- Instruments

- Others

- Asia Pacific Surface Disinfectant Market, by End-use

- Hospitals

- Laboratories

- Households

- Hotel/Restaurants/Cafes

- Educational Institutes

- Malls

- Railways

- Airports

- Food Processing Industries

- Others

- China

- China Surface Disinfectant Market, By Composition

- Chemical

- Alcohol

- Ammonium Compounds

- Oxidizing Agents

- Phenolics

- Aldehydes

- Others

- Biobased

- Chemical

- China Surface Disinfectant Market, By Form

- Liquid

- Wipes

- Sprays

- China Surface Disinfectant Market, by Application

- In House

- Instruments

- Others

- China Surface Disinfectant Market, by End-use

- Hospitals

- Laboratories

- Households

- Hotel/Restaurants/Cafes

- Educational Institutes

- Malls

- Railways

- Airports

- Food Processing Industries

- Others

- China Surface Disinfectant Market, By Composition

- India

- India Surface Disinfectant Market, By Composition

- Chemical

- Alcohol

- Ammonium Compounds

- Oxidizing Agents

- Phenolics

- Aldehydes

- Others

- Biobased

- Chemical

- India Surface Disinfectant Market, By Form

- Liquid

- Wipes

- Sprays

- India Surface Disinfectant Market, by Application

- In House

- Instruments

- Others

- India Surface Disinfectant Market, by End-use

- Hospitals

- Laboratories

- Households

- Hotel/Restaurants/Cafes

- Educational Institutes

- Malls

- Railways

- Airports

- Food Processing Industries

- Others

- India Surface Disinfectant Market, By Composition

- Japan

- Japan Surface Disinfectant Market, By Composition

- Chemical

- Alcohol

- Ammonium Compounds

- Oxidizing Agents

- Phenolics

- Aldehydes

- Others

- Biobased

- Chemical

- Japan Surface Disinfectant Market, By Form

- Liquid

- Wipes

- Sprays

- Japan Surface Disinfectant Market, by Application

- In House

- Instruments

- Others

- Japan Surface Disinfectant Market, by End-use

- Hospitals

- Laboratories

- Households

- Hotel/Restaurants/Cafes

- Educational Institutes

- Malls

- Railways

- Airports

- Food Processing Industries

- Others

- Japan Surface Disinfectant Market, By Composition

- Australia

- Australia Surface Disinfectant Market, By Composition

- Chemical

- Alcohol

- Ammonium Compounds

- Oxidizing Agents

- Phenolics

- Aldehydes

- Others

- Biobased

- Chemical

- Australia Surface Disinfectant Market, By Form

- Liquid

- Wipes

- Sprays

- Australia Surface Disinfectant Market, by Application

- In House

- Instruments

- Others

- Australia Surface Disinfectant Market, by End-use

- Hospitals

- Laboratories

- Households

- Hotel/Restaurants/Cafes

- Educational Institutes

- Malls

- Railways

- Airports

- Food Processing Industries

- Others

- Australia Surface Disinfectant Market, By Composition

- Asia Pacific Surface Disinfectant Market, By Composition

- Latin America

- Latin America Surface Disinfectant Market, By Composition

- Chemical

- Alcohol

- Ammonium Compounds

- Oxidizing Agents

- Phenolics

- Aldehydes

- Others

- Biobased

- Chemical

- Latin America Surface Disinfectant Market, By Form

- Liquid

- Wipes

- Sprays

- Latin America Surface Disinfectant Market, by Application

- In House

- Instruments

- Others

- Latin America Surface Disinfectant Market, by End-use

- Hospitals

- Laboratories

- Households

- Hotel/Restaurants/Cafes

- Educational Institutes

- Malls

- Railways

- Airports

- Food Processing Industries

- Others

- Brazil

- Brazil Surface Disinfectant Market, By Composition

- Chemical

- Alcohol

- Ammonium Compounds

- Oxidizing Agents

- Phenolics

- Aldehydes

- Others

- Biobased

- Chemical

- Brazil Surface Disinfectant Market, By Form

- Liquid

- Wipes

- Sprays

- Brazil Surface Disinfectant Market, by Application

- In House

- Instruments

- Others

- Brazil Surface Disinfectant Market, by End-use

- Hospitals

- Laboratories

- Households

- Hotel/Restaurants/Cafes

- Educational Institutes

- Malls

- Railways

- Airports

- Food Processing Industries

- Others

- Brazil Surface Disinfectant Market, By Composition

- Mexico

- Mexico Surface Disinfectant Market, By Composition

- Chemical

- Alcohol

- Ammonium Compounds

- Oxidizing Agents

- Phenolics

- Aldehydes

- Others

- Biobased

- Chemical

- Mexico Surface Disinfectant Market, By Form

- Liquid

- Wipes

- Sprays

- Mexico Surface Disinfectant Market, by Application

- In House

- Instruments

- Others

- Mexico Surface Disinfectant Market, by End-use

- Hospitals

- Laboratories

- Households

- Hotel/Restaurants/Cafes

- Educational Institutes

- Malls

- Railways

- Airports

- Food Processing Industries

- Others

- Mexico Surface Disinfectant Market, By Composition

- Latin America Surface Disinfectant Market, By Composition

- Middle East & Africa

- Middle East & Africa Surface Disinfectant Market, By Composition

- Chemical

- Alcohol

- Ammonium Compounds

- Oxidizing Agents

- Phenolics

- Aldehydes

- Others

- Biobased

- Chemical

- Middle East & Africa Surface Disinfectant Market, By Form

- Liquid

- Wipes

- Sprays

- Middle East & Africa Surface Disinfectant Market, by Application

- In House

- Instruments

- Others

- Middle East & Africa Surface Disinfectant Market, by End-use

- Hospitals

- Laboratories

- Households

- Hotel/Restaurants/Cafes

- Educational Institutes

- Malls

- Railways

- Airports

- Food Processing Industries

- GCC Countries

- GCC Countries Surface Disinfectant Market, By Composition

- Chemical

- Alcohol

- Ammonium Compounds

- Oxidizing Agents

- Phenolics

- Aldehydes

- Others

- Biobased

- Chemical

- GCC Countries Surface Disinfectant Market, By Form

- Liquid

- Wipes

- Sprays

- GCC Countries Surface Disinfectant Market, by Application

- In House

- Instruments

- Others

- GCC Countries Surface Disinfectant Market, by End-use

- Hospitals

- Laboratories

- Households

- Hotel/Restaurants/Cafes

- Educational Institutes

- Malls

- Railways

- Airports

- Food Processing Industries

- Others

- GCC Countries Surface Disinfectant Market, By Composition

- South Africa

- South Africa Surface Disinfectant Market, By Composition

- Chemical

- Alcohol

- Ammonium Compounds

- Oxidizing Agents

- Phenolics

- Aldehydes

- Others

- Biobased

- Chemical

- South Africa Surface Disinfectant Market, By Form

- Liquid

- Wipes

- Sprays

- South Africa Surface Disinfectant Market, by Application

- In House

- Instruments

- Others

- South Africa Surface Disinfectant Market, by End-use

- Hospitals

- Laboratories

- Households

- Hotel/Restaurants/Cafes

- Educational Institutes

- Malls

- Railways

- Airports

- Food Processing Industries

- Others

- South Africa Surface Disinfectant Market, By Composition

- Middle East & Africa Surface Disinfectant Market, By Composition

- North America

Surface Disinfectant Market Dynamics

Drivers: Growing Number Of Disease Outbreaks

Healthcare-associated infections (HAIs) are infections that are not detected during admission but transmitted during a patient's stay at hospitals and other related facilities. According to the Centers for Disease Control and Prevention (CDC), these types of infections comprise catheter-associated urinary tract infections (CAUTI), ventilator-associated pneumonia (VAP), surgical site infection (SSI), and central line-associated bloodstream infections (CLABSI). Infection control practices primarily cause healthcare-associated infections, individuals' immune status, and numerous infectious agents all over the healthcare units. Other factors include immunosuppression, extended hospital stays, stays in intensive care units, and older age. Approximately, 20% of these types of infections occur in ICUs. The key pathogens instigating healthcareassociated infections comprise Staphylococcus aureus, Clostridium difficile, and Escherichia coli, among others. These pathogens can be transmitted by uninterrupted interaction with contaminated environment or healthcare workers. Healthcare-associated infections in Canada are still a significant problem, resulting in the need for the development of various strategies to avoid related contaminations with medical devices. Consequently, the Canadian Nosocomial Infection Surveillance Program (CNISP) has conducted a survey to address the problems and collect hospital-wise data. In 2019, according to a study by the Centers for Disease Control and Prevention (CDC), 3% of hospitalized patients in the U.S. were reported to have one or more healthcare-associated infections.

Growing Implementation Of Regulations In Medical Hygiene

There is a spiraling demand for superior-quality surface disinfectants products due to the growing requirement to improve hygiene in ambulatory surgical centers, clinics, and hospitals to inhibit the spread of infections including COVID-19 among staff and patients. The market is also driven by the growing number of laboratories and rising awareness among people about personal hygiene. Furthermore, various governments in North America and Europe have implemented stringent regulations concerning chemical-based disinfectants and their discharge processes. Some of the critical initiatives of the government bodies is spreading awareness regarding sanitation, health, and safety. In order to encourage hygiene and health and raise awareness regarding healthy habits, safe drinking practices, and regular handwashing, numerous campaigns have been launched. Regulations established by various government bodies for safety, health, and to tackle the increasing occurrences of chronic diseases are also projected to be the key factors boosting the growth of surface disinfectant market. Most government bodies have undertaken several guidelines and initiatives to increase awareness regarding cleanliness on account of rising occurrences of infectious diseases. For example, the Affordable Care Act forces hospitals to safeguard cleanliness in their facilities.

Restraints: Rising Awareness Regarding The Toxicity Of Chemical Surface Disinfectants

Surface disinfectants consist of chemical substances that yield excellent results when used properly per guidelines. They help prevent the occurrence and transmission of diseases. However, using these disinfectants can threaten humans and animals and lead to environmental hazards. Incomplete knowledge regarding the proper use of surface disinfectants and the health hazards associated with these products can potentially threaten market growth. Knowledge of possible health risks related to disinfectants is vital as improper use of products may lead to ailments. For instance, phenols used as chemical disinfectants have been found to have considerable side effects in humans, causing nausea, vomiting, abdominal pain, and diarrhea. They can also cause severe corrosive injury in the stomach, throat, and esophagus, along with bleeding, perforation, and scarring. If disposed of improperly, disinfectants can be hazardous to the environment. Disinfectants drained down the sewer system to public waste treatment works must meet appropriate disposal requirements. Formaldehyde is also a powerful disinfectant; however, due to its toxicity and carcinogenic properties, it can cause several side effects, such as skin irritation, cough, eye irritation, shortness of breath, exacerbation of asthma, and chronic bronchitis. Similarly, glutaraldehyde is a strong irritant to the respiratory system, eyes, and skin as it causes skin sensitization, leading to allergic contact dermatitis. These factors pose a potential threat to the product demand and are, thus, anticipated to hamper the market growth over the forecast period

What Does This Report Include?

This section will provide insights into the contents included in this surface disinfectant market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Surface disinfectant market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Surface disinfectant market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the surface disinfectant market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for surface disinfectant market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of surface disinfectant market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Surface Disinfectant Market Categorization:

The surface disinfectant market was categorized into five segments, namely composition (Chemical, Biobased), form (Liquid, Wipes, Sprays), application (In House, Instruments), end-use (Hospitals, Laboratories, Households, Hotel/Restaurants/Cafes, Educational Institutes, Malls, Railways, Airports, Food Processing Industries), and region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa).

Segment Market Methodology:

The surface disinfectant market was segmented into composition, form, application, end-use, and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The surface disinfectant market was analyzed at a regional level. The global was divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. These regions were further divided into twelve countries, namely, the U.S.; Canada; Germany; the UK.; France; China; India; Japan; Brazil; Mexico; GCC Countries; South Africa.

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

Surface disinfectant market companies & financials:

The surface disinfectant market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-

PDI, Inc. , PDI, Inc. is engaged in manufacturing healthcare products. The company conducts its business operations through three divisions, namely PDI Healthcare, Sani Professional, and Contract Manufacturing. Under its PDI healthcare, the company listed its disinfectant products. It also provides surface disinfectants and wipes for applications, including healthcare and industrial and institutional cleaning.

-

GOJO Industries, Inc. , GOJO Industries, Inc. is a family-owned company engaged in manufacturing disinfectant products. The company manufacturing facilities are located in North America, South America, Asia Pacific, and Europe. The company markets its disinfectant products under "Purell". The company's product portfolio comprises dispensers, hand cleaners, sanitizers, hand soaps, skin conditioners, shower gel, shampoo, and handwash. The company exports its products to over 50 countries.

-

W.M. Barr , W.M. Barr is a manufacturer that offers products under various categories, namely clean, remove, protect, and automotive. It provides all the products under 13 different brands. The company is employee-owned; thus, the employees receive higher wages. The various brands owned by the company include Goof Off, Mold Armor, Spray and Forget, CitriStrip, Jasco, Klean-Strip, Klean-Strip Green, DampRid, Microban, SprinkleRite, Heff Relief, BullDog, and Klean-Strip Automotive

-

Spartan Chemical Company, Inc. , Spartan Chemical Company, Inc. is a manufacturer that offers sanitation and cleaning solutions for the industrial and institutional markets. The company has 9000 distribution centers in more than 52 countries. It caters to various industrial segments, including food service and processing, lodging/hospitality, health care, vehicle care, etc. The company offers 25 different categories of products. Disinfectant/Sanitizers product category includes 52 products, such as bottles, spray, and wipes. Its manufacturing facility is located in Ohio on a 135-acre campus.

-

W.W. Grainger, Inc. , W.W. Grainger, Inc. is an industrial supplies and equipment provider across the globe. The company has a presence in more than 300 locations across U.S. and Canada. It is an American fortune 500 company. The company offers over 1.6 million products through 33 different product categories. The product category of Surface Disinfectants and Sanitizers includes 315 products available in various forms. These forms include Aerosol Spray cans, Bags, Bottles, Boxes, Buckets, Buckets with a spigot, Canisters, Drums, Jugs, Packets, Pallatized tanks, Portion Measuring Bottles, Soft packs, Totes, Trigger Spray Bottles, and Trigger Spray Cans.

-

Carenowmedical , Carenowmedical is a global manufacturer of healthcare products that include anti-microbial oral hygiene, patient bathing wipes, incision cleansing swabs, wipes, hand hygiene solutions, patient bathing wipes, advanced wound dressing, surface disinfection wipes, and many others. The company is a part of Healthium Medtech limited. The company has eight manufacturing facilities with global certifications.

-

Reckitt Benckiser Group PLC , Reckitt Benckiser Group PLC is a British multinational consumer goods company. The merger between Denmark-based Benckiser NV and the UK-based Reckitt & Colman plc formed it. It manufactures a wide range of toiletry, household, food, and health products across the world. Its business is divided into three units namely hygiene, health, and nutrition. Its operations are spread across 60 countries and products are sold across 200 countries worldwide. The company has 20 brands under its umbrella. It sells its surface disinfectant under the brand Lysol. Lysol is sold in 61 markets globally. The product is found in nearly 50% of US households.

-

PaxChem Ltd , PaxChem Ltd is involved in manufacturing disinfectant products and has business in more than 22 countries. The company product portfolio comprises biocides, sanitizers, antiseptics, disinfectants, preservatives & anti-microbial. The company's manufacturing facilities are certified with international quality standards, including ISO 9000, ISO 14000, OHSAS 18000, and cGMP - ICHQ7, GLP, and FDA Certifications.

-

BODE Chemie GmbH , BODE Chemie GmbH is a company that manufactures disinfection, skin protection, and hygiene products. It has a presence in the Americas, Europe, Asia, Africa, and the Middle East. The company manufactures more than 400 products in Germany at the Hamburg-Stellingen site. The products are sold in more than 50 countries. It offers five product categories namely hands, skin, instruments, surface, and equipment. Under surface category, the company provides five surface disinfection products.

-

Star Brands Ltd , Star Brands Ltd is a company that produces a wide variety of household cleaning products. It offers products such as laundry detergent, dish soap, stain removers, and others. The company sells its products under the brands Pink Stuff and Star Drops. The pink stuff utilizes 100% natural cleaning particles for effective cleaning.

Value chain-based sizing & forecasting

Supply Side Estimates

-

Company revenue estimation via referring to annual reports, investor presentations, and Hoover’s.

-

Segment revenue determination via variable analysis and penetration modeling.

-

Competitive benchmarking to identify market leaders and their collective revenue shares.

-

Forecasting via analyzing commercialization rates, pipelines, market initiatives, distribution networks, etc.

Demand side estimates

-

Identifying parent markets and ancillary markets

-

Segment penetration analysis to obtain pertinent

-

revenue/volume

-

Heuristic forecasting with the help of subject matter experts

-

Forecasting via variable analysis

Surface Disinfectant Market Report Objectives:

-

Understanding market dynamics (in terms of drivers, restraints, & opportunities) in the countries.

-

Understanding trends & variables in the individual countries & their impact on growth and using analytical tools to provide high-level insights into the market dynamics and the associated growth pattern.

-

Understanding market estimates and forecasts (with the base year as 2023, historic information from 2018 to 2021, and forecast from 2023 to 2030). Regional estimates & forecasts for each category are available and are summed up to form the global market estimates.

Surface Disinfectant Market Report Assumptions:

-

The report provides market value for the base year 2023 and a yearly forecast till 2030 in terms of revenue/volume or both. The market for each of the segment outlooks has been provided on region & country basis for the above-mentioned forecast period.

-

The key industry dynamics, major technological trends, and application markets are evaluated to understand their impact on the demand for the forecast period. The growth rates were estimated using correlation, regression, and time-series analysis.

-

We have used the bottom-up approach for market sizing, analyzing key regional markets, dynamics, & trends for various products and end-users. The total market has been estimated by integrating the country markets.

-

All market estimates and forecasts have been validated through primary interviews with the key industry participants.

-

Inflation has not been accounted for to estimate and forecast the market.

-

Numbers may not add up due to rounding off.

-

Europe consists of EU-8, Central & Eastern Europe, along with the Commonwealth of Independent States (CIS).

-

Asia Pacific includes South Asia, East Asia, Southeast Asia, and Oceania (Australia & New Zealand).

-

Latin America includes Central American countries and the South American continent

-

Middle East includes Western Asia (as assigned by the UN Statistics Division) and the African continent.

Primary Research

GVR strives to procure the latest and unique information for reports directly from industry experts, which gives it a competitive edge. Quality is of utmost importance to us, therefore every year we focus on increasing our experts’ panel. Primary interviews are one of the critical steps in identifying recent market trends and scenarios. This process enables us to justify and validate our market estimates and forecasts to our clients. With more than 8,000 reports in our database, we have connected with some key opinion leaders across various domains, including healthcare, technology, consumer goods, and the chemical sector. Our process starts with identifying the right platform for a particular type of report, i.e., emails, LinkedIn, seminars, or telephonic conversation, as every report is unique and requires a differentiated approach.

We send out questionnaires to different experts from various regions/ countries, which is dependent on the following factors:

-

Report/Market scope: If the market study is global, we send questionnaires to industry experts across various regions, including North America, Europe, Asia Pacific, Latin America, and MEA.

-

Market Penetration: If the market is driven by technological advancements, population density, disease prevalence, or other factors, we identify experts and send out questionnaires based on region or country dominance.

The time to start receiving responses from industry experts varies based on how niche or well-penetrated the market is. Our reports include a detailed chapter on the KoL opinion section, which helps our clients understand the perspective of experts already in the market space.

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationShare this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."