- Home

- »

- Clothing, Footwear & Accessories

- »

-

Surfing Apparel And Accessories Market Size Report, 2030GVR Report cover

![Surfing Apparel And Accessories Market Size, Share & Trends Report]()

Surfing Apparel And Accessories Market Size, Share & Trends Analysis Report By Product (Apparel, Accessories), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-229-7

- Number of Pages: 87

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Consumer Goods

Market Size & Trends

The global surfing apparel and accessories market size was valued at USD 9.15 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.5% from 2023 to 2030. An increase in the number of surf schools and acceptance of surfing as a lifestyle sport among all age groups is among the prominent factors expected to drive the demand for surfing apparel and accessories over the forecast period. The increasing number of people participating in sports has significantly boosted the sales of sporting products, including surfing apparel & accessories. Growing awareness and increasing interest in water sports, as well as the rising popularity of surfing as a fitness activity, are projected to drive market growth. According to the Annual Watersports Participation Survey 2021, there has been a minor increase in the number of people who frequently participate in on-water activities (3+ times). Young people consider surfing a thrilling and fun activity, which is also expanding the market for surfing apparel and accessories.

Many sports enthusiasts visit beaches to enjoy a range of adventurous activities or sports. One such adventure sport that has gained significant attention is surfing, and this, in turn, has given a big boost to the market for surfwear and surf-inspired clothing. Thus, surf apparel and garments have immense growth potential, especially with apparel becoming a style statement for many.

Surfing apparel includes a range of clothes including shorts, and other accessories worn by individuals while surfing or doing water sports. These products are designed and manufactured to make them most suitable for water sports and the beach environment. Surfing apparel is considered ‘cool’ and comfortable and is purchased by people who don’t indulge in the sport as well.

Several designers are leveraging this trend and launching surf-inspired clothing collections. Fast fashion brands like Zara and H&M have also launched surfwear lines. As surfing apparel and accessories go beyond the beach, the market is expected to witness robust growth.

Further, the increasing awareness among people, especially the youth, that surfing is just not an adventure sport but a lifestyle is a primary factor expected to have a significant impact on the market during the forecast period. Lately, technological innovations have resulted in the proliferation of several artificial surf pools and boosted the adoption of surfing as a sport. Technological advancements can enhance the accessibility as well as affordability of surfing for common people, helping the sport go beyond just the sports enthusiasts.

Environment-friendly apparel and other wearables are the recent trends in the industry. Manufacturers are focusing on developing and designing eco-friendly wetsuits using materials such as natural rubber and water-based glue as a substitute for neoprene. Additionally, green wetsuits are also being manufactured using water bottles, recycled plastics, and fishing nets, which are gaining immense popularity among consumers.

Product Insights

The surf tees product segment is anticipated to register the largest CAGR of 6.6% over the forecast period. Surf tees are typically made from synthetic materials like polyester or nylon, which are highly durable and resistant to fading and damage from exposure to saltwater, sun, and chlorine.

They may also be treated with UV protection to help protect the wearer from the sun's harmful rays. Surf tees are often worn as a standalone top, but can also be layered under a wetsuit for added warmth and protection. In addition to their functional properties, surf tees also often feature unique and colorful designs that reflect surf lifestyle and culture. They may include graphics, logos, or slogans that celebrate the ocean, waves, and coastline.

The surfboard leash segment of the surfing accessories market is anticipated to have the highest CAGR of 7.6% over the forecast period of 2023-2030.Surfboard leashes come in a variety of lengths and thicknesses, depending on the size and type of the surfboard being used, as well as the skill level and experience of the surfer.

They are an essential piece of equipment for surfers of all levels and are typically required at most surf breaks for safety reasons. As it is one of the most important accessories for a surfer, the players in the industry are offering security perspectives and innovative accessories to surfers.

Distribution Channel Insights

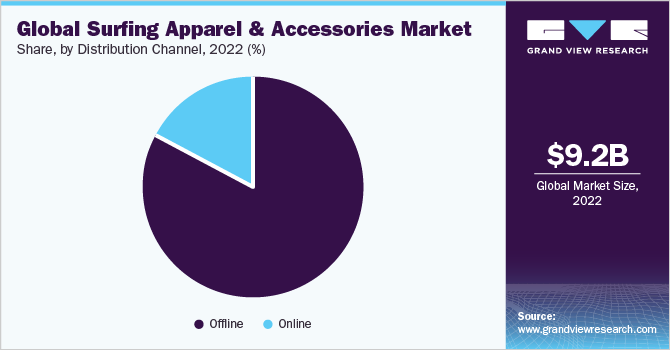

The offline distribution channel held the largest revenue share of 82.9% in 2022. Offline stores offer a tangible experience, where customers can see, touch, and try on the apparel (depending on the shop’s policies), helping them make an informed decision. Moreover, offline stores often offer services such as appraisals and valuations, which can be important when buying surfing apparel and accessories in bulk. Consumers prefer to look around and compare prices in larger retail stores as different retailers offer different deals and promotions.

The online distribution channel segment is anticipated witness a considerable CAGR of 6.8% over the forecast period. Online retailers offer a broad variety of international brands, steep discounts, free shipping, and straightforward return policies, all of which tempt customers to buy surfing apparel and accessories. Online stores make it easier to meet the requirements of a wide range of customers, especially those on a budget, by providing a diverse selection of surfing goods at different prices.

Regional Insights

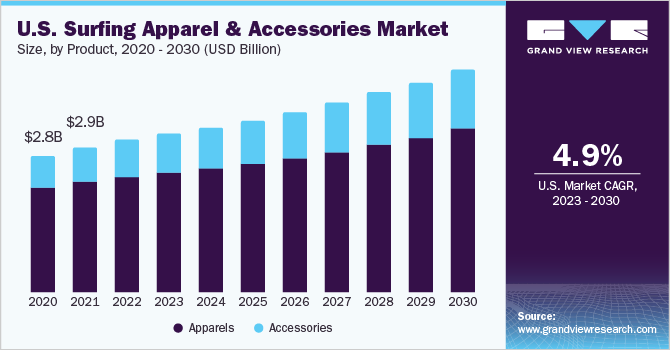

North America dominated the surfing apparel and accessories market with a share of 39.4% in 2022. The industry for surfing equipment and accessories is expanding in North America due to surfing's rising appeal among adventure seekers. The United States has the world's longest beaches, which contributes to its popularity as a surfing and other water activities destination.

Asia Pacific is anticipated to register the highest CAGR of 6.1% over the forecast period. Asia Pacific is one of the most lucrative markets for surfing apparel & accessories, owing to the growing awareness and the availability of new and more effective products in the region. The growing popularity of surfing and other adventure sports among adventure enthusiasts and youngsters in countries like Cambodia, Indonesia, the Maldives, Thailand, Japan, and Vietnam are expected to drive market growth.

Key Companies & Market Share Insights

The market is characterized by the presence of a few established players and new entrants. Many big players are increasing their focus on the changing trends in the industry. They are diversifying their service offerings to maintain market share. For instance:

- In February 2023, the company launched three new collections on the occasion of its title sponsorship of the Hurley Pro Sunset Beach 2023 in North Shore, U.S. The first collection features performance-based hooded performance surf tops, boardshorts, and t-shirts. The second collection includes swimwear and a line-up of local activations.

- In October 2022, the company acquired a 50% stake in the fashion swim brand It’s Now Cool. GLOBE INTERNATIONAL LIMITED took full control of the business operations and started selling its products in Europe, the U.S., and Australia.

Some prominent players in the Global surfing apparel and accessories market include:

-

Billabong

-

Hurley, Inc.

-

O’Neill

-

RVCA

-

Volcom, LLC

-

GLOBE INTERNATIONAL LIMITED

-

REEF

-

Roxy, Inc.

-

Curl. Ltd.

-

Quiksilver, Inc.

Surfing Apparel And Accessories Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 9.59 billion

Revenue forecast in 2030

USD 14.1 billion

Growth Rate

CAGR of 5.5% from 2023 to 2030

Base year for estimation

2022

Report updated

April, 2023

Historical data

2017 - 2020

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; France; Spain; U.K.; Australia; New Zealand; Brazil; South Africa

Key companies profiled

Billabong; Hurley, Inc.; O’Neill; RVCA; Volcom, LLC; GLOBE INTERNATIONAL LIMITED; REEF; Roxy, Inc.; Curl. Ltd.; Quiksilver, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Surfing Apparel And Accessories Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global surfing apparel and accessories market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Apparels

-

Wetsuits

-

Board Shorts

-

Surf Tees

-

Others

-

-

Accessories

-

Surfboard Leash

-

Fins

-

Others

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

-

Europe

-

U.K.

-

France

-

Spain

-

-

Asia Pacific

-

Australia

-

New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global surfing apparel and accessories market size was estimated at USD 9.15 billion in 2022 and is expected to reach USD 9.59 billion in 2023.

b. The global surfing apparel and accessories market is expected to grow at a compound annual growth rate of 5.5% from 2023 to 2030 to reach USD 14.1 billion by 2030.

b. The surf apparel product segment dominated the surfing apparel and accessories market with a share of 77.3% in 2022. This is attributable to the rising demand for innovative products among consumers. These apparel are made up of durable materials and technical fabrics to design trendy and high-performing surf-wear.

b. Some key players operating in the surfing apparel and accessories market include TQuicksilver, Billabong International, Hurley, O'Neill, RVCA, Volcom, Globe International, Reef Sports, Roxy, Ripcurl, and Oakley.

b. Key factors that are driving the surfing apparel and accessories market growth include growing interest in surfing sport among adventure enthusiasts globally, an increasing number of surf schools, and acceptance of surfing as a trendy and lifestyle sport equally by all the age groups.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."