- Home

- »

- Medical Devices

- »

-

Surgical Drapes Market Size & Share Report, 2021-2028GVR Report cover

![Surgical Drapes Market Size, Share & Trends Report]()

Surgical Drapes Market Size, Share & Trends Analysis Report By Type (Reusable, Disposable), By Risk Type (Moderate (AAMI Level 3), Minimal (AAMI Level 1)), By End Use (Hospitals, ASCs), And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-558-0

- Number of Pages: 90

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- Industry: Healthcare

Report Overview

The global surgical drapes market size was valued at USD 1.24 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 3.18% from 2021 to 2028. The rising number of surgical procedures and the increasing prevalence of chronic diseases are among the key factors driving the market. Moreover, the growing demand for the protection of patients and healthcare staff and a surge in the prevalence of surgical site and hospital-acquired infections are further escalating the market growth. Surgical drapes offer a physical barrier and protect the surgical field from contamination. A rise in the number of surgeries will lead to a surge in demand for surgical drapes. For instance, as per the American Society of Plastic Surgeons (ASPS), in 2018, in the U.S., around 17.7 million surgeries and minimally-invasive cosmetic surgeries were performed. Similarly, as per Molnlycke Health Care AB, around 70 million surgical procedures are performed in Europe, growing 3% to 4% annually. The Eurostat data, also states that, in 2018, at least 1.16 million cesarean sections were conducted in the EU-27. Thus, a rise in the number of surgical procedures is expected to boost the market growth over the forecast period.

Furthermore, healthcare-associated infections (HAIs) are a major concern for patients as well as healthcare professionals across the globe. A global upsurge in the number of hospitalizations and HAIs will further raise the demand for surgical drapes. For instance, the Centres for Disease Control and Prevention (CDC) predicts that 1 in every 31 hospitalized patients report at least 1 HAI case yearly. Moreover, as per the NHSN Surgical Site Infection (SSI) Surveillance data, in 2019, an estimated 157,500 SSI infections occur in the U.S. every year. SSI is the most expensive HAI type, with a projected yearly cost of USD 3.3 billion, and accompanying about 1 million additional inpatient days. They are also a major cause of morbidity, prolonged hospitalization, and unplanned readmissions after surgery and death. Thus, the increasing incidence of HAIs and SSIs globally is expected to fuel market growth.

Another key factor majorly propelling the growth of the market is a rise in the incidence of chronic diseases across the globe. For instance, as projected by the American Heart Association, by 2035, more than 130 million adults or 45.1% of the U.S. population might suffer from some of the other form of CVD. Likewise, according to the CDC, about 655,000 Americans die from heart disease annually, which is 1 in every 4 deaths. The CDC also states that 6 in 10 adults in the U.S. have a chronic disease, and 4 in 10 adults suffer from 2 or more chronic diseases. Thus, the growing patient pool leads to an increase in surgeries and hospitalizations, thereby raising the demand for surgical drapes.

The recent outbreak of COVID-19 has drastically increased the demand for surgical drapes, thus significantly impacting the market growth. According to worldomete.info, as of 7th September 2021, more than 222,004,303 confirmed cases and around 4,589,270 deaths have been reported globally. Thus, the demand for surgical drapes will continue to surge owing to the rising number of patients.

Furthermore, the pandemic has increased the concerns regarding infectious microorganism transfer through aerosol formation in endonasal and transoral surgeries. Thus, to help this resolve, the negative-pressure otolaryngology viral isolation drape (NOVID) is under development to restrict aerosol and droplet transmission in and around the surgery site. Such developments are further stimulating market growth.

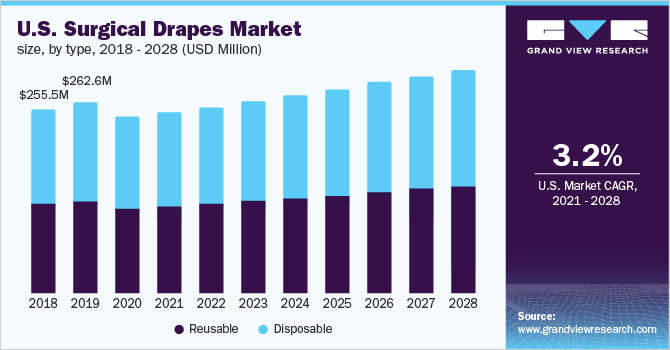

Type Insights

Reusable surgical drapes held the largest revenue share of over 55.0% in 2020. Reusable surgical drapes entail robust and high-performance materials. Innovative textiles such as trilaminate and microfilament fabrics offer high safety. These drapes can be washed and autoclaved for reprocessing. Moreover, reusable textiles are environmentally friendly and provide adequate barrier protection, infection control, and enhanced comfort.

In addition, according to several research studies, reusable surgical drapes perform considerably better than disposables in terms of resource efficiency, as they use 38% less energy, produce 80% less solid waste, and provide 62% water saving. Thus, owing to such factors, the segment is expected to witness rapid growth in the forecast period. Furthermore, these surgical drapes are extensively used in low and middle-income nations and therefore hold a substantial market share. However, infections due to the usage of reusable drapes might hamper the segment growth.

The disposable segment is anticipated to expand at the fastest growth rate of 3.4% over the forecast period. Comprehensive use of disposable drapes and the growing awareness of disposable surgical drapes are driving the disposable surgical drapes segment. Disposable drapes are usually manufactured from non-woven material and are destroyed after each operation. Nonwoven fabric is preferred over woven fabric as it provides better protection against hospital-acquired diseases and surgical-site infections. It offers advantages such as low weight, low cost, simple recycling procedures, and lower manufacturing costs. Furthermore, as compared to reusable surgical drapes, disposable drapes provide resistance to liquids, abrasion, and tearing. Therefore, the aforementioned advantages offered by non-woven fabric are driving the demand for disposable surgical drapes.

Risk Type Insights

Moderate (AAMI Level 3) risk surgical drapes held the largest revenue share of over 30.0% in 2020 and are expected to witness the fastest growth over the forecast period. The segment growth is attributed to the wide application in numerous surgeries, cost-effectiveness, and safety assurance. These drapes are used for a wide range of surgical procedures, where the risk of fluid exposure is moderate. As a result, the rising number of surgeries with a large amount of bleeding is likely to increase the demand for moderate-risk surgical drapes. Moreover, the increasing need to protect patients and surgical staff from blood, liquid, and other infectious materials is propelling the segment growth.

High ((AAMI Level 4) risk surgical drapes held a considerable market share in 2020. These drapes are used in high-risk situations and work as a barrier to large amounts of fluids for a prolonged period. In surgical and fluid-intensive procedures, high-risk surgical drapes help protect against non-airborne diseases and prevent virus penetration. Thus, an increase in surgical procedures with associated risk, such as orthopedic procedures without a tourniquet, open cardiovascular or thoracic procedures, trauma procedures, and cesarean sections, is driving the demand for these drapes.

In addition, according to the WHO research, cesarean section accounts for more than 1 in 5 (21%) of all childbirths. The number is set to continue growing over the forecast period, with nearly 29% by 2030. Furthermore, these drapes are very breathable, tear-resistant, latex and lint-free, flame resistant, comfortable, and have high tensile strength. Thus, the aforementioned advantages are leading to segment growth.

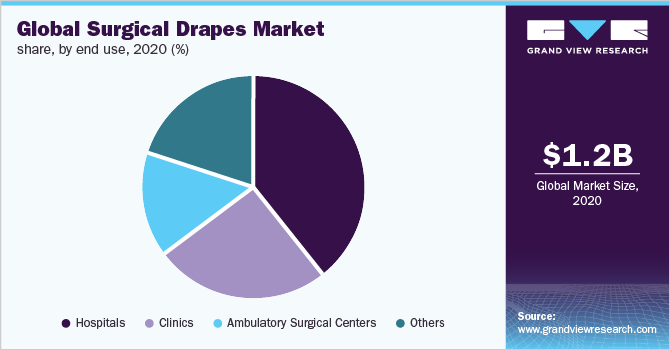

End-use Insights

The hospital segment held the largest revenue share of over 40.0% in 2020. The majority of surgeries globally are performed in hospitals, which makes hospitals the largest consumer of surgical drapes. Moreover, the increasing prevalence of SSI is leading to high demand for surgical drapes in hospitals settings. For instance, as per the article published in Bio Med Central (BMC), the prevalence of SSI was around 24.6% of which 10% develop the deep site, 9.2% organ spaced, and 5.2% develop superficial space SSI. Additionally, the prevalence was high in patients who had undertaken orthopedics (54.3%) and abdominal (30%) surgeries.

In addition, increasing construction of hospitals, coupled with the growing government investments, is bolstering the growth of the segment. For instance, as per the American Hospital Association, the number of U.S. Community hospitals was 6,090. Thus, the growing number of hospitals will further escalate the market growth.

Ambulatory surgical centers are expected to register the fastest CAGR of 3.7% over the forecast period. Ambulatory surgical centers are also known as outpatient care units. Various surgeries such as cataract, dental, elective cosmetic, and reconstructive are also performed in these centers. With an increase in these types of procedures, the need for easy-surgical drapes is also anticipated to increase over the forecast period. Growing awareness and availability of advanced surgical drapes are expected to fuel the segment growth in the coming years. Thus, the high preference for outpatient surgeries, increase in the adoption of minimally invasive surgeries, and cost-effectiveness of ambulatory surgery center-based procedures are the key factors fueling the ASCs segment growth.

Regional Insights

Asia Pacific dominated the market in 2020 with a revenue share of over 25.0%. The market growth can be accredited to the rising number of surgeries, coupled with the growing population. Moreover, technological advancements in the healthcare sector and increasing research and development activities are expected to create new growth opportunities for the market in the forecast period. In addition, the rapidly growing medical tourism industry is contributing to a surge in the demand for surgical drapes in this region.

North America is expected to witness considerable growth over the forecast period. The market growth is attributed to the well-developed infrastructure, the growing surgical procedures, and an increasing number of surgical site infections. For instance, according to the Journal of Infectious Disease Advisor, in the U.S., around 27 million surgical procedures are performed annually, with up to 5% resulting in surgical site infections. Furthermore, rising healthcare expenditure act as a supporting factor in the growth of the market. For instance, according to the statistics published in CMS.gov, U.S. healthcare expenditure increased by 4.6% in 2019, reaching USD 3.8 trillion per person accounting for 17.7% share of the nation’s GDP. Thus, the aforementioned factors are likely to augment the market growth in this region.

Key Companies & Market Share Insights

Key players are involved in adopting strategies such as mergers & acquisitions, partnerships, and the launch of new products to strengthen their foothold in the market. In July 2020, EDM Medical Solutions launched CT scanner drapes aimed at reducing the spread of infections in the medical environment. The single-use, sterile drapes are the latest addition to the company's line of infection control supplies. Some prominent players in the global surgical drapes market include:

-

3M

-

Cardinal Health

-

Mölnlycke Health Care

-

Steris

-

Paul Hartmann AG

-

Standard Textile Co.

-

Medline Industries, Inc.

-

Priontex

-

OneMed

-

Medic

Surgical Drapes Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 1.28 billion

Revenue forecast in 2028

USD 1.59 billion

Growth Rate

CAGR of 3.18% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million/billion and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, risk type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; Australia; South Korea; Brazil; Mexico; Argentina; Colombia; South Africa; Saudi Arabia; UAE

Key companies profiled

3M; Cardinal Health; Molnlycke Health Care AB; Steris; Paul Hartmann AG; Standard Textile Co.; Medline Industries, Inc.; Priontex; OneMed; Medic

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the global surgical drapes market report on the basis of type, risk type, end use, and region:

-

Type Outlook (Revenue, USD Million, 2016 - 2028)

-

Reusable

-

Disposable

-

-

Risk Type Outlook (Revenue, USD Million, 2016 - 2028)

-

Minimal (AAMI Level 1)

-

Low (AAMI Level 2)

-

Moderate (AAMI Level 3)

-

High (AAMI Level 4)

-

-

End-use Outlook (Revenue, USD Million, 2016 - 2028)

-

Hospitals

-

Clinics

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2028)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global surgical drapes market size was estimated at USD 1.24 billion in 2020 and is expected to reach USD 1.28 billion in 2021.

b. The global surgical drapes market is expected to grow at a compound annual growth rate of 3.18% from 2021 to 2028 to reach USD 1.59 billion by 2028.

b. The Asia Pacific dominated the global surgical drapes market with a share of 29.4% in 2020. This is attributable to the rising number of surgeries coupled with increasing population. Moreover, technological advancements in the healthcare sector and increasing research and development activities are expected to further create new opportunities for the surgical drapes market in this region.

b. Some of the key players operating in the global surgical drapes market include 3M, Cardinal Health, Molnlycke Health Care, Steris, and Paul Hartmann AG.

b. Key factors that are driving the surgical drapes market growth include the rising number of surgical procedures, the increasing prevalence of chronic diseases and surgical site infections, and the growing demand for the protection of patients, & healthcare staff.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."