- Home

- »

- Medical Devices

- »

-

Surgical ENT Devices Market Size & Share Report, 2030GVR Report cover

![Surgical ENT Devices Market Size, Share & Trends Report]()

Surgical ENT Devices Market Size, Share & Trends Analysis Report By Product (Radiofrequency Handpieces, Sinus Balloon Dilation Devices), By End Use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-921-4

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Healthcare

Report Overview

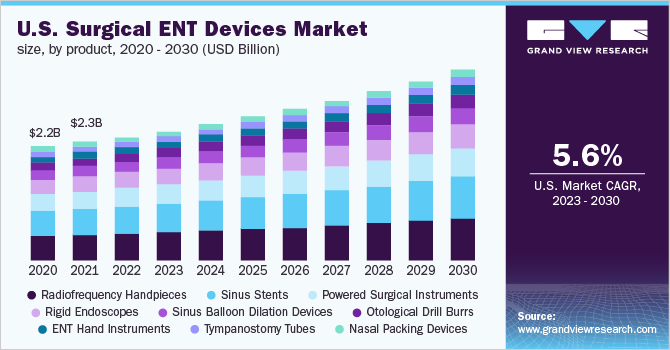

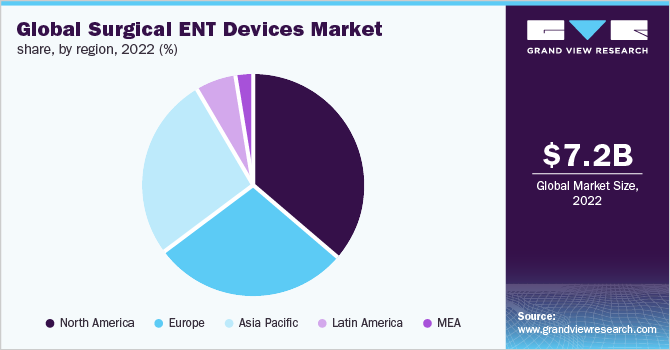

The global surgical ENT devices market size was valued at USD 7.2 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.77% from 2023 to 2030. The increasing prevalence of ENT disorders, technological advancements in surgical ENT devices, and increasing demand for minimally invasive surgical procedures are factors likely to propel the market growth during the forecast period. In addition to the aforementioned factors, measures to increase the adoption of cochlear implants can affect the market growth positively.

As per the WHO, 5% of the global population suffers from hearing loss, which is nearly 432 million adults and 34 million children. By 2050, 2.5 billion people are expected to suffer from hearing loss, of which 700 million will require a hearing aid or surgery, increasing the demand for cochlear implant devices. Tonsillitis is another prevalent ENT disorder. According to the latest report by PubMed, 600 million people worldwide have tonsilitis, wherein the prevalence of the disorder is highest in children and requires surgery. The growing prevalence of ENT disorders that require surgery is increasing the demand for ENT surgical devices.

Over the past decade, there has been rapid advancement in healthcare technologies, including surgical devices for otorhinolaryngology. Electromagnetic image-guided surgery systems and Fusion ENT navigation are two of the key trending technologies, offering high accuracy, ease of use, and expandability. Robotic surgery is one of the major technological advancements transforming ENT surgeries. Robotic surgical devices are making surgery minimally invasive by offering the advantage of ED-enhanced visualization. Rapid advancements in technology are boosting the demand for advanced surgical devices for better patient outcomes.

COVID-19 surgical ENT devices market impact: 4.48% increase from 2020 to 2021

Pandemic Impact

Post COVID Outlook

ENT surgeons had the highest risk of COVID-19 infection as they typically performed surgeries on areas directly related to the disease. According to a report by the European Annals of Otorhinolaryngology, Head and Neck Diseases, the number of ENT surgeries declined by 84% during the initial months of the pandemic, resulting in a decrease in demand for ENT surgical devices. Providers of ENT surgical devices, therefore, faced large financial losses.

The resumption of elective procedures and gradual increase to reach the pre-pandemic surgical volume are expected to increase product demand and reduce revenue losses suffered by medical care providers and manufacturers.

Till the end of June, market conditions varied greatly across regions, with surgery volumes recovering quickly in the U.S., China, Germany, and Australia and more slowly in Spain, the U.K., and Italy. Surgeries across most emerging markets, including Latin America and India, have remained very low as COVIDâ€19 cases continue to grow.

Technological advancements and rapid adoption in the later phases of the pandemic are resulting in the implementation of better solutions for minimally invasive and safe surgeries. Advanced surgeries using robotic assistance are showing increased demand.

Product InsightsIn the current scenario, merger and acquisition activity in the ENT devices sector has reduced significantly. There have been several deals as market players boost their technical capabilities. For instance, in January 2021, Olympus Corporation and Hitachi Ltd. announced a 5-year contract agreement to jointly develop Endoscopic Ultrasound Systems (EUS). In October 2020, Starkey and OrCam Technologies announced a partnership in assistive technology solutions. The partnership will deliver a single solution to people who have both vision and hearing loss by combining wearable OrCam MyEye devices with Livio Edge AI hearing aids via a wireless connection.

The radiofrequency handpieces segment held the largest revenue share of over 22.6% in 2022. These are medical devices, which coupled with pre-existing legacy RF signal generator systems, provide certain precision-controlled radiofrequency therapies and treatments for ear, nose, and throat. For instance, the handpiece from Ellman International, Inc. is designed to fit comfortably in an operator’s hand, therefore, maximizing productivity by reducing operator fatigue and discomfort. It is easy to use and can be used across fields of ENT surgery.

Surgical ENT devices are mainly used for treating, diagnosing, or conducting surgeries for disorders of the ear, nose, and throat. These devices help in treating issues related to snoring, speaking, hearing, or smell, and a broad range of surgical ENT devices is available in the market. Growing preference for minimally invasive surgeries and the increasing prevalence of ENT disorders are expected to impel market growth in the coming years.

The sinus balloon dilation devices market is expected to register the fastest CAGR of 6.0 % during the forecast period. Applications of dilation devices in providing ease of treating prevalent ENT conditions such as Sinusitis are expected to majorly contribute to the demand for these devices. However, the shortage of skilled ENT surgeons and otolaryngologists is a major challenge to the growth of the market.

Regional Insights

North America dominated the market in 2022 with a revenue share of over 36.4%. Major factors contributing to the growth of this region are the growing geriatric population and the increasing prevalence of hearing loss. The presence of key manufacturers, such as Medtronic and Stryker, in the region, plays a major role in the easy availability of devices locally. In the region, Canada is expected to register the fastest growth rate over the forecast period due to factors such as the increasing adoption of minimally invasive surgical procedures.

Asia Pacific is expected to witness remarkable growth at a CAGR of 5.91% during the forecast period. The market is expected to grow due to the large patient population, increasing adoption of cochlear implants, and rising awareness regarding available treatments. In the MEA, countries such as the UAE and South Africa have better infrastructure for ENT surgeries as compared to other nations in the region, which is expected to boost the market growth.

Asia Pacific is expected to register the fastest growth rate over the forecast period due to factors, such as the large patient population and developments in healthcare infrastructure, leading to high demand for ENT surgeries and associated devices. The region is majorly driven by China and Japan. Japan dominated the overall surgical ENT devices market in Asia Pacific region. This can be attributed to a large geriatric population. India is anticipated to be the fastest-growing market during the forecast period in the Asia Pacific region.

Key Companies & Market Share Insights

The market is evolving and becoming increasingly competitive in terms of R&D activities regarding the assessment of the existing products for efficiency, along with the launch of new products and marketing for payers. Rapid innovations and geographical expansion are key strategies being adopted by the major players. Hence, competitive rivalry in this market is expected to be high. Recent launches include H-SteriScope, a line of five single-use endoscopes by Olympus Corporation in April 2021, and a software solution for TruDi Navigation System by Johnson & Johnson in September 2021. Geographic expansion by establishing subsidiaries and acquisitions further contributes significantly to rivalry in the market.

Some prominent players in the global surgical ENT devices market include:

-

Medtronic plc

-

Olympus Corporation

-

Richard Wolf GmbH

-

ZEISS Group

-

Stryker

-

Smith & Nephew

-

Johnson & Johnson

-

Integra LifeSciences

-

HOYA Corporation

-

Sonova

Surgical ENT Devices Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 7.6 billion

Revenue forecast in 2030

USD 11.2 billion

Growth Rate

CAGR of 5.77% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Japan; China; India; South Korea, Australia, Mexico; Brazil; South Africa, Saudi Arabia, UAE

Key companies profiled

Medtronic plc; Olympus Corporation; Richard Wolf GmbH; ZEISS Group; Stryker; Smith & Nephew; Johnson & Johnson; Integra LifeSciences; HOYA Corporation; Sonova

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Surgical ENT Devices Market Segmentation

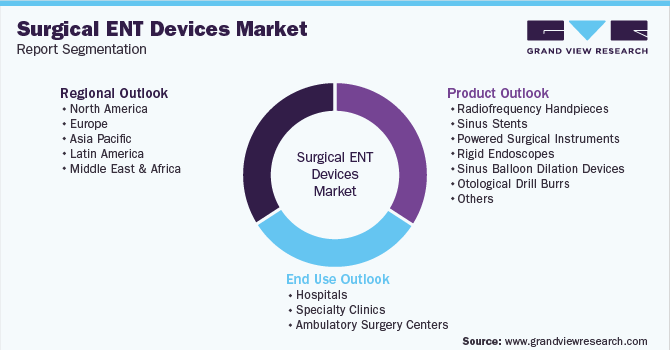

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global surgical ENT devices market report on the basis of product, end use, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Radiofrequency Handpieces

-

Sinus Stents

-

Powered Surgical Instruments

-

Rigid Endoscopes

-

Laryngoscopes

-

Rhinoscopes

-

Otological Endoscopes

-

-

Sinus Balloon Dilation Devices

-

Otological Drill Burrs

-

ENT Hand Instruments

-

Tympanostomy Tubes

-

Nasal Packing Devices

-

-

End Use Outlook (Revenue, USD Million, 2017 - 2030)

-

Hospitals

-

Specialty Clinics

-

Ambulatory Surgery Centers

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Mexico

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. North America dominated the surgical ENT devices market with a share of 36.4% in 2022. This is attributable to the growth of this region are growing geriatric population and increasing prevalence of hearing loss.

b. Some of the key players operating in the surgical ENT devices market are Medtronic plc; Olympus Corporation; Richard Wolf GmbH; Zeiss; Stryker; Smith & Nephew; Johnson & Johnson; Integra LifeSciences; HOYA Corporation; and Sonova.

b. Key factors that are driving the surgical ENT devices market growth include the increasing prevalence of ENT disorders, technological advancements in surgical ENT devices, and increasing demand for minimally invasive surgical procedures.

b. The global surgical ENT devices market size was estimated at USD 7.2 billion in 2022 and is expected to reach USD 7.6 billion in 2023.

b. The global surgical ENT devices market is expected to grow at a compound annual growth rate of 5.77% from 2023 to 2030 to reach USD 11.2 billion by 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."