- Home

- »

- Medical Devices

- »

-

Surgical Simulation Market Size Report, 2021-2028GVR Report cover

![Surgical Simulation Market Size, Share & Trends Report]()

Surgical Simulation Market Size, Share & Trends Analysis Report By Specialty (Cardiac Surgery, Neurosurgery, Transplant), By Material (Metal, Polymer), By End-use (Specialty Center, Hospital), And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-827-3

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- Industry: Healthcare

Report Overview

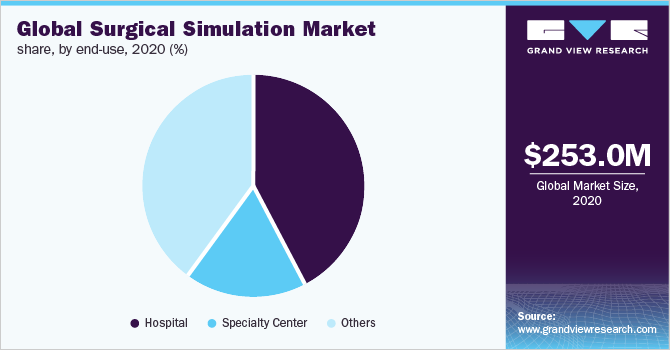

The global surgical simulation market size was valued at USD 253 million in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 16.1% from 2021 to 2028. Increasing focus on patient safety and the growing geriatric population is propelling the demand for surgical simulation products. According to the WHO, the population in the Southeast Asia region is rapidly aging. In 2017, the proportion of persons aged 60 or above was 9.8%, which will be augmented to 13.7% by 2030 and 20.3% by 2050. Thus, the health issues in elder people are diverse, such as Noncommunicable Diseases (NCDs) injuries and disabilities, owing to declining functional ability.

The rising number of surgeries performed globally is expected to result in high demand for simulation products to help avoid or diminish medical errors during surgeries, which, in turn, is contributing to the market growth. With technological advancement, the use of minimally invasive surgical procedures is growing rapidly. Minimal invasive techniques are quickly becoming standard surgical techniques for numerous surgical procedures. Performing minimally invasive treatment procedures requires specific psychomotor skills. Simulation provides a proper tool for training and learning these skills.

Various simulation modalities are used for learning and training minimally invasive surgeries. Thus, the growing demand for minimally invasive surgical procedures is driving the market growth.

Owing to the COVID-19 pandemic, the world has entered a state of emergency. To protect lives and conserve Personal Protective Equipment (PPE), the governments of different nations placed restrictions on nonessential medical procedures. This stopped elective surgery cases across the globe, triggering a dramatic reduction in the number of cases accessible for the education of surgical residents. The virtual simulation was adopted during the COVID-19 pandemic to improve and strengthen procedural and patient care skills. The pandemic has reduced medical training opportunities in the traditional apprenticeship process, with fewer elective procedures and reduced access for residents to operating rooms.

In response, vendors, such as VirtaMed, introduced a surgical gynecology simulation suite in February 2021.Moreover, during the pandemic, VirtaMed occupied their simulators on ‘tour’ frequent times to support continuing medical education and supply workshops for residents across France, Switzerland, and Germany. In September 2020, the company’s second surgical simulation tour was introduced in France in association with the STAN Institute and the French Association of Surgery. Considered impactful by residents and educators alike, most tour contributors agreed that surgical simulation must be a sure training requirement. Thus, versatile and expanding surgical education solutions are expected to enhance the market growth in the coming years.

The traditional method of teaching surgeons and other physicians is almost gone. This method is no longer ethical or applicable mostly because of patient safety concerns. Thus, it has been replaced with competency-based training and the acceptance of simulation-based education. In addition, 3D-printed surgical simulators have many advantages over other forms of simulation. 3D printing permits for rapid design and manufacturing of simulators in a cost-effective manner. Likewise, it can deliver high fidelity and accurate models for the simulation of procedures. Thus, the rising acceptance of additive manufacturing technology/3D printing in surgical simulation supports market growth.

Patient safety is important enabling the practitioners to work and perform the surgical procedures without putting patients at risk. Simulation-based healthcare education is a newer modality of training, which was established primarily for patient safety. Thus, simulated settings allow the practitioners to make mistakes safely and learn from mistakes by avoiding the harm caused to the patients. In November 2021, NHS Scotland incorporated physical and digital simulation into its surgical training program to permit trainees to develop vital skills before coming face-to-face with patients.

Specialty Insights

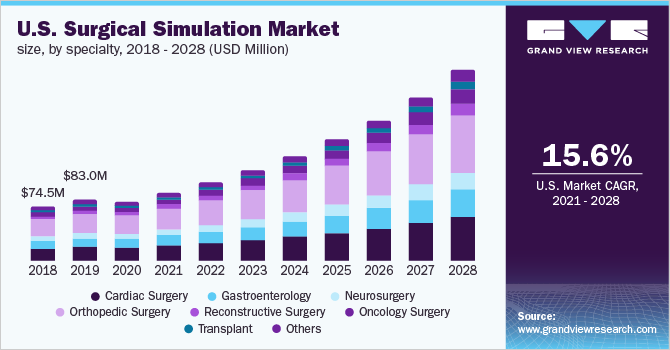

The orthopedic surgery segment is expected to account for the largest revenue share of over 31% in 2020. There is an increase in the number of cases of orthopedic conditions, including osteoporosis, osteoarthritis, rheumatoid arthritis, and ligamentous knee injuries globally. 3D printing of bone models and other musculoskeletal parts is very useful for orthopedic operations including diagnosis, training, and surgery planning. Swemac has experience in developing simulators, both for teaching orthopedic surgeons and manufacturing their products within fracture treatment. TraumaVision and ArthroVision are orthopedic simulator systems offered by Swemac.

The neurosurgery segment is anticipated to witness lucrative growth over the forecast period. Growing awareness about neurological disorders, obtainable treatment options in the market, and emerging healthcare infrastructure are the key factors driving the segment growth. In a 2016 review article sponsored by the Government of India and published in Neurology India, the use of simulation training in neurosurgery in the country is still in the infancy stage with growing opportunities for market players. This has opened new opportunities for the development of patient-specific models to support current neurosurgical training.

Material Insights

The plastic segment accounted for the largest revenue share of over 65% in 2020.The increasing adoption of 3D printing technologies and the benefits offered by plastics are expected to propel the segment growth. As per Monroe Engineering Products, thermoplastics are the most used materials for 3D printing as they eliminate the need for adhesives, allow for a variety of colors, and are relatively inexpensive. Commonly used thermoplastics include ABS, Nylon, Polylactic Acid (PLA), acrylic, Polycarbonate (PC), polyethylene, and other high-performance materials.

Some of the commonly used metals in surgical simulators include stainless steel, copper, titanium, aluminum, magnesium, cobalt-chromium, and others. the presence of local market players and the need for cost-effective surgical simulators is estimated to contribute to the segment growth over the coming years. Golden Nimbus Pvt. Ltd. in India, for instance, develops and sells a range of medical equipment. It is CE-certified and uses lab-tested raw materials, such as titanium, stainless steel, aluminum, etc.

End-use Insights

The hospital segment accounted for the maximum revenue share of more than 42% in 2020. The developing healthcare infrastructure, growing demand to enhance the pre-planning of complex surgeries, and improved surgical outcomes are expected to contribute to the segment growth in the coming years. Hospitals are also collaborating with industry partners to develop custom 3D simulator solutions. For instance, in February 2021, Apollo Hospitals partnered with Anatomiz3D Medtech to create Hospital 3D Printing Labs in India.

The specialty center segment is anticipated to show lucrative growth over the forecast period. The highest growth of adoption of simulation techniques and growing public-private partnerships in the healthcare industry is estimated to fuel the segment growth in the coming years. For instance, in September 2021, India’s 1st simulation center for medicos, a first-of-its-kind post-graduate medical simulation center opened at Apollo Specialty Hospital in Chennai.

Regional Insights

North America dominated the market in 2020 with a revenue share of more than 34% due to the presence of key market players, such as CAE Healthcare, 3D Systems, Inc., and others. The early adoption of advanced technologies and product innovation by market players further facilitated the growth of the market. For instance, in January 2019, ImmersiveTouch introduced ImmersiveView Surgical Plan for personalized VR surgical simulation.

In Asia Pacific, the market for surgical simulation is expected to register the fastest CAGR over the forecast period. This is attributed to the growing geriatric population, increased healthcare expenditure, high awareness about surgical simulation, and supportive government initiatives. The Government of India mandated simulation-based training in all undergraduate programs. Such government initiatives will boost the growth of the regional market.

Key Companies & Market Share Insights

Key market players adopt various strategic initiatives to gain deeper market penetration. For instance, in May 2021, PrecisionOS introduced the first fully interactive robotics platform in VR. Using the ground-breaking VR medical simulation offered by the company, all OR people trained on robotics technology at the same time, eventually minimalizing on-the-job learning circumstances that have the potential to affect patient care.

In July 2021, the Rush Center for Clinical Skills and Simulation (RCCSS) and CAE Healthcare proclaimed that they have entered a simulation research partnership to improve healthcare education and advance patient safety, including support for simulation research initiatives of RCCSS. Through this partnership, Rush students and industry partners now have access to the most advanced medical simulation technology. Some of the prominent key players in the global surgical simulation market include:

-

Materialise

-

Startasys Ltd.

-

Canadian Aviation Electronics, Ltd.

-

Surgical Science

-

Mentice

-

Gaumard Scientific

-

Simulab Corp.

-

VirtaMed AG

-

3-Dmed

-

Laerdal Medical

-

3D Systems, Inc.

-

Osteo3d

-

Axial3D

-

Formlabs

Surgical Simulation Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 293 million

Revenue forecast in 2028

USD 835.2 million

Growth rate

CAGR of 16.1% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Specialty, material, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; China; Japan; India; Singapore; Thailand; Indonesia; Philippines; Malaysia; Vietnam; Myanmar; Cambodia; Brazil; Mexico; Argentina; South Africa; Saudi Arabia

Key companies profiled

Materialise; Startasys Ltd.; Canadian Aviation Electronics, Ltd.; Surgical Science; Mentice; Gaumard Scientific; Simulab Corporation; VirtaMed AG; 3-Dmed; Laerdal Medical; 3D Systems, Inc.; Osteo3d; Axial3D; Formlabs

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For the purpose of this report, Grand View Research has segmented the global surgical simulation market report on the basis of specialty, material, end-use, and region:

-

Specialty Outlook (Revenue, USD Million, 2016 - 2028)

-

Cardiac Surgery/Interventional Cardiology

-

Gastroenterology

-

Neurosurgery

-

Orthopedic Surgery

-

Reconstructive Surgery

-

Oncology Surgery

-

Transplants

-

Others

-

-

Material Outlook (Revenue, USD Million, 2016 - 2028)

-

Metal

-

Polymer

-

Plastic

-

Others

-

-

-

End-use Outlook (Revenue, USD Million, 2016 - 2028)

-

Hospitals

-

Specialty Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2028)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Singapore

-

Thailand

-

Indonesia

-

Philippines

-

Malaysia

-

Vietnam

-

Myanmar

-

Cambodia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global surgical simulation market size was estimated at USD 253.0 million in 2020 and is expected to reach USD 293.0 million in 2021.

b. The global surgical simulation market is expected to grow at a compound annual growth rate of 16.1% from 2021 to 2028 to reach USD 835.2 million by 2028.

b. North America dominated the surgical simulation market with a share of 34.8% in 2020. Early adoption of advanced technologies, product innovation by market players further facilitated the growth of the market.

b. Some of the key players in the surgical simulation market are Materialise, Startasys Ltd, Canadian Aviation Electronics, Ltd., Surgical Science, Mentice, Gaumard Scientific, Simulab Corporation, VirtaMed AG, 3-Dmed, Laerdal Medical, 3D Systems, Inc., Osteo3d, Axial3D, Formlabs

b. Key factors that are driving the surgical simulation market growth include increasing focus on patient safety, growing geriatric population, and technological advancements in products

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."