- Home

- »

- Biotechnology

- »

-

Synthetic Biology Market Size, Share & Growth Report, 2030GVR Report cover

![Synthetic Biology Market Size, Share & Trends Report]()

Synthetic Biology Market Size, Share & Trends Analysis Report By Product (Enzymes, Cloning Technologies Kits), By Technology (PCR, NGS), By Application (Non-healthcare, Healthcare), By End-use, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-182-5

- Number of Pages: 135

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

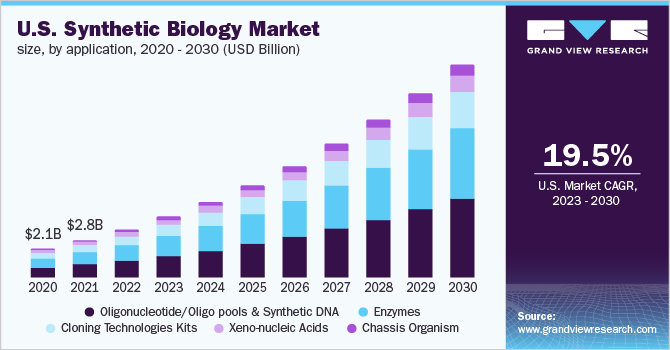

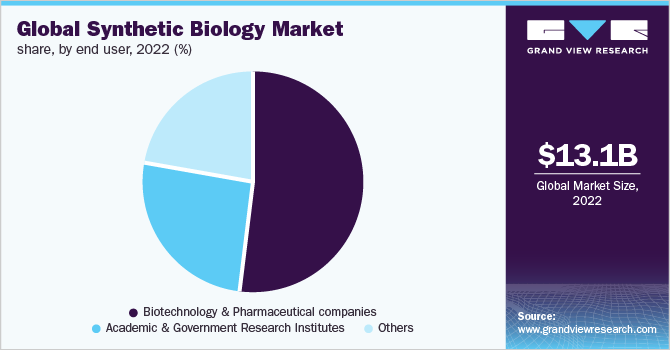

The global synthetic biology market size was valued at USD 13.09 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 18.97% from 2023 to 2030. The increasing scope of synthetic biology applications for multiplexed diagnostics & cellular recording, as well as therapeutic genome editing, is anticipated to surge its demand during the study period. Additionally, the utility of organisms and products from synthetic biology techniques in other sectors, including energy and chemicals, is also likely to impact the overall market growth.

The outbreak of COVID-19 led to an increased usage of synthetic biology products in the past 2 years. Many key pharmaceutical and biotechnology companies as well as synthetic biology players in the industry have increased their research activities globally, by adopting new techniques for producing test kits, therapies, and vaccines for COVID-19. In a study from European Parliament, synthetic biology is considered to be one of the developing technologies. It has the ability to be used in combating COVID-19 infection. Synthetic biology has also been highlighted as a means to accelerate vaccine development by the National Institute of Health in the U.S.

The global market is expected to advance as a result of the growing research and development activities in various fields. To improve conventional biofuel production, players are implementing synthetic biology approaches to enhance performance and increase the utilization of low-cost inputs such as waste. For instance, fashion companies such as Modern Meadow, Bolt Threads, and Vitro Labs are employing biotechnology to develop sustainable materials.

The market witnessed strong investments from private & public partnerships. As per the data published by SynBioBeta, the startups in the synthetic biology industry raised 7.8 billion in investment in 2020, and USD 18.0 billion in 2021. Companies such as Arbor Biotechnologies and DNA Script raised around USD 215 million and USD 167.2 million, respectively. The heavy investment increases the circulation of funds in the market and supports the growth of companies across the supply chain.

Furthermore, advances in genome editing and the presence of bio-foundries, as well as the availability of natural resources and enormous markets, are highlighted as global strengths in synthetic biology to build a bio-based economy. The possible challenges to the field's long-term development, such as insufficient infrastructure and policies, are discussed along with proposals for overcoming them through public-private partnerships, more effective multilateral cooperation, and a well-developed governance framework.

Additionally, players in the market are entering with the latest technologies in order to meet the growing demand and capture untapped avenues of the market. For instance, in November 2021, Creative Biogene released its broad shRNA products to accelerate RNAi research. The company has broad expertise and experience to offer high-quality RNAi products, including shRNA clones and siRNA libraries, intending to provide effective, convenient, and reliable tools to fast-track RNAi research.

Technology Insights

The PCR segment held the highest market share of 27.29% in 2022 and the trend is expected to continue throughout the forecast period. Polymerase Chain Reaction (PCR) has emerged as one of the key technologies for the detection and analysis of specific gene sequences. The real-time PCR assays provide high sensitivity and specificity, making it the go-to method for numerous genomic studies based on PCR. This technique is widely used in various areas such as forensic research, DNA cloning, molecular diagnostics, and genomics.

Genome editing technology, on the other hand, is anticipated to expand at a substantial CAGR during the projected period. The anticipated growth of gene-editing tools can be attributed to several advantages associated with synthetic and genetically modified organisms. The ability of gene editing techniques to develop products with desired traits has revolutionized various sectors, including human & animal healthcare and the agricultural sector.

Product Insights

Oligonucleotide/Oligo Pools and Synthetic DNA segment generated a revenue of USD 4,655.86 million in 2022. In several molecular and synthetic biology applications, oligonucleotides are considered the primary point. Increasing adoption of targeted NGS, mutagenesis experiments, DNA computing, and CRISPR gene editing are the major segment drivers for the same. For instance, OligoMix is an innovative and personalized product for genomics discoveries. It synthesizes numerous sequences of oligonucleotide in massive parallel. The cost for the same is lower than 0.8 cents per base.

On the other hand, the enzymes segment is anticipated to expand at a CAGR of 19.26% during the forecasted period. Enzymes are used as catalysts during biochemical reactions. The prospective application of enzymatic synthesis in delivering lengthier genes in a limited turnaround time is anticipated to boost market growth. However, the technology is still in the developing stage and has not yet been commercialized.

Application Insights

The healthcare segment dominated the market and is expected to expand at a CAGR of 19.23% throughout the forecast period. Diagnostic based on synthetic biology provides a highly specific, sensitive, real-time, and non-invasive process for detecting infectious agents, cancer cells, and therapeutics. Researchers employ rational engineering techniques to design novel bio-sensing systems that are dynamic and constituted of a processor, sensor, and reporter.

The segment is also propelled by an increase in neurological disorders such as multiple sclerosis. For instance, as of July 2022, the experts in synthetic biology from the University of Toronto Engineering are developing custom stem cells from the tissues of patients to treat diseases. Such research efforts are anticipated to supplement the segment growth.

End-use Insights

The biotechnology and pharmaceutical companies segment captured the highest revenue share of 51.69% in 2022. Synthetic biology has aided biotech and pharmaceutical companies in the development of new therapeutics for chronic diseases. For instance, Merck utilized synthetic biology techniques to generate Januvia (sitagliptin), a diabetes medication. Moreover, Novartis introduced Kymriah (Tisagenlecleucel) for the treatment of B-cell acute lymphoblastic leukemia.

Furthermore, the academic & government research institutes segment is expected to show steady growth during the forecast period. The R&D sector is considered to be capital-intensive owing to long development periods and approval cycles. R&D expenditure and funding have witnessed a steady increase during the years. According to an article published in September 2020, the R&D spending in the life sciences industry surged 22% from 2018 to 2019.

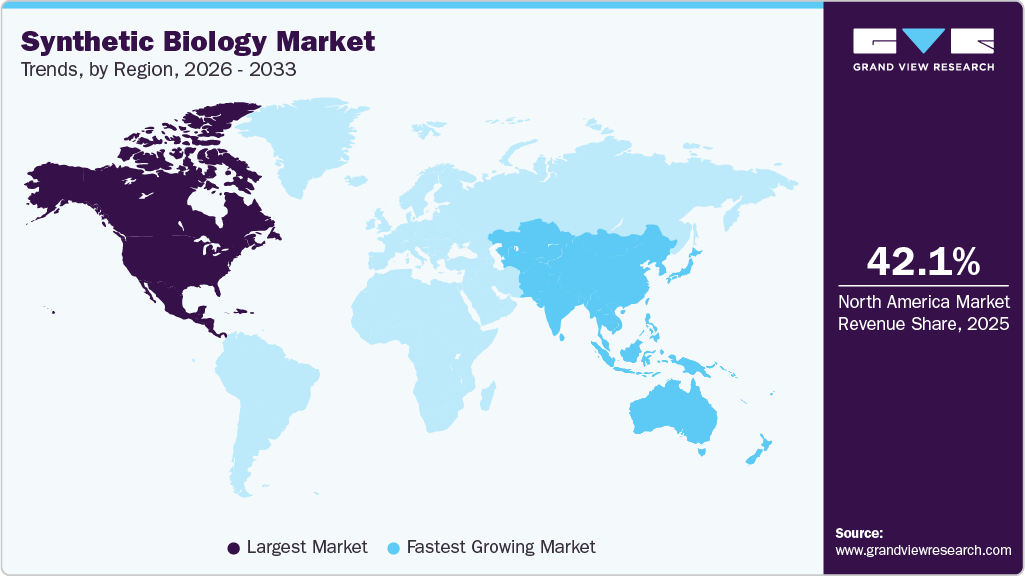

Regional Insights

North America dominated the regional market with a share of 41.22% in 2022. This major share can be attributed to increasing investment in private companies, favorable regulations, and government assistance. The U.S. majorly concentrates on research in the area of proteomics, drug screening & discovery, and genomics structure prediction, thereby propelling the growth of the synthetic biology market.

The Asia Pacific is estimated to be the fastest-growing region; the significant developments by rising investments in Asia Pacific countries, increasing partnerships & funding in the Chinese market, and increasing collaborations in the field of synthetic biology are among the factors anticipated to drive the growth of the synthetic biology market. Moreover, several Asian countries have recently established national institutes, state-sponsored research programs, and academia-industry collaborations to promote technological innovation for the advancement of synthetic biology.

Key Companies & Market Share Insights

Key players in this market are implementing various strategies to increase profitability, including partnerships, mergers & acquisitions, geographical expansions, and strategic collaborations. For instance, in July 2021, Codexis, Inc. and Kalsec, Inc. announced the expansion of their research collaboration and enrolled in a special supply agreement for a new enzyme to manufacture Kalsec’s newest natural hop acid. Some prominent players in the global synthetic biology market include:

-

Bota Biosciences Inc.

-

Codexis, Inc.

-

Creative Biogene.

-

Creative Enzymes.

-

Enbiotix, Inc.

-

Illumina, Inc.

-

Merck Kgaa (Sigma-Aldrich Co. Llc)

-

New England Biolabs

-

Euro fins Scientific

-

Novozymes

-

Pareto Bio, Inc.

-

Scarab Genomics, Llc

-

Synthego

-

Synthetic Genomics Inc.

-

Thermo Fisher Scientific, Inc.

Synthetic Biology Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 16.4 billion

Revenue forecast in 2030

USD 55.37 billion

Growth rate

CAGR of 18.97% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Technology, product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Russia; China; Japan; India; Australia; Singapore; Brazil; Mexico; South Africa; Saudi Arabia; UAE

Key companies profiled

Bota Biosciences Inc.; Codexis, Inc.; Creative Biogene; CREATIVE ENZYMES; Enbiotix, Inc.; Illumina, Inc.; Merck Kgaa (Sigma-Aldrich Co. LLC); New England Biolabs; Euro fins Scientific; Novozymes; Pareto Bio, Inc.; Scarab Genomics, LLC; Synthego; Synthetic Genomics Inc.; Thermo Fisher Scientific, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Synthetic Biology Market Segmentation

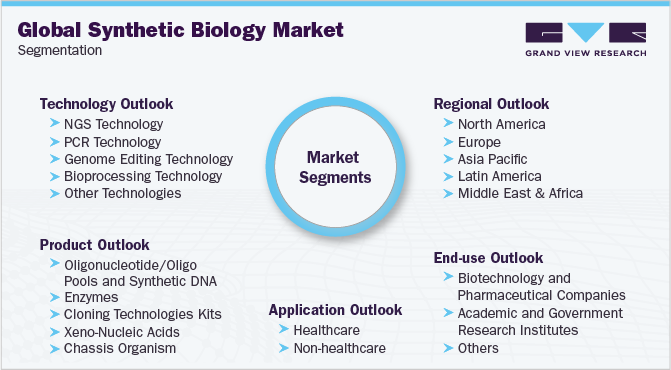

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global synthetic biology market report based on technology, product, application, end-use, and region.

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

NGS Technology

-

PCR Technology

-

Genome Editing Technology

-

Bioprocessing Technology

-

Other Technologies

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Oligonucleotide/Oligo Pools and Synthetic DNA

-

Enzymes

-

Cloning Technologies Kits

-

Xeno-Nucleic Acids

-

Chassis Organism

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare

-

Clinical

-

Non-Clinical

-

-

Non-healthcare

-

Biotech Crops

-

Specialty Chemicals

-

Bio-fuels

-

Others

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Biotechnology and Pharmaceutical Companies

-

Academic and Government Research Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Singapore

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global synthetic biology market size was estimated at USD 10, 285.3 million in 2021 and is expected to reach USD 13,097.2 million in 2022

b. The global synthetic biology market is expected to grow at a compound annual growth rate of 19.7% from 2022 to 2030 to reach USD 55,371.1 million by 2030

b. Oligonucleotide/oligo pools and synthetic DNA were the largest revenue-generating product segment with a share of 35.3% in 2021. The ability for scientists to design their custom DNA oligos for experiments has created ample opportunities in the fields such as Molecular Biology and Synthetic Biology.

b. Some key players operating in the synthetic biology market include Bota Biosciences; Codexis, Inc.; Creative Biogene; Creative Enzymes; EnBiotix, Inc.; Eurofins Scientific; Illumina; Merck (Sigma Aldrich); New England Biolabs; Novozymes; Pareto Biotechnologies, Inc.; Scarab Genomics ; Synthego ; Synthetic Genomics; Thermo fisher Scientific Inc.

b. Key factors driving the synthetic biology market growth include the declining cost of DNA sequencing and synthesizing, increasing investments in the market, rising R&D funding, and growing initiatives in the synthetic biology field

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."