- Home

- »

- Homecare & Decor

- »

-

Tabletop Kitchen Products Market Size, Share Report, 2030GVR Report cover

![Tabletop Kitchen Products Market Size, Share & Trends Report]()

Tabletop Kitchen Products Market Size, Share & Trends Analysis Report By Product (Dinnerware, Drinkware), By Application (Commercial, Residential), By Region (Asia Pacific, Europe), And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68038-167-2

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Consumer Goods

Report Overview

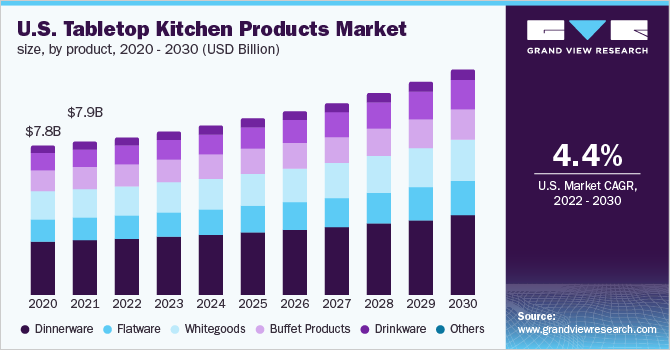

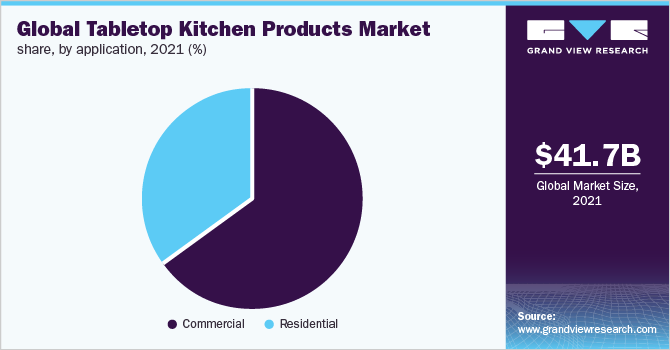

The global tabletop kitchen products market size was valued at USD 41.68 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 4.1% from 2022 to 2030. The rising adoption of serving ware for everyday domestic use, coupled with significant development in the foodservice and hospitality industry, has been majorly driving the demand for tabletop kitchen products. Furthermore, the growing trend of nuclear families is creating more growth opportunities for the market. Developments in the residential category are expected to drive the product demand during the forecast period. The rising trend of separate beverage counters in the commercial and residential sectors has significantly contributed to higher demand for the drinkware category. The evolving concept of structuring bar counters at homes is also expected to positively impact the tabletop drinkware application.

Restaurants, buffets, parties, and other public dining places feed a large number of people and thus, the need for quick service becomes vital. Feeding a large number of people and keeping food on display also requires temperature regulation, for which, chafing dishes have been helpful. This generates the demand for various buffet tabletop utensils. Moreover, increasing innovation in the drinkware segment is aiding product uptake among consumers across commercial and residential settings. For instance, in December 2019, AHIMSA, a U.S.-based company, introduced a line of colorful stainless-steel dinnerware for kids, which includes dishes, bowls, cups, and cutlery in options like rainbow and iridescent blue. The company is known to have produced the world’s first colorful stainless-steel dinnerware for kids.

Furthermore, with the increasing number of COVID-19 cases, more businesses are facing the brunt of the pandemic to an extent where the industry sectors of the economy have reduced to a standstill. The outbreak has also resulted in a scenario where consumers are shifting from purchasing lifestyle needs to daily essentials. The homecare and décor industry has been witnessing steady growth over the course of the first quarter of 2020. However, on a detailed note, specific sub-categories of the industry have experienced a significant impact of the pandemic.

Product Insights

Based on products, the global tabletop kitchen product market has been further divided into dinnerware, flatware, white goods, buffet products, drinkware, and others. The dinnerware segment led the market in 2021 and accounted for the largest revenue share of more than 35.00%. The dominance of the dinnerware products segment can be attributed to the high preference for these products among consumers from both, the residential and commercial sectors. Rising awareness about the health benefits of eating from metal plates is boosting the demand for metal-based products, such as stainless steel and aluminum.

The drinkware segment is anticipated to expand at the fastest CAGR from 2022 to 2030. The market is driven by factors, such as significant product demand from the hospitality & foodservice industry and increasing beverage consumption. In addition, initiatives by major companies to introduce innovative, designer products made from eco-friendly materials will boost the market growth. For instance, Tiki Barware by Urban Bar launched a range of drinkware made of steel, which is etched with Hawaiian-themed tiki patterns. The harmful effects of plastic drinkware on the environment and health are driving the demand for safe and recyclable material-based products.

Application Insights

Based on applications, the global market has been further bifurcated into commercial and residential segments. The commercial application segment accounted for the largest revenue share of more than 64.70% in 2021. With the rising competition, restaurants and bars are taking extra efforts to make customers feel special, boosting the demand for top-notch tabletop products from the sector. The developments in the hospitality sector have resulted in the growth of the hotel industry, leading to the construction of a greater number of hotels across the globe.

The residential application segment is also projected to register a significant growth rate from 2022 to 2030. The growing number of residential constructions, rapid urbanization, and an increasing number of nuclear families are acting as major drivers for market growth. Thus, these developments in the residential household category are expected to drive the product demand in the coming years. In addition, convenient electric and portable small appliances, which are suited for small kitchens & tabletops, are paving the way for segment growth.

Regional Insights

Europe dominated the market and accounted for the largest share of more than 34.50% in 2021. Shifting trends in eating culture, such as increasing preference for social & casual dining, are spurring the product demand in restaurants and hotels across the region. Another trend positively impacting the market is the increasing influence of numerous Southern European cuisines &food cultures, such as French and Italian, on countries in North Europe. This has resulted in the use of high-end cutlery and dinnerware among restaurants and food service outlets. Aesthetic and high-end tableware products make dining out an even more pleasurable experience for families and friends, further encouraging the use of such products.

Asia Pacific is expected to witness the fastest CAGR from 2022 to 2030 owing to the growing target population, increasing levels of disposable income, and improving economic conditions in countries, such as India and China. In addition, a rapidly expanding commercial and residential construction industry in the region is likely to have a significant impact on the market. North America is expected to witness a CAGR from 2022 to 2030. Major home improvement projects undertaken by consumers in the region are boosting the need for premium houseware to complement the luxury interiors. Consumers are likely to invest in high-end tabletop kitchen products to lay out innovative & high-quality cutlery and dinnerware at social gatherings.

Key Companies & Market Share Insights

The market includes both international and domestic participants. Key market players focus on strategies, such as innovation and new product launches, to enhance their portfolio offering.

-

In January 2021, Villeroy & Boch Tableware Division was renamed Dining & Lifestyle. The new name reflects the division’s evolution. Throughout 2019 and 2020, the division was gradually restructured

-

In June 2021, Lenox Corp. officially announced the acquisition of Oneida Consumer LLC. All existing Oneida Consumer LLC tabletop products, including flatware, tableware, and cutlery, are included in the deal

-

In November 2021, Samsung Electronics Co., Ltd. announced a new relationship with Mindful Chef, marking the U.K.’s top healthy recipe box company’s first technological partnership Some of the key players operating in the global tabletop kitchen products market include:

-

Arc International

-

The Oneida Group

-

Samsung Electronics Co. Ltd.

-

Haier Group Corporation

-

Robert Bosch GmbH

-

Villeroy & Boch AG

-

Lenox Corporation

-

Koninklijke Philips N.V.

Tabletop Kitchen Products Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 42.74 billion

Revenue forecast in 2030

USD 59.81 billion

Growth rate

CAGR of 4.1% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; U.K.; China; India; Brazil

Key companies profiled

Arc International; The Oneida Group; Samsung Electronics Co. Ltd.; Haier Group Corporation; Robert Bosch GmbH; Villeroy & Boch AG; Lenox Corporation; Koninklijke Philips N.V.; The Vollrath Co., L.L.C.; Matfer Bourgeat International

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global tabletop kitchen products market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Dinnerware

-

Flatware

-

Whitegoods

-

Buffet Products

-

Drinkware

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Residential

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global tabletop kitchen products market size was estimated at USD 41.68 billion in 2021 and is expected to reach USD 42.74 billion in 2022.

b. The global tabletop kitchen products market is expected to grow at a compound annual growth rate of 4.1% from 2022 to 2030 to reach USD 59.81 billion by 2030.

b. Europe led the global tabletop kitchen products market in 2021 with a revenue share of over 34% and will expand further at a steady CAGR from 2022 to 2030.

b. Some key players operating in the tabletop kitchen products market include Arc International, Zalto, Haier, The Oneida Group, The Vollrath Company, Hendi, Matfer Bourgeat International, and BSH Hausgeräte GmbH.

b. Key factors that are driving the tabletop kitchen products market growth include rising adoption of serving ware for everyday domestic use and significant development in the foodservice and hospitality industry has been majorly driving demand.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."