- Home

- »

- Healthcare IT

- »

-

Telecare Market Size, Share & Growth Report, 2030GVR Report cover

![Telecare Market Size, Share & Trends Report]()

Telecare Market Size, Share & Trends Analysis Report By Type (Activity Monitoring, Remote Medication Management), By Region (North America, Europe, Asia Pacific, Latin America, MEA), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-915-1

- Number of Pages: 118

- Format: Electronic (PDF)

- Historical Range: 2016 - 2021

- Industry: Healthcare

Report Overview

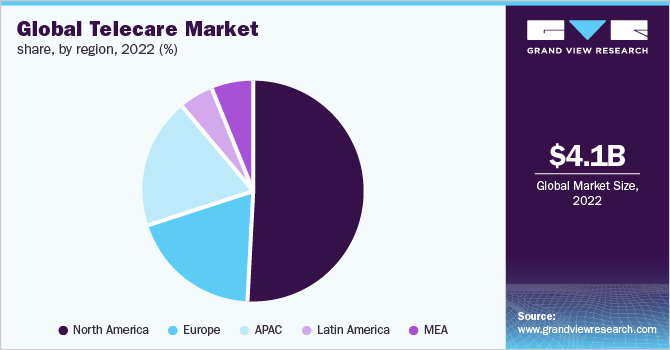

The global telecare market size was valued at USD 4.1 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.4% from 2023 to 2030. Increasing advancement of the technology to provide more efficient and improved healthcare services to patients in their own homes by reducing the costly residence care or clinic attendance is anticipated to drive the market over the forecast years. In addition, growing awareness to maintain physical health and increasing penetration of the internet and smartphones also accelerate market growth. Moreover, increasing adoption and use of consumer-oriented fitness and health apps, exercise tracking tools and sensors, digital medication reminder systems, or early warning and detection technologies that connect people with family members or other caregivers also support the growth of the market.

Furthermore, breakthroughs in digital health, telecommunication, and electronic health record systems contribute significantly to the growth of the adoption of telecare tools for extending rehabilitation, health, and wellness services. In addition, the growing number of health apps for activity monitoring and continuous improvement of the app quality by the developers is also expected to boost the market growth. For instance, according to the data published in the journal BMJ, as of 2021, about 2.87 million mobile applications are available on the Google Play store and 1.96 million apps on the Apple Store, of those 99,366 belong to medical, health, and fitness categories.

In addition, telecare services help in the health monitoring of elderly people. The digital platforms and software used by remote monitoring centers can monitor and provide assistance to the elderly for unusual behavior patterns, or any warning signs of falls, further boosting its adoption. Furthermore, the growing geriatric population all over the world is also anticipated to drive the market for telecare over forecast years. For instance, according to the World Health Organization (WHO) by 2030, one in six people will be aged over 60 years in the world. Moreover, some of the telecare technologies also track the environmental condition and unconsciousness of the elderly person and automatically trigger the required response. These kinds of technological advancements thereby further support market growth.

Furthermore, the growing number of mobile subscribers and increasing penetration of the internet all over the globe are the major factors accelerating the adoption of telecare services. For instance, according to Ericsson, which is a leading provider of information and communication technology there are 8.1 billion mobile subscribers in 2021 and the number will rise to 8.9 billion in 2027. In addition, increasing app promotion activities and growing use of social media platforms are also anticipated to accelerate telecare service adoption. For instance, by October 2021 there were about 4.55 billion social media users over the world according to the DataReportal statistics, which equates to around 57.6% of the total world population.

COVID19 Telecare market impact: 9.4% growth in revenue from 2019 to 2020

Pandemic Impact

Post COVID Outlook

The Telecare market increased by 9.4% from 2019 to 2020

The market is estimated to witness a y-o-y growth of approximately 3.5% to 8.5% in the next 5 years

The rapid spread of the COVID-19 pandemic all over the world and the adoption of social distancing practices accelerated the telecare adoption in 2020. The government imposed shut down and lock down to reduce disease exposure which also supported the market growth during the pandemic.

The increasing government initiatives to promote digital healthcare platforms for remote healthcare services is also anticipated to drive telecare adoption after the pandemic.

Increasing demand for remote patient monitoring and management during the COVID-19 also accelerated the market growth in 2020. For instance, as per the report published by the center for disease control and prevention (CDC) in October 2020, there is a 154% increase in telehealth visits in March 2020 than March 2019

Growing investment activities by the government to promote digital health services is also expected to boost the market growth during forecast years. For instance, in February 2021, the United States Department of Agriculture (USDA) invested $42 Million for distance learning and telemedicine infrastructure to provide virtual care services and health education to students and patients in remote locations

Moreover, there is an increase in the trend of digital health services adoption including telecare observed during the COVID-19 pandemic. The growing risk of coronavirus infection in 2020 further increases the adoption of telecare services. Telecare uses electronic modalities, like smartphones to support virtual and long-distance interactions between patients and health care professionals. During the COVID-19 pandemic, the government and non-government organizations promoted to use of telecare services for the patients suffering from several chronic disorders and the older population who are homebound with several physical ailments, such as muscle weakness and chronic pain, in turn, supported the market for telecare during COVID-19 pandemic.

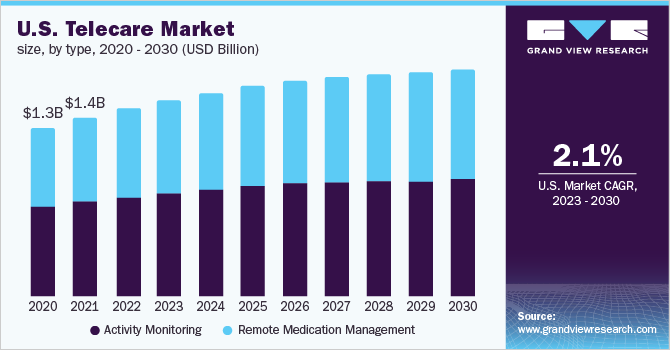

Type Insights

The activity monitoring segment dominated the market for telecare and accounted for the highest revenue share of 50.7% in 2022. This high share is attributed due to the high adoption of telecare services for activity monitoring, especially among the elderly population. In addition, the increasing adoption of telecare platforms by patients with physical disabilities for daily activity monitoring and the rising geriatric population to maintain their self-efficacy and remain safe in their own homes are the other factors supporting the growth of the segment.

Moreover, the remote medication management segment is anticipated to witness the highest CAGR in the market for telecare over the forecast period. Growing demand for management of chronic disease conditions through virtual face-to-face encounters. Increasing use of telecare platforms like pill reminders by individuals to take their medicines at the right time with the correct dosage and prevent any adverse drug events is expected to drive the segment.

Regional Insights

North America dominated the telecare market for telecare and accounted for the highest revenue share of 49.7% in 2022. This is attributed to several factors such as the high penetration of smartphones and the internet, growing awareness among individuals to maintain physical health and the use of remote healthcare services. In addition, the growing burden of chronic diseases coupled with the increasing geriatric population are among the major factors anticipated to drive the market growth in this region. Besides, the increasing number of telecare providers and the presence of key players in the U.S. is also leading to the adoption of such services in this region.

Furthermore, in Asia Pacific, the market for telecare is expected to exhibit the fastest growth rate of 40.9% over the forecast period owing to the large population and increasing demand for remote health management services. In addition, growing users of the internet and fast-growing smartphone penetration are also anticipated to drive the market growth over the forecast period in the Asia Pacific. Moreover, increasing government initiatives to promote digital health platforms also further support market growth in this region.

Key Companies & Market Share Insights

Growing adoption of mobile health technology for domiciliary care, by providing support to live in their own homes independently, enhancing their safety, and managing risks, particularly for elderly and vulnerable populations, creates a competitive environment among the top players. The key players are looking forward to developing and launching cost-effective digital healthcare platforms as per the consumer demand to hold a strong position in the global market. In addition, acquisitions, mergers, and collaboration are some of the key strategies followed by the top players that also fuel the competition and are anticipated to accelerate the market growth over the years. For example, in June 2019, LloydsPharmacy a division of McKesson U.K. acquired Echo, a startup company that offers an app to help manage medication and order online repeat prescriptions for delivery. Some of the prominent players in the telecare market include:

-

Teladoc Health, Inc.

-

Abbott Laboratories

-

Johnson and Johnson

-

AstraZeneca PLC

-

F. Hoffmann-La Roche Ltd.

-

Novartis AG

-

Bristol-Myers Squibb Company

-

GlaxoSmithKline plc

-

Merck and Co., Inc.

-

Pfizer, Inc.

-

Sanofi

-

Samsung Electronics Co. Ltd

-

Qualcomm Technologies, Inc.

-

Orange

-

Google (Alphabet), Inc

-

Allscripts

-

Airstrip Technologies, Inc

-

AT&T

-

Apple, Inc.

Telecare Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.4 billion

Revenue forecast in 2030

USD 6.3 billion

Growth Rate

CAGR of 5.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2016 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; Spain; France; Italy; Russia; Australia; China; Japan; India; South Korea; Singapore; Mexico; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Teladoc Health, Inc.; Abbott Laboratories; Johnson and Johnson; AstraZeneca PLC; F. Hoffmann-La Roche Ltd.; Novartis AG; Bristol-Myers Squibb Company; GlaxoSmithKline plc; Merck and Co., Inc.; Pfizer, Inc.; Sanofi; Qualcomm Technologies, Inc.; Orange; Google (Alphabet), Inc.; Allscripts; Airstrip Technologies, Inc.; AT&T; Apple, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Telecare Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2030. For the purpose of this study, Grand View Research, Inc. has segmented the global telecare market report on the basis of type and region:

-

Product Type Outlook (Revenue, USD Million, 2016 - 2030)

-

Activity Monitoring

-

Remote Medication Management

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

Italy

-

France

-

Spain

-

Russia

-

-

Asia Pacific

-

Australia

-

China

-

Japan

-

South Korea

-

India

-

Singapore

-

-

Latin America

-

Mexico

-

Brazil

-

Argentina

-

-

Middle East Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global telecare market is expected to grow at a compound annual growth rate of 5.4% from 2023 to 2030 to reach USD 6.3 billion by 2030.

b. The activity monitoring segment dominated the telecare market with a share of 50.7% in 2022. This is attributable to the high adoption of telecare services for activity monitoring, especially among the elderly population.

b. Some key players operating in the telecare market include Teladoc Health, Inc., Abbott Laboratories; Johnson and Johnson; AstraZeneca PLC; F. Hoffmann-La Roche Ltd.; Novartis AG; Bristol-Myers Squibb Company; GlaxoSmithKline plc; Merck and Co., Inc.; Pfizer, Inc.; and Sanofi

b. Key factors that are driving the telecare market growth include growing awareness to maintain physical health and increasing penetration of the internet and smartphones and increasing advancement of the technology to provide more efficient and improved healthcare services to patients in their own homes.

b. The global telecare market size was estimated at USD 4.1 billion in 2022 and is expected to reach USD 4.4 billion in 2023.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."