- Home

- »

- Communications Infrastructure

- »

-

Telecom Millimeter Wave Technology Market Report, 2020-2027GVR Report cover

![Telecom Millimeter Wave Technology Market Size, Share & Trends Report]()

Telecom Millimeter Wave Technology Market Size, Share & Trends Analysis Report By Frequency Band (V-band, E-band), By Licensing Type (Fully-licensed, Light-licensed, Unlicensed), By Application, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-2-68038-227-3

- Number of Pages: 95

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry: Technology

Report Overview

The global telecom millimeter wave technology market size was valued at USD 573.3 million in 2019 and is expected to expand at a compound annual growth rate (CAGR) of 37.01% from 2020 to 2027. The increasing R&D activities in the Millimeter Wave (MMW) technology and the continuously rising demand for bandwidth-intensive applications are anticipated to propel the market growth. The need for bandwidth-intensive applications is arising particularly from consumer electronic products and mobile devices, such as smartphones and wearable electronics. Data-intensive services, such as video streaming, video conferencing, media exchange over the internet, and high-speed online gaming, are expected to boost the demand for high-bandwidth, fostering the demand for adopting telecom MMW technology.

Furthermore, the next generation of wireless communication is at its beginning with the approaching time. The telecom world is implementing several technologies to verify precisely which frequencies 5G would be deployed. Millimeter Wave is anticipated to be the key enabler for deploying 5G with 5G fixed wireless. The technical requirements of 5G, such as peak data rate i.e., above 10 Gbps, 1 msec latency rate, cell edge data rate of 100 Mbps, and so on, are the driving factors predicted to propel the adoption of MMW technology in the telecom sector.

The large amount of adjoining bandwidth available above 24 GHz, is necessary to fulfill data throughput requirements for the 5G services. The research and lab trials have proved that the millimeter-wave can deliver multi-gigabit per second data rates. Besides, the competitive environment is upbringing the latest innovative approaches such as using MMW in the downlink and sub-6 GHz spectrum in the uplink. Thus, with these innovative approaches, the need for power-hungry MMW transmitters is being eliminated in the 5G devices; in turn, lowering the cost and power consumption.

The support and momentum for millimeter-wave technology to allow 5G use cases are strong enough despite the barriers and challenges in the application of technology. Service providers, chipset manufacturers, network infrastructure vendors, and stakeholders from all fronts, are undertaking combined efforts to overcome the challenges associated with high-frequency MMW technology.

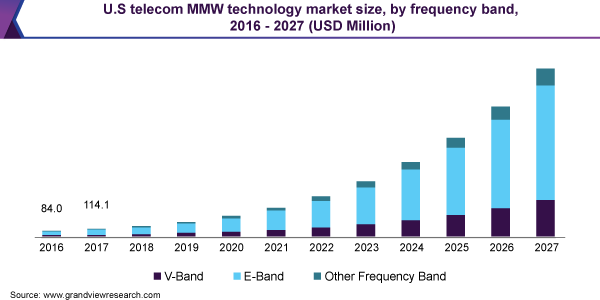

Frequency Band Insights

E-band led the telecom millimeter wave technology market and accounted for more than 73.6% revenue share in 2019. Rising application of E-band frequency is anticipated to drive the growth of the segment. E-band frequencies hold a prominent application in the telecommunication equipment segment. Whereas, the V-band frequencies range between 40 GHz to and 70 GHz, and the millimeter waves of these bands are particularly used in military and defense applications. In addition, the V-band frequencies are extensively used in radar and satellite communications.

The global telecommunication industry is growing extensively across the globe and is likely to keep growing at a rapid pace with the approaching years owing to the rising demand from various applications such as consumer electronics, smart education, smart home, automation industry, and so on. Therefore, the E-band frequency segment is in the telecom MMW industry is projected to intensify notably over the forecast period.

Application Insights

Civil segment led the market and accounted for more than 84.6% share of the global revenue in 2019. The civil segment comprises various applications such as telecommunications, automotive and transport, healthcare, and electronics, and semiconductor applications. The growth rate of civil segment is expected to be high in the coming years owing to the increased demand for high-speed data transfer and communication arising from the residential and the commercial sectors such as data centers and IT offices.

The use of telecom millimeter wave technology in military applications is expected to rise during the forecast period. The military segment is projected to witness the fastest growth rate on account of increasing adoption of MM modules and sensors in various military and defense applications. The technology is being widely adopted at international airport authorities on account of the global terrorism issues. This overall scenario is expected to propel the growth of the market in the coming future.

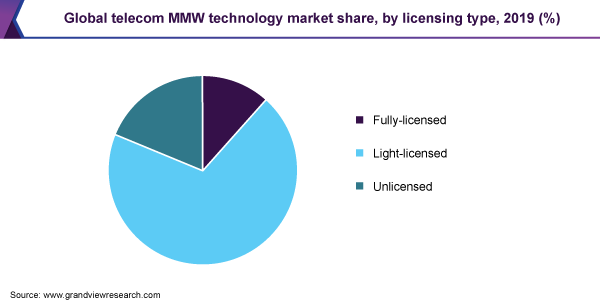

Licensing Type Insights

The light-licensed spectrum led the market and accounted for more than 69.35% share of the global revenue in 2019. The high market share of the light-licensed spectrum is due to its lower cost and it is simple to manage. Federal agencies have allocated the E band (70/80 GHz) for public use with few light licensing requirements. The carriers can quickly get these licenses. All wireless technologies use radio waves to receive and transmit information. The wireless spectrum is bifurcated into various frequency bands so that many different technologies can use the radio waves simultaneously. By licensing these frequencies, it helps the government to ensure noninterference of wireless operators with each other's transmissions.

The unlicensed spectrum is also called a license-exempt spectrum, which uses radio waves without any individual authorization. Many mobile operators launched carrier Wi-Fi and 4G in this spectrum. Moreover, 5G technology will likely launch in the unlicensed or light-licensed spectrum. Whereas federal agencies auction a fully licensed spectrum, and its owner exclusively uses it. This spectrum is a top priority in the telecom industry as it provides a higher quality of service, mobility, and control.

Regional Insights

North America dominated the market and accounted for over 39.0% share of global revenue in 2019. This high market share of the region is attributable to region’s tendency of adapting to modern technologies. Countries such as the U.S. and Canada are one of prominent and early adopters of the upcoming and emerging technologies. Thus, the factors are creating opportunities for telecom MMW technology in different applications. Additionally, the region’s intensifying demand for Carrier Ethernet services in the metro areas is anticipated to drive the overall regional market.

However, the MMW technology market in the Asia Pacific region is anticipated to witness notable growth over the forecast period. The Asia Pacific region is poised to exhibit highest CAGR of more than 42.0% over the forecast period. This rapid growth of the technology in the region can be accredited to the developments and upgradations being carried out in its telecom infrastructures. Further, the installation of new telecom equipment, based on the millimeter wave technology, is further expected to drive the overall market across the region, at a significant pace.

Key Companies and Market Share Insights

The service providers in the telecom industry are intensely focusing on improvising the technology to meet the demands of the increasing bandwidth applications and high-speed internet requirements arising from the bandwidth-intensive applications. In October 2018, LightPointe Communications, Inc. launched AireLink 60 10 Gig, a point to point backhaul radio, featuring a high capacity of 60GHz and 10 Gbps of throughput. The newly launched product is a cost-effective alternative for licensed E-band radios. Some of the prominent players in the telecom millimeter wave technology market include:

-

Aviat Networks, Inc.

-

Siklu Communication Ltd.

-

E-band Communications LLC

-

Sage Millimeter, Inc.

-

LightPointe Communications, Inc.

- Bridgewave Communications, Inc.

Telecom Millimeter Wave Technology Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 814.5 million

Revenue forecast in 2027

USD 7.38 billion

Growth Rate

CAGR of 37.01% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Frequency band, licensing type, application, region

Regional scope

North America; Europe; Asia Pacific; Rest of World

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Japan; South Korea; Singapore

Key companies profiled

Aviat Networks, Inc.; Siklu Communication Ltd.; E-band Communications LLC; Sage Millimeter, Inc.; LightPointe Communications, Inc.; Bridgewave Communications, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global telecom millimeter wave technology market report based on frequency band, licensing type, application, and region:

-

Telecom MMW Technology Frequency Band Outlook (Revenue, USD Million, 2016 - 2027)

-

V-Band

-

E-Band

-

Other Frequency Bands

-

-

Telecom MMW Technology Licensing Type Outlook (Revenue, USD Million, 2016 - 2027)

-

Fully-licensed

-

Light-licensed

-

Unlicensed

-

-

Telecom MMW Technology Application Outlook (Revenue, USD Million, 2016 - 2027)

-

Military

-

Civil

-

-

Telecom MMW Technology Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

The U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Singapore

-

-

Rest of World

-

Frequently Asked Questions About This Report

b. The global telecom millimeter wave technology market size was estimated at USD 573.3 million in 2019 and is expected to reach USD 814.5 million in 2020.

b. The global telecom millimeter wave technology market is expected to grow at a compound annual growth rate of 37.01% from 2020 to 2027 to reach USD 7,383.1 million by 2025.

b. North America dominated the telecom millimeter wave technology market with a share of 39.87% in 2019. This is attributable to the increasing demand for Carrier Ethernet services in the U.S. and Canada.

b. Some key players operating in the telecom millimeter wave technology market include Aviat Networks, Inc., Siklu Communication Ltd., E-band Communications LLC, Keysight Technologies, Sage Millimeter, Inc., and Bridgewave Communications, Inc.

b. Key factors that are driving the market growth include increasing research & development activities pertaining to the MMW technology and constantly growing demand for bandwidth-intensive applications.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."