- Home

- »

- Healthcare IT

- »

-

Teleradiology Software Market Size & Share Report, 2030GVR Report cover

![Teleradiology Software Market Size, Share & Trends Report]()

Teleradiology Software Market Size, Share & Trends Analysis Report By Type (Radiology Information System, Picture Archive And Communication System, Vendor Neutral Archive), By Deployment, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-991-3

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Teleradiology Software Market Size & Trends

The global teleradiology software market size was valued at USD 1.85 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 10.3% from 2023 to 2030. The rising prevalence of chronic diseases, such as cardiovascular diseases, cancer, liver disorders, spinal cord injury, and others, is a major factor increasing the demand and need for teleradiology software. With the increasing demand for imaging diagnostics, various radiology centers and hospitals are adopting teleradiology solutions. The growing geriatric population is also one of the reasons for the growth of this market. According to a report published by the American Cancer Society, in the U.S., around 1.9 million new cases of cancer and around 609,820 deaths per day are estimated to be caused by cancer. As per the report, the death counts are about 1,670 deaths per day in 2023. In the U.S., cancer is the 2nd most common reason for death, surpassed only by heart illness.

Cloud-based solutions have witnessed significant adoption by healthcare providers. According to the 2023 Future of Healthcare report by HIMSS, patients’ willingness to use digital health tools (DTHs) is expected to increase. According to the report, nearly 3-quarters of US healthcare payers believed big tech innovation is the major and important driver of digital transformation. Numerous advantages of cloud-based teleradiology software, such as high accessibility to patient data despite large volumes, are expected to drive the adoption of cloud-based software solutions, fueling the overall market growth.

The rising adoption of digital healthcare infrastructure across all geographies and the rapid increase in radiology image data sets are among the few vital factors driving the demand for healthcare information networks to store, ingest, manage, access, and interpret clinical data of various patients individually. The rise in the number of medical images produced annually is propelling the need for a structured reporting system for radiology images to integrate it with individual Electronic Health Records (EHR) solutions, which has further surged the demand and adoption of Radiology Information System (RIS) by diagnostic centers and other healthcare institutes.

Also, non-profit organizations and governments across all regions are promoting and investing in teleradiology services, which is expected to drive the market. For instance, Teleradiology Solutions, a non-profit trust that focuses on imparting teleradiology support to hospitals located in rural/under-served/semirural parts of Asia, has collaborated with the National Board of Medical Examiners through its e-learning portal “Radguru.” This portal's mission is to stimulate radiology's growth through interactive e-learning. This collaboration will allow about 800 PG students to receive interactive training in radiology from international faculty. Similarly, growth in joint ventures between governments and private companies, such as the Singapore government and Teleradiology Solutions and Tripura government and Teleradiology Solutions, is anticipated to create growth opportunities in the forthcoming years.

Moreover, the surging implementation of Picture Communication and Archiving Systems (PACS) is expected to boost the demand for teleradiology software. Diagnostic centers, medium-sized hospitals, and diagnostic clinics focus on procuring specialized PACS tools due to the growing demand for CT scans. Companies developing PACS are focusing on the changing requirements of small hospitals. For instance, in August 2021, GE Healthcare launched Edison True PACS. This AI-enabled transformative system offers decision support to radiologists and helps them adapt to higher workloads and exam complexity, further improving diagnostic accuracy.

Companies offering teleradiology software are involved in new product launches, existing product upgrades, mergers and acquisitions, and regional expansion to enhance their market position. For instance, in July 2019, Comarch SA opened its office in Australia to expand its business and strengthen its global presence. Also, the company is focusing on developing a hosting services portfolio for its present and future clients in Australia. Likewise, in February 2023, Carestream Health introduced a 'Carestream Motion Mobile X-ray system.' The system is equipped to carry out basic radiography examinations. It is portable and easy to move into small spaces. It was recently launched at the Indian Radiology and Imaging Association meeting.

Type Insights

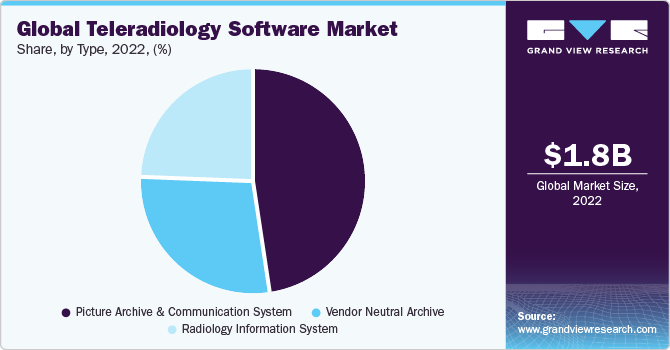

Based on type, the market is segmented into radiology information systems (RIS), picture archive and communication systems (PACs), and vendor-neutral archives (VNA). The picture archive and communication system software segment dominated the market and accounted for the largest revenue share of around 48% in 2022. Factors such as medical diagnostic procedures and the growing adoption of remote patient monitoring have increased the adoption of PACS software among healthcare providers. There are several benefits of using PACS in radiology, such as data organization and image visualization; other than this, financial saving is another significant plus. According to a recent HIMSS Analytics Essentials report, the radiology PACS technology is used extensively across the healthcare industry, allowing healthcare providers to store and access electronic imaging studies effectively and cost-effectively.

Companies are updating their PACS systems as technology and innovation advancements continue to drive customer collaboration. For instance, in 1997, FUJIFILM Healthcare Americas Corporation launched Synapse NT software, a new line that entered the PACS market. In 2022 the company unveiled Synapse 7.2, the latest version of Synapse. The earlier version Synapse 7x unites mammography, radiology, cardiology, and enterprise imaging on a diagnostic PACS viewer, which is cloud deployable. Version 7.2 provides more than 80 new features and advanced tools to boost the efficiency of cardiology users and clinical radiology. It addresses multiple challenges of providing centralized image visualization technology and enterprise diagnostic imaging that meets the demands of both cardiology and radiology diagnostic fields.

The vendor-neutral archive (VNA) segment is expected to grow at the fastest CAGR of 11.6% during the forecast period. The rising need to easily share medical imaging information among healthcare providers is one of the key factors boosting the demand for VNA. Healthcare providers are utilizing VNA software owing to its advantages over PACS, such as flexibility, accessibility, interoperability, and data ownership. Some of the major features of VNA software are image object change management (IOCM), image lifecycle management (ILM), tag morphing, and hanging protocols. Although the initial investments required for VNA are very high, this can be proved as a cost-effective solution in the long run as they avoid data migration costs. For instance, RamSoft, a leading healthcare IT software and services company, offers 'OMEGA AI VNA,' the latest vendor-neutral archive solution, which provides incomparably cutting-edge and potent features like built-in flexibility for optimized image viewing healthcare providers a thorough 360° view of a patient's health. Hence in March 2022, this VNA solution captivated HIMSS.

RIS aids radiologists with patient scheduling, registration, documentation, and booking and scheduling. Growing awareness about the benefits of RIS among radiologists is a prominent driver for the growth of the RIS Segment. Also, radiologists' demand for cloud-based RIS is increasing due to benefits such as reduced operational costs and easy accessibility to patient data. Radiologists can effectively analyze and save the report on the cloud using cloud-based RIS, making the data accessible to multiple practitioners from different physical locations.

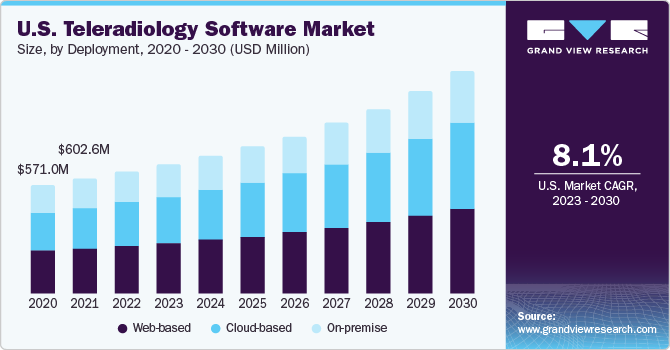

Deployment Insights

Based on deployment, the global teleradiology software market is segmented into web-based, cloud-based, and on-premise deployment. The web-based segment dominated the market and accounted for the largest revenue share in 2022. Remote data accessibility and a high preference for web applications are some factors propelling the segment’s growth. Moreover, the number of imaging procedures is growing as CT and MRI scans are becoming routine, and thus radiologists have to access many images at any time. This factor is likely to drive the demand for web-based teleradiology solutions.

The cloud-based segment is expected to grow at the fastest CAGR during the forecast period from 2023 to 2030. Benefits of cloud-based solutions, such as unlimited scalability and deployment flexibility, cost-effectiveness, and predictability, are aiding the adoption of these solutions among healthcare providers. Also, using cloud-based solutions, radiologists can effectively manage multimodality units without paying high upfront costs. In March 2018, Vue Cloud-an imaging cloud service based on the Carestream Clinical Collaboration Platform-managed more than 26 billion images in private and public data centers across the globe. Although the use of on-premise solutions is lower than web-based and cloud solutions, factors such as data security and limited internet connection requirements in the case of on-premise solutions are aiding segment growth. Also, benefits offered by on-premise solutions, such as customization depending on radiologists’ or healthcare providers’ requirements, support market growth.

Regional Insights

North America dominated the market and accounted for the largest revenue share of over 40% in 2022. The key factors that have contributed to the growth are increasing the target population, the prevalence of chronic diseases, such as cancer and bone impairments, the presence of major market players, and the existence of developed healthcare IT infrastructure. Favorable government initiatives, technological advancements, and high healthcare expenditure are the leading factors positively impacting regional market growth.

Asia Pacific is expected to grow at the fastest CAGR of 13.1% during the forecast period. A high unmet medical need resulting from the prevalence of targeting chronic diseases, such as cancer and cardiac diseases, propels the demand for medical imaging in the region. Also, the shortage of radiologists in several countries such as India, favorable government initiatives in the digital health sector, and the growing adoption of advanced technology support the market growth in the region.

Europe held a significant revenue share in 2022, owing to factors such as the shortage of radiologists and the need for specialist advisors and on-call radiology reading. Increasing healthcare costs and reducing healthcare budgets have pushed for efficient teleradiology services, supporting regional market growth. Also, PACS's high demand and availability are expected to create growth opportunities for teleradiology software in Europe.

Key Companies & Market Share Insights

Key companies are investing more in this market due to increasing demand for imaging diagnostics. Product launches, approvals, strategic acquisitions, and innovations are just a few of the important business strategies market participants use to maintain and grow their global reach. For instance, in November 2022, OpenRad, a radio technology firm, announced the launch of Enterprise Edition. This enterprise remote reporting platform enables advanced mobile fleet management and cloud-based collaborative workflows across companies in one offering. Some of the players in the global teleradiology software market are:

-

Carestream Health

-

Telerad Tech

-

Comarch SA

-

Medicentre Theme

-

PERFECT IMAGING, LLC

-

Impose Technologies Pvt Ltd.

-

Radical Imaging LLC.

-

OpenRad

-

RamSoft, Inc.

-

Koninklijke Philips N.V.

-

Pediatrix Medical Group

Teleradiology Software Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.00 billion

Revenue forecast in 2030

USD 3.97 billion

Growth Rate

CAGR of 10.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, deployment, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Carestream Health; Telerad Tech; Comarch SA.; Medicentre Theme; PERFECT IMAGING, LLC; Impose Technologies Pvt Ltd.; Radical Imaging LLC.; OpenRad; RamSoft, Inc.; Koninklijke Philips N.V.; Pediatrix Medical Group

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs.

Global Teleradiology Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global teleradiology software market report based on type, deployment, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Radiology Information System (RIS)

-

Picture Archive and Communication System (PACs)

-

Vendor Neutral Archive (VNA)

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Web-based

-

Cloud-based

-

On-premise

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global teleradiology software market size was estimated at USD 1.85 billion in 2022 and is expected to reach USD 2.0 billion in 2023.

b. The global teleradiology software market is expected to grow at a compound annual growth rate of 10.3% from 2023 to 2030 to reach USD 3.97 billion by 2030.

b. In 2022, the PACS software segment dominated the market for teleradiology software and accounted for the largest revenue share of 48.0%.

b. Some key players operating in the teleradiology software market include Carestream Health, Telerad Tech, Comarch SA, Medsynaptic Pvt Ltd, Perfect Imaging LLC, Impose Technologies Pvt Ltd., and Radical Radiology.

b. Key factors that are driving the teleradiology software market growth include shortage of radiologists, growing prevalence of chronic diseases and rising adoption of digital healthcare infrastructure.

b. In 2022, the web-based segment dominated the market for teleradiology software and accounted for the largest revenue share of 39.7%.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."