- Home

- »

- Medical Devices

- »

-

Temperature Modulation Devices Market Size Report 2030GVR Report cover

![Temperature Modulation Devices Market Size, Share & Trends Report]()

Temperature Modulation Devices Market Size, Share & Trends Analysis Report, By Product (Portable blood/IV Warming Devices, Convective Patient Heating Systems), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-022-4

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Market Size & Trends

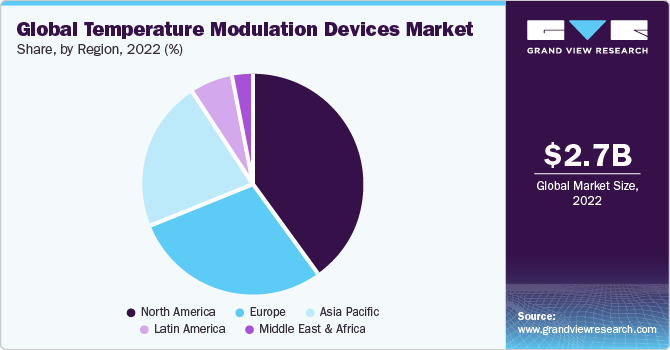

The global temperature modulation devices market size was estimated at USD 2.7 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 6.9% from 2023 to 2030. Increasing number of surgical procedures worldwide, along with growing incidence of road accident fatalities is anticipated to drive the temperature modulation devices market. Additionally, growing demand of blood/IV warmers from ambulatory services and military/defense sectors are expected to further fuel the market’s growth in the near future. Incidence of patient hypothermia are the biggest factor that demand the need for patient temperature control systems globally. In the U.S., an estimated 10-12 million incidents of hypothermia along with another 2-3 million incidents of hyperpyrexia have been observed. Factors such as blood loss due to injury/shock, extreme environments, natural calamities, and cold stored blood/IV that may cause hypothermia, increases the risk of fatality. It has been observed that in the U.S. out of few million incidents of IV induced hypothermia, 75.0% cases are caused in ambulatory settings. In order to prevent risk due to blood/IV induced hypothermia, portable blood/IV warmers have witnessed an increasing demand in the U.S. and EU since 2010, thereby driving the market’s growth over the forecast period.

Road accidents and gunshot wounds are the primary reason for fatalities due to major blood loss, globally. Hemorrhagic shock results in the death of around 60,000 U.S. citizens, whereas globally the number of fatalities go up to 2.0 million deaths annually. Among the global hemorrhagic fatalities, 1.5 million are due to physical injury such as road/workplace accident, and gunshot wounds. Blood/IV warmers reduce the risk of hypothermic complications caused by inducing cold stored blood/IV to hemorrhagic patients and thereby help in increasing the chances of patient survival.

Growing incidence of surgical procedures have further fueled the demand for patient temperature control devices in North America. Over 70.0% of patient warming demands in the U.S. are met in hospitals, whereas the rest are met in ambulatory services and defense sectors. Major surgical procedures often require considerable time to complete. Furthermore, many surgical procedures require transplantation and implants that are often maintained well below regular body temperature in order to control microbial infection. Introduction of such implants are observed to reduce the body temperature of the patient, thereby requiring patient heating systems. Additionally, weaker patients find it difficult to regulate their body temperature and therefore, require body warming devices to help them recover better and reduce the risk of complications.

Product Insights

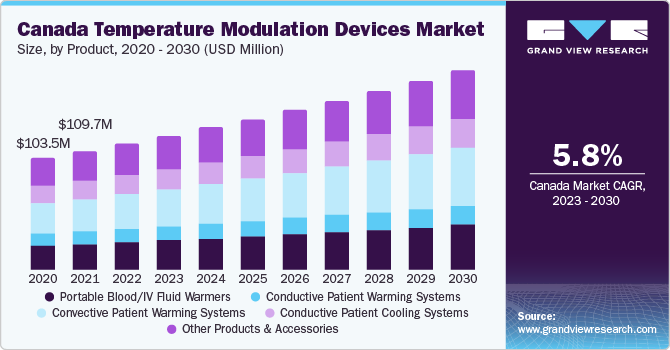

By product type, temperature modulation devices market is categorized into portable blood/IV warming devices, conductive patient heating systems, convective patient heating system, convective patient cooling systems, and other products & accessories. Among the product types, convective patient heating system have been observed to be the largest market in terms of value, owing to the greater demand of patient warming systems in western countries and growing patient pool globally. In addition, growing demand from remote clinics and emergency centres is also expected to fuel the demand for temperature control systems in future.

Accessories and other products were observed to be the second largest market segment in the temperature control devices market segment. Other products include non-portable/traditional blood/IV warmers such as 3M’s Ranger and similar products, along with non-contact temperature regulators and room temperature control systems. Accessories hold a major part of the market, as most consumers often continue to demand product accessories in higher volume than that of the complete device itself. Hospital institutions have steady long-term contracts with suppliers that manufacture temperature modulation device accessories.

Portable blood/IV warmers were observed to be the third largest market segment and second largest product category in terms of market value globally. However, the number of products sold under blood/IV warmer category were significantly higher when compared to convective patient warmer devices. This suggests that volume demand for portable blood/IV warmers remains the highest among temperature control devices. A majority of the demand for portable blood/IV warmers comes from ambulatory and defence sectors. However, when compared to the overall product value demand for blood/IV warmers, portable devices only cover a fraction of the market, especially in the U.S.

Regional Insights

North America registered maximum market share of 40.0% in 2022 and is expected to witness growth in future as well owing to the high cost of medical devices, increasing healthcare expenditure, and increasing incidence of surgical procedures/hospital visits. In addition, growing number of product development in patient temperature control system is also expected to drive the market in the region.

Increased spending on defense sector in addition to the spending on search and rescue emergency services have resulted in the growing demand for temperature modulation devices in North America. The geographical location of this region results in an extremely cold weather patterns that render the region prone to blizzards and heavy snow. Numerous fatalities have been recorded that have been attributed to such extreme snow/frost related incidents.

Asia Pacific is anticipated to be the fastest growing segment owing to growing presence of quality medical device manufacturers, increased awareness, increased medical expenditure, and demand from remote emergency healthcare & defense sectors to name a few. Moreover, growing number of surgeries in Asia Pacific region owing to the larger population and increasing incidence of accidental injuries are some of the key factors driving the demand for temperature modulation devices in the region.

Key Companies & Market Share Insights

3M is among the most popular manufacturer of patient temperature modulation devices with a known brand in every product segment such as 3M Bear Hugger and 3M Ranger. Bear Hugger is a normothermia system that provides both patient warming and patient cooling effects that helps in significantly increasing the success of patient recovery. 3M ranger has been among the most well-known hospital-based blood/IV warmers in the U.S. and E.U, providing a faster output of body temperature regulated blood/IV fluids with increased volume capacity compared to their competitors, allowing 3M to garner a significant market presence in the western world. Some of the prominent key players in the global temperature modulation devices market include:

-

Stryker Corporation

-

Gentherm Medical

-

Belmont Medical

-

Becton, Dickinson and Company

-

3M

-

The Surgical Company

-

ICU Medical

Temperature Modulation Devices Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.9 billion

Revenue forecast in 2030

USD 4.6 billion

Growth rate

CAGR of 6.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; Australia; South Korea; Mexico; Brazil; Argentina; Colombia; South Africa; Saudi Arabia; UAE

Key companies profiled

Stryker; Gentherm Medical; Belmont Medical; Becton, Dickinson and Company; 3M; The Surgical Company; ICU Medical

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Global Temperature Modulation Devices Market Report Segmentation

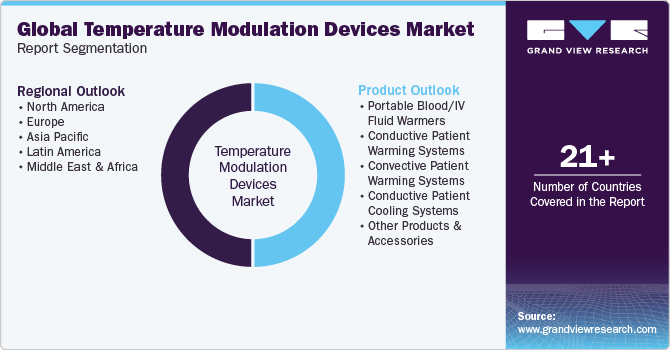

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global temperature modulation devices market report based on product, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Portable Blood/IV fluid warmers

-

Conductive patient warming systems

-

Convective patient warming systems

-

Conductive patient cooling systems

-

Other Products & Accessories

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global Temperature Modulation Devices market size was estimated at USD 2.7 billion in 2022 and is expected to reach USD 2.9 billion in 2023.

b. The global Temperature Modulation Devices market is expected to grow at a compound annual growth rate of 6.9% from 2023 to 2030 to reach USD 4.6 billion by 2030.

b. North America dominated the temperature modulation devices market with a share of 40.0% in 2022. This is attributable to the high cost of medical devices and the expensive medical care market in North America.

b. Some key players operating in the temperature modulation devices market include Stryker, Gentherm Medical, Belmont Medical, The Surgical Company, 3M, Mennen Medical, and Smiths Medical.

b. Key factors that are driving the temperature modulation devices market growth include an increasing number of surgical procedures worldwide, growing incidence of road accident fatalities, growing demand of blood/IV warmers from ambulatory services, and military/defense sectors are expected to further fuel the market’s growth in the near future.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."