- Home

- »

- Advanced Interior Materials

- »

-

Textile Recycling Market Size, Share & Analysis Report, 2030GVR Report cover

![Textile Recycling Market Size, Share & Trends Report]()

Textile Recycling Market Size, Share & Trends Analysis Report By Material (Cotton, Polyester, Wool, Polyamide), By Source (Apparel Waste), By Process (Mechanical), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-969-1

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Textile Recycling Market Size & Trends

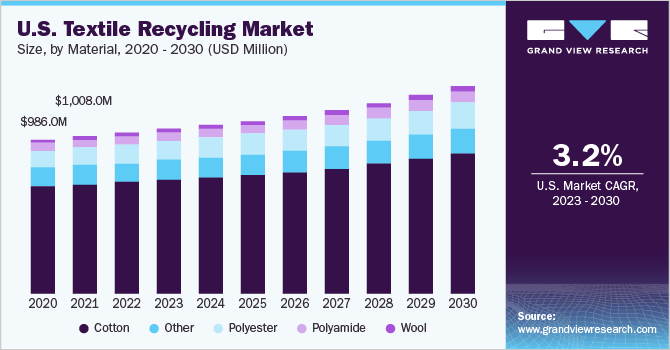

The global textile recycling market size was valued at USD 4,632.4 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 3.2% from 2023 to 2030. The rising environmental concern about textile waste production and growing social awareness about textile recycling is expected to propel the market growth.According to the Environmental Protection Agency (EPA), 5% of landfill space is occupied by textile waste. The U.S. produces an average of 25 billion pounds of textiles yearly or around 82 pounds per citizen. These aforementioned factors are expected to drive the demand for textile recycling over the forecast period. Textile waste recycling provides environmental sustainability. Upcycling is a potential recycling approach that maximizes resource conservation of water, raw materials, and energy and minimizes the environmental impact. Furthermore, textile recycling lessens the environmental effect compared to textile incineration and landfill disposal. By replacing items made from primary resources, resource recovery can result in considerable environmental advantages. All the aforementioned factors are expected to boost the market growth over the forecast period.

According to the National Council of Textile Organization of the U.S., the textile industry in the U.S. is one of the largest producers of textile-related products in the world. Moreover, the waste generated from discarded textiles amounts to a large quantity in the U.S. According to the Council for Textile Recycling, the average citizen throws away approximately 70 pounds of textiles annually in the country. These aforementioned factors are expected to propel the demand for textile recycling in the coming years.

Moreover, the increasing population and the consumer rising spending capacity are anticipated to generate textile waste and result in concerns about its management. Several government authorities and private firms are considering textile recycling as one of the solutions for tackling issues related to textile waste management and promoting the adoption of a circular economy in the country. According to the U.S. Environmental Protection Agency Report 2022, the rate of recycling of all textiles in the country was 14.7% in 2018.

In the U.S., various programs and start-ups are gaining momentum, contributing significantly to the increasing rate of textile recycling. American Textile Recycling Services (ATRS) is the donation bin operator, for donation and collection services of clothing, footwear, and household items. ARTS is continuously expanding to the new cities in the country driving the growth of recycling. These aforementioned factors are anticipated to further propel the demand for textile recycling in the U.S. over the projected period.

Clothing and textile waste production are rising continuously as the average life of a particular garment is decreasing. This has a huge impact on the environment due to landfill disposal and incineration process, giving rise to greenhouse gas emissions. According to EPA and SMART, recycling textiles has a major impact on reducing greenhouse gas emissions and acts as a growth driver. Furthermore, developments in recycling techniques and groundbreaking research in the field are anticipated to facilitate the growth of the market. For instance, LIST Technology AG announced a breakthrough in the textile recycling industry and presented a lyocell T-shirt made from 100% recycled material, in February 2022, at the International Conference on Cellulose Fibers.

The U.S. Government has set goals to increase consumer awareness regarding textile recycling. For instance, the government has launched an initiative to achieve zero waste by 2037 under the guidance of the Council of Textile Recycling (CTR). With this initiative, the Council of Textile Recycling (CTR) is focused on post-consumer decision-making and is reaching out to manufacturers, brands, municipalities, retailers, and charities beyond textile recyclers to increase awareness regarding recycling. The aforementioned developments and initiatives are expected to contribute to the growth of the industry in the U.S. in the coming years.

Material Insights

The cotton material segment led the market and accounted for 69.7% of the global textile recycling revenue share in 2022. Recycled cotton reduces textile waste and uses considerably fewer resources than conventional or organic cotton, making it a sustainable option. Due to its considerable demand and utilization in clothing and other textiles, cotton is one of the biggest contributors to textile waste. In the textile sector, wool apparel has better intrinsic durability and longer shelf life.

Tyton BioSciences created a water-based hydrothermal solution to recycle garments made of cotton, polyester, and polycotton blends. Their low-impact method removes the cotton from polyester by disassembling it into its monomer components, allowing it to be reassembled into new polyester while preserving the cellulose integrity for use in Man Made Cellulosic Fibres (MMCFs) as a replacement for new tree pulp. Moreover, Tyton BioSciences closed USD 8 million in funding in 2022, which is expected to be used to speed up its path to commercialization. The round was led by Tin Shed Ventures, the investment arm of the clothing company, Patagonia.

The polyester recycling segment is expected to register a CAGR of 4.7% over the forecast period. Due to increasing demand from the apparel industry as many companies continue to commit to the increased use of recycled polyester in clothing, replacing normal polyester. Compared to virgin polyester, recycled polyester has a smaller carbon impact, according to the Sustainable Apparel Coalition's Higg Material Sustainability Index. Moreover, each kilogram of mechanically recycled polyester results in a reduction of approximately 70% of greenhouse gas emissions.

Recycled polyamide is an ideal alternative for ecologically conscious consumers, as it diverts waste from landfills and provides plastic a new lease of life in products. Recycled polyamide has the advantage of being more circular than recycled polyester because it can be recycled endlessly. Compared to virgin polyamide/ nylon, the use of recycled polyamide fabrics can dramatically lower CO2 emissions. For instance, Patagonia uses recycled polyamide in 90% of the apparel they created, resulting in a 20% reduction in emissions, which amounts to over 3.5 million pounds of CO2.

Source Insights

The apparel waste segment accounted for 28.9% of the global textile recycling revenue in 2022. It consists of waste produced by the leftover fabric during the manufacturing, rejected/damaged garments, and post-consumer discarded clothes, and shoes, among others. Over the last two decades, the average lifespan of a new garment has reduced significantly, resulting in more waste products from the apparel industry. These aforementioned factors are expected to drive the demand for the textile recycling of apparel.

Home furnishing waste consists of textile waste generated from pillows, carpets, rugs, bedsheets, curtains, and sofas. Increasing disposable income across the world has resulted in increased spending and frequent buying of these products, simultaneously giving rise to the generation of home furnishing waste. Factors such as population expansion, an increase in the variety of home furnishings available, and an improvement in living standards contribute to global home furnishing consumption, which generates a substantial amount of post-industrial and post-consumer home furnishing waste. These aforementioned factors are expected to drive the demand for the recycling of home furnishing waste.

The automotive waste segment is expected to witness growth at a CAGR of 3.3% over the forecast period. The textile used in automobiles includes carpets, seat covers, cushions, roof liners, door liners, tires, filters, and airbags. Increasing vehicle ownership in developing nations is also creating the problem of automotive waste. Increasing automotive textile waste management initiatives are likely to prompt positive market growth.

Stuffed toys are classified as textiles for recycling, and according to the Secondary Materials and Recycled Textiles Association (SMART), only 15% of textiles in the U.S. are donated for reuse or recycling. Every year, the average American family discards 324 pounds of unwanted textiles including stuffed animals. Furthermore, in 2021, Bank & Vogue Ltd. recycled approximately 1,400,000 pounds of toys. SK-Tex recycled clothing, converting it into car seat upholstery filling, furniture insulation, and ECO building insulation. These aforementioned factors are expected to drive the demand for the recycling of sailing, fishing nets, insulation, and stuffed toys.

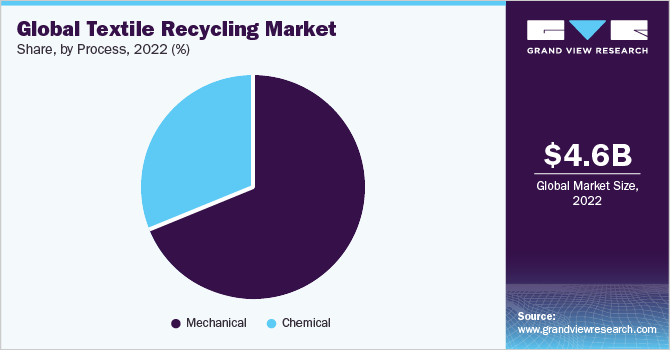

Process Insights

The mechanical segment led the market share and accounted for 70.8% market revenue share in 2022. This is mainly attributed to a large number of players in the market recycling textiles using mechanical process comparatively more than the chemical process. The benefits of using these yarns processed through the mechanical process include the reduced need for chemical processing in the dyeing process because the fibers have color from the previous dyeing, making the entire process waterless.

Mechanical recycling technologies are the topmost CO2-friendly, with a potential reduction of 60%- 90% among all fiber types on spun fiber levels. Furthermore, the company, Recover, from Spain accurately sorts through various types of cotton textile waste to produce high-quality, mechanically recycled cotton fibers. These aforementioned factors are expected to drive the mechanical process for textile recycling over the forecast period.

Chemical textile recycling employs a series of chemical processes to dissolve the fiber from the fabric into solvent/monomer form to construct a newer fiber compound or extract one compound from a mix. The finished items usually retain all of their original physical features and are of comparable quality to their virgin counterparts. When it comes to the technology, this is far better than mechanical recycling due to the use of enzymes, chemicals, and controlled environments, with the added benefit of fewer limitations in the form of fabric, such as knits, catering to a wide range of products such as auto parts, jackets, and home decor.

The chemical process segment is expected to grow at a CAGR of 3.8% over the forecast period. With increasing research and development, new solutions have been emerging in the chemical recycling market. Around 20%-30% of regenerated viscose is used for optimal recycled viscose yarn, however, with technological advancements, this percentage is on the rise. In 2020, Birla Cellulose was working to develop solutions with 50%+ recycled content. Technological advances for chemically reutilizing textile fibers are emerging across the world as they can potentially reduce the huge environmental impact of the textile industry.

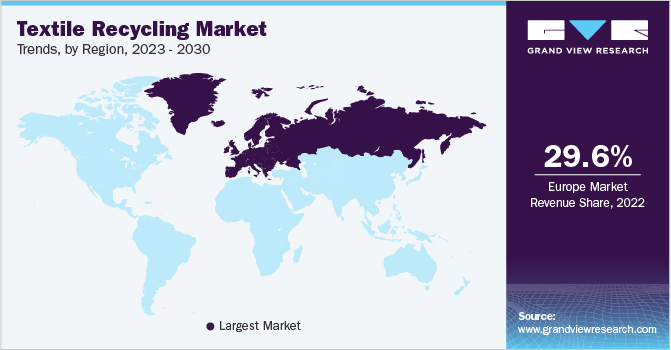

Regional Insights

Europe region led the textile recycling industry and accounted for 29.6% of the global revenue share in 2022. The market in the region is also expected to grow significantly in the coming years owing to surging support from governments of the countries and an increasing number of initiatives related to recycling. The Waste and Resources Action Program (WRAP) registered in the UK and operational across Europe with the support of local governments and private firms, promotes the recycling of waste, including textile waste in the region.

In Europe; Germany, Italy, France, Belgium, the Czech Republic, and Poland are the biggest market for recycled apparel. Italy is a well-known hub for the recycling of textiles and is the capital of textile recycling. Over a hundred companies have joined the Italian Textile and Recycling Association, located in Prato, Italy, where traditionally, old rugs and clothes are collected from all over the world and converted into yarn.

Asia Pacific is anticipated to register a CAGR of 3.8% over the forecast period. The demand for textile recycling activities is anticipated to increase in this region over the forecast period owing to rising concerns regarding the environmental impact of textile waste, increasing government initiatives for textile waste management, and ongoing development of innovative technologies for textile recycling.

Textile consumption and waste generation are also increasing in Central & South America owing to a surge in consumer spending on goods and services. This has led to a rise in demand for sustainable textile waste management solutions and an increase in the requirement for textile recycling activities in the region.

Key Companies & Market Share Insights

The global market is still niche and at a developing stage. The market is fragmented and is characterized by the presence of small-scale key players. Key strategies opted by the key players include technological development, expansion, and merger and acquisitions, to increase revenue generation and market share.

In April 2023, Zara partnered with Circ to launch a womenswear collection made with recycled polyester and lyocell separated from blended textile waste. Furthermore, in June 2020, the PET recycling facility of AG Resinas Ltda. Was acquired by Indorama Ventures Public Company Limited through one of its subsidiaries. The company acquired a 100% equity stake. AG Resinas is located in Juiz de Fora, Brazil, and processes post-consumer PET into recycled flakes and pellets of PET. Some prominent players in the global textile recycling market include:

-

Worn again technologies

-

Lenzing Group

-

Birla Cellulose

-

BLS Ecotech

-

The Woolmark Company

-

iinouiio Ltd

-

Ecotex Group

-

The Boer Group

-

Unifi, Inc.

-

Textile Recycling International

-

Hyosung Group

-

Martex Fiber

-

RenewCell

-

Pistoni S.r.l.

-

RE TEXTIL Deutschland GmbH.

Textile Recycling Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4,737.0 million

Revenue forecast in 2030

USD 5,962.7 million

Growth rate

CAGR of 3.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

May 2023

Quantitative units

Revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, trends

Segments covered

Material, source, process, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country Scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; China; India; Japan; Australia; Brazil; Argentina; UAE; Saudi Arabia

Key companies profiled

Worn again technologies; Lenzing Group; Birla Cellulose; BLS Ecotech; The Woolmark Company ; iinouiio Ltd; Ecotex Group ; The Boer Group; Unifi, Inc.; Textile Recycling International; Hyosung Group; Martex Fiber; RenewCell; Pistoni S.r.l.; RE TEXTIL Deutschland GmbH

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Textile Recycling Market Report Segmentation

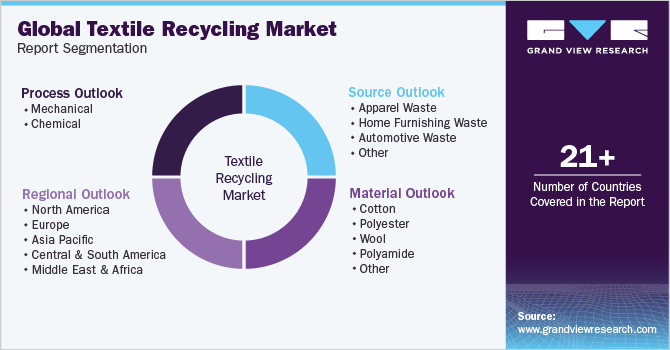

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global textile recycling market report based on material, source, process, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Cotton

-

Polyester

-

Wool

-

Polyamide

-

Other

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Apparel Waste

-

Home Furnishing Waste

-

Automotive Waste

-

Other

-

-

Process Outlook (Revenue, USD Million, 2018 - 2030)

-

Mechanical

-

Chemical

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

U.K.

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global textile recycling market size was estimated at USD 4,632.4 million in 2022 and is expected to be USD 4,737.0 million in 2023.

b. The textile recycling market, in terms of revenue, is expected to grow at a compound annual growth rate of 3.2% from 2023 to 2030 to reach USD 5,962.7 million by 2030.

b. Europe dominated the textile recycling market with a revenue share of 29.6% in 2022. Higher generation of textile waste, higher collection rate, and strong presence of key players in the region attributable for the large market revenue share.

b. Some of the key players operating in the textile recycling market include: Worn Again Technologies, Lenzing Group, Birla Cellulose, BLS Ecotech, The Woolmark Company, iinouiio Ltd, Ecotex Group, The Boer Group, Unifi, Inc., Textile Recycling International, Hyosung Group, Martex Fiber, Re:NewCell, Pistoni S.r.l., and RE TEXTIL Deutschland GmbH.

b. Key factors that are driving the textile recycling market growth include rising environmental concerns over textile waste disposal, increasing initiatives in waste managements, developments in the recycling technologies and increasing consumer social awareness.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."