- Home

- »

- Medical Devices

- »

-

Therapeutic Contact Lenses Market Size Analysis Report, 2030GVR Report cover

![Therapeutic Contact Lenses Market Size, Share & Trends Report]()

Therapeutic Contact Lenses Market Size, Share & Trends Analysis Report By Product (Soft Lens, Rigid Lens), By Application (Corneal Surgery/Disorders, Post Ocular Surgery, Drug Delivery), By Distribution Channel, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-945-8

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Healthcare

Report Overview

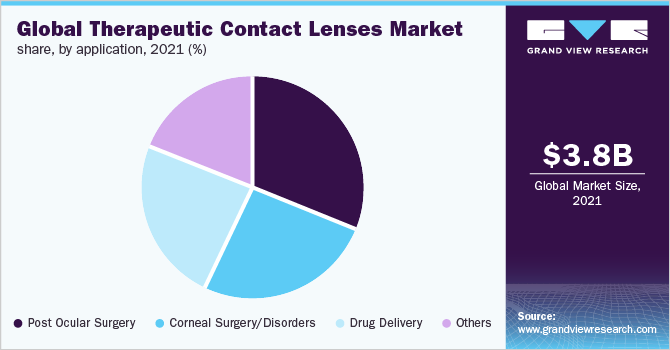

The global therapeutic contact lenses market size was estimated at USD 3.8 billion in 2021 and is estimated to expand at a compound annual growth rate (CAGR) of 7.13% during the forecast period. A rising number of research and development activities have been used in optometry and optics to advance the technology. Advances such as the introduction of dynamic soft therapeutic contact lenses combined with advanced technology are predicted to boost the growth of therapeutic contact lenses. Favorable government support and reimbursements, along with technological advancements in therapeutic contact lenses are the major factors anticipated to augment the market growth. Several hospitals and medical practices were affected during the COVID-19 pandemic owing to several changes in protocols.

The ophthalmology procedures were also affected in this novel COVID-19 disease outbreak as health checkups along with surgical procedures including ophthalmology were reduced due to COVID-19 restrictions. Additionally, the supply chain of the therapeutic contact lens was also disrupted during the COVID-19, creating a negative impact on the market growth in 2020.

The impact of the pandemic on the optical industry has largely demonstrated itself through negative economic effects; delayed diagnoses and treatments for patients; and a stated rise in situations such as digital eye strain, quarantine myopia, and Mask Associated Dry Eye (MADE). This is anticipated to gradually surge the demand for therapeutic contact lens during this period.

Also, there have been disparities in the availability and adaptability of optical services during the COVID-19 pandemic.

Therapeutic contact lenses are a significant tool for the treatment of ocular diseases and other corneal disorders. These lenses protect the cornea from environmental circumstances and counter the coarse effects of the patient’s eyelids. Therapeutic contact lenses can help repair tissue, maintain visual acuity and manage pain. Additionally, therapeutic contact lenses are used to protect the ocular surface from mechanical erosions, and among patients with recurring corneal erosion syndrome to aid promote re-epithelialization and reduce pain. Hence, increasing cases of corneal diseases is anticipated to propel the demand for therapeutic contact lens during the forecast period.

Increasing developments in therapeutic contact lenses along with drug-delivering capabilities are some of the factors anticipated to augment the market over the forecast period. Increasing demand for soft contact lenses is expected to create potential growth opportunities in the market for therapeutic contact lenses. Furthermore, several manufacturers are focusing on developing and advancing therapeutic contact lenses to expand their geographical position. Additionally, companies operating in the therapeutic contact lenses market are augmenting their output product capacities including therapeutic contact lens to resolve various corneal disorders.

Product Insights

The soft lens segment held the largest share accounting for around 65% market share in 2021 owing to the high effectiveness and adoption rates of the soft lens throughout the globe. For several ocular conditions, therapeutic contact lenses can help limit the acute pain that patients experience. A patient’s quality of life can be considerably improved through the use of a therapeutic contact lens.

The silicon hydrogel segment held a considerable market share in 2021. Silicon hydrogel is more compatible with the physiology of cornea than its predecessors, hence there is a reduced risk of hypoxia-related complications. Several silicon hydrogel lenses are available for day and night wear. Recently developed soft lenses have low water content and are more resistant to dehydration, thereby increasing their preference among individuals.

The rigid lens segment held a substantial market share in 2020. Rigid lenses are often used for therapeutic and optical indications. Corneal abnormalities leading to a high amount of irregular astigmatism will benefit visually only with the rigid lens. Increasing adoption of the rigid lens and rising prevalence of ocular disorders owing to its competitive advantage over the soft lens is anticipated to secure the market position. Also, increasing R&D investments for rigid lenses across the globe is predicted to augment the market progression.

Application Insights

Post corneal surgery segment held around 36.9% market share in 2021. Therapeutic contact lenses are extensively used to relieve pain, enhance healing of the corneal surface and protect the cornea. Therapeutic contact lenses are used postoperatively to aid in pain relief. After refractive surgery procedures such as photorefractive keratectomy (PRK) or laser epithelial keratomileusis (LASEK), therapeutic contact lenses are used for better pain relief.

The corneal surgery/disorders segment held a considerable market share in 2021. Therapeutic contact lenses (TCLs) are frequently used in the management of a wide variety of ocular surface diseases (OSDs) and corneal. Therapeutic contact lenses without or with glue adhesives are used to close and seal small corneal damages. Sometimes, they are also used as linking treatment before penetrating keratoplasty in larger corneal perforations, thereby increasing its adoption rate. An increasing number of corneal surgeries across the globe is anticipated to boost the segment growth during the forecast period.

Distribution Channel Insights

Based on distribution channel, the market is segmented into retail, e-commerce, and others. Retail is among the leading segment holding around 52% market share in 2021. The retail segment is growing owing to the manufacturer’s initiative to produce advanced therapeutic contact lenses at an affordable price at retail stores, which are also united with extra discounts provided by retail sellers. Additionally, the robust growth of retail pharmacies in developed economies is anticipated to fuel the segment growth.

The e-commerce segment witnessed over 6.78% CAGR during the forecast period. The segmental growth is attributable to the increasing focus of manufacturers on distributing their products through online platform for easy product availability among patients. For instance, UltraVision CLPL is escalating its business through e-commerce and building a product portfolio in hydrogel therapeutic contact lenses.

Regional Insights

North America dominated the therapeutic contact lens in 2021. Recent progressions in therapeutic contact lenses and the launch of dynamic soft contact lenses combined with flexibility and choices are some of the factors responsible for the largest share held by North America. The increasing number of outdoor activities and the presence of advanced healthcare infrastructure across the U.S. and Canada is predicted to accelerate the therapeutic contact lens market growth. In addition, the local presence of major market players in the U.S., such as CooperVision, Alcon, Bausch & Lomb Incorporated, and others is expected to augment the regional growth.

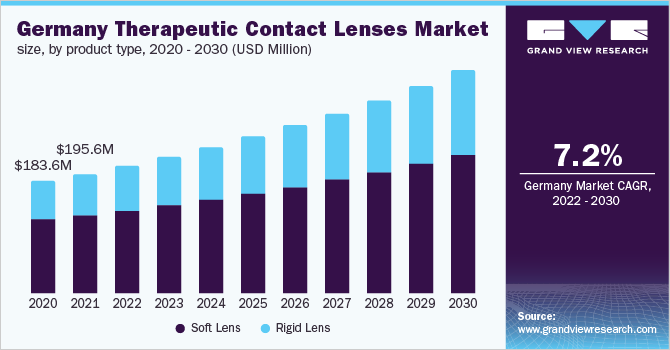

The European region accounted for the second-highest revenue and is expected to grow with a CAGR of around 6.93% during the forecast period. The increasing prevalence of ocular diseases is estimated to surge the adoption of therapeutic contact lenses among healthcare professionals. The region is expected to grow at a lucrative rate during the forecast period due to the presence of skilled professionals and a well-established healthcare infrastructure.

Asia Pacific is predicted to expand at a significant CAGR over the forecast period. An increase in purchasing power of consumers is anticipated to foster the growth of the therapeutic contact lens market. Rising elderly population base and increasing adoption of therapeutic contact lenses. within India and China is anticipated to fuel the market. Furthermore, increasing healthcare expenditure and R&D activities is expected to boost the demand for therapeutic contact lens over the forecast period.

Key Companies & Market Share Insights

Key companies operating in the therapeutic contact lens arena have established vital business strategies such as strategic acquisitions & collaborations, product launches, approvals, and innovations are some of the significant business strategies adopted by market participants to maintain a strong market position. The market is focusing on R&D activities to develop efficient and cost-effective therapeutic contact lens. For instance, in April 2021, Johnson & Johnson Vision announced a collaboration with Menicon for developing and manufacturing therapeutic contact lens. Some of the key players operating in the global therapeutic contact lenses market include:

-

Bausch & Lomb Incorporated

-

Advanced Vision Technologies

-

CooperVision

-

VISTAKON (division of Johnson & Johnson Vision Care, Inc.)

-

X-Cel Specialty Contacts

-

Contamac

-

Excellent Hi-Care Pvt Ltd

-

Alcon

-

Surgitech Innovation

-

UltraVision CLPL

Therapeutic Contact Lenses Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 4.08 billion

Revenue forecast in 2030

USD 7.08 billion

Growth rate

CAGR of 7.13% from 2022 to 2030

Base year for estimation

2021

Actual estimates/Historic data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million & CAGR from 2022 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors & trends

Segments covered

Product type, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; South Korea; Australia; Brazil; Mexico; Argentina; Columbia; South Africa; Saudi Arabia; UAE

Key companies profiled

Bausch & Lomb Incorporated; Advanced Vision Technologies; CooperVision; VISTAKON (division of Johnson & Johnson Vision Care, Inc.); X-Cel Specialty Contacts; Contamac; Excellent Hi-Care Pvt Ltd; Alcon; Surgitech Innovation; UltraVision CLPL

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global therapeutic contact lenses market report based on product type, application, distribution channel, and region:

-

Product Type Outlook (Revenue, USD Million; 2017 - 2030)

-

Soft Lens

-

Silicon hydrogel

-

Hydrogel

-

Others

-

-

Rigid Lens

-

-

Application Outlook (Revenue, USD Million; 2017 - 2030)

-

Corneal Surgery/Disorders

-

Post Ocular Surgery

-

Drug Delivery

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million; 2017 - 2030)

-

Retail

-

E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global therapeutic contact lens market size was estimated at USD 3.8 billion in 2021 and is expected to reach USD 4.08 billion in 2022.

b. The global therapeutic contact lens market is expected to grow at a compound annual growth rate of 7.13% from 2022 to 2030 to reach USD 7.08 billion by 2030.

b. North America dominated the global therapeutic contact lens market with a share of 42.5% in 2021. This is attributable to the rising geriatric population, and well-developed healthcare infrastructure.

b. Some key players operating in the global therapeutic contact lens market include Bausch & Lomb Incorporated, Advanced Vision Technologies, Contamac, Alcon, Surgitech Innovation, Johnson & Johnson Vision Care, CooperVision, X-Cel Specialty Contacts, UltraVision CLPL

b. Key factors that are driving the therapeutic contact lens market growth include the increasing aging population base, a rising number of corneal surgeries, and developing healthcare infrastructure across the globe.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."