- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Tocotrienol Market Size, Share & Trends Report, 2030GVR Report cover

![Tocotrienol Market Size, Share & Trends Report]()

Tocotrienol Market Size, Share & Trends Analysis Report By Product (Alpha, Beta, Gamma, Delta), By End-use (Dietary Supplements, Pharmaceuticals, Cosmetics, Others), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-762-9

- Number of Pages: 125

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Consumer Goods

Tocotrienol Market Size & Trends

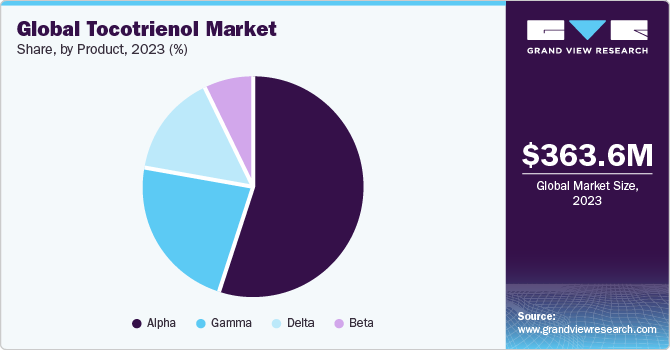

The global tocotrienol market size was estimated at USD 363.6 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.1% from 2024 to 2030. This is attributed to tocotrienols increasing demand in pill and capsule form as an important source of vitamin E. Tocotrienols are known for their potential as antioxidants and their role in preventing heart damage and reducing platelet aggressiveness This awareness has led to a rise in consumption and demand for tocotrienols. The growth of its various end-use industries such as food manufacturing, beauty products, and biofuels has also contributed to a rise in demand for the product.

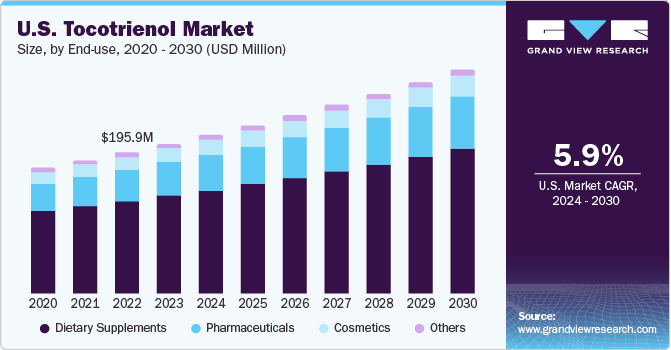

The U.S. tocotrienol market is influenced by several factors including increasing awareness of the role of lipids and lipoproteins as risk factors for cardiovascular disease (CVD). As CVD remains a significant health concern, there is a growing demand for products that can help manage and prevent such conditions. Tocotrienols, with their potential cardiovascular benefits, have gained attention in the market.

Furthermore, the U.S. market is influenced by the demand for functional foods and dietary supplements. Elevated triglyceride levels and other risk factors associated with CVD have led to an increased focus on dietary interventions. Tocotrienols, as a dietary supplement, are being recognized for their potential in managing these risk factors. The market for functional foods and dietary supplements is highly competitive, with various companies from food, pharma, agriculture, and nutraceutical sectors contending for market share.

Key end-use industries in the global market for tocotrienol include food manufacturing, beauty products, and dietary supplements. In the food industry, tocotrienols are used as additives to perform special functions, such as stabilizing and maintaining quality of processed foods. In the beauty industry, tocotrienols are incorporated into skincare products due to their potential benefits for skin health and wellness. In addition, the dietary supplement industry utilizes tocotrienols as a natural remedy for managing cardiovascular health and other conditions.

The evolving role of cosmetic products in personal wellness is another driver of the tocotrienol market. Consumers are increasingly recognizing the importance of skincare and beauty products in maintaining overall well-being. Tocotrienols, known for their potential benefits for skin health, are being incorporated into skincare formulations, contributing to the market growth.

Market Concentration & Characteristics

The global market is consolidated in nature, with key players such as BASF SE, Caymen Chemical and Parchem dominating the industry. This consolidation is driven by factors such as high entry barriers, including the need for significant investments in research and development, production capabilities, and distribution networks. In addition, established companies benefit from brand recognition and customer loyalty, further solidifying their market position.

The market is also influenced by increasing demand for tocotrienols in various end-use industries. One of the significant factors driving this demand is growing awareness of the health benefits associated with tocotrienols. This is contributing to a few big market players acting as primary suppliers for key corporations in the end-use industries such as cosmetics, pharmaceuticals, and food & beverages.

The global market is characterized by continuous innovation and product development. Companies are investing in research and development to enhance the efficacy and bioavailability of tocotrienols, leading to introduction of novel formulations and delivery systems. For instance, nanoemulsion technology has been applied to improve absorption and stability of tocotrienols, allowing for better bioavailability and effectiveness.

The market is also influenced by changing regulations and standards in different regions. For instance, the European Union has implemented strict regulations regarding use of tocotrienols in food and cosmetic products, ensuring their safety and quality. Compliance with these regulations is essential for companies operating in the European market, driving the need for standardized production processes and quality control measures.

Product Insights

Alpha dominated the market and accounted for a share of 54.8% in 2023. This high percentage can be attributed to its application as an effective antioxidant in pharmaceutical and nutraceutical industries as a dietary supplement. Its usage is primarily focused on promoting cardiovascular health, reducing inflammation, and protecting against various types of cancer. End-use industries that benefit from alpha tocotrienol include dietary supplement manufacturers, pharmaceutical companies, and functional food producers.

Gamma tocotrienol is another major form of tocotrienol and is known for its potent antioxidant properties. It is widely used in cosmetic and skincare industry due to its ability to protect the skin from oxidative stress and damage caused by free radicals. Gamma tocotrienol is commonly found in anti-aging creams, lotions, and serums. With increasing awareness and demand for natural and organic skincare products, gamma-tocotrienol has gained significant popularity. It is often used as a key ingredient in products targeting skin rejuvenation, wrinkle reduction, and UV protection.

Delta is used in the development of drugs and therapies focused on liver diseases such as non-alcoholic fatty liver disease and hepatitis. Delta tocotrienol has applications in reducing liver inflammation, protecting against liver damage, and supporting overall liver function. In the medical industry, delta-tocotrienol is used in formulation of supplements targeting inflammation-related conditions, such as arthritis and cardiovascular diseases. The demand for delta-tocotrienol is driven by increasing prevalence of these health conditions and growing consumer interest in natural alternatives for reducing inflammation.

End-use Insights

The dietary supplements segment dominated the market in 2023. This is attributable to usage of tocotrienols, including alpha, gamma, and delta tocotrienols, are commonly used as ingredients in dietary supplements due to their potential health benefits. Tocotrienols are a form of vitamin E that possess antioxidant properties and have been associated with various health benefits, including cardiovascular health, brain health, and anti-inflammatory effects. The trend in the dietary supplement industry is towards personalized nutrition and targeted supplementation, contributing to the tocotrienols market growth.

The pharmaceutical sector is projected to grow at the fastest CAGR over the forecast period. Pharmaceuticals are another important end-user industry for tocotrienols. They are used in various pharmaceutical applications, including drug delivery systems and as therapeutic agents. Their antioxidant and anti-inflammatory properties make them viable options for the development of new pharmaceutical formulations. Tocotrienols can be used in pharmaceutical formulations as excipients or as active pharmaceutical ingredients (APIs). As excipients, they can enhance stability and bioavailability of drugs.

In cosmetics, tocotrienols are primarily used as ingredients in skincare products, hair care products, and anti-aging formulations. They can be found in creams, lotions, serums, and oils. Tocotrienols help to nourish and hydrate skin, improve skin elasticity, and reduce the appearance of fine lines and wrinkles. They can also help to protect skin from environmental stressors, such as pollution and UV radiation.

Regional Insights

North America dominated the market and accounted for a 60.0% share in 2023. This high share is attributable to a rise in health-conscious consumers in the region who are looking to incorporate natural and effective ingredients in their skincare and wellness products. They help in reducing appearance of wrinkles, improving skin elasticity, and providing protection against UV-induced damage. Skincare brands in the region such as Biossance and Drunk Elephant have incorporated tocotrienols into their product formulations, highlighting their antioxidant and anti-aging benefits.

Asia Pacific is anticipated to witness significant growth in the market. This is attributed to extensive usage of tocotrienols in expanding cosmetics industry in the Asia Pacific region. The Asia Pacific cosmetics market is witnessing a surge in demand for products that combine traditional wisdom with modern science. Tocotrienols, with their natural origin and proven benefits, have aligned with this trend, resulting in a significant increase in their consumption. For instance, Korean skincare brands like Innisfree and Sulwhasoo have incorporated tocotrienols into their formulations, emphasizing their antioxidant and anti-aging properties.

European market for tocotrienols is driven by growing trend towards sustainable and eco-friendly beauty products in the region. Consumers are increasingly conscious of the environmental impact of their skincare choices and are seeking products that are ethically sourced and produced. Brands such as The Body Shop and Weleda incorporate tocotrienols into their skincare formulations, highlighting their antioxidant and skin-nourishing properties. The European market also emphasizes transparency making tocotrienols an attractive choice for consumers looking for high-quality cosmetics.

Key Companies & Market Share Insights

Some of the key players operating in the market include Caymen Chemical; SOP Nutraceuticals and Orochem Technologies Inc.

-

Caymen Chemical specializes in manufacturing of tocotrienols (γ-Tocotrienol, α-Tocotrienol), biochemical, assay kits, recombinant proteins, and antibodies. It serves products targeted mainly at two segments, human and animal health

-

SOP Nutraceuticals has two primary processing schemes for manufacturing of tocotrienol and offers carotenes and red palm oil in its product offerings under its Merris brands

Davos Life Science, SourceOne Global Partners and Sime Darby Oils Nutrition are some of the emerging market participants in the market.

-

Davos Life Science is a part of the KLK OLEO, the oleochemicals business segment of Kualalumpur Kepong Berhad. It has a variety of oleo-based offerings under its DavosLife E3 and DavosLife BiCarotene brand, serving the food & beverages and cosmetics & personal care industries

-

SourceOne Global Partners is a provider of health and wellness products such as VESIsorb COQ10 soft gel and other products powered by VESIsorb technology, aimed at medical, food & beverages, and personal care sectors

Key Tocotrienol Companies:

- BASF SE

- BTSA Biotechnologías Aplicados SA

- American River Nutrition, Inc.

- Eisai Co., Ltd.

- Vance Group Ltd.

- ExcelVite

- Davos Life Science

- SourceOne Global Partners

- Cayman Chemical

- Orochem Technologies Inc.

- A.C. Grace Company

- Parchem

- Sime Darby Oils Nutrition.

- Supervitamins Sdn. Bhd.

- SOP Nutraceuticals

Recent Developments

-

In October 2023, PhytoGaia, a key firm in the nutraceutical unveiled a new series of branded ingredients such as TocoGaia and STGaia. The ingredients are manufactured for usage in gluten-free and vegan diets, offering properties such as sugar-free and low in calories.

-

In July 2023, KLK OLEO, a key organization working in phytonutrients and oleo chemicals unveiled a new range of sustainable products including the DavosLife E3 DVP 30-WD, a natural tocotrienol water dispersible powder. The product, produced using tocotrienol will be available in hard capsules, functional food & beverage and will work for anti-inflammation and autoxidation purposes.

-

In January 2023, the Malaysian ministry of health authorized the use of palm tocotrienol rich fraction. It authorized the use of palm based tocotrienol extracts for usage in improving cognitive function and reducing oxidative stress.

Tocotrienol Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 387.60 million

Revenue forecast in 2030

USD 586.67 million

Growth rate

CAGR of 6.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

BASF SE; BTSA Biotechnologías Aplicados SA; American River Nutrition., Inc.; Eisai Co., Ltd.; Vance Group Ltd.; ExcelVite, Davos Life Science; SourceOne Global Partners; Cayman Chemical; Orochem Technologies Inc.; A.C. Grace Company; Parchem; Sime Darby Oils Nutrition; Supervitamins Sdn. Bhd.; SOP Nutraceuticals Sdn. Bhd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Tocotrienol Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global tocotrienol market report based on product, end-use, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Alpha

-

Beta

-

Gamma

-

Delta

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Dietary Supplements

-

Pharmaceuticals

-

Cosmetics

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global tocotrienol market size was estimated at USD 363.6 million in 2023 and is expected to reach USD 387.6 million in 2024.

b. The global tocotrienol market is expected to grow at a compound annual growth rate of 6.1% from 2024 to 2030 to reach USD 586.7 million by 2030.

b. Alpha tocotrienol dominated the tocotrienol market with a share of 54.81% in 2023. This is attributable to the fact that it helps lowering the total and the LDL cholesterol level.

b. Some key players operating in the tocotrienol market include American River Nutrition, Ltd, Vance Group, Excel Vite Inc, Davos Life Sciences, Orochem, Eisai FOOD & Chemical Co., Cayman Chemicals, Ac Grace Company and Parachem Fine & Specialty Chemicals and BASF.

b. Key factors that are driving the market growth include rising concern to treat diseases such as pancreatic cancer and respiratory disorders. Tocotrienols naturally derived from annatto help in reducing the inflammation associated with cardiovascular diseases and are also used in anti-aging creams.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."