- Home

- »

- Electronic Devices

- »

-

Traction Transformer Market Size And Share Report, 2030GVR Report cover

![Traction Transformer Market Size, Share & Trends Report]()

Traction Transformer Market Size, Share & Trends Analysis Report By Mounting Position, By Voltage Network (AC Systems, DC Systems), By Rolling Stock (Electric Locomotives, High-Speed Trains), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-046-0

- Number of Pages: 81

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Semiconductors & Electronics

Traction Transformer Market Size & Trends

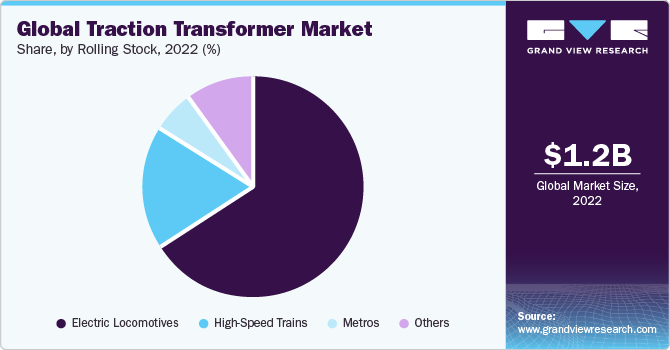

The global traction transformer market size was valued at USD 1.20 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.5% from 2023 to 2030. The promising pace of development of rail infrastructure in several countries across the globe and an increase in the demand for faster commuting networks have helped the market gain momentum over the years.

Several OEMs in the market are entering into public-private partnerships to develop rail infrastructure in different countries worldwide. Furthermore, favorable government initiatives, including funding for the development of better public transportation, are estimated to facilitate the implementation of this equipment, which in turn will help strengthen the operational capabilities of railway infrastructure across several countries over the forecast period.

Moreover, increased adoption of rail traction systems in both traditional and next-generation locomotives, such as diesel and electric locomotives, high-speed trains, and tram trains to support the rising number of passengers and travel routes is expected to drive the market over the forecast years.

The equipment is manufactured with non-flammable, high-temperature, and vibration-resistant materials to deal with varied working as well as climatic conditions across different regions. Such complicated design standards and varying requirements for various railway power supply systems can restrain the growth of the traction transformer market.

Voltage Network Insights

The AC (alternative current) systems segment accounted for the largest revenue share of 69.3% in 2022 and is expected to grow at the fastest CAGR over the forecast period. Growing awareness regarding the need to switch to energy-efficient products as a way of reducing economic and ecological damage caused by outdated technologies is leading to increased demand for AC-type equipment worldwide. Furthermore, the burgeoning popularity of AC systems in mainline railways has been contributing to the growth of the segment.

The DC (direct current) systems segment is expected to witness significant growth over the forecast period. It is attributed to the factors such as voltage stability, increasing electrification of railway networks, and cost efficiency.

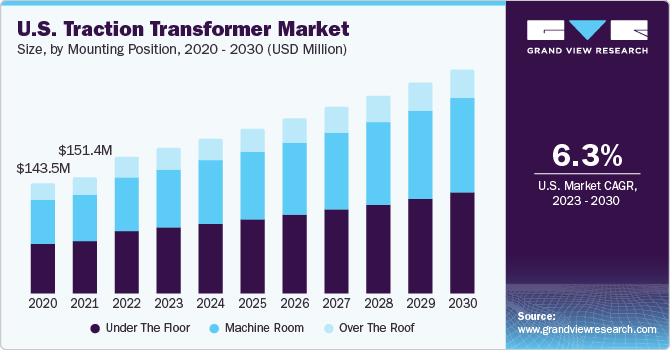

Mounting Position Insights

The under-the-floor segment accounted for the largest revenue share of around 45.3% in 2022. The installation of traction transformers under the floor provides additional space and capacity in trains. Thus, the demand for equipment that can be placed under the floor is expected to experience an upswing 1in economies wherein an increasing population is placing extra pressure on existing transport infrastructure.

The machine room segment is estimated to register the fastest CAGR of 7.5% over the forecast period. Equipment installed in machine rooms offers maximum reliability and flexibility in multi-phase rail systems. Soaring use of machine room traction systems in electric locomotives and high-speed trains is projected to supplement the growth of the segment over the forecast period.

Rolling Stock Insights

The electric locomotives segment held the largest revenue share of 66.0% in 2022 and is expected to grow at the fastest CAGR over the forecast period. As railway infrastructure is continually evolving across the globe, electric locomotives are replacing diesel and steam locomotives. The railway sector is increasingly shifting towards novel technologies and cleaner and faster machines. This trend is anticipated to result in an improved scope of demand for traction transformers in the electric locomotives segment over the forecast period. These transformers also find high adoption in high-speed trains.

The high-speed trains segment is expected to witness significant growth over the forecast period. It is attributed to the increasing importance of energy-efficient and sustainable transportation solutions is boosting the market growth in this segment. Also, high-speed trains require a substantial amount of electrical power to accelerate quickly and maintain high speeds.

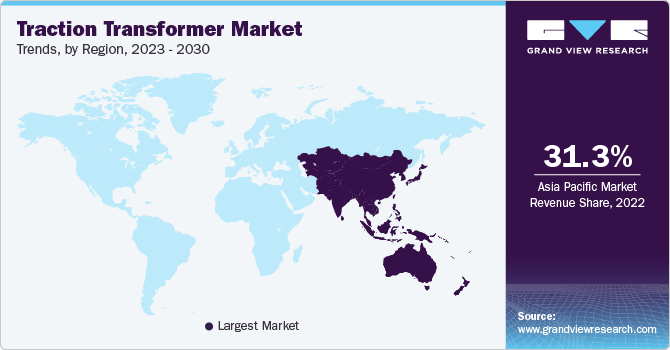

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of 31.3% in 2022 and is expected to grow at the fastest CAGR over the forecast period. This growth is attributed to increasing government investments and favorable regulations aimed at establishing advanced railway infrastructure in the region.

Europe is expected to witness significant growth over the forecast period. The market in Europe is mature, with early implementation of most of the recent technological advancements observed in rail traction systems. The rail infrastructure in emerging and developed economies across the Asia Pacific and Europe has witnessed the advent of high-speed and metro railways over the years, thanks to the steady electrification of national railroads. Major electric traction programs have been undertaken in developed countries across these regions in the past years.

Countries including Japan, Switzerland, Belgium, and the Netherlands are at the forefront of electrified urban rapid-transit rail systems implementation. As such, these regions present promising growth opportunities for advanced traction transformer manufacturers shortly.

Key Companies & Market Share Insights

The industry players are adopting strategic initiatives, such as regional expansion, merger & acquisition, partnership, and collaboration to sustain their market position. Organic growth remains the key strategy for most of the market's incumbents. For instance, in June 2023, VLI, a company specializing in logistics solutions and operating ports, railways, and terminals, announced the signing of a contract. The contract involves the acquisition of nine Wabtec Evolution Series locomotives, specifically the ES43BBI model. These locomotives will be integrated into VLI's premium fleet to facilitate the transportation of cargo on Ferrovia Centro-Atlântica (FCA).

Key Traction Transformer Companies:

- ABB

- Siemens

- JST Transformateurs

- ZARCO REALTIES PRIVATE LIMITED

- Hirect

- International Electric Co., Ltd.

- Mitsubishi Electric Corporation

- Schneider Electric

- Wilson Transformers

- GE

- Setrans Holding AS

Recent Developments

-

In April 2023, the BHEL-TWL consortium achieved a significant milestone by securing a major order for 80 Vande Bharat Trains in one of the largest railway tenders for the manufacturing and maintenance of these trains. BHEL, renowned as a prominent supplier of rolling stock electrics to the Indian railways, will play a crucial role in this project. Their responsibilities encompass the supply of a comprehensive propulsion system, including a train control management system, IGBT-based traction converter-inverter, auxiliary converter, motors, transformers, and mechanical bogies.

-

In January 2023, the RATP (Parisian Autonomous Transport Administration), the operator of the Paris metro, initiated an upgrade program on Line 6, spanning from Charles de Gaulle-Étoile to Nation. As part of this program, MP89 rubber-tired trains are expected to be deployed. The existing MP73 fleet on Line 6 is expected to be replaced by refurbished and shortened MP89 trains from Line 4, reducing their length from six cars to five.

-

In June 2021, Hitachi ABB Power Grids launched two new traction transformers. The RESIBLOC CRail 25 kV transformer replaces mineral oil with dry insulation material, eliminating the risk of oil leakage and ensuring safety. The Natural Cooling Effilight Traction Transformer utilizes natural airflow generated by the train's motion, reducing energy consumption and improving efficiency.

Traction Transformer Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.28 billion

Revenue forecast in 2030

USD 1.99 billion

Growth Rate

CAGR of 6.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Voltage network, mounting position, rolling stock, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

ABB; Siemens; JST Transformateurs; ZARCO REALTIES PRIVATE LIMITED; Hirect; International Electric Co., Ltd.; Mitsubishi Electric Corporation; Schneider Electric; Wilson Transformers; GE; Setrans Holding AS

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Traction Transformer Market Report Segmentation

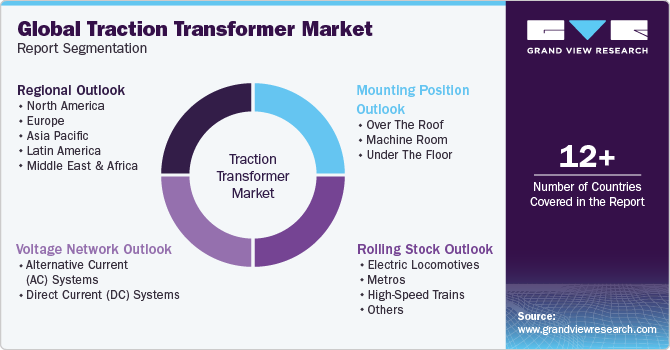

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global traction transformer market based on voltage network, mounting position, rolling stock, and region:

-

Voltage Network Outlook (Revenue in USD Million, 2017 - 2030)

-

Alternative Current (AC) Systems

-

Direct Current (DC) Systems

-

-

Mounting Position Outlook (Revenue in USD Million, 2017 - 2030)

-

Over The Roof

-

Machine Room

-

Under The Floor

-

-

Rolling Stock Outlook (Revenue in USD Million, 2017 - 2030)

-

Electric Locomotives

-

Metros

-

High-Speed Trains

-

Others

-

-

Regional Outlook (Revenue in USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global traction transformer market size was estimated at USD 1.20 billion in 2022 and is expected to reach USD 1.28 billion in 2023.

b. The global traction transformer market is expected to grow at a compound annual growth rate of 6.5% from 2023 to 2030 to reach USD 1.99 billion by 2030.

b. AC voltage segment dominated the traction transformer market with a share of 69.3% in 2022. This is attributable to increased demand for AC type equipment, especially in mainline railways.

b. Some key players operating in the traction transformer market include ABB; Siemens; JST Transformateurs; ZARCO REALTIES PRIVATE LIMITED; Hirect; International Electric Co., Ltd.; Mitsubishi Electric Corporation; Schneider Electric; Wilson Transformers; GE; Setrans Holding AS

b. Key factors that are driving the market growth include promising pace of rail infrastructure development and rise in installations owing to favorable government initiatives worldwide.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."