- Home

- »

- Medical Devices

- »

-

Transcatheter Aortic Valve Replacement Market Report, 2030GVR Report cover

![Transcatheter Aortic Valve Replacement Market Size, Share & Trends Report]()

Transcatheter Aortic Valve Replacement Market Size, Share & Trends Analysis Report By Implantation Procedure (Transfemoral, Transapical, Transaortic), By Material, By Mechanism, By End-Use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-511-3

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

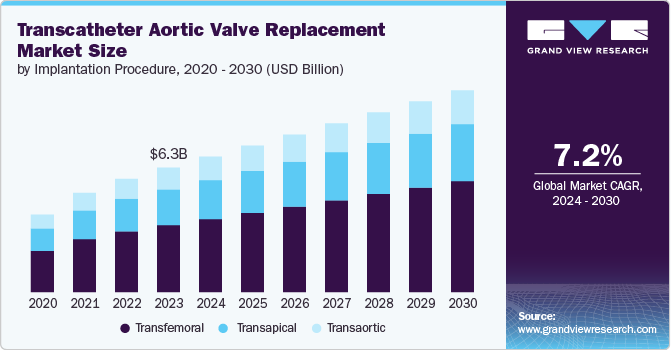

The global transcatheter aortic valve replacement market size was valued at USD 5,714.3 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 7.2% from 2023 to 2030. The rising prevalence of aortic valve stenosis (AS), increasing demand for minimal-invasive procedures such as transcatheter aortic valve replacement (TAVR), and the growing geriatric population drive demand for the TAVR industry. According to Cardiovascular business magazine, in 2021, 92,000 TAVR valves were implanted in patients in the U.S. The COVID-19 pandemic considerably affected the global economy and the healthcare system. Due to the disrupted supply chain of medical devices and the decrease in overall medical operation numbers during the pandemic, major manufacturers of cardiovascular devices faced considerable losses in revenue.

For instance, Boston Scientific's quarterly sales indicated that the cardiovascular device segment declined by 12% in 2020, while Medtronic revealed a 33% decline in its cardiac and vascular portfolio in its 2020 quarterly financial results. As a result, the decline in key players' segmental revenue indicates a significant setback that had a detrimental impact on the industry. Furthermore, according to an article published in the Journal of the American College of Cardiology in April 2021 titled "COVID-19 in Adults with Congenital Heart Disease," adults with congenital heart disease were at potentially high risk for mortality and other complications during the pandemic.

However, lifting COVID-19 restrictions and increasing patient visits to hospitals and clinics will likely enhance heart disease diagnostics and treatment demand, propelling the TAVR procedure industry growth over the forecast period. Moreover, innovation in the industry continues to boost prospects. For example, in September 2021, the U.S. FDA authorized the Epic Plus and Epic Plus Supra Stented Tissue Valves by Abbott Laboratories, Inc to expand therapy alternatives for patients with AS disease. The market is expanding owing to the technological developments in TAVR procedures. Moreover, key manufacturers adopt several strategic initiatives contributing to the growth of the industry.

For instance, in January 2022, Sahajanand Medical Technologies Limited released a Hydra Transcatheter Aortic Heart Valve CE data study in the Cardiovascular Interventions journal of the American College of Cardiology. The Hydra transcatheter aortic heart valve was evaluated for 30-day & 1-year safety and efficiency in addressing symptomatic AS in the cardiac patient pool with significant or high surgical risk. According to the Hydra CE research study, Transcatheter Aortic Heart Valve with the Hydra valve delivers high efficiency after one year, with an efficacious orifice area, minimal transvalvular gradient, and modest complication rates.

The geriatric population (65 or above) is more susceptible to AS. For instance, in February 2020, as per the study Epidemiology of AS and aortic incompetence (AI), the prevalence of AS/AI was similar in different parts of the world. The epidemiology of AS varies significantly between developed and developing countries. In addition, there is a high increase in the prevalence of AS with age, with 9.8% in those aged 80-89 years, 3.9% in those aged 70-79 years, 1.3% in those aged 60-69 years, and 0.2% in those aged 50-59 years. Thus, such studies demonstrate that transcatheter heart valves are employed in patients suffering from serve AS, and the demand for TAVR is expected to rise during the forecast period.

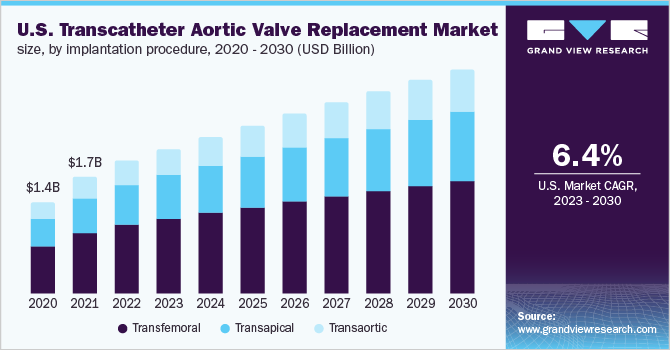

Implantation Procedure Insights

Based on the implantation procedure, the market is segmented into transfemoral, transapical, and transaortic. In 2022, the transfemoral segment dominated the market with a share of 53.6%. The transfemoral approach has become the preferred method for patients compared to surgical aortic valve replacement (SAVR), owing to its convenience of use, early mobility capability, availability of awake procedures, fast-track protocols, and minimization of surgical incisions.

The transapical segment is expected to witness the fastest CAGR over the forecast period. The transapical approach has a short distance between the left ventricular apex and the aortic valve, which allows for better operator mobility during device implantation and the large sheath diameter that can be placed. Several businesses have invented and developed innovative transapical devices. For example, the Sapien device by Edwards Lifesciences is a balloon-expandable system. The Sapien device has the most clinical experience to date and was the first to receive regulatory approval for transapical implantation.

Material Insights

Based on material, the market is segmented into nitinol, cobalt chromium, stainless steel, and others. In 2022, the nitinol segment dominated the market with a revenue share of 41.8%. Nitinol is an alloy of nickel and titanium in almost equal proportion. Moreover, it is commonly used in most TAVR devices owing to its specific properties, such as the absence of magnetism, biocompatibility, flexibility, and fatigue resistance, enabling medical devices in minimally invasive surgeries and implants to provide improved outcomes, thus boosting segment growth. For example, the Evolut R device (Medtronic), Portico valve (St. Jude Medical, Inc.), and JenaValve (JenaValve Technology GmbH) all these devices have nitinol metal material in their frame structure.

The cobalt-chromium segment is anticipated to grow at the fastest CAGR over the forecast period. Due to its higher radiopacity & resilience compared to steel stents, which can have a smaller mesh size, which lowers the chance of thrombosis. They provide good biocompatibility as well. For instance, Edwards Lifesciences' Sapien 3 device is the fourth generation of the balloon-expandable Sapien line of devices. The Sapien 3 device has a cobalt-chromium frame.

Mechanism Insights

Based on the mechanism, the market is segmented into balloon-expanding valve and self-expanding valve. The balloon-expanding valve segment accounted for the largest market share of 57% in 2022. The balloon-expanding valve is the most widely used in TAVR procedures. As balloon-expanding valves are non-repositionable, intra-annular, and have a lower stent frame profile, it enables easier coronary access. Moreover, the delivery method is more steerable than the self-expanding device, facilitating valve implantation in patients with challenging vascular anatomy, such as a horizontal aorta (aortic angulation >60°). In addition, numerous product launches are driving the segment’s growth.

For instance, in September 2022, Edwards Lifesciences obtained FDA approval for its Sapien 3 transcatheter aortic valve, furnished with materials that the company claims will constitute the backbone of potential heart valve implants. The self-expanding valve segment is anticipated to grow at the fastest CAGR over the forecast period. Most of the self-expanding valves are supra-annular, resulting in a larger effective orifice area, lesser gradients, and a decreased rate of severe prosthesis-patient mismatch (PPM). Moreover, key manufacturers constantly focus on product development, which drives segment growth. For instance, In August 2021, Medtronic stated that the FDA had authorized its Evolut FX next-generation self-expanding device for patients with severe symptomatic AS. The new device also includes a modified catheter tip for easier insertion and an improved delivery mechanism with a more flexible range of motion.

End-use Insights

Based on end-use, the market is segmented into hospitals, ambulatory surgical centers, and others. In 2022, hospitals accounted for the largest market share of 90.3% due to rising AS and increased TAVR procedures. According to the American College of Cardiology Foundation, in 2019, there were 72,991 TAVR procedures performed among U.S. hospitals. Moreover, technological advancements in TAVR products and systems, improving healthcare infrastructure, and favorable reimbursement scenarios in developed and developing countries are driving segment growth. For instance, the Centers for Medicare & Medicaid Services (CMS) covers TAVR for treating severe AS under the Coverage with Evidence Development (CED).

The ambulatory surgical centers are anticipated to grow at the fastest CAGR over the forecast period. Ambulatory surgical centers charge 45%-60% less than hospitals and have lower overhead, fixed costs, and shorter hospital stays. For instance, in June 2022, Atlas Healthcare Partners, a company specializing in the development and management of ambulatory surgery centers, collaborated with MedAxiom, a company specializing in cardiovascular organizational performance improvement, to launch its first-of-its-kind cardiovascular-focused ambulatory surgery centers business. Atlas and MedAxiom will work together to improve cardiovascular care by increasing the range of high-quality, patient-centered cardiovascular treatment in ambulatory surgery centers.

Regional Insights

In 2022, North America dominated the market in terms of revenue share, with a share of 38.2%. Due to its well-developed healthcare infrastructure and the increasing prevalence of disorders such as AS and regurgitation. The rising prevalence of AS diseases and aortic regurgitation in the population will likely fuel region growth throughout the forecast period. For instance, according to the article "Aortic Regurgitation," published by StatPearls in April 2022, the prevalence of aortic regurgitation in the U. S. was between 4.9% and 10%. Furthermore, according to the same source, men (13%) are more likely to be plagued with aortic regurgitation than women (8.5%).

The Europe region is expected to expand at the fastest growth of during the forecast period. Several factors drive the market, including rising TAVR procedures, economic expansion, regulatory ramifications, and novel product launches in the EU. For instance, in October 2021, JenaValve Technology, Inc., a manufacturer of TAVR systems, announced the European release of the Trilogy heart valve system. Furthermore, the Trilogy system is CE Mark authorized for AS, providing European clinicians with dual-disease therapy options.

Key Companies & Market Share Insights

The key manufacturers operating in the market are increasingly focusing on acquisitions, mergers, partnerships, and expansion to strengthen their market presence. For example, in September 2022, OpSens Inc. revealed that the FDA had approved 510(k) regulatory clearance for SavvyWire, its novel guidewire for TAVR surgeries. Some prominent players in the global transcatheter aortic valve replacement market include:

-

Medtronic plc

-

Abbott Laboratories, Inc.

-

Boston Scientific Corporation

-

Meril Life Sciences Pvt. Ltd., Inc.

-

Edwards Lifesciences Corporation

-

St. Jude Medical, Inc.

-

JenaValve Technology, Inc.

-

Bracco SpA

-

Transcatheter Technologies GmbH

Transcatheter Aortic Valve Replacement Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 6,271.4 million

Revenue forecast in 2030

USD 10.2 billion

Growth rate

CAGR of 7.2 % from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, trends

Segments covered

Implantation procedure, material, mechanism, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Companies profiled

Medtronic plc; Abbott Laboratories, Inc.; Boston Scientific Corp.; Meril Life Sciences Pvt. Ltd., Inc.; Edwards Lifesciences Corp.; St. Jude Medical, Inc.; JenaValve Technology, Inc.; Bracco SpA; Transcatheter Technologies GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Transcatheter Aortic Valve Replacement Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global transcatheter aortic valve replacement market report based on implantation procedure, material, mechanism, end-use, and region:

-

Implantation Procedure Outlook (Revenue, USD Million, 2018 - 2030)

-

Transfemoral

-

Transapical

-

Transaortic

-

Stainless Steel

-

Nitinol

-

Cobalt Chromium

-

Others

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Stainless Steel

-

Nitinol

-

Cobalt Chromium

-

Others

-

-

Mechanism Outlook (Revenue, USD Million, 2018 - 2030)

-

Balloon-expanding Valve

-

Self-expanding Valve

-

-

End-Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the transcatheter aortic valve replacement market include Medtronic plc; Abbott Laboratories, Inc; Boston Scientific Corporation; Meril Life Sciences Pvt. Ltd., Inc.; Edwards Lifesciences Corporation; St. Jude Medical, Inc.; JenaValve Technology, Inc.; Bracco SpA; Transcatheter Technologies GmbH.

b. Key factors that are driving the market growth include rising prevalence of aortic valve stenosis (AS), increasing demand for minimal procedures such as TAVR, and the growing geriatric population drive demand for the TAVR market.

b. The global transcatheter aortic valve replacement market size was estimated at USD 5,714.3 million in 2022 and is expected to reach USD 6,271.4 million in 2023.

b. The global transcatheter aortic valve replacement market is expected to grow at a compound annual growth rate of 7.2% from 2023 to 2030 to reach USD 10.2 billion by 2030.

b. North America dominated the transcatheter aortic valve replacement market with a share of 38.2% in 2020. This is attributable to its well-developed healthcare infrastructure and the increasing prevalence of disorders such as AS and regurgitation.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."