- Home

- »

- Electronic Devices

- »

-

Two Wheeler Hub Motor Market Size & Share Report, 2030GVR Report cover

![Two Wheeler Hub Motor Market Size, Share & Trends Report]()

Two Wheeler Hub Motor Market Size, Share & Trends Analysis Report By Vehicle, By Installation (Front Hub Motor, Rear Hub Motor), By Motor, By Sales Channel, By Power Output, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-421-5

- Number of Pages: 140

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Semiconductors & Electronics

Two Wheeler Hub Motor Market Trends

The global two wheeler hub motor market size was valued at USD 10.34 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 12.3% from 2023 to 2030. A Hub motor is an electric motor integrated into the vehicle’s wheel hub assembly. The motor uses the electric energy stored in the battery by converting it into rotary motion, thereby driving the drivetrain. These types of motors are generally used in electric vehicles. The changing end-user preference towards adopting zero-emission vehicles owing to increasing awareness of global warming is anticipated to fuel market growth. Moreover, favorable government policies such as stringent regulations to curb (CO2) emissions and subsidies for electric two-wheeler manufacturers and end-users are also projected to uplift market growth over the forecast period.

Besides, hassle-free installation, cost-effectiveness, and better performance are benefits of two-wheeler hub motors compared to mid-drive motors. Thus, in-wheel/hub motors are anticipated to emerge as the preferred choice for electric two-wheeler manufacturers. In addition, amplified power, high torque, better vehicle handling, and improved vehicle range are some factors that have fostered industry growth.

Currently, the hub motor is gaining popularity for electric vehicles, as it helps reduce maintenance costs and offers an improved driving experience due to its advantages, such as lightweight, flexibility, high power efficiency, elasticity, and compact sizes. In addition, two-wheeler hub motors eliminate the need for axles, transmission, and drivelines by eliminating the main powertrain in electric vehicles. Thus, it helps reduce mechanical losses important in all components between the wheel and engine, resulting in a quieter running vehicle and lesser noise generation.

Moreover, several governments across the globe are taking initiatives to curb rising pollution levels. The governments are expected to implement regulations, objectives, and policies for electric vehicle deployment, thus, signaling OEMs and other industry stakeholders to actively participate in increasing the adoption of electric vehicles. They aim to increase the electric two-wheeler penetration amongst the end-user by building confidence through mobilizing investments in attractive discounts, sharing services, and carrying out awareness campaigns. For instance, the governments of countries such as India, China, and the U.S. have subsidized the purchase of e-scooters, e-bikes, and e-motorcycles to promote the adoption of environment-friendly transportation. Such initiatives are likely to aid in the growth of the electric two-wheeler industry, thus augmenting the overall market growth.

Additionally, several traditional vehicle manufacturers announced their strategic plans to launch new high-powered electric two-wheelers in the next two to three years. For instance, in 2019, HARLEY-DAVIDSON launched the e-motorcycle LiveWire, available on sale at Harley-Davidson dealerships in Canada, the U.S., and Europe. Similarly, in October 2019, Okinawa Autotech Pvt. Ltd. announced to launch a premium electric motorcycle by 2020, which would be a direct competitor to Revolt RV400 in India. Therefore, intense market competition is anticipated to trigger the demand for electric motorcycles, increasing the demand for high-powered two-wheeler hub motors over the forecast period.

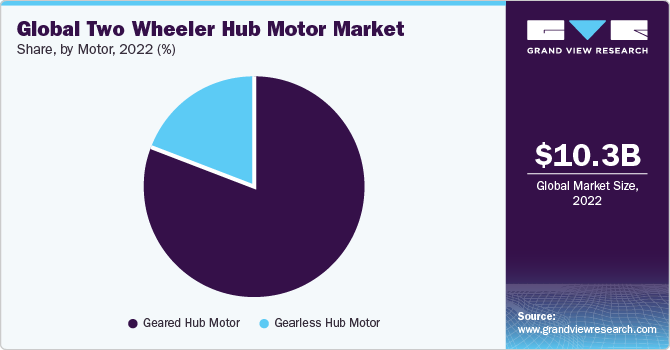

Motor Insights

Based on motor, the market is segmented into geared hub motor and gearless hub motor. The geared hub motor segment held the largest revenue share of 80.6% in 2022 and is expected to grow at the fastest CAGR of 12.7% over the forecast period. Geared two-wheeler hub motors have planetary gears to reduce the vehicle's speed but also allow the motor to rotate faster. Two-wheeler hub motors are commonly geared for better durability and speed control. Moreover, geared motors are smaller and lighter and are preferred by most electric 2-wheeler manufacturers.

The gearless hub motor segment is expected to grow at a significant CAGR of 10.9% over the forecast period. Gearless two-wheel hub motors can provide large amounts of power and torque. This makes them especially well-suited for higher-performance electric vehicles. However, they are generally heavy and bulky, which adds to the overall vehicle weight and reduces vehicle performance. Therefore, OEMs select geared or gearless motors based on the vehicle's required weight and power.

Vehicle Insights

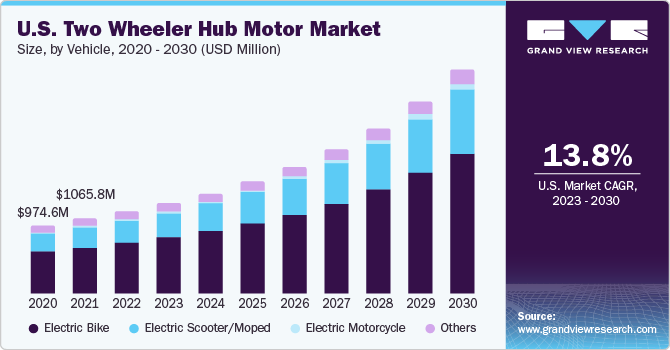

Based on vehicle, the market is segmented into electric scooter/moped, electric bike, electric motorcycle, and others. The electric bike segment held the largest market share of 56.3% in 2022. Two-wheeler hub motors are prominently used in electric bikes due to their increased power/speed, high torque, and extended range per single charge. It offers better vehicle handling for both existing and new vehicles due to its lightweight design. For instance, the growing support from regulatory bodies in Norway and France and the OEM’s efforts to expand the present electric bike fleet is anticipated to drive the sales of electric bikes from 2020 to 2027.

The electric motorcycle segment is estimated to register the fastest CAGR of 14.4% over the forecast period. This can be attributed to the growing sales of these vehicles, fueled by various governments’ initiatives in the form of incentives and subsidies. For instance, in the U.S., the goal of the Governor of California to reach 1.5 million zero-emission vehicles by 2025 is contributing to regional demand. The U.S. is expected to emerge as a favorable adopter of electric scooters as new products are being introduced and various large-scale manufacturers, such as Mahindra GenZe, have entered the U.S. market.

Regional Insights

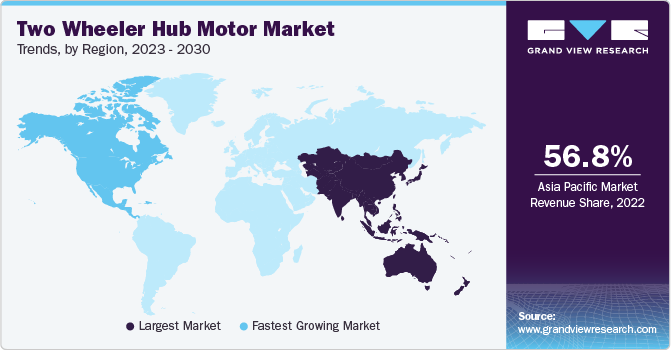

Asia Pacific accounted for the largest market share of 56.8% in 2022. The market growth in this region is also mainly driven by China, Japan, India, and South Korea. China is the largest market for two-wheeler hub motors in the Asia Pacific due to the presence of major two-wheeler hub motor manufacturers, namely QS Motor, MAC SHANGHAI ELECTRIC MOTOR COMPANY LTD, TDCM, and NTN Corporation.

North America is projected to demonstrate growth at the highest CAGR of 13.7% over the forecast period. This is due to the rising focus of manufacturers on developing high-performance, cleaner, and faster electric vehicles. In the U.S., the leading OEMs such as LUNA CYCLE, Zero Motorcycles, Harley-Davidson, Xiaomi (United States), and Victory Motorcycles launched electric two-wheelers, resulting in an enormous demand for two-wheeler hub motors. Moreover, benefits such as better torque control, powerful acceleration, and improved stability are anticipated to boost the demand for two-wheeler hub motors further.

Installation Insights

Based on the installation, the two wheeler hub motor market is segmented into rear and front hub motor. The rear hub motor segment dominated the market with a market share of 91.5% in 2022 and is anticipated to witness the fastest CAGR of 12.6% over the forecast period. The manufacturers prefer to install two-wheeler hub motors on the rear wheel as it offers better traction, improved stability, and higher vehicle performance. Therefore, the market is also anticipated to grow over the forecast period. Most of the vehicle's weight is centered at the rear end of the vehicle. Thus, a rear two-wheeler hub motor offers more traction than a front two-wheeler hub motor.

The front hub motor segment is anticipated to witness substantial growth and is projected to expand at a CAGR of 9.3% over the forecast period. With the growing interest in electric vehicles, including two-wheelers, front hub motors have gained popularity due to their compatibility with electric propulsion systems. Electric two-wheelers are gaining traction as a sustainable and eco-friendly transportation option, and front hub motors play a crucial role in providing the necessary power and torque for electric propulsion.

Sales Channel Insights

Based on sales channel, the market has been segmented into OEM and aftermarket. The OEM segment dominated the market with a revenue share of 92.0% in 2022 and is estimated to grow at the fastest CAGR of 12.5% over the forecast period, as the majority of users prefer to buy two-wheelers with company-fitted electric motors. In addition, the increasing preference of end-users for electric scooters and motorcycles as a replacement for traditional scooters or motorcycles for daily commutes is one of the influential factors driving the growth of the OEM segment. Besides, the rising rate of exporting and manufacturing electric two-wheelers is also responsible for the increasing market shares of the OEM segment over the forecast period..

The aftermarket segment is estimated to grow at a significant CAGR of 10.5% over the forecast period. Most startups and SMEs operating in the industry are concentrating more on modifying traditional bikes by integrating two-wheeler hub motors to either wheel to convert them into electric bikes. Therefore, adopting such trends within the business is anticipated to propel the growth of the aftermarket segment over the forecast period.

Power Output Insights

Based on power output, the market has been segmented into Below 1 kW, (1-3) kW, and above 3 kW. The below 1 KW segment dominated the market with a revenue share of 54.4% in 2022. Electric bikes, electric skateboards, and electric kick scooters generally prefer motors with a power output below 1 kW. The segment's growth is expected to be driven by the increasing adoption of electric bicycles, particularly in Europe and North America. For example, in Germany, electric bike sales surged by 37.0% in the first half of 2019, reaching 920,000 units, almost equaling the total sales for the entire year of 2018. Consequently, the electric bike segment dominated the market in 2022, with a value of USD 5.82 billion.

The (1-3) KW segment is estimated to register the fastest CAGR of 13.2% over the forecast period. The motor with a higher power output is preferred because the manufacturers want to increase the vehicle's speed without affecting the vehicle's performance. Electric scooters/mopeds, electric motorcycles, and other electric two-wheeler models use motors with power outputs above 1 kW. Hence, the demand for high-power e-motorcycles and e-scooters is anticipated to bode well for motors with a power output of (1-3) kW and above 3 kW.

Key Companies & Market Share Insights

The industry players are undertaking strategies such as product launches, acquisitions, and collaborations to increase their global reach. For instance, in May 2018, Elaphe Propulsion Technologies Ltd. launched the Elaphe L1500 two-wheeler hub motor. Moreover, in November 2018, Savic Motorcycles announced a new electric motorcycle model Cafe Racer and will launch it by 2020.

Key Two Wheeler Hub Motor Companies:

- Blinkfire Analytics, Inc.

- Gumgum, Inc.

- Kairos AR, Inc.

- SparkTrendz

- Cloudsight, Inc.

- Chooch.com

- Google LLC

- Attrasoft, Inc.

- Catchroom

- Hitachi, Ltd.

- Honeywell International Inc.

- LTU Tech

- NEC Corporation

- Qualcomm Technologies, Inc.

- Slyce Acquisition Inc.

Recent Developments

-

In February 2023, FLASH, a technology supplier and electronic component manufacturer, further bolstered its Electric Vehicle (EV) capabilities and product lineup through a new technological collaboration with GEM Motors, a European electric vehicle company. Through this partnership, both companies collaborated in producing hub motors for various segments of electric vehicles, spanning from 1 kW to 15 kW. The motors will feature a flexible and modular design, allowing FLASH to offer customization options with faster turnaround times. This approach enables FLASH to meet customers' specific requirements and effectively accommodate their demanding project deadlines.

-

In January 2023, Joy E-bike announced its plans to introduce a brand-new electric scooter at the Auto Expo. The electric vehicle manufacturer asserts that this forthcoming product will be a high-speed e-scooter designed for the "new age."

-

In November 2022, Hero Electric unveiled a strategic collaboration with NIDEC Japan. The purpose of this alliance is to collaboratively engineer electric propulsion systems catering to Hero Electric's extensive lineup of vehicles.

-

In October 2022, Ola Electric Mobility Pvt Ltd launched its expansion into the mainstream two-wheeler market by introducing the S1 Air. This cutting-edge scooter features a 4.5 km hub motor and a robust 2.5 kWh battery pack and achieves an impressive top speed of 85 mph. Notably, the scooter boasts a commendable range of 100 km when operated in eco mode, reflecting Ola Electric's commitment to delivering efficient and sustainable urban mobility solutions.

-

In September 2022, Hero MotoCorp Ltd announced that it would launch its first electric scooter in October 2022. The launch occurred under Hero's trademark sub-brand, Vida, which had been set up to focus on the electric two-wheeler segment.

-

In August 2022, Hop Electric Mobility launched its first electric motorcycle, the Hop Oxo. The Hop Oxo is positioned as a high-performance electric motorcycle, boasting a claimed top speed of 100 mph.

Two Wheeler Hub Motor Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 11.25 billion

Revenue forecast in 2030

USD 25.39 billion

Growth Rate

CAGR of 12.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Vehicle, installation, motor, power output, sales channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

Blinkfire Analytics, Inc.; Gumgum, Inc.; Kairos AR, Inc.; SparkTrendz; Cloudsight, Inc.; Chooch.com; Google LLC; Attrasoft, Inc.; Catchroom; Hitachi, Ltd.; Honeywell International Inc.; LTU Tech; NEC Corporation; Qualcomm Technologies, Inc.; Slyce Acquisition Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Two Wheeler Hub Motor Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global two wheeler hub motor market report based on vehicle, installation, motor, sales channel, power output, and region:

-

Vehicle Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Electric Scooter/Moped

-

Electric Bike

-

Electric Motorcycle

-

Others

-

-

Installation Outlook (Revenue, USD Million, 2017 - 2030)

-

Front Hub Motor

-

Rear Hub Motor

-

-

Motor Outlook (Revenue, USD Million, 2017 - 2030)

-

Geared Hub Motor

-

Gearless Hub Motor

-

-

Sales Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

OEM

-

Aftermarket

-

-

Power Output Outlook (Revenue, USD Million, 2017 - 2030)

-

Below 1 kW

-

(1-3) kW

-

Above 3 kW

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global two wheeler hub motor market size was estimated at USD 10.34 billion in 2022 and is expected to reach USD 11.25 billion in 2030.

b. The global two wheeler hub motor market is expected to grow at a compound annual growth rate of 12.3% from 2023 to 2030 to reach USD 25.39 billion by 2030.

b. Asia Pacific dominated the two wheeler hub motor market with a share of 56.8% in 2022. The growth of the market in this region is also mainly driven by China, Japan, India, and South Korea.

b. Some key players operating in the two wheeler hub motor market include QS MOTOR; MAC SHANGHAI ELECTRIC MOTOR COMPANY LTD; TDCM, NTN Corporation; Heinzmann GmbH and Co. KG.; Robert Bosch GmbH; Schaeffler Technologies AG and Co. KG; and Elaphe Propulsion Technologies Ltd.

b. Key factors that are driving the market growth include the changing end user preference towards the adoption of zero-emission vehicles owing to increasing awareness of global warming, and several governments across the globe are taking initiatives to curb the rising pollution levels.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."