- Home

- »

- Medical Devices

- »

-

Unilateral Biportal Endoscopy Market Size Report, 2030GVR Report cover

![Unilateral Biportal Endoscopy Market Size, Share & Trends Report]()

Unilateral Biportal Endoscopy Market Size, Share & Trends Analysis Report By Product, By Application, By End-user, By Region (North America, Europe, APAC, Latin America, MEA), And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-941-7

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2014 - 2020

- Industry: Healthcare

Report Overview

The global unilateral biportal endoscopy market size was valued at USD 776.2 million in 2021 and is projected to expand at a compound annual growth rate (CAGR) of 6.4% from 2022 to 2030. Increasing demand for minimally invasive or key-hole surgeries for diagnostic and therapeutic purposes is expected to drive the overall growth. Advancements in the field of robotic surgery and visually advanced endoscopic procedures are expected to drive the demand for spinal endoscopic procedures. For instance, in March 2018, Auris Health, Inc. received FDA approval for its new robotic endoscopy system, Monarch Platform. In addition, the growing awareness levels of the benefits of these procedures such as reduced hospitalization, shortened operating time, minimal collateral tissue damage, and quicker recovery are boosting demand and contributing to market development. Emergence of advanced visualization technologies is complementing the growing demand for minimally invasive surgeries and is expected to positively influence the market for unilateral biportal endoscopy over the forthcoming years.

Some of these innovations are advanced image-guided technology, flexible radiolucent spinal implants, 3D printing of disc tissue, and bone fusion. The use of computer-assisted image guidance for spine localization is constantly evolving and is delivering real-time image datasets. Moreover, these advancements focus on the development of lesser noninvasive surgical techniques, preservation of motion in the operated spinal segment, minimum postoperative pain and complications, and reduction in recovery time.

In addition, Artificial Intelligence (AI) and machine learning are gaining popularity in the field of spinal surgeries. AI aids in surgical decision-making and running data analysis on image datasets by enhancing the surgeon and endoscopist’s data processing capabilities. The ongoing COVID-19 pandemic has negatively impacted the market, as healthcare systems are undergoing a tremendous burden and have led to significant transformations in the healthcare industry, thereby forcing endoscopy facilities to reduce volumes of elective and non-essential endoscopic procedures. For instance, a survey conducted for endoscopy units across 55 countries by the World Endoscopy Organization between April 2020 and May 2020, reported an 87% reduction in the number of endoscopy procedures.

The ongoing pandemic has caused alterations in the operating room structures, workforce, indications, and pre-op setup. The alarming decline in endoscopic procedures was recorded in emerging economies with developing healthcare facilities. Factors such as shortage of Personal Protective Equipment (PPE) and trained workforce, lack of testing facilities, reduced patient load, and restrictions and lockdowns forced the healthcare facilities to reschedule and prioritize procedures as essential or nonessential. They had to cancel endoscopies in medium-to low-risk patients, which can be attributed to the decreasing revenue share of the market.

The growing number of healthcare facilities such as hospitals, ambulatory surgery centers, and specialty clinics is anticipated to boost the demand for unilateral biportal endoscopies over the forecast period. Furthermore, numerous healthcare professionally-owned and managed ambulatory surgery centers are gaining popularity with endoscopists carrying out minimally invasive surgeries in these outpatient settings. For instance, in Europe, the U.K. had the highest number of hospitals, accounting for 3,186 in 2018 and this number is expected to reach 10,027 hospitals by 2025, growing at a CAGR of 18.0%. Furthermore, countries such as Brazil and South Africa are expected to register a significant increase in the number of hospitals with a CAGR of 10.1% and 11.8%, respectively.

Lastly, the global geriatric population is growing at an alarming pace and is susceptible to spinal deformities and degenerative diseases. According to estimates published by United Nations in 2020, the global geriatric population aged 65 or above in 2019 was nearly 727 million, accounting for 9.3% of the global population, and this number is expected to reach over 1.5 billion by 2050, representing 16.0% of the global population. The prevalence of neck and lower back pain is growing and is estimated to affect over 80% of the global geriatric population. Spinal disorders such as lumbar disc herniation, spondylolisthesis, spinal stenosis, and prolapsed intervertebral disc are being recorded worldwide in the geriatric population.

Product Insights

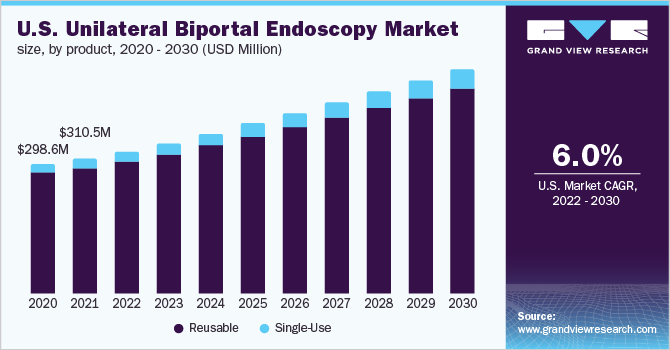

In 2021, the reusable product segment accounted for the largest revenue share of 93.4%. The traditional practice of using reusable products by surgeons and endoscopists due to its recoverability rate and categorization on the basis of exposure to infection risk. On the other hand, the single-use product segment is anticipated to register the fastest growth during the forecast period owing to the increasing prevalence of hospital-acquired infections caused by the use of reusable and uncleaned products. As per reports, the transformation to single-use products has resulted in the U.S. endoscopic market growing tenfold over the past decade. Increasing usage of single-use endoscopes due to the low cost of maintenance, cleaning, and storage is propelling the product demand. For instance, in July 2019, Integrated Endoscopy received the U.S. FDA clearance for its NUVIS, a single-use, economical arthroscope.

Application Insights

In 2021, the decompression application segment accounted for the largest revenue share of 39.1%. Non-invasive nature and quicker recovery are some of the benefits of this procedure and are expected to boost the segment. The decompression procedure enables direct anatomical visualization and minimizes collateral tissue damage. Additionally, decompression procedures have proven to have more favorable clinical outcomes when compared to conventional methods. per an Asian Spine Journal report published in April 2019, a study conducted to record clinical outcomes in 105 patients with spinal stenosis undergoing bilateral endoscopic surgeries and interlaminar decompression stated ODI improved from 67.4±11.5 to 22.9±12.4.

Furthermore, the decompression application segment is anticipated to register the fastest growth during the forecast period owing to benefits such as minimized collateral tissue damage, faster and assured recovery, small incision, and minimal blood loss. Furthermore, degenerative lumbar canal stenosis is the highest revenue-generating indication for decompression procedures since it prevents paraspinal muscle atrophy, reduced muscle dissection, and retraction when compared to conventional open surgical methods.

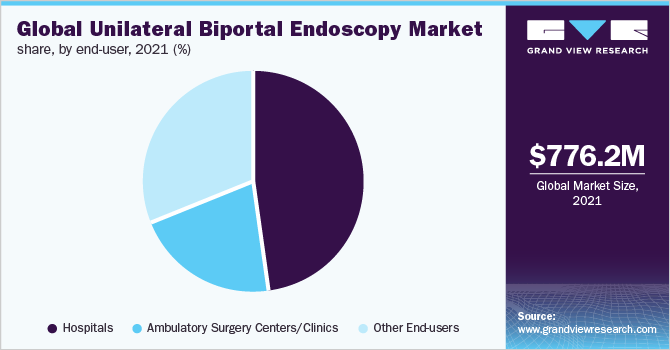

End-user Insights

In 2021, the hospitals segment accounted for the largest revenue share of 48.2% owing to the widespread adoption of unilateral biportal endoscopies which are replacing conventional open procedures. The growing demand for minimally invasive endoscopies with enhanced anatomical visualization is contributing to the growing adoption of these procedures in healthcare facilities.

On the other hand, the ambulatory surgery centers/clinics segment is anticipated to register the fastest growth during the forecast period owing to the increasing number of healthcare professionally-owned and managed ambulatory care settings to cater to the rising demand for minimally invasive surgeries. Furthermore, the growing preference for same-day surgery resulting in cost savings and reduced hospitalization is contributing to the growth of this care delivery segment.

Regional Insights

North America dominated the market for unilateral biportal endoscopy and accounted for the largest revenue share of 42.4% in 2021, owing to factors such as developed and evolving healthcare infrastructure, growing geriatric population and rising prevalence of non-communicable diseases, widespread adoption of advanced technologies, presence of key players, and increase in awareness about advantages of minimally invasive surgeries. Asia Pacific is anticipated to register the fastest growth during the forecast period. Developing healthcare infrastructure and facilities, increased healthcare expenditures, and expansion of renowned players are propelling the unilateral biportal endoscopy market. In addition, infrastructure investments, regional expansion, economic development, and a highly skilled workforce. Moreover, companies are devising entry strategies and mergers and acquisitions to cater to the Asia Pacific endoscopy market.

Key Companies & Market Share Insights

Key companies are increasingly focusing on expanding their geographical reach and introducing newer, innovative technologies through various strategies, including partnerships, product launches, and collaborations, to support end-users in adopting minimally invasive surgeries, delivering value-based care, combating the COVID-19 pandemic, and maintaining a competitive edge in the market for unilateral biportal endoscopy. For instance, in April 2021, Erbe Elektromedizin announced the acquisition of a German company, Maxer Endoscopy, a manufacturer of endoscopic systems and instruments. Through this acquisition, Erbe Elektromedizin is expected to offer fluorescence-guided and 4K systems for endoscopy. The acquisition can aid Erbe Elektromedizin in expanding its visualization portfolio as Maxer’s major innovation focus is the development of high-end visualization technology. Some of the prominent players in the global unilateral biportal endoscopy market include:

-

Endovision Co. Ltd.

-

Karl Storz

-

Smith & Nephew

-

Stryker Corporation

-

CONMED Corporation

-

Maxer Endoscopy GmbH

-

Joimax GmbH

-

Richard Wolf

-

Jiangsu Bonss Medical Technology Co. Ltd.

-

Kinetix Lifesciences

Unilateral Biportal Endoscopy Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 822.7 million

Revenue forecast in 2030

USD 1.3 billion

Growth rate

CAGR of 6.4% from 2022 to 2030

Base year for estimation

2021

Historical data

2014 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-user, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Spain; Italy; Russia; China; Japan; India; Australia; New Zealand; Indonesia; Malaysia; Vietnam; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Endovision Co. Ltd; Karl Storz; Smith & Nephew; Stryker Corporation; CONMED Corporation; Maxer Endoscopy GmbH; Joimax GmbH; Richard Wolf; Jiangsu Bonss Medical Technology Co. Ltd; Kinetix Lifesciences

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2030. For the purpose of this study, Grand View Research, Inc. has segmented the global unilateral biportal endoscopy market report based on product, application, end-user, and region:

-

Product Outlook (Revenue, USD Million, 2014 - 2030)

-

Reusable

-

Single use

-

-

Application Outlook (Revenue, USD Million, 2014 - 2030)

-

Decompression

-

Lumbar Central Canal Stenosis

-

Degenerative Lumbar Canal Stenosis

-

Lumbar Spinal Stenosis

-

Deherniation

-

Spinal Stabilization

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2014 - 2030)

-

Hospitals

-

Ambulatory Surgery Centers/Clinics

-

Other end-users

-

-

Regional Outlook (Revenue, USD Million, 2014 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

Spain

-

France

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

New Zealand

-

Indonesia

-

Malaysia

-

Vietnam

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global unilateral biportal endoscopy market size was estimated at USD 776.2 million in 2021 and is expected to reach USD 822.7 million in 2022.

b. The global unilateral biportal endoscopy market is expected to grow at a compound annual growth rate of 6.4% from 2022 to 2030 to reach USD 1,346.8 million by 2030.

b. North America dominated the unilateral biportal endoscopy market with a share of 42.4% in 2021. This is attributable to factors such as developed & evolving healthcare infrastructure, growing geriatric population & rising prevalence of non-communicable diseases, widespread adoption of advanced technologies, presence of key players, and increase in awareness about advantages of minimally invasive surgeries.

b. Some key players operating in the unilateral biportal endoscopy market include Endovision Co. Ltd, Maxer Endoscopy GmbH, Karl Storz, Richard Wolf, Stryker Corporation, Smith & Nephew, CONMED Corporation, Jiangsu Bonns Medical Technology, Kinetix Lifesciences, and joimax GmbH.

b. Key factors that are driving the unilateral biportal endoscopy market growth include increasing demand for minimally invasive or key-hole surgeries for diagnostic and therapeutic purposes is expected to drive the overall growth. Advancements in the field of robotic surgery and visually advanced endoscopic procedures is expected to drive the demand for spinal endoscopic procedures.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."