- Home

- »

- Pharmaceuticals

- »

-

Urothelial Cancer Drugs Market Size, Share, Industry Report 2018-2023GVR Report cover

![Urothelial Cancer Drugs Market Size, Share & Trends Report]()

Urothelial Cancer Drugs Market Size, Share & Trends Analysis Report By Treatment Class (Chemotherapy, Immunotherapy), By Major Markets, Competitive Landscape, And Segment Forecasts, 2018 - 2023

- Report ID: GVR-2-68038-429-1

- Number of Pages: 86

- Format: Electronic (PDF)

- Historical Range:

- Industry: Healthcare

Report Overview

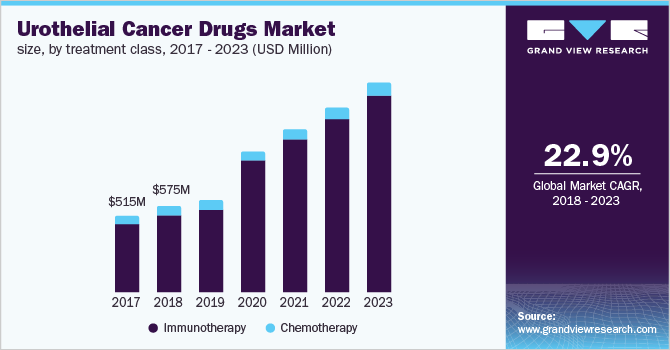

The global urothelial cancer drugs market size to be valued at USD 3.6 billion by 2023 and is expected to grow at a compound annual growth rate (CAGR) of 22.9% during the forecast period. The U.S. held the dominant share among the seven major markets. Market growth is largely attributed to factors such as availability of novel drugs, the presence of a strong pipeline, rise in the incidence of urothelial cancer due to the growing geriatric population, unorganized lifestyle, and rising public awareness. Urothelial carcinoma or transitional cell carcinoma is a malignant neoplasm occurring from urothelium. The disease is the ninth most common malignancy in the world, with approximately 2.5 million patients and 420,000 newly diagnosed cases each year. Bladder transitional cell carcinoma (TCC) accounted for approximately 90% of all urinary cancer cases.

Urothelial cancer is clinically divided into three categories: non-muscle invasive bladder cancer (NMIBC, early-stage), muscle-invasive disease (MIBC, mid-stage), and metastatic disease (late-stage). At diagnosis, approximately 70% of cases are non-muscle invasive disease, 20% are at the muscle-invasive stage, and 10% at the advanced stage.

Approximately 59% of bladder cancer cases occur in developed regions such as North America and Europe. The economic and human toll of urothelial cancer represents a highly disproportionate health burden. The disease has the highest lifetime cost of care per patient among all tumors in the U.S. due to its high relapse rate and invasive lifelong monitoring including cystoscopy follow-ups.

Urothelial Cancer Drugs Market Trends

The growing global geriatric population is a major factor propelling the market growth. According to World Health Organization, the population of people over 60 years of age is estimated to be 1.4 billion in 2020. Moreover, in 2050, this number is expected to reach 2.1 billion. This factor is expected to propel industry growth during the forecast period.

Moreover, increasing awareness among the population regarding early treatment and diagnosis for related disorders, coupled with the steady shift towards unhealthy diets and sedentary lifestyles, is driving the market demand. Advancements in drug development have enabled physicians to administer drugs directly to the infected tissues without harming surrounding healthy tissues, which has contributed to increasing patient compliance, which in turn is expected to boost industry growth.

The high research and development cost associated with the manufacturing of urothelial cancer drugs, coupled with increased penetration of generic drugs, is likely to hamper the market growth. However, technological advancements in drug development to manufacturing cost-effective and side-effect-free drugs are anticipated to create opportunities for industry movements.

Treatment Class Insights

Early-stage of urothelial cancer is generally treated with transurethral resection (TURBT), followed by intravesical therapy to reduce recurrence. Partial or radical cystectomy may be recommended in high-grade cancer, multiple tumor sites, or large tumor size at the time of diagnosis. However, relapse rates after surgical resection is high. The standards of care are generic chemotherapeutics, Bacillus Calmette-Guérin (BCG) immunotherapy, and mitomycin C for NMIBC and Gemcitabine-Cisplatin for muscle-invasive disease and metastatic disease.

The treatment landscape for patients with urothelial cancer has undergone multiple changes in the past year, due to the development of PD-1/PD-L1 inhibitors. Combination regimens, particularly checkpoint inhibitors, are likely to become first-line treatment to target key unmet market-needs such as curbing tumor resistance, enhancing progression-free survival, and bettering the quality of life. There remain plenty of opportunities for BCG-intolerant or ineligible patients in the non-muscle invasive bladder cancer (NMIBC) setting.

Pipeline Insights

Disease progression and recurrence rates remain high among patients with aggressive carcinoma in-situ (CIS) classification. The future urothelial cancer treatment landscape has a high probability of gaining an array of first-in-class therapies and it is anticipated that several novel treatments will gain approvals during the forecast period.

The potential for the use of immunotherapies in adjuvant and neoadjuvant settings is now the subject of several clinical trials. These treatments will be used in conjunction with standard therapies to provide patients with safer and effective treatment options. Innovative treatments such as CAR-T therapies and viral therapy continue to generate interest as a potential treatment of urothelial cancer.

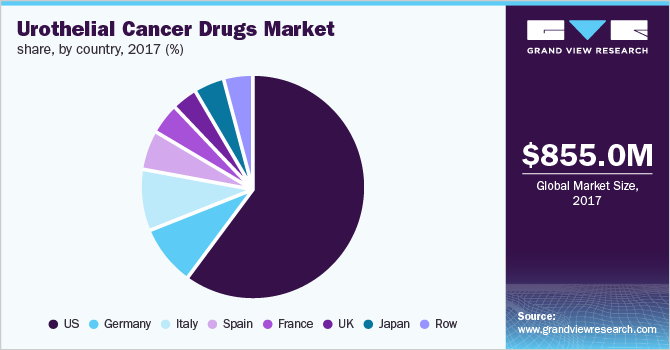

Country Insights

The U.S. dominated the urothelial cancer drugs market in 2017, followed by Germany. The U.S. is estimated to retain its leading position in 2023, followed by Japan. Presence of a large target population increased adoption of novel therapeutics, and impending product launches during the forecast period will fuel the market.

China offers a strong opportunity for market expansion. Factors such as high unmet clinical needs and the presence of a large target population are expected to propel the market in this region. Several local players are currently evaluating products as second/third-line treatments in Phase II trials and are well-positioned to be launched in the China market in the upcoming years.

Key Companies & Market Share Insights

Some of the key players operating in this market are Roche, Merck, Bristol-Myers Squibb, AstraZeneca, and Pfizer. Collaborations for development, broader product portfolios, and regional expansion in emerging markets are key strategic undertakings of these companies to increase their market share. The market is expected to grow increasingly crowded with several product launches during the forecast period.

Merck and AstraZeneca are expected to lead the market in 2023, supported by approvals of (Imfinzi + tremelimumab) and (Keytruda + chemotherapy) regimens in early lines of treatment for both chemo-ineligible and chemo-eligible patients. It is expected that immune checkpoint blockade therapy could replace the current standard of care in bladder cancer.

Recent Developments

-

In April 2022, Pfizer made an equity investment worth USD 25 million in Zentalis Pharmaceuticals, Inc. This investment is expected to help Pfizer to leverage its development capabilities globally

-

In May 2022, Pfizer entered a research collaboration agreement of two years with NetVation DL Medicine. This collaboration is anticipated to aid and advance Pfizer in its research activities

-

In June 2022, Roche introduced a human papillomavirus (HPV) self-sampling solution that enables patients to perform HPV screening in the presence of a healthcare worker. This is expected to expand the company’s cancer screening solution line-up

Urothelial Cancer Drugs Market Report Scope

Report Attribute

Details

Revenue forecast in 2023

USD 3.6 billion

Base year for estimation

2017

Forecast period

2017 - 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2017 to 2023

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Treatment class

Country scope

U.S.; U.K.; Germany; Spain; Italy; France; Japan

Key companies profiled

Roche; Merck; Bristol-Myers Squibb; AstraZeneca; Pfizer.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Urothelial Cancer Drugs Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2023. For this study, Grand View Research has segmented the global urothelial cancer drugs market report based on treatment class:

-

Treatment Class Outlook (Revenue, USD Million, 2017 - 2023)

-

Chemotherapy

-

Immunotherapy

-

-

Country Outlook (Revenue, USD Million, 2017 - 2023)

-

The U.S.

-

The U.K.

-

France

-

Germany

-

Italy

-

Spain

-

Japan

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."