- Home

- »

- Medical Devices

- »

-

U.S. Acute Hospital Care Market Size Report, 2022-2030GVR Report cover

![U.S. Acute Hospital Care Market Size, Share & Trends Report]()

U.S. Acute Hospital Care Market Size, Share & Trends Analysis Report By Medical Condition (Emergency Care, Trauma Care), By Facility Type, By Service (Intensive Care Unit, Neonatal Intensive Care Unit), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-917-1

- Number of Pages: 95

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Healthcare

Report Overview

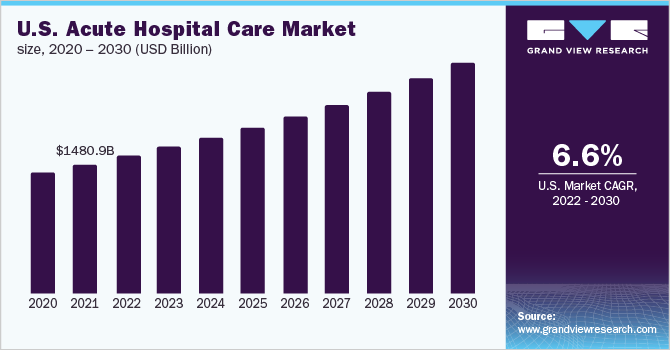

The U.S. acute hospital care market size was valued at USD 1,480.9 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 6.6% from 2022 to 2030. Its growth can be attributed to factors such as the growing geriatric population, increasing prevalence of chronic diseases, and favorable public reimbursement available for the services through Medicare and Medicaid. According to NCBI studies, individuals over the age of 65 years are at a greater risk of developing chronic illnesses, which could lead to acute exacerbations of underlying chronic diseases. As per the U.S. Census Bureau, the number of people aged 65 was 40.3 million in 2010 and increased to 54.1 million, as of July 2019. The number of elderly patients with critical illnesses has significantly increased over the past few years.

The risk of malnutrition and frailty in the geriatric population with comorbidities, such as depression, stroke, and dementia, is much higher, mainly owing to various age-related changes in body composition and muscle mass. This results in reduced ability to perform Activities of Daily Living (ADLs), thereby increasing the risk of falls or injuries. As hospital-based emergency rooms are becoming increasingly crowded-with wait times averaging 55 minutes-more patients enrolling in high-deductible health plans, demand for acute hospitals has intensified, especially for patients with severe conditions.

The American Academy of Orthopedic Surgeons reported that in the U.S., bone fracture is a common injury and around 6 million people suffer from it every year. Out of these, around 300,000 patients receive acute care in hospitals. This is expected to boost the growth of the market for acute hospital care in the U.S. Furthermore, there has been a constant increase in the prevalence of chronic diseases, such as cardiovascular diseases, diabetes, cancer, hypertension, and neurological disorders, which could require hospitalization for exacerbation of the underlying chronic diseases. Around 45.0% of the U.S. population, or 133 million people, suffers from at least one chronic condition. Over 1.7 million people die every year in the U.S. due to chronic conditions. The growing prevalence of chronic diseases is one of the crucial factors expected to boost the demand for acute hospitalization.

COVID-19 U.S. Acute Hospital Care Market Impact: 7.1 % increase in revenue from 2019 to 2020

Pandemic Impact

Post COVID Outlook

The COVID-19 pandemic exposed shortcomings of the overburdened U.S. healthcare system, taking a significant toll on healthcare facilities and providers. As per the Massachusetts HPC Report, total inpatient admissions decreased in April 2020, patient days in ICU or CCU increased significantly, growing by 63% over April 2019.

COVID-19 proved to be a turning point for digital transformation in acute care. Apart from the rising adoption of pre-existing technology solutions such as smart monitoring, telemedicine, and remote monitoring, AI has been investigated as a diagnostic tool, an epidemiological instrument, and a model for drug selection.

As the infection spread, hospitals converted clinical capacity to treat COVID-19 patients. The number of COVID19-related admissions increased in April 2020, accounting for around 20% of all admissions in that month.

In the coming years, the number of inpatient admissions for non-COVID-related diseases is projected to increase, positively impacting the market growth.

The increasing prevalence of chronic diseases is leading to a rise in healthcare expenditure. Patients with chronic disorders are frequent users of U.S. healthcare services. Such patients account for nearly 76.0% of the overall physician visits, around 81% of the hospital admissions, and approximately 91.0% of all prescriptions filled. It is also estimated that by 2025, almost 49.0% of the total U.S. population will be affected by chronic conditions. The healthcare providers are trying to reduce the cost burden by limiting the average length of stay is anticipated to boost the market for acute hospital care in the U.S. over the forecast period.

Medical Condition Insights

The emergency care segment dominated the market for acute hospital care in the U.S. and accounted for a revenue share of 54.1% in 2021. The growing prevalence of communicable illnesses among patients, rising burden of burn and trauma injuries, and increase in the incidence of cardiovascular diseases are some of the major factors driving the growth of the segment. The dominant share of the segment can be attributed to a wide range of services being offered as emergency treatment at hospitals to patients suffering from life- or limb-threatening conditions. Life-threatening situations include acute myocardial infarction or heart attack, Cerebrovascular Accident (CVA) or stroke, extreme difficulty in breathing, severe bleeding, acute abdominal pain, poisoning, broken bones, severe allergic reactions, burns, and lacerations, and trauma cases such as Traumatic Brain Injury (TBI). Limb-threatening emergencies include acute compartment syndrome and brachial artery aneurysms.

A high number of hospital visits due to traumatic conditions is expected to contribute to the market growth of the trauma care segment. For instance, TBI is a major cause of disability and death in the U.S. According to Healthcare Cost and Utilization Project (HCUP), in 2017, a total of 801,700 ED visits occurred due to TBI. There were 0.3 million hospital visits due to accidents and 35 million due to injury, in the U.S., according to National Hospital Ambulatory Medical Care Survey.

Facility Type Insights

The general acute care facilities segment held the maximum revenue share of 60.3% in 2021, as the majority of admissions were due to short-term acute care. Patients suffering from acute diseases, illnesses, or injuries are initially admitted to these hospital facilities. On the other hand, the psychiatric hospitals segment is projected to witness remarkable growth during the forecast period. Growing awareness about mental disorders is expected to aid in the growth of this segment. According to NCBI studies, individuals over the age of 65 years are at a greater risk of developing chronic illnesses, which could lead to acute exacerbations of underlying chronic diseases.

As per the U.S. Census Bureau, the number of people aged 65 was 40.3 million in 2010 and increased to 54.1 million, as of July 2019. The number of elderly patients with critical illnesses has significantly increased over the past few years. Specialty hospitals provide specialized treatment for medical illnesses that require a subset of specific expertise and technologies. In recent years, specialized hospitals have been established to focus on orthopedic surgery, cardiovascular surgery, and general and surgical women's health. There has been an increase in the demand for specialized inpatient and outpatient care. This coupled with the rising number of specialist doctors is likely to favor the growth of the market for acute hospital care in the U.S.

Rehabilitation services include physical therapy, occupational therapy, speech therapy, cognitive therapy, respiratory treatment, psychotherapy services, and prosthetic/orthotic services. Inpatient rehabilitation is necessary when an individual's medical situation precludes the provision of requisite services in a less intensive setting. Individuals with serious functional deficits linked with spinal cord injuries, stroke, acquired brain injuries, major burns, and trauma are examples of conditions needing inpatient rehabilitation. Increasing demand for rehabilitation services is fueling the segment growth.

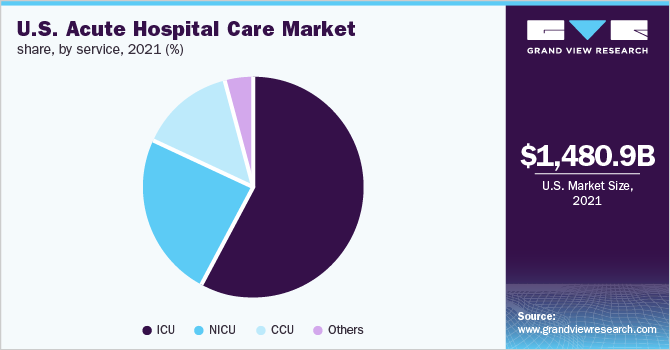

Service Insights

The ICU segment dominated the U.S. acute hospital care market and accounted for the largest revenue share of 58.4% in 2021. Increasing patient volume seeking intensive monitoring and nursing round the clock is contributing to the growth of the segment. ICUs are staffed by multidisciplinary teams of highly skilled physicians and support professionals. According to the U.S. Department of Health and Human Services, 5,578 reporting hospitals operate 80,933 staffed ICU beds, including 24,920 ICU beds in use for COVID-19 treatment as of January 2022.

The NICU segment is expected to witness lucrative growth in the coming years owing to increased demand for safer and better services for newborns, particularly during pandemics such as COVID-19. According to CDC, preterm births affected 1 of every 10 infants born in the U.S. in 2019. The rate of preterm births among African American women was 14.4%, which was higher than preterm births among white women (9.3%) and Hispanic women (10%). All the above factors are expected to contribute to increasing the demand for NICUs.

CCU is a specialist hospital ward dedicated to the treatment of individuals suffering from significant or urgent cardiac issues. Individuals undergoing cardiac surgery are also admitted to CCU for recovery. According to the AHA 2021 annual survey, the U.S. has 15,160 CCU beds. As per CDC, approximately 805,000 people suffer heart attacks each year. Furthermore, each year, up to 200,000 people in the U.S. undergo coronary bypass surgery. As a result, CCU is typically a busy area in most hospitals. Thus, the increasing prevalence of cardiovascular conditions is a primary factor responsible for segment growth.

Key Companies & Market Share Insights

The market for acute hospital care in the U.S. is highly fragmented due to the presence of many multinational as well as local hospitals and healthcare facilities. Hospitals are collaborating with medical technology companies to adapt to the latest technologies for healthcare delivery. Market players are devising their collaborations and mergers and acquisition strategies to gain a competitive edge and expand their business footprint. For instance, in February 2021, Stanford Medicine and Sutter Health formed a collaborative venture to expand access to integrated, state-of-the-art cancer care for East Bay patients and their families. Some of the prominent players in the U.S. acute hospital care market include:

-

TH Medical (Tenet Healthcare Corporation)

-

Universal Health Services Inc.

-

Community Health Systems, Inc.

-

Ascension

-

Lifepoint Health, Inc.

-

Ardent Health Services

-

Emerus Hospital Partners, LLC

-

Stanford Health Care, Inc.

-

NYU Langone Hospitals

-

NewYork-Presbyterian Hospital

U.S. Acute Hospital Care Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 1,578.7 billion

Revenue forecast in 2030

USD 2,635.6 billion

Growth Rate

CAGR of 6.62% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Medical condition, facility type, service type, region

Country scope

U.S.

Key companies profiled

TH Medical (Tenet Healthcare Corporation); Universal Health Services Inc.; Community Health Systems, Inc.; Ascension; Lifepoint Health, Inc.; Ardent Health Services; Emerus Hospital Partners, Llc; Stanford Health Care, Inc.; NYU Langone Hospitals; and NewYork-Presbyterian Hospital

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. acute hospital care market report on the basis of medical condition, facility type, service and region:

-

Medical Condition Outlook (Revenue, USD Billion, 2017 - 2030)

-

Emergency care

-

Short-term stabilization

-

Trauma care

-

Acute care surgery

-

Others

-

-

Facility Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

General Acute Care Hospitals

-

Psychiatric Hospitals

-

Specialized Hospitals

-

Rehabilitation Hospitals

-

Long Term Acute Care (LTAC)

-

-

Service Outlook (Revenue, USD Billion, 2017 - 2030)

-

Intensive Care Unit (ICU)

-

Neonatal Intensive Care Unit (NICU)

-

Coronary Care Unit (CCU)

-

Others

-

-

Region Outlook (Revenue, USD Billion, 2017 - 2030)

-

Northeast

-

Southeast

-

Southwest

-

Midwest

-

West

-

Frequently Asked Questions About This Report

b. The U.S. acute hospital care market size was estimated at USD 1,480.9 billion in 2021 and is expected to reach USD 1,578.7 billion in 2022.

b. The U.S. acute hospital care market is expected to grow at a compound annual growth rate of 6.62% from 2022 to 2030 to reach USD 2,635.6 billion by 2030.

b. The intensive Care Unit (ICU) segment dominated the U.S. acute hospital care market with a share of 58.4% in 2021. Increasing patient volume seeking intensive monitoring and nursing round the clock is contributing to the growth of the segment.

b. Some key players operating in the U.S. acute hospital care market include TH Medical (Tenet Healthcare Corporation); Universal Health Services Inc.; Community Health Systems, Inc.; Ascension; Lifepoint Health, Inc.; Ardent Health Services; Emerus Hospital Partners, LLC; Stanford Health Care, Inc.; NYU Langone Hospitals; and NewYork-Presbyterian Hospital

b. Key factors driving the U.S. acute hospital care market growth include the growing geriatric population, increasing prevalence of chronic diseases, and favorable public reimbursement available for the services through Medicare and Medicaid.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."