- Home

- »

- Pharmaceuticals

- »

-

U.S. Aromatherapy Market Size And Share Report, 2030GVR Report cover

![U.S. Aromatherapy Market Size, Share & Trends Report]()

U.S. Aromatherapy Market Size, Share & Trends Analysis Report By Product (Consumables, Equipment), By Mode of Delivery (Topical Application, Aerial Diffusion), By Application, By Distribution Channel, By End-use, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-233-4

- Number of Pages: 125

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

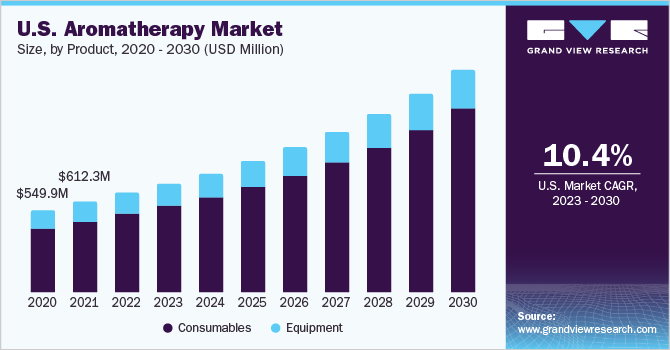

The U.S. aromatherapy market size was estimated at USD 626.6 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 10.0% from 2023 to 2030. Growing awareness about the therapeutic benefits of essential oils is one of the primary drivers for market growth. Essential oils have varied applications. They are widely used by people as a therapeutic measure for various medical conditions. An increase in the millennial population is also expected to help in boosting the market growth.

In 2022, the U.S. Census Bureau estimated a millennial population of approximately 72 million and it has surpassed baby boomers as the biggest group and this trend is estimated to continue. Essential oils are known to possess healing properties. Therapeutic-grade essential oils can positively influence the overall wellness of a patient. These oils have the potential to be natural cleansers and act as an antibacterial when ingested.

As per an article published by The National Centre for Biotechnology Information (NCBI) in 2016, a clinical trial using inhalation of essential oils was conducted on 50 patients suffering from second- and third-degree burns. The results displayed that the oils were highly effective in reducing pain. Hence, aromatherapy can be used as a complementary therapy for pain relief among patients with burn injuries, which is also aiding in its market growth.

As per the findings of NCBI, aromatherapy may be useful in lowering pain and anxiety. When compared to placebo plus routine care or routine care alone, inhaled aromatherapy plus routine care relieved discomfort after dressing patients with burn wounds. Inhaled aromatherapy along with regular care can be more effective than routine care alone in reducing anxiety after dressing. Similarly, aromatherapy massage combined with routine care is also more effective than routine care alone in reducing overall anxiety.

Anxiety disorders including generalized anxiety disorder (GAD), panic disorder, social anxiety disorder, and post-traumatic stress disorder (PTSD) are widespread in the U.S., affecting approximately 31% of the population at some point in their lives. While aromatherapy cannot be utilized as a stand-alone treatment for anxiety, it may be used in conjunction with a multi-faceted approach to alleviate symptoms. The soothing properties of lavender, chamomile, and bergamot essential oils promote relaxation, mood enhancement, stress reduction, and improved sleep.

The COVID-19 outbreak has boosted the aromatherapy industry in a variety of ways. There is a greater demand for alternative therapies owing to the growing emphasis on health and self-care. Aromatherapy's stress-relieving properties have enticed those seeking relaxation during tough times. The growing popularity of at-home treatments has raised the demand for aromatherapy products. The use of plant-derived essential oils in aromatherapy has coincided with a growing interest in natural and holistic solutions.

Major players such as doTERRA International, Frontier Natural Products Co-op, and Young Living Essential Oils are all based in the U.S. They have extensive product portfolios, increasing their penetration through an array of essential oils and other aromatherapy products in the country. U.S. is one of the leaders in aromatherapy retail, according to a SPINS survey. The swift growth of its retail and organic sectors is anticipated to collectively boost the aromatherapy market.

Approval of organic essential oils for disease treatment is another major factor anticipated to aid growth. Pharmaceuticals can damage healthy cells along with diseased ones, for instance, in the case of cancer therapy. Thus, extensive research is being carried out to manage brain cancer through essential oil therapy.

Product Insights

Based on product, the market is segmented into consumables and equipment (diffusers). The consumables segment held the largest share of 78.3% in 2022 and is expected to grow at a CAGR of 10.7% over the forecast period. This is due to an increase in the use of essential oils as therapeutic agents for various conditions. Consumables include essential oils as well as carrier oils. Essential oils can promote natural healing, which increases their growth potential. Essential oils comprise single oils and blended oils. Single oils are further segmented into herbaceous, floral, woody, citrus, earthy, spicy, camphoraceous, and others.

They can be inhaled by diffusers, tissue inhalation, or personal diffusers to have the desired positive effect on emotions and memory via the limbic system. Essential oils can also be used directly via massage or diluted in carrier oils for particular benefits such as relaxation, stress reduction, and muscle relief. They may also be added to baths to give a calming or exciting experience.

Diffusers are used in aromatherapy to diffuse essential oils into the air, producing a therapeutic atmosphere. To disperse the scent of essential oils, several diffusers such as ultrasonic, nebulizing, thermal, and evaporative diffusers are used. Aromatherapy is intended to increase relaxation, decrease anxiety, improve attention, and improve mood. Individuals can experience the potential advantages of essential oils during treatment sessions or in personal areas by inhaling the smells provided by diffusers.

Mode Of Delivery Insights

In terms of mode of delivery, the topical application segment dominated the market in 2022 due to an increase in preference for topical application of aromatherapy oils for various skin conditions. Essential oils are proven to be highly effective against chronic skin issues. Topical aromatherapy is the therapeutic use of essential oils directly to the skin. These highly concentrated plant extracts are recognized for their medicinal effects, which include encouraging relaxation, pain relief, mood enhancement, and general well-being. When essential oils are applied topically, they can be absorbed into the bloodstream and interact with the body's systems, offering targeted effects. To ensure safe and effective use, they are frequently mixed with carrier oils such as coconut, jojoba, or almond oil. Topical aromatherapy, whether through massage, compresses, or lotions, is a pleasant and accessible approach to harnessing the healing potential of essential oils and enjoying their fragrant and therapeutic benefits.

Aerial diffusion, on the other hand, is expected to exhibit a lucrative CAGR over the forecast period due to its effectiveness in treating colds and flu. Aerial diffusion is a simple and effective technique to enjoy the therapeutic effects of essential oils in a pleasant environment. The preference for aerial diffusion has increased with the growing demand for evaporative diffusers, such as AromaMist Ultrasonic Diffuser by Mountain Rose Herbs. It is a method of spreading essential oil molecules into the air for use in aromatherapy. It may be accomplished using a variety of devices such as nebulizers, ultrasonic, evaporative, and thermal diffusers, as well as Reed diffusers and personal inhalers. To experience the therapeutic effects of aromatherapy, the factors to consider are selecting appropriate oils, diluting appropriately, diffusing intermittently, ensuring ventilation, and being conscious of personal sensitivities.

Application Insights

In terms of application, the relaxation segment dominated the market in 2022 due to factors such as an increase in the prevalence of anxiety and stress. The preference for natural and herbal treatments has led people to opt for such products to get relief from stress. Aromatherapy decreases stress and anxiety, improves sleep quality, boosts mood, increases muscular relaxation, and stimulates the mind-body connection.

People with skin rashes often seek aromatherapy as it can help nourish the skin and reduce inflammation. Synthetic products are not always preferred by people due to their adverse effects. Thus, essential and carrier oils are opted for by people with various skin disorders. These oils possess antifungal, antibacterial, and antiseptic properties, which help various skin and hair conditions.

Distribution Channel Insights

In terms of distribution channel, the direct-to-consumer (DTC) sales segment dominated the market in 2022. This is because DTC is associated with multilevel marketing of aromatherapy products. Concerning aromatherapy, it is crucial to smell fragrances before purchasing the products. Hence, retail stores that offer aromatherapy products are seen to be the largest revenue-generating units.

Major players such as doTERRA International, Young Living Essential Oils, and Mountain Rose Herbs offer products to wholesalers at a discounted rate to boost sales. Such factors are anticipated to propel segment growth over the coming years.

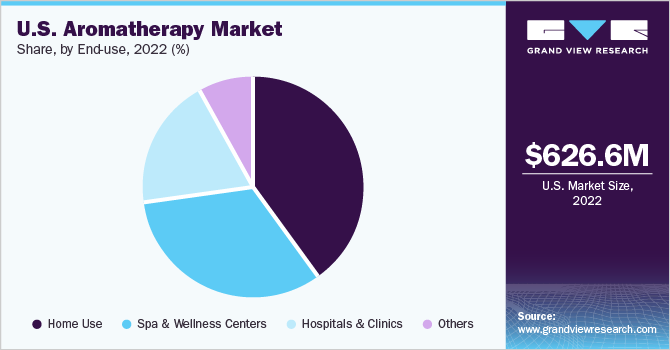

End-use Insights

Based on end-use, the market is segmented into home use, spa & wellness centers, hospitals & clinics, and others. The home use segment dominated the U.S. market in 2022 with a market share of 39.5% and is estimated to be the fastest-growing segment in the coming years. There is an increase in the use of aromatherapy for relaxation, pain management, treating colds, coughs, insomnia, and skin & hair management at home.

People visit spa and wellness centers for relaxation, stress relief, and quick healing & recovery. Spa and wellness centers held a significant share in 2022.Aromatherapy stimulates lymphatic, circulatory, and musculoskeletal systems, thereby enhancing immunity. It is also being used in hospitals and specialty clinics for its various properties such as enhancing blood circulation, easing digestion; reducing anxiety, nausea, & stress; and helping expedite recovery. As it is a non-invasive technique, its adoption is increasing across various applications, which is expected to aid in the growth of the market.

Key Companies & Market Share Insights

Key strategies undertaken by major players include new product development, strategic partnerships, and regional expansions. In February 2022, doTERRA announced that it was ready to meet the demand for essential oils & natural products in India, with its corporate office in Mumbai.

In December 2021, Tilley Company, Inc. and SK Capital Partners (portfolio company) announced a merger with a distributor of high-quality fragrance & flavor compounds and ingredients, Phoenix Aromas and Essential Oils. The merger is expected to enhance the quality, value, and range of solutions to both suppliers and customers. Some prominent players in the U.S. aromatherapy market include:

-

Edens Garden

-

doTERRA International

-

Frontier Natural Products Co-op

-

Mountain Rose Herbs

-

Young Living Essential Oils

-

Rocky Mountain Oils

-

Plant Therapy Essential Oils.

U.S. Aromatherapy Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 1.3 billion

Growth Rate

CAGR of 10.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report Updated

September 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, mode of delivery, application, distribution channel, end-use

Regional scope

U.S.

Country scope

U.S.

Key companies profiled

Edens Garden; doTERRA International; Frontier Natural Products Co-op; Mountain Rose Herbs; Young Living Essential Oils; Rocky Mountain Oils, LLC; Plant Therapy Essential Oils; FLORIHANA; Biolandes; Falcon Essential Oils.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Aromatherapy Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. aromatherapymarket report based on product, mode of delivery, application, distribution channel, and end-use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumables

-

Essential Oils

-

Singles

-

Herbaceous

-

Woody

-

Spicy

-

Floral

-

Citrus

-

Earthy

-

Camphoraceous

-

Others

-

-

Blends

-

-

Carrier Oils

-

-

Equipment

-

Ultrasonic

-

Nebulizing

-

Evaporative

-

Heat

-

-

-

Mode of Delivery Outlook (Revenue, USD Million, 2018 - 2030)

-

Topical Application

-

Aerial Diffusion

-

Direct Inhalation

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Relaxation

-

Skin & Hair care

-

Pain Management

-

Cold & Cough

-

Insomnia

-

Scar management

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

D2C

-

Retail

-

E-commerce

-

-

B2B

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Home use

-

Spa & Wellness Centers

-

Hospitals & Clinics

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. aromatherapy market size was estimated at USD 626.6 million in 2022 and is expected to reach USD 682.6 million in 2023.

b. The U.S. aromatherapy market is expected to grow at a compound annual growth rate of 10.0% from 2023 to 2030 to reach USD 1.3 billion by 2030.

b. The consumables segment dominated in 2022 with over 77.8%. This is due to an increase in the use of essential oils as therapeutic agents for various conditions.

b. Some key players are Edens Garden, doTERRA International, Frontier Natural Products Co-op, Mountain Rose Herbs, Young Living Essential Oils, Rocky Mountain Oils, and Plant Therapy Essential Oils.

b. Growing awareness about the therapeutic benefits of essential oils is one of the primary drivers. Essential oils have varied applications. They are widely used by people as a therapeutic measure for various medical conditions.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."