- Home

- »

- Clinical Diagnostics

- »

-

U.S. Cancer Biopsy Market Size, Share & Growth Report, 2030GVR Report cover

![U.S. Cancer Biopsy Market Size, Share & Trends Report]()

U.S. Cancer Biopsy Market Size, Share & Trends Analysis Report By Type (Fine-needle Aspiration, Core, Surgical, Skin Biopsy/Punch Biopsy), By Application, By Site, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-467-3

- Number of Pages: 155

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

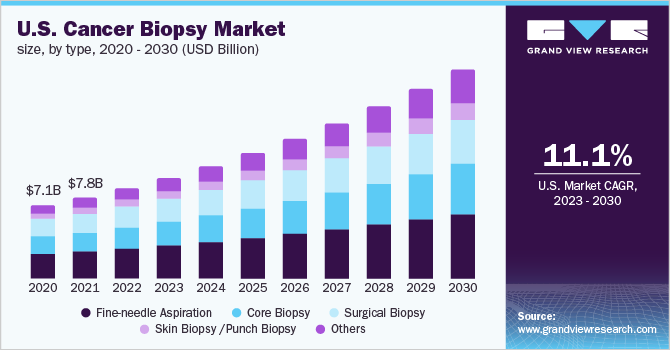

The U.S. cancer biopsy market size was estimated at USD 8.68 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 11.12% by 2030. The U.S. cancer biopsy market is witnessing growth due to the factors such as advancements in quality & payment pertaining to genetic cancer diseases and the advent of liquid biopsies and their growing clinical implementation. Moreover, the increasing prevalence of cancer and the growing geriatric population is also likely to fuel the market growth. The COVID-19 outbreak has negatively impacted cancer treatment tourism across the globe. Due to the travel restrictions imposed by several countries, the treatment of many patients was interrupted abruptly. This may hinder the market growth of medical tourism for cancer treatment.

Cancer remains the leading cause of death across the globe. Thus, there is a growing need for advanced diagnostic tools designed for early detection. In recent years, precision oncology has emerged as a promising approach to management. With the evolution of the precision oncology field, companion diagnostic tools are increasingly being utilized to guide treatment decisions and select therapies based on a patient’s unique genomic profile. These tools facilitate the effective & safe use of corresponding therapeutic products. Till June 2021, more than 40 FDA-approved companion diagnostic assays for oncology indications are available in the market.

Advancements in diagnostic methods have created scope for their widespread clinical applications as well as translational research applications. Several initiatives have been undertaken to accelerate the utilization of various methods in translational research across academia and research industry. The Cancer Moonshot Blood Profiling Atlas is one such initiative that aims to accelerate the development of liquid biopsy tests for the management of cancer. This initiative focuses on collaborations between academia, government, and industries to boost test development.

Accurate detection of the progression of cancer is very important for the selection of an appropriate treatment regimen. Currently, available tests show false-positive results in some cases. Thus, supportive confirmatory tests are required to be performed, which increases the monetary burden on patients. Tests using tumor markers and specific biomarkers give results that are relatively more accurate. However, they are not available abundantly. As a result, the lack of highly sensitive tests is impeding market growth.

Type Insights

Fine-needle aspiration segment dominated the U.S. cancer biopsy market in 2022 with a revenue share of 32.7%. Fine-needle aspiration (FNA) biopsy is a well-established approach for the initial diagnosis of most body lesions, including benign and malignant. It is an effective and quick test for determining the status of uncertain tissue. Moreover, the simplicity offered by the noninvasive approach that demands a skilled aspirator aided with the routine use of needles, stains, and syringes is further propelling the growth of the market.

This has prompted several companies to invest in the development of FNA systems. For instance, in October 2021, Micro-Tech Endoscopy, launched endoscopic ultrasound-guided needles: Areus FNA and Trident FNB. Areus FNA and Trident FNB are available in 22ga and 25ga.

Skin /punch biopsy segment is expected to show lucrative growth during the forecast period. Skin biopsy is one of the most significant diagnostic tests for skin disorders. Punch biopsy is recognized as the most important technique for finding diagnostic full-thickness skin samples. This segment is inclusive of the revenue generated by biopsies performed on patients with skin lesions.

Awareness about the use of shave and punch biopsy, among others, has increased. The launch of new technologically advanced products will further drive the growth of the segment in the review period. For instance, in December 2021, Innovia Medical announced the expansion of its single-use instrument product line into the U.S. The product leading the growth is a gynecology product called the Cervical Rotating Biopsy Punch.

Application Insights

Screening & monitoring segment held the largest share of 53.5% in 2022. This can be attributed to the increasing adoption of different techniques in screening & monitoring applications. Biopsy has gained significant attention among professionals for the early detection of cancer, particularly when it is difficult to make a direct screening recommendation.

The screening process involves a negative biopsy report alongside other detection techniques. Previous negative biopsy lowers the risk of cancer onset, which relies heavily on race, family history, and increasing age. In addition, a number of risk-stratification or decision-making algorithms are developed that helps to minimize adverse effects associated with biopsy, which, in turn, is expected to impel the segment growth.

Pharma & Biopharma Discovery & Development segment is expected to show the fastest growth during the forecast period. The use of various types of biopsies in pharma drug discovery & development is currently at a nascent stage; however, it is expected to increase in the coming years. The U.S. is, thus, expected to become the fastest-growing market.

The construction of a bio bank of organoids requires a large pool of biopsy specimens so that gene expression profiling can be performed before drug screening, which is a complex process. The end goal of utilizing biopsy in gene expression profiling is to establish protocols for developing a Patient-derived Organoid (PDO) tumor model to study novel drug candidates.

For instance, in November 2020, FoundationOne Liquid CDx test manufactured by Foundation Medicine, Inc., which is a liquid biopsy, next-generation sequencing device, received approval from the U.S. FDA.

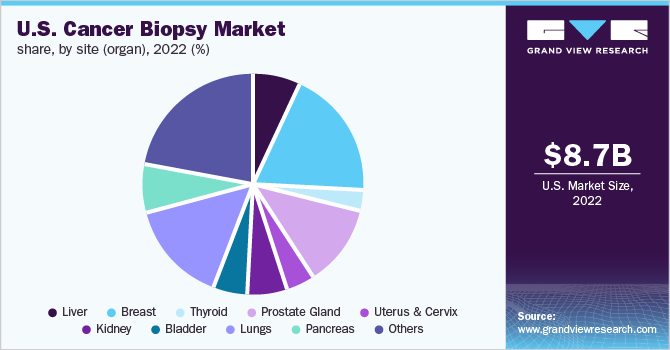

Site (Organ) Insights

Breast cancer segment accounted for the largest revenue share of 19.5% in the U.S. cancer biopsy market in 2022. The dominance of the segment is attributed to the increasing prevalence of breast cancer aided by the growing recommendation for suspected cancer patients to undergo microscope-based analysis of breast tissue, which helps doctors conclude on a definitive diagnosis along with detecting stage and characterization of the disease.

This has propelled the demand for a needle biopsy or surgical biopsy to obtain tissue for microscopic analysis. Image-guided needle biopsy has emerged as a safe and accurate nonsurgical approach for diagnosing suspicious tissues in the breast. These diagnostic approaches yield findings that are integral for designing apt therapeutic methods.

Thyroid segment is expected to show the fastest growth during the forecast period. Thyroid cancer is a comparatively infrequent malignancy that accounts for about 2.0% of cancer cases in men and less than 1.0% to 5.0% in women. Fine-needle aspiration (FNA) biopsy is the most accurate test for detecting malignancy in thyroid patients; it can be pivotal in the effective evaluation of thyroid nodules.

Several studies suggested that results obtained through FNA are superior when combined with Ultrasound Guidance (USFNA). Techniques such as palpation-directed FNA and Ultrasound-directed (US) FNA are set to gain traction in this segment. High demand for FNA is also a result of routine usage of US FNA across follow-up surveillance of thyroid cancer patients.

Country Insights

U.S. cancer biopsy market is the leading market in terms of revenue generation owing to high cancer prevalence, rapid technological advancements, and growing government initiatives. Moreover, investments and the presence of several biotechnology companies developing the tests will further propel the market growth during the forecast period.

Various organizations, such as the American Society of Clinical Oncology, are engaged in supporting the implementation of cancer biopsy, which is likely to boost revenue in this market. In addition, the US Preventive Services Task Force (USPSTF) also recommends population-based screening for cervical, breast, colorectal, and cancers.

In addition, strong government organizations and private cancer foundations have made significant contributions to the rising demand for cancer biopsy products in the U.S. This robust network has helped both patients and healthcare professionals to gain a better understanding of biopsy requirements in the diagnosis of cancer. Moreover, strong recommendations for biopsies for early diagnosis of breast cancer by the American Cancer Society are expected to positively impact the market growth during the forecast period.

In addition, doctors and physicians in the U.S. use Breast Imaging Reporting and Data Systems (BI-RADS), which is a numbered system for the assessment of mammogram reports. As per the BI-RADS, a breast biopsy is strongly recommended for the majority of the categories. Moreover, in vitro diagnostics companies are continuously investing and advancing through innovative automation strategies to introduce platforms that have gained CLIA-waived status.

These strategies aid the companies to effectively offset the regulatory challenges. For instance, in June 2021, Grail launched its liquid biopsy test in the U.S. and is sold under a CLIA waiver and can be used to test people aged over 50 at elevated risk of cancer.

Key Companies & Market Share Insights

The key players operating in the U.S. cancer biopsy market are focusing on partnerships, geographical expansion, and strategic collaborations in emerging and economically favorable regions. For Instance, in January 2022, Epic Biosciences announced the launch of multi-analyte metastatic breast cancer liquid biopsy. The company’s DefineMBC includes both cell-free and cell-based analysis. Some of the prominent players in the U.S. cancer biopsy market include:

-

BD (Becton, Dickinson And Company)

-

IZI Medical Products

-

Johnson & Johnson Services, Inc.

-

Argon Medical

-

Spectra Medical Devices, Inc.

-

Medtronic

-

Boston Scientific Corporation

-

CONMED Corporation

-

INRAD, Inc.

-

Thermo Fisher Scientific, Inc.

U.S. Cancer Biopsy Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 9.70 billion

Revenue forecast in 2030

USD 20.18 billion

Growth rate

CAGR of 11.12%from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, application, site(organ)

Country Scope

U.S.

Key companies profiled

BD (Becton, Dickinson and Company); IZI Medical Products; Johnson & Johnson Services, Inc.; Argon Medical; Spectra Medical Devices, Inc.; Medtronic; Boston Scientific Corporation; CONMED Corporation; INRAD, Inc.; Thermo Fisher Scientific, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

U.S. Cancer Biopsy Market Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the U.S. Cancer Biopsy Market based on the type, application, and site (organ):

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Fine-needle Aspiration

-

Pharma-use

-

Clinical

-

-

Core Biopsy

-

Pharma-use

-

Clinical

-

-

Surgical Biopsy

-

Pharma-use

-

Clinical

-

-

Skin Biopsy /Punch Biopsy

-

Pharma-use

-

Clinical

-

-

Others

-

Pharma-use

-

Clinical

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Screening & Monitoring

-

Diagnostics

-

Investigational & Translational Research

-

Pharma & Biopharma Discovery & Development

-

-

Site (Organ) Outlook (Revenue, USD Million, 2018 - 2030)

-

Liver

-

Breast

-

Thyroid

-

Prostate Gland

-

Uterus & Cervix

-

Kidney

-

Bladder

-

Lungs

-

Pancreas

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. cancer biopsy market size was estimated at USD 8.68 billion in 2022 and is expected to reach USD 9.70 billion in 2023.

b. The U.S. cancer biopsy market is expected to grow at a compound annual growth rate of 11.12% from 2023 to 2030 to reach USD 20.17 billion by 2030.

b. The fine-needle aspiration biopsy (FNA) dominated the U.S. cancer biopsy market in 2022 with a revenue share of more than 32.72%.

b. Some key players operating in the U.S. cancer biopsy market include BD (Becton, Dickinson And Company), IZI Medical Products, Johnson & Johnson Services, Inc., Argon Medical, Spectra Medical Devices, Inc., Medtronic, Boston Scientific Corporation, CONMED Corporation, INRAD, Inc., and Thermo Fisher Scientific, Inc.

b. Key factors that are driving the U.S. cancer biopsy market growth include the rise in the adoption of biopsies based on multi-parametric magnetic resonance imaging and the increasing popularity of image-guided needle biopsies in precision medicine applications.

b. The breast segment accounted for the largest revenue share of 19.50% in 2022 in the U.S. cancer biopsy market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."