- Home

- »

- Consumer F&B

- »

-

U.S. Canned Foods Market Size, Share, & Trends Report, 2025GVR Report cover

![U.S. Canned Foods Market Size, Share & Trends Report]()

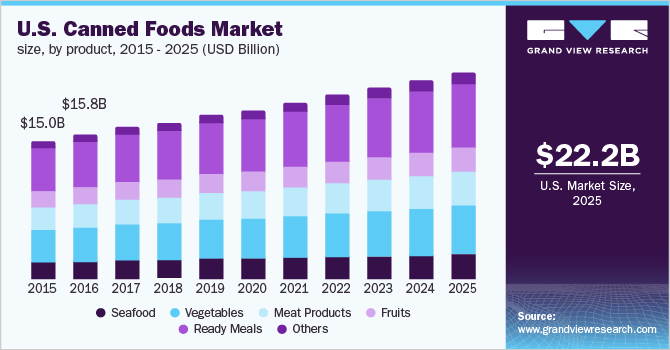

U.S. Canned Foods Market Size, Share & Trends Analysis Report, By Type (Seafood, Vegetables, Meat Products, Fruits, Ready Meals), Competitive Landscape, And Segment Forecasts, 2018 - 2025

- Report ID: GVR-2-68038-160-3

- Number of Pages: 70

- Format: Electronic (PDF)

- Historical Range: 2014 - 2016

- Industry: Consumer Goods

Report Overview

The U.S. canned foods market size to be valued at USD 22.23 billion by 2025. Improvement in distribution infrastructure and the resultant increasing popularity of ready-to-eat food products, coupled with the affordability of canned foods and changing lifestyles are expected to propel the industry growth over the forecast period.

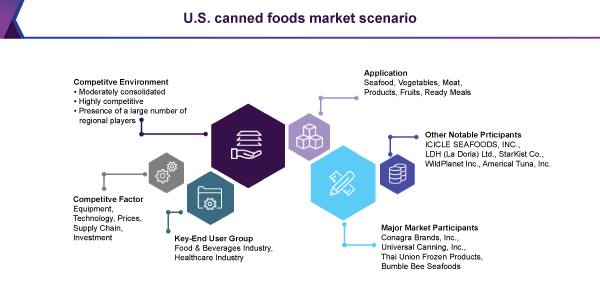

The market exhibits the presence of large players acquiring smaller entities with these players reducing prices, thus, yielding to intense competition. It is also observed that the exit barriers for canned food companies are high owing to divestment of assets and higher fixed costs of automated processes thus intensifying the rivalry among competitors.

The demand in the U.S. is estimated to be valued at USD 22.23 billion by 2025. In the U.S., sustainable farming techniques coupled with the benefits of these food products has resulted in an increase in its consumption. The various advantages of canned foods such as ease in cooking and increased shelf life are also expected to drive the market growth in the U.S.

The industry is characterized by high volume and low margin of the product. The supplier power is anticipated to be weak with canned food processing companies sourcing the input from a large number of suppliers. The retail industry is observed to be fragmented with companies selling products to small buyers.

In January 2017, “Control of Listeria monocytogenes in Ready-To-Eat Foods”, draft guidance was released by the U.S. Food and Drug Administration, which aims at preventing ready-to-eat (RTE) foods from the risk of Listeria monocytogenes (L. mono). The FDA supports ongoing efforts by government agencies and industry participants to achieve food safety across the nation.

The companies involved in the industry are required to file the processes utilized in the manufacturing of canned food products and report them to the U.S. FDA. The authority under 21 CFR 108 also regulates the type of processes utilized in the manufacturing of canned food products, and container size & quality utilized for packaging purposes.

U.S. Canned Foods Market Trends

The global market is driven by the recyclable aspects of cans, hygienic food processing, and nutritional value. Owing to the growth of active lifestyle, busy schedule, and rising female labor force, the demand for processed or packaged foods has increased that contributes to customers’ shift to healthy food options. Moreover, the availability of several suitable food options such as ready-to-eat, and ready-to-serve promotes the growth of the global market. The increased demand for ready-to-eat food around the world is expected to boost the growth of canned food products even further.

Cans of food are made using non-biodegradable tin and aluminum cans. Once used, the cans are disposed away and remain in the atmosphere for a longer time causing major environmental hazards. When subjected to abiotic or biotic causes, the cans emit hazardous fumes and poisonous chemicals. Furthermore, governments in various countries are encouraging people to avoid tin and aluminum packaged cans. This is anticipated to negatively impact the market growth.

With the rising health concerns, customers are spending more on organic food items thereby creating opportunities for food companies to emphasize organic canned food products. Manufacturers provide a variety of canned food items with excellent taste, quality, and nutritional content to retain their position in the competitive market.

Type Insights

The U.S. industry serves various product types including seafood, vegetables, meat products, fruits, ready meals, and others. Ready meals play a major role in the growth of the U.S. market on account of rising demand for convenience foods, healthy protein-rich foods, and increased awareness among the population.

The market for vegetables is contributed to the higher amounts of minerals exhibited by the product used in reduction of hypertension, osteoporosis, and others. The vegetable market has various nutritional benefits and is thus in high demand from the U.S. The segment is thus expected to progress at a CAGR of 4.0% over the forecast period.

Growing tuna consumption is expected to play a crucial role in driving market growth over the forecast period. However, the tuna market is affected by culture, tradition, education & awareness in consumers. There are certain constraints regarding harvest sustainability that is expected to hamper industry growth.

The demand for meat products is likely to rise at an estimated CAGR of 3.3% by revenue, over the forecast period. The canned meat products market is expected to grow at a steady rate owing to the growing popularity in restaurants and fast food joints as well as improved production including harvesting, processing, and canning.

Country Insights

The U.S. canned foods industry is anticipated to ascend at an estimated CAGR of 3.9% over the forecast period. The extensive consumption of canned foods in the U.S. is contributed to improved processing techniques and a rise in awareness among the people regarding the nutritional value of the products.

Technological development in the aquaculture method in the U.S. is anticipated to create immense market potential for the market in the near future. The aquaculture method is used for volume production over the traditional method of wild fish harvesting. Other technological innovations are observed in the fish feed industry with sustainable feed products such as algae.

The canning companies in the U.S. use aluminum as the raw material for canning instead of using tin for its enhanced heat processing capacity. The dominant position of the tin plate for canned foods is changed with the introduction of aluminum alloy as it possesses hardness greater than tin and is well suited for canning.

The buyers in the industry are rising owing to the increased availability of canned foods in various varieties in online retail stores. Moreover, the growth of this market is contributed to the cheaper option available to buyers to cook the meal at home rather than going to restaurants. These factors are expected to propel the market growth over the next eight years.

Key Companies & Market Share Insights

The U.S. canned foods industry is characterized by the presence of a large number of regional players and is highly competitive in nature. The threat of new entrants in the industry is expected to remain low with buyers concentrating on buying from established brand names for assurance of quality.

The major players have strong brands and high-volume production facilities thus reducing the market for smaller players. In addition, the regulatory requirements and government policies are stringent, thus, increasing the threat for new entrants. Also, it is observed that the capital investment is considerable owing to the establishment of canning plants.

Recent Developments

-

In August 2021, Wild Planet Foods, an innovation leader and pioneer in the US sustainable canned fish market was acquired by Bolton Group. Wild Planet and Bolton Group collaborated to create an sustainable supply chain

-

In September 2021, Hemmer, a Brazilian food company was acquired by Kraft Heinz. This acquisition provides a valuable opportunity to advance our global expansion strategy based on Taste Elevation.

Companies such as Conagra Brands, Inc.., Universal Canning Inc., StarKist Co., Bumble Bee Seafoods, Wild Planet Foods, Inc., Connors Bros Ltd., and LDH (La Doria) Ltd. are involved in the manufacturing of these food products. Distributors such as Gourmet Food World, Seven Star Ocean Fisheries, and Godrej’s Nature Basket, supply canned food products to consumer companies.

U.S. Canned Foods Market Report Scope

Report Attribute

Details

Revenue forecast in 2025

USD 22.23 billion

Base year for estimation

2017

Historical data

2014 - 2016

Forecast period

2017 - 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2017 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type

Key companies profiled

BASF SE; AkzoNobel; PPG Industries; Axalta Coating Systems.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Canned Foods Market Segmentation

This report forecasts revenue and volume growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the U.S. canned foods market report on the basis of type.

-

Type Outlook (Volume, Kilotons, Revenue, USD Million; 2014 - 2025)

-

Seafood

-

Vegetables

-

Meat Products

-

Fruits

-

Ready Meals

-

Others

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."