- Home

- »

- Advanced Interior Materials

- »

-

U.S. Ceiling Tiles Market Size, Share & Growth Report, 2030GVR Report cover

![U.S. Ceiling Tiles Market Size, Share & Trends Report]()

U.S. Ceiling Tiles Market Size, Share & Trends Analysis Report By Material (Mineral Wool, Metal, Gypsum, Wood Wool), By Application (Residential, Non-Residential, Industrial), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-026-2

- Number of Pages: 49

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Advanced Materials

Market Size & Trends

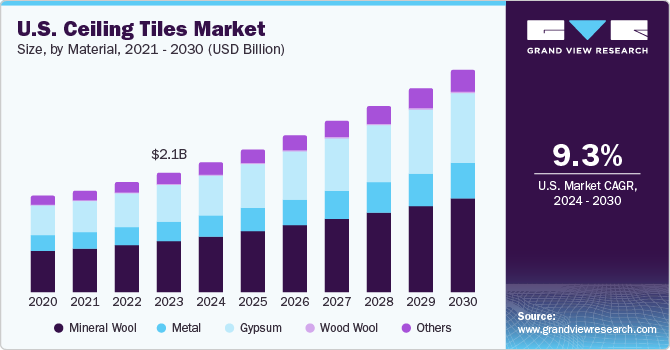

The U.S. ceiling tiles market size was estimated at USD 2.08 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 9.3% from 2024 to 2030. The country's market growth is aided by the rising rate of construction and remodeling activities. The product imparts aesthetic appeal to buildings, while also enhancing their insulation, resulting in energy savings. This drives the demand for ceiling tiles in the country. Another primary driver of ceiling tiles is their ability to control or minimize sound transmission. Ceiling tiles are designed such that they absorb noise by diffusing it. The product is well suited for soundproofing, owing to which it finds wide usage in hospitals, schools, restaurants, and commercial buildings, such as offices. These places are typically crowded, while at the same time, silence is desired to create a pleasant working environment. Thus, the usage of a product is increasing in these application areas.

Ceiling tiles are available in several colors, textures, designs, sizes, and shapes to choose from. Moreover, these tiles help enhance the aesthetic appeal of a building, while also covering up unsightly objects such as pipes and wires. Ease of installation of ceiling tiles, coupled with their various other advantages, have made it a preferred choice for many construction project owners, and these advantages are also projected to contribute to the future growth of the product.

Manufacturing processes of ceiling tiles have continued to become more efficient owing to technological advancements. Automation, including robotics and computer-controlled machinery, allows for precision in cutting and shaping, reducing material waste and boosting overall productivity. This streamlining also helps reduce costs, making high-quality ceiling tiles more affordable.

Advancements in nanotechnology have aided in the development of self-repairing and self-cleaning ceiling tiles. These tiles are coated with nanomaterials that repel stains and dirt, which helps ensure that they remain in pristine condition with minimal maintenance. In addition, they can automatically repair small damages, extending their lifespan and reducing the need for replacements.

The market is anticipated to witness extensive growth opportunities on account of the current exponential growth in the country's construction sector. The population of the U.S. is rapidly increasing due to the high rate of migration of the young population demographic from developing countries to pursue higher education and have better job prospects. This has led to a high demand for residential buildings, which contributes to the rising demand for ceiling tiles in the economy.

The U.S. construction industry is witnessing a significant inclination toward the adoption of green building practices owing to rising awareness regarding environmental issues, coupled with increasingly stringent government regulations regarding CO2 and VOC emissions. Ceiling tiles are considered sustainable and eco-friendly, as they can be recycled into different products. Thus, rising awareness regarding the utilization of eco-friendly materials for the construction of buildings is expected to boost market growth.

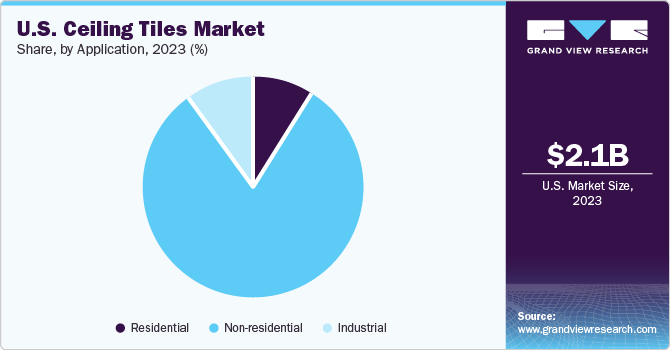

Application Insights

Based on application, the non-residential segment dominated the market with a revenue share of 80.7% in 2023. The surge in construction activity of commercial spaces is driving the growth of this segment. Ceiling tiles are recognized as integral components in commercial and institutional construction projects due to their multifaceted benefits. These serve a dual role by significantly enhancing interior aesthetics and improving acoustic performance within the constructed spaces.

From an aesthetic perspective, ceiling tiles offer an array of design options, enabling architects and interior designers to create visually appealing and functional environments. Moreover, ceiling tiles are engineered to absorb and dampen sound, effectively reducing noise levels and preventing sound transmission between rooms. This acoustic control is vital for productivity in workplaces, concentration in educational institutions, patient comfort in healthcare settings, and an enjoyable shopping experience in retail spaces. This is further anticipated to boost the adoption of products in the U.S. market.

The residential segment is anticipated to witness the fastest CAGR over the forecast period owing to a boom in the construction of the housing sector. Growing population, rise in disposable incomes, and urbanization are the key factors that are contributing to the market growth. Materials such as mineral wool and metals are generally suited for residential applications. Furthermore, changes in preference for aesthetically pleasing housing interiors and exteriors are expected to contribute to the demand for a product over the forecast period.

The increasing trend toward open-concept living spaces in modern homes further amplifies the need for innovative ceiling solutions, stimulating market growth. Moreover, rising demand for sustainable and energy-efficient housing has led to the integration of eco-friendly ceiling tiles, a trend driven by regulatory incentives and heightened environmental consciousness among consumers. Acoustic performance is another significant factor, as homeowners increasingly prioritize creating noise-free and comfortable living environments, fueling the use of acoustic ceiling tiles.

Material Insights

Based on material, the gypsum material segment dominated the market with a revenue share of 32.0% in 2023 and is further anticipated to grow at a CAGR of 9.3% over the forecast period. Gypsum ceiling tiles are made from incombustible gypsum boards of high quality and are free from harmful substances that can affect the environment. These tiles come in different patterns and colors, which provide acoustic looks to a ceiling.

The growing trend of retrofitting and renovation projects is driving the demand for gypsum ceiling tiles. These can be easily installed in existing structures, making them a popular choice for upgrading older buildings. As urbanization continues and more aging infrastructure needs revitalization, gypsum tiles are an attractive solution for improving both the aesthetics and functionality of these spaces.

The mineral wool segment is anticipated to grow at the fastest CAGR over the forecast period owing to its wide adoption as an insulation and soundproofing material. Mineral wool in ceiling tiles has various attributes, such as aesthetic designs, fire protection, and effective thermal insulation, and is an eco-friendly material, which is driving its demand.

The growing emphasis on energy efficiency and sustainability in construction projects is further driving the demand for mineral wool ceiling tiles. There is a growing global awareness of the environmental impact of construction and building operations. As a result, builders and designers are working on construction materials that can contribute to energy efficiency and lower a structure's carbon imprint. Mineral wool ceiling tiles align with this sustainability goal as they are manufactured using recycled materials and are themselves recyclable, making them a preferred choice for eco-conscious projects.

Key Companies & Market Share Insights

Key players operating in the market include AWI Licensing LLC; USG Corporation; ROCKWOOL A/S; Hunter Douglas N.V; CERTAINTEED; Genesis Products; and SAS International. The market is characterized by intense competition owing to the presence of a large number of prominent manufacturers of ceiling tiles in the country.

These players have a low level of product and price differentiation that further fuels the intensity of competitive rivalry among them. Furthermore, players are opting for strategies such as acquisition and new product launches to expand their market share. For instance, in July 2022, Saint-Gobain, the parent company of CERTAINTEED completed the acquisition of Kaycan, a manufacturer and distributor of exterior building materials based in the U.S. and Canada.

Key U.S. Ceiling Tiles Companies:

- AWI Licensing LLC,

- USG Corporation

- Genesis Products

- ROCKWOOL A/S

- Odenwald Faserplattenwerk GmbH

- ArtUSA Industries, Inc.

- SAS International

- Hunter Douglas N.V

- American Tin Ceilings

- CERTAINTEED

- Acoustical Surfaces, Inc.

- BAUX AB

U.S. Ceiling Tiles Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 3.88 billion

Growth rate

CAGR of 9.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in million square meters, revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, application

Country scope

U.S.

Key companies profiled

AWI Licensing LLC; USG Corporation; Genesis Products; ROCKWOOL A/S; Odenwald Faserplattenwerk GmbH; ArtUSA Industries, Inc.; SAS International; Hunter Douglas N.V; American Tin Ceilings; CERTAINTEED; Acoustical Surfaces, Inc.; BAUX AB

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Ceiling Tiles Market Report Segmentation

This report forecasts revenue & volume growth at country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. ceiling tiles market report based on material, and application:

-

Material Outlook (Volume, Million Square Meters; Revenue, USD Billion, 2018 - 2030)

-

Mineral Wool

-

Metal

-

Gypsum

-

Wood Wool

-

Others

-

-

Application Outlook (Volume, Million Square Meters; Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Non-residential

-

Industrial

-

Frequently Asked Questions About This Report

b. The U.S. ceiling tiles market size was estimated at USD 2.08 billion in 2023 and is expected to reach USD 2.27 billion in 2024.

b. The U.S. ceiling tiles market is expected to grow at a compound annual growth rate of 9.3% from 2024 to 2030 to reach USD 3.88 billion by 2030.

b. Non-residential segment accounted for the larger revenue share of 80.7% in 2023 owing to the multifaceted benefits of ceiling tiles, the product has recognized as integral components in commercial and institutional construction projects.

b. Some of the key players operating in the U.S. ceiling tiles market include AWI Licensing LLC, ROCKWOOL A/S, Genesis Products, CERTAINTEED, Hunter Douglas N.V, and SAS International.

b. The key factors that are driving the U.S. ceiling tiles market include growing refurbishment and new construction activities in the U.S.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."