- Home

- »

- Processed & Frozen Foods

- »

-

U.S. And China Glucose Market Size Report, 2020-2028GVR Report cover

![U.S. And China Glucose Market Size, Share & Trends Report]()

U.S. And China Glucose Market Size, Share & Trends Analysis Report By Form (Syrup, Solid), By Application (Food & Beverages, Cosmetic & Personal Care, Pharmaceutical), And Segment Forecasts, 2020 - 2028

- Report ID: GVR-4-68039-520-4

- Number of Pages: 97

- Format: Electronic (PDF)

- Historical Range: 2017 - 2019

- Industry: Consumer Goods

Report Overview

The U.S. and China glucose market size was valued at USD 6.47 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 4.8% from 2020 to 2028. The high expenditure on food and beverage products in the U.S. due to the high overall disposable income of the U.S. population is boosting the growth of the country’s glucose (dextrose) market. In addition, China is the world’s largest consumer of food and beverages, which is a primary factor supporting the glucose (dextrose) market growth. Rising disposable income and changing consumer dietary habits of the residents are likely to boost the demand for ingredients used in food processing.

The U.S. is exhibiting potential growth in the glucose (dextrose) market due to the high spending power of residents in the country and the busy lifestyle, which is, in turn, supporting the demand for packaged and ready-to-eat food products. According to the U.S. Department of Agriculture, food away-from-home accounted for 54.8% of total food expenditure in the U.S. in 2019.

The major manufacturers are continuously involved in the development of advanced and innovative products, like low sugar glucose syrup and organic glucose products, which is, in turn, driving the market value. The glucose (dextrose) manufacturing sector is experiencing development in terms of technological advancements and manufacturing processes. Simultaneously, the food & beverage sector is also witnessing several changes due to continuously increasing demand from the end users.

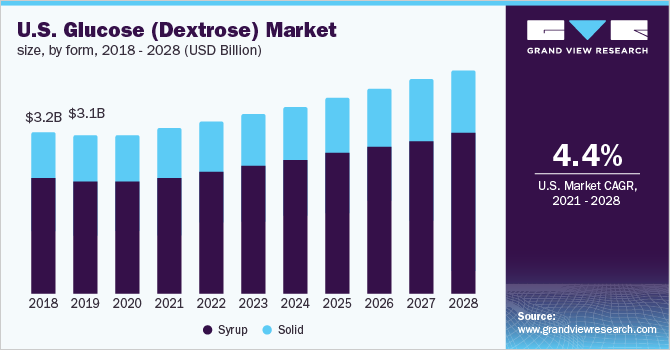

Form Insights

In 2020, the syrup segment accounted for the largest revenue share of 69.2% and is projected to retain its lead from 2020 to 2028. The glucose syrup is a transparent viscous liquid majorly derived from corn, wheat, rice, and tapioca starch. It finds usage in various food and beverage applications including confectionery and bakery, beverages (alcoholic and non-alcoholic), and certain canned and premade baked goods. Moreover, the segment is expected to witness the fastest growth during the forecast period. This is particularly because of the continuously increasing demand for glucose syrup across continuously expanding applications across different industry verticals.

The increasing demand for glucose syrup across confectionery including gummies, candies, lollipops, candy bars, chocolate, and cotton candy is driving the market. The rising demand for U.S. confectionery due to its popularity is supporting the growth of glucose syrup. For instance, Hancocks, a wholesaler, reported an increase in demand for U.S. sweets and snacks range as a result the firm has expanded its portfolio of offerings for the same. The wholesaler has reported that it has started stocking some exclusive American brands including SweeTarts, Warhead, Mike & Ike, Cookie Dough, Laffy Taffy, and Nerds with brand new launches from RedVines and Sour Punch. Some of the other major U.S. brands stocked by the Hancocks include Hershey’s, Reese’s, Faygo, Jolly Rancher, Sour Punch, Jelly Belly, and Airheads.

Glucose syrup has various applications across the Pharmaceutical sector and major manufacturers are offering pharma-grade liquid glucose. For instance, Cargill, Incorporated provides C☆PharmSweet, a glucose liquid derived from hydrolysis of starch used in cough syrup manufacturing. It increases viscosity and improves mouthfeel in the cough syrup. The functionalities of the product include coating agent, bulking agent, anti-crystallizing agent, sweetening agent, and viscosity increasing agent. Glucose syrup from Roquette Pharma is derived from enzymatic and/or acid hydrolysis of food starches. It is a viscous, clear, colorless liquid with a sweet taste having varied pharmacopeia compliance including Ph. Eur., and USP-NF.

Application Insights

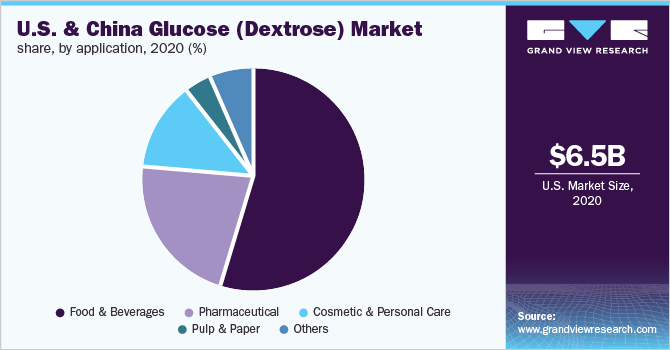

The food and beverages application segment accounted for the largest revenue share of 54.9% in 2020 and is estimated to maintain its position from 2020 to 2028. Glucose syrup is having a potential share in food and beverage applications, including bakery products, confectionery, soft drinks, and other sweet beverages. The continuously expanding usage of liquid syrup across F&B applications is driving the market.

The food and beverages segment of the U.S. glucose (dextrose) market is gaining pace on account of the increasing demand for snack food and confectionery. According to the Foreign Agricultural Service (FSA), a U.S. Department of Agriculture, U.S. snack food and confectionery exports to the CAFTA-DR countries (Costa Rica, El Salvador, Guatemala, Honduras, Nicaragua, and the Dominican Republic) have shown 15% growth from USD 148.5 million in 2015 to USD 170.2 million in 2019. Moreover, the COVID-19 pandemic has declined the value of U.S. snack and confectionery exports to CAFTA-DR countries by 24% from January to October 2020. However, the market is estimated to regain its value in 2021.

The food and beverages segment is followed by the pharmaceutical segment. Glucose is used in various medical conditions like in low blood sugar (hypoglycemia), where it provides glucose to the patient’s blood, and provides carbohydrates to those people who are unable to eat because of illness, trauma, or any other medical condition. Along with these, liquid glucose is used in oral syrup preparations and in tablets for coating and as a granulating agent. The increasing cases of chronic diseases like diabetes mellitus are bolstering the demand for tablets and other medications that use glucose as an ingredient.

The cosmetic and personal care application segment is anticipated to exhibit the fastest revenue-based CAGR of 5.5% from 2020 to 2028. The increasing demand for natural ingredients in the cosmetics and personal care products like hair & skincare, and makeup products are driving the market growth. Glucose is used as a flavoring agent, humectant, and skin-conditioning agent in cosmetics and personal care products.

Country Insights

China dominated the market with a revenue share of 50.9% in 2020. The changing eating habits in China, along with the large customer base, is supporting the country’s market growth. The presence of plenty of small and medium players in the local market of China such as Dancheng Caixin Sugar Industry Co. Ltd., Guangzhou Shuangqiao Company LTD., and Fengchen Group Co., Ltd. is further contributing to the country market value.

China is also projected to witness the fastest growth from 2020 to 2028. According to the Worldometers elaboration of the latest United Nations data, as of July 28, 2021, China's population is 1,445,266,749. The country's population is equivalent to around 18.47% of the total global population and it ranks number 1 in the world by population. The continuously increasing population, coupled with the economic development of the country, is the major factor projected to support the fastest growth during the forecast period.

China is now an upper-middle-income country and its rapid economic growth exceeded the pace of institutional development, according to the World Bank. The country is influencing other developing economies through its trade, investment, and ideas of growth. However, during COVID-19, China is the only country that has achieved positive growth in 2020 and has recorded a GDP of 2.3% in 2020.

Key Companies & Market Share Insights

The glucose (dextrose) manufacturers are making possible efforts for the expansion of their share in the overall market. The growing opportunities in the varied application sectors, including food and beverages, pharmaceutical, cosmetics and personal care, and pulp and paper, are expected to drive the market. The changing consumer eating habits and rapid urbanization are boosting the demand for packaged and convenient food products, which is additionally creating opportunities for the major players in the market. For instance, in April 2021, ADM has launched SweetRight, a Reduced Sugar Glucose Syrup (RSGS), in the American market. The new product is designed to replace the traditional corn syrup in similar applications without compromising its functions.

The increasing demand in the market is forcing major players to expand their production capacities in order to meet the growing demand. For instance, in March 2018, Tate & Lyle PLC has doubled the size of its Shanghai, China-based food application laboratory. As a part of new strategic expansion, it has added new customer-facing facilities. Some prominent players in the U.S. and China glucose (dextrose) market include:

-

Archer Daniels Midland Company (ADM)

-

Ingredion Incorporated

-

AGRANA Beteiligungs-AG

-

Tate & Lyle PLC

-

Cargill, Incorporated

-

Roquette Frères

-

Grain Processing Corporation

-

Tereos S.A.

-

Fooding Group Limited

-

Global Sweeteners Holdings Limited

-

Guangzhou Shuangqiao Company LTD.

-

Fengchen Group Co., Ltd.

-

Sinofi Ingredients

-

Henan Fenghe Chemical Co., Ltd.

-

Dancheng Caixin Sugar Industry Co. Ltd.

-

XIWANG GROUP

U.S. And China Glucose Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 6.76 billion

Revenue forecast in 2028

USD 9.44 billion

Growth Rate

CAGR of 4.8% from 2020 to 2028

March demand in 2021

14,965.7 kilotons

Volume forecast in 2028

20,272.3 kilotons

Growth Rate

CAGR of 4.4% from 2020 to 2028

Base year for estimation

2020

Historical data

2017 - 2019

Forecast period

2020 - 2028

Quantitative units

Revenue in USD million/billion; volume in kilotons; CAGR from 2020 to 2028

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, application, country

Country scope

U.S.; China

Key companies profiled

Archer Daniels Midland Company (ADM); Ingredion Incorporated; AGRANA Beteiligungs-AG; Tate & Lyle PLC; Cargill, Incorporated; Roquette Frères; Grain Processing Corporation; Tereos S.A.; Fooding Group Limited; Global Sweeteners Holdings Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue and volume growth at the country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the U.S. and China glucose market report on the basis of form, application, and country:

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2028)

-

Syrup

-

Solid

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2028)

-

Food & Beverages

-

Bakery & Confectionery

-

Dairy

-

Soups, Dressings & Sauces

-

Beverages

-

Others

-

-

Pharmaceutical

-

Cosmetic & Personal Care

-

Pulp & Paper

-

Others

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2028)

-

U.S.

-

China

-

Frequently Asked Questions About This Report

b. The U.S. & China glucose (dextrose) market was estimated at USD 6.47 billion in the year 2020 and is expected to reach USD 6.76 billion in 2021.

b. The U.S. & China glucose (dextrose) market is expected to grow at a compound annual growth rate of 4.8% from 2020 to 2028 to reach USD 9.44 billion by 2028.

b. China emerged as a dominating region with a revenue of USD 3,297.9 million in the year 2020 owing to the growing demand for food & beverages and cosmetics and personal care products across the country.

b. The key market player in the U.S. & China glucose (dextrose) market includes Archer Daniels Midland Company (ADM), Ingredion Incorporated, AGRANA Beteiligungs-AG, Tate & Lyle PLC, Cargill, Incorporated, Roquette Frères, Grain Processing Corporation, Tereos S.A., FOODING, Global Sweeteners Holdings Limited, Guangzhou Shuangqiao Company LTD, Fengchen Group Co., Ltd, Sinofi Ingredients, Henan Fenghe Chemical Co., Ltd., Dancheng Caixin Sugar Industry Co Ltd, and XIWANG GROUP.

b. Increasing demand for low sugar glucose products in food & beverages and increasing usage of glucose in cosmetics & personal care products are likely to drive the U.S. & China glucose (dextrose) market growth over the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."