- Home

- »

- Advanced Interior Materials

- »

-

U.S. Cold Chain Packaging Market Size, Industry Report, 2018-2025GVR Report cover

![U.S. Cold Chain Packaging Market Report]()

U.S. Cold Chain Packaging Market Analysis Report By Product (Insulated Containers & Boxes, Cold Packs), By Material (Insulating Material, Refrigerants), By Application, And Segment Forecasts, 2018 - 2025

- Report ID: GVR-2-68038-699-8

- Number of Pages: 114

- Format: Electronic (PDF)

- Historical Range: 2014 - 2016

- Industry: Advanced Materials

Report Overview

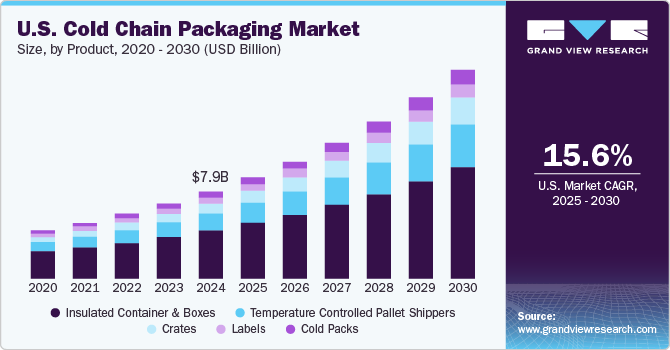

The U.S. cold chain packaging market size was valued at USD 3.04 billion in 2017 and is expected to register a CAGR of 14.1% from 2018 to 2025. Industry growth can be attributed to expanding organized retail sectors in emerging economies, which will create opportunities for U.S.-based cold chain service providers in the coming years.

In the U.S., demand for processed and frozen foods is increasing as a result of growing population in metro cities such as New York, Los Angeles, and Chicago and changing lifestyle and habits of consumers. While rising population is triggering demand for food products, changing lifestyle is prompting consumers to opt for processed and easy-to-eat food items.

Processed food items such as frozen vegetables and fruits, dairy products, seafood, and meat are in demand throughout the country. For instance, the annual ground beef demand in the U.S. is more than 7 billion pounds. Such trends are particularly evident in states like California, Washington, and Florida, and this is driving demand for effective and efficient refrigeration solutions.

The retail sector in the country is witnessing a change in consumer behavior as shopping patterns continue to shift from conventional retail businesses to online shopping. The growing online grocery business is particularly expected to open new growth opportunities.

Online grocery shopping is gaining popularity in line with increasing penetration of the Internet and subsequent rise in number of tech-savvy consumers. For instance, sales of packaged food products are contributing significantly toward Amazon.com, Inc.’s online grocery sales in U.S. Rising demand for packaged food is expected to drive the market.

Application Insights

Based on application, the market has been categorized into fish, meat and seafood, processed food, fruit pulp and concentrates, fruits and vegetables, bakery and confectionery, dairy products, and pharmaceuticals. The processed food segment is expected to have register the highest CAGR of 15.0% over the forecast period.

Fruits and vegetables need to be properly refrigerated in order to maintain their freshness until they reach the end consumer. An efficient cold chain packaging solution can help food producers and processed food manufacturing companies in effectively managing their operations.

Demand for cold storage solutions is also driven by the pharmaceutical industry, which needs to store and preserve high-quality pharmaceutical products, medicines, blood samples, vacancies, and other temperature-sensitive medical items. Cold storage systems can help incumbents in the pharmaceutical industry in efficiently managing and monitoring their supply chain operations and maintaining the quality of their temperature-sensitive medical products.

Product Insights

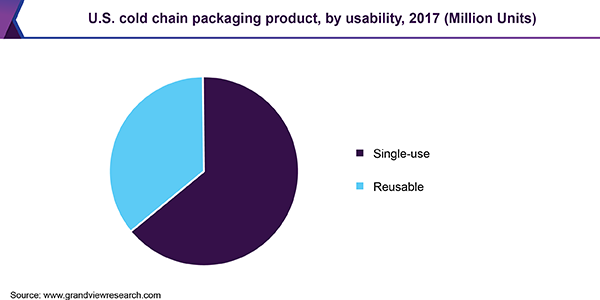

Based on product, the market has been classified into crates, cold packs, insulated container and boxes, labels, and temperature-controlled pallet shippers. The insulated container and boxes segment dominated the market in terms of revenue in 2017. The segment is further classified based on payload size and usability. The shipment of insulated container and boxes was pegged at 33.67 million units in 2017 and is expected to rise at a CAGR of 13.6% from 2018 to 2025.

Beyond specifications and temperature control factors, environmental and financial factors are also taken into consideration while selecting containers among single-use and reusable containers. In shipping temperature-sensitive products such as pharmaceuticals, it is significant to maintain temperature stability of a transit or shipping solution. However, the nature of all temperature-controlled shipping solutions is not the same.

Temperature controlled pallet shippers are specifically used for bulk shipments of pharmaceuticals, frozen food, biological samples, and specimens. Cold chain packaging offers a variety of low-density polyethylene (LDPE), polyurethane (PUR), and EPS pallet shippers.

Material Insights

Based on material, the U.S. cold chain packaging market has been categorized into insulating material and refrigerants. The insulating material segment is further classified into expanded polystyrene (EPS), polyurethane (PUR), vacuum insulated panel (VIP), cryogenic tank, and others. The others segment includes insulting pouches, active thermal systems, and hard cased thermal boxes.

Rising awareness concerning low ozone depletion potential (ODP) and low global warming potential (GWP) refrigerants to tackle environmental and social facets is a key driver of refrigerants across the globe. Increasing demand for energy-efficient natural refrigerants is also impacting segment growth. Inorganic refrigerants such as ammonia and Co2 and hydrocarbon-based are the most popular natural refrigerants, increasingly being preferred by end users for their energy efficiency, low cost, and low GWP and ODP.

The major challenge of food processing applications today is to ensure the freshness of perishable goods while also reducing the impact on the environment. Use of synthetic refrigerants such as hydrofluorocarbon (HFC), hydrochlorofluorocarbons (HCFC), and chlorofluorocarbon (CFC) leads to various environmental problems that include depletion of the ozone layer and global warming. Hence, use of carbon dioxide (CO2) and ammonia (NH3) provides sustainable refrigeration and acts as a long-term alternative to synthetic refrigerants.

Key Companies & Market Share Insights

Key players operating in the industry include Sonoco Thermosafe; Sofrigam; Softbox Systems, Inc.; Va-q-tec AG; and Creopack. Service providers are constantly engaging in inorganic growth strategies such as partnerships, M&A, and collaborations to stay ahead of the competition.

In January 2018, Softbox Systems Ltd acquired TP3 Global, a provider of thermal protection covers for the pharmaceutical industry. The former aims to strengthen its product portfolio and expand its presence worldwide with this acquisition.

U.S. Cold Chain Packaging Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 4,477.0 million

Revenue forecast in 2025

USD 8.66 billion

Growth Rate

CAGR of 14.1% from 2018 to 2025

Base year for estimation

2017

Historical data

2014 - 2016

Forecast period

2018 - 2025

Quantitative units

Revenue in USD million, and CAGR from 2018 to 2025

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments covered

Product, material, application, country

Country scope

The U.S.

Key companies profiled

Sonoco Thermosafe; Sofrigam; Softbox Systems, Inc.; Va-q-tec AG; Creopack.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report provides forecasts for revenue growth at country and state levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the U.S. cold chain packaging market report on the basis of product, material, and application:

-

Product Outlook (Revenue, USD Million, 2014 - 2025)

-

Crates

-

Dairy

-

Pharmaceuticals

-

Fisheries

-

Horticulture

-

-

Insulated Container & Boxes

-

Type

-

Cold Chain Bags/Vaccine Bag

-

Corrugated Box

-

Others

-

-

Payload size

-

Large

-

Medium

-

Small

-

X-small

-

Petite

-

-

Cold Packs

-

Labels

-

Temperature Controlled Pallet Shippers

-

-

Material Outlook (Revenue, USD Million, 2014 - 2025)

-

Insulating Material

-

EPS

-

PUR

-

VIP

-

Cryogenic Tanks

-

Others (insulating pouches, active thermal systems, and active thermal systems

-

-

Refrigerants

-

Fluorocarbons

-

Inorganics

-

Ammonia

-

CO2

-

-

Hydrocarbons

-

-

-

Application Outlook (Revenue, USD Million, 2014 - 2025)

-

Fruits & Vegetables

-

Fruits & Pulp Concentration

-

Dairy Products

-

Milk

-

Butter

-

Cheese

-

Ice-cream

-

-

Fish, Meat, & Seafood

-

Processed Food

-

Pharmaceuticals

-

Vaccines

-

Blood Banking

-

-

Bakery & Confectionaries

-

Others

-

Frequently Asked Questions About This Report

b. Product segment dominated the U.S. cold chain packaging market with a share of 67.89% in 2019. This is attributable to increasing demand for processed and frozen foods due to growing population in metro and changing lifestyle and habits of consumers.

b. Key factors that are driving the U.S. cold chain packaging market growth include expanding organized retail sectors in emerging economies, which will create opportunities for U.S.-based cold chain service providers in the coming years.

b. The U.S. cold chain packaging market size was estimated at USD 3,906.0 million in 2019 and is expected to reach USD 4,477.0 million in 2020.

b. The U.S. cold chain packaging market is expected to grow at a compound annual growth rate of 15.7% from 2020 to 2027 to reach USD 12,428.6 million by 2027.

b. Some key players operating in the U.S. cold chain packaging market include Sonoco Thermosafe; Sofrigam; Softbox Systems, Inc.; Va-q-tec AG; and Creopack.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."