- Home

- »

- Processed & Frozen Foods

- »

-

U.S. Cold Storage Market Size, Share & Growth Report 2030GVR Report cover

![U.S. Cold Storage Market Size, Share & Trends Report]()

U.S. Cold Storage Market Size, Share & Trends Analysis Report By Warehouse Type, By Construction Type (Bulk Storage, Production Stores, Ports), By Temperature Type, By Application, By State, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-451-2

- Number of Pages: 75

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Consumer Goods

U.S. Cold Storage Market Size & Trends

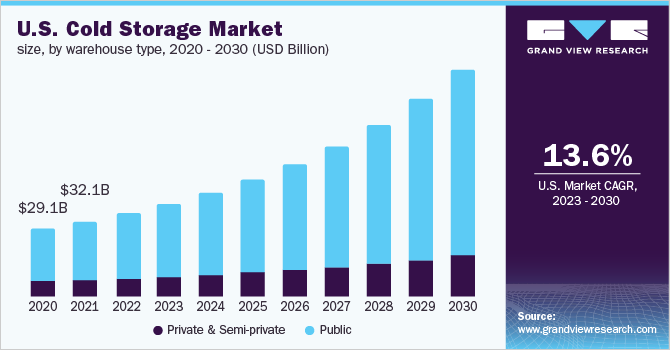

The U.S. cold storage market size was valued at USD 36.91 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 13.3% from 2023 to 2030. The growth can be attributed to several critical factors, such as technological advancements in packaging, processing, and storage of perishable food products and temperature-sensitive items. The market has also benefitted significantly from the stringent government regulation toward the production and supply of temperature-sensitive products. The industry is poised for unprecedented growth in the next seven years owing to growing organized retail sectors in the emerging economies which will create opportunities for the service providers over the forecast period.

Growing demand for connected trucks, high-cube refrigerated trailers, and vehicles that facilitate cross-product transportation is likely to drive demand for cold chain services. Ever-increasing health consciousness among consumers has inspired healthier eating habits and resulted in a rising demand for quality food packaging and storage solutions. Outsourcing services have been gaining popularity among businesses owing to factors such as increasing competition, a rapid rise in operational costs, and stringent quality standards. Numerous benefits of outsourcing these services, such as reduced operational costs, improved flexibility, higher efficiency, and expertise, have also encouraged its widespread adoption.

Service providers in the U.S. cold storage market have enhanced their efforts to protect temperature-controlled products from potential tampering or malicious actions. Securing the facility encompasses not only refrigerated warehouses but employees and visitors as well. This has resulted in increasing demand for the adoption of monitoring components such as telematics and telemetry devices, sensors, data loggers, and networking devices. Such components significantly improve the performance and efficiency of refrigerated storage and transportation.

Industry players are relying on RFID and Automatic Identification and Data Capture (AIDC) for enhancing the efficiency of the order fulfillment process. The growing penetration of Bluetooth technology and RFID sensors, across the logistics industry, is expected to spur the adoption of AIDC technology. Furthermore, cold storage operators focus on maximizing their throughput and order accuracy by using robotics applications, high-speed conveyor systems, and automated materials handling equipment. These technological advancements are in turn expected to boost the growth of the market over the forecast period.

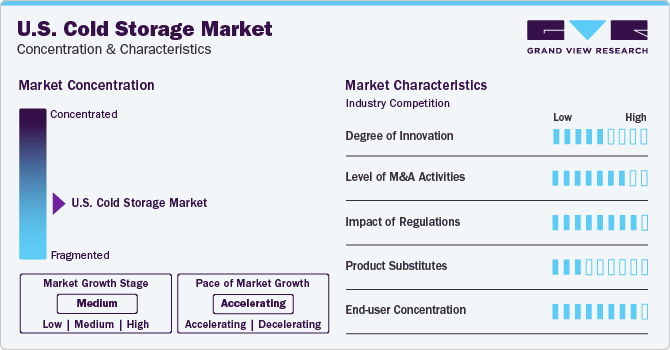

Market Concentration & Characteristics

The U.S. cold storage market growth stage is high. Globalization of the food supply chain, changing customer preferences, and the growing need to preserve medications and other temperature-sensitive goods have altogether contributed to an increase in the demand for cold storage facilities.The increasing preference of consumers for fresh and perishable commodities has led to a surge in the need for cold storage facilities to maintain the integrity and quality of these products.

The target market is also characterized by a high level of mergers & acquisitions by the leading players. The high level of mergers and acquisitions (M&A) in the U.S. cold storage market is driven by the pursuit of market consolidation and strategic expansion. Cold storage operators are engaging into such growth strategies to constantly upgrade their technology and stay ahead of the competition. To expand their services and offer end-to-end solutions, players also collaborate with logistics suppliers, transportation corporations, or technology organizations.

The complex regulatory environment around cold storage is essential to guaranteeing security, excellence, and adherence to standards of temperature-controlled storage facilities. Policies differ from region to region and are intended to handle the particular difficulties that come with storing medications, perishable commodities, and other items that are sensitive to temperature. Aspects including equipment standards, facility design, and environmental considerations are all covered under the regulatory framework. Strict regulations are imposed on the distribution and storage of pharmaceutical items by regulatory bodies including the U.S. Food and Drug Administration (FDA). Good Distribution Practice (GDP) compliance is essential to preserving the safety and effectiveness of pharmaceuticals, and cold storage facilities need to follow these guidelines to guarantee the integrity of the pharmaceutical supply chain.

A few alternatives and substitutes have emerged in the constantly evolving cold storage industry, providing innovative solutions to concerns related to perishable goods preservation and storage. Hybrid cooling systems provide an innovative way to improve energy efficiency by fusing conventional refrigeration with alternative technologies like thermal energy storage or phase change materials. By optimizing cooling operations in response to variables like demand and energy prices, these systems help lessen the need for constant electrical refrigeration. Insulated containers and pallets equipped with advanced insulation materials and designs offer another option for cold storage consumers. When fitted with heating or cooling components, these containers can regulate temperature during transit and offer an alternate method of product preservation without requiring centralized cold storage facilities.

In many different markets and industries, end-user concentration plays a vital role in shaping pricing strategies, supply and demand dynamics, and overall business stability. This concentration describes the degree to which a company's revenue is largely derived from a small number of clients or customers. End-user concentration can have a significant influence and is frequently evaluated in terms of both opportunities and hazards. Businesses largely depend on a limited number of critical consumers for their revenue in marketplaces where end-user concentration is strong. Businesses frequently adopt tactics like customer diversification, market expansion, and product or service portfolio development to mitigate risks associated with end-user concentration.

Warehouse Type Insights

In terms of revenue, the public segment dominated the market with a share of 77.94% in 2022, owing to its significant adoption among consumers on leased or short terms purposes at affordable costs. Based on the warehouse type, the market has been categorized into two segments, namely private & semi-private and public. A public warehouse is operated as an independent business or third-party provider that offers various services, such as handling, warehousing, and transportation for a fixed or variable fee. Public warehouses are also known as duty-paid warehouses that can be owned by an individual or some agency.

Given the massive costs associated with the construction and maintenance of warehouses, only big companies can afford to own and maintain their private warehouses. However, the companies are increasingly constructing private warehouses as they offer significant benefits, such as flexibility, greater control over cost, and the ability to make decisions regarding the overall activities and priorities of the facility. Moreover, due to increased international trade and consumer spending, cold storage operating profits have risen dramatically in the last five years. Low-interest rates have also enabled operators to finance new constructions. The private and semi-private segment is expected to portray a significant CAGR of 11.1% from 2023 to 2030.

Construction Type Insights

The production stores segment held the largest share in 2022 and is estimated to grow at the highest CAGR exceeding 15.6% from 2023 to 2030. This growth is attributed to the growing emphasis on the protection of goods, which include raw materials as well as finished food products throughout the production process in a plant. The bulk storage segment is also expected to proliferate over the forecast period. Bulk storage warehouses are suitable for storing fruits and vegetables in large volumes. They can also be used to extend the availability of other bulk materials such as flour, cooking ingredients, and canned goods while protecting them from spoilage and keeping them away from direct sunlight.

Constructing refrigerated warehouses near ports can help simplify the customs procedures associated with the import and export of temperature-sensitive products. Improvements in efficiency and automation have widened the gap in operating performance between older and newer cold storage facilities. In the past few years, operators in the industry have implemented new technologies, such as high-speed doors, energy-efficient walls, automated cranes, and cascade refrigeration systems, to increase efficiency and reduce operating costs. For instance, the adoption of automated cranes has enabled operators to pile goods at greater heights, leading to an increase in the average building height of newer facilities.

Temperature Type Insights

The frozen segment accounted for the largest share exceeding 81% in 2022. Increasing awareness about convenience food among individuals has led to a shift in their preference for ready-to-cook meals. Moreover, consumers are increasingly opting for frozen food owing to its support for microwave cooking and ease of use in terms of packing techniques. These trends have significantly contributed to the rise in the adoption of frozen foods, thereby leading to segment growth. However, the chilled segment is anticipated to witness a notable shift in growth over the forecast period.

Based on temperature type, the market is segmented into chilled and frozen cold storage. The warehouses falling under the chilled segment maintain their storage temperature in the ranges of above -5°C. They are used to store fresh fruits & vegetables, eggs, dry fruits, milk, and dehydrated foods, among others. Meanwhile, the warehouses falling under this segment maintain their temperature in the range from -10 to -20°F. They are used to store frozen vegetables, fish, meat, seafood, and other products.

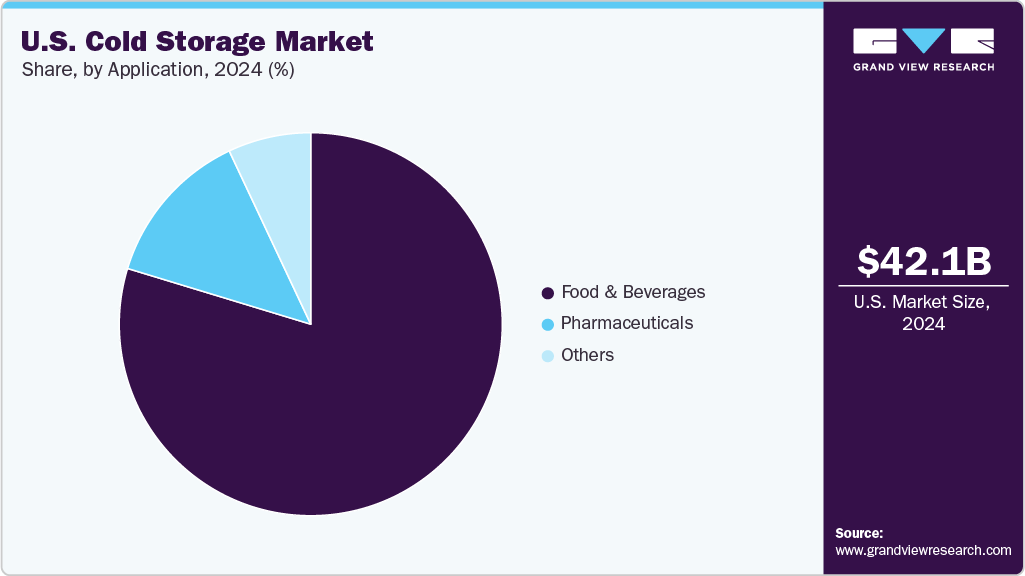

Application Insight

In terms of revenue and market share, the fish, meat & seafood application segment captured the largest market share of 35% in 2022. Based on application, the market is categorized into fish, meat & seafood; fruits & vegetables; dairy; processed food; and pharmaceuticals. The processed food segment is projected to witness highest growth of 16.9% from 2023 to 2030 owing to high demand of processed food products due to its several advantages such as immediate consumption, easy cooking, easy handling, and storage. Moreover, continuously changing lifestyle, increased safety, and growing need for easy convenience majorly drives the adoption of processed food. The adoption of processed food is also increased owing to excellent marketing and innovative packaging offered by the providers which further fuels the growth of the market.

The increasing demand for perishable products and fast delivery requirements associated with the e-commerce-based food and beverage delivery market has led to a significant boost in cold chain operations. The processed food segment is expected to witness the highest CAGR over the forecast period owing to the continued improvements in food packaging materials. However, the growing incidence of food and pharmaceutical counterfeiting has resulted in the introduction of stringent government regulations regarding production and supply chains. These regulations are impelling industry incumbents to develop rigorous practices, and service providers are making investments in improving their infrastructure to obtain safety certifications.

States Insight

California held the largest share in terms of revenue in 2022 and is projected to maintain its dominance in the market from 2023 to 2030. The significant share is attributed to the state’s 400 million cubic feet of cold storage space, which serves a large user base. California represents the highest number of facilities, which can be attributed to its large population and the significant need for these facilities. All the facilities in this state are regulated by the California Department of Public Health, Food and Drug Branch.

Florida, Washington, and Texas are some of the leading states in the market, which held a significant market share in 2022. North Carolina and South Carolina are some of the highest-growing markets which are expected to witness a CAGR of over 15.2% and 14.7%, respectively, from 2023 to 2030. The cold storage companies are also finding lucrative opportunities in North Dakota and Virginia among other states. Developments in transportation facilities, technological advancements, and increased adoption of frozen foods have proliferated demand for refrigeration and storage, leading to market growth.

Key Companies & Market Share Insights

Some of the key players operating in the market include Americold Logistics, Inc. and Wabash National Corporation among others.

-

Americold Logistics, Inc. is a temperature-controlled warehousing and transportation company. The company operates its business through three segments, namely warehouse, third-party managed, and transportation. Its offerings include producer solution and retailer solution. In December 2020, Americold Logistics, Inc. acquired Agro Merchants Group from an investor group for USD 1.59 billion.

Wabash National Corporation offers advanced, connected, engineered solutions for the incumbents of the logistics, transportation, and distribution industries. The company operates through Transportation Solutions and Parts & Services business segments. Its product range includes refrigerated vans, tank trailers, dry vans, platform trailers, refrigerated truck bodies, and dry truck bodies.

Tippmann Group and Penske are some of the emerging market participants in the target market.

-

Tippmann Group has two subsidiaries, namely Interstate Warehousing and Tippmann Construction, which specialize in the construction of cold storage and management of frozen and refrigerated distribution centers. Interstate Warehousing manages refrigerated and frozen warehousing needs, offering temperature-controlled and customized distribution solutions for the food industry.

-

Penske provides supply chain management and logistics solutions worldwide. The company operates dedicated cold storage and ambient temperature facilities, driving operations through its expertise and technology. It majorly caters to convenience and grocery stores. It offers solutions such as freight management, warehousing, distribution center management, and Transportation Management Solutions (TMS).

Key U.S. Cold Storage Companies:

- AmericoldLogistics, Inc.

- AGRO Merchants Group North America

- Burris Logistics

- Henningsen Cold Storage Co.

- Lineage Logistics Holdings, LLC

- Nordic Logistics

- Preferred Freezer Services

- VersaCold Logistics Services

- United States Cold Storage

- Wabash National Corporation

Recent Developments

-

In December 2022, Interstate Warehousing, a Tippmann Group’s company, announced the expansion of its facilities by holding a groundbreaking ceremony in Kingman, Arizona. The facility was built on a 92 acre site to address the cold storage needs on the West Coast.

-

In September 2022, LINEAGE LOGISTICS HOLDING, LLC finalized the acquisition of Grupo Fuentes, a significant transport and cold-storage facility operator based in Murcia, Spain. On August 2nd, 2022, the deal was initially announced. Grupo Fuentes manages a fleet of approximately 500 cars and trailers, a cold storage warehouse, six logistics centers, and value-added services to support those facilities.

-

In August 2022, Wabash National Corporation announced a strategic partnership with Bergey Truck Center, a commercial truck solutions provider. The partnership was aimed at expanding the company’s geographic footprint in North America.

-

In June 2022, Burris Logistics acquired R.W. Zant Co., a Los Angeles-based company that specializes in the distribution and storage of proteins and meats. As a result of this acquisition, Honor Foods, a subsidiary of Burris Logistics, expanded its food service distribution network in the western U.S.

-

In April 2022, LINEAGE LOGISTICS HOLDING, LLC, a prominent global food firm, announced the development of a next-generation automatic facility for cold storage in Windsor, Colorado. It built a more than 200,000-square-foot automated facility that will offer JBS improved blast freezing and storage capacity and rail connectivity to assist export product transportation to West Coast ports.

-

In January 2022, Seafrigo Group announced the opening of a new warehouse in New Jersey. This was the fifth warehouse of the company in the area; the new 85,000 square feet warehouse facility was aimed to address customer fulfillment needs.

U.S. Cold Storage Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 39.72 billion

Revenue forecast in 2030

USD 96.90 billion

Growth rate

CAGR of 13.6% from 2023 to 2030

Actual Data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Warehouse Type, Construction Type, Temperature Type, Application, and State

Country scope

U.S.

Key companies profiled

Americold Logistics, Inc., Burris Logistics, LINEAGE LOGISTICS HOLDING, LLC, Wabash National Corporation, United States Cold Storage, Tippmann Group, NFI Industries, Penske, Seafrigo Group, NewCold

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Cold Storage Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. cold storage market report based on warehouse type, construction type, temperature type, application, and states:

-

Warehouse Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Private & Semi-private

-

Public

-

-

Construction Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Bulk Storage

-

Production Stores

-

Ports

-

-

Temperature Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Chilled

-

Frozen

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Fruits & Vegetables

-

Dairy

-

Fish, Meat & Seafood

-

Processed Food

-

Pharmaceuticals

-

-

State Outlook (Revenue, USD Million, 2017 - 2030)

-

Maine

-

Massachusetts

-

Vermont

-

New Jersey

-

New York

-

Pennsylvania

-

Delaware

-

Florida

-

Georgia

-

Maryland

-

North Carolina

-

South Carolina

-

Virginia

-

Illinois

-

Indiana

-

Michigan

-

Ohio

-

Wisconsin

-

Alabama

-

Kentucky

-

Mississippi

-

Tennessee

-

Iowa

-

Kansas

-

Minnesota

-

Missouri

-

Nebraska

-

North Dakota

-

South Dakota

-

Arkansas

-

Louisiana

-

Oklahoma

-

Texas

-

Arizona

-

Idaho

-

New Mexico

-

Utah

-

California

-

Oregon

-

Washington

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. cold storage market size was estimated at USD 35.56 billion in 2022 and is expected to reach USD 39.72 billion in 2023.

b. The U.S. cold storage market is expected to grow at a compound annual growth rate of 13.3% from 2023 to 2030 to reach USD 96.90 billion by 2030.

b. The public segment dominated the U.S. cold storage market with a share of 78% in 2022. This is attributable to the need of companies to improve productivity and efficiency of cold storage facilities, which can be addressed by automation.

b. Some key players operating in the U.S. cold storage market include Americold Logistics, LLC; AGRO Merchants Group North America, Burris Logistics, Cloverleaf Cold Storage, Henningsen Cold Storage Co., Lineage Logistics Holdings, LLC.

b. Key factors that are driving the U.S. cold storage market growth include technological advancements in packaging, processing, and storage of perishable food products and temperature-sensitive items.

Table of Contents

Chapter 1 U.S. Cold Storage Market: Methodology and Scope

1.1 Research Assumptions

1.2 Research Methodology

1.3 List to Data Sources

Chapter 2 U.S. Cold Storage Market: Executive Summary

2.1 Summary

2.2 Segment Outlook

Chapter 3 U.S. Cold Storage Market: Variables, Trends & Scope

3.1 Market Segmentation

3.2 Market Size and Growth Prospects, 2017 - 2030

3.3 U.S. Cold Storage - Value Chain Analysis

3.4 U.S. Cold Storage Market Dynamics

3.4.1 Market Driver Analysis

3.4.1.1 Increasing automation in warehouses

3.4.1.2 Growing popularity of e-commerce as a channel for purchasing fresh food

3.4.1.3 Increasing demand for quality foods

3.4.1.4 Increasing IT spending in cold storage logistics

3.4.1.5 RFID technology for cold chain applications

3.4.1.6 Growing organized retail demand

3.4.2 Market Restraint Analysis

3.4.2.1 High initial investment

3.4.3 Market Opportunity Analysis

3.4.3.1 Growing application of telematics in logistics and transportation

3.4.3.2 Low-carbon design, environmental auditing, and crafty construction of cold storage warehouses

3.4.4 Market Challenge Analysis

3.4.4.1. Compliance with the accurate temperature and humidity regulation

3.5 U.S. Cold Storage Industry Analysis - Porter’s Five Force Analysis

3.6 U.S. Cold Storage Industry Analysis - PEST Analysis

3.7 Cold Storage Construction Trends

3.7.1 Refrigerants Market Trends

3.7.2 Cold Storage Cost

3.7.1.1 Insulation cost per square foot

3.7.1.2 Refrigeration equipment cost per cubic foot

3.7.1.3 Cold storage service rates

3.8 U.S. Cold Storage Industry: Sale Lease Back Program

3.8.1 Buy-Lease-Resell Scenario

3.9 Cold Storage Outsourcing Trends

3.9.1 In-Source Vs Outsource

3.9.2 Use Case Of Outsource Strategy

3.9.1.1 Overview Of The Strategies Followed By The Pharmaceutical Industry For Outsourcing Cold Storage Operations

3.9.1.2 Factors Considered Before Outsourcing The Pharma Cold Storage Operations

3.9.1.3 List Of 3pl Companies Operating In The U.S. Cold Storage Market

3.10 U.S. Cold Storage Industry: Case Studies

3.10.1 Case Study 1: Partner Logistics

3.10.2 Case Study 2: Md Logistics

3.10.3 Case Study 3: Cold Chain Technologies, Inc.

3.11 Regulatory Framework for Chilled and Frozen Food

3.12 List of Cold Storage Facility with their Capacity in the U.S., 2022

3.13 Impact of Covid-19 on the U.S. Cold Storage Market

Chapter 4 U.S. Cold Storage Warehouse Type Outlook

4.1 U.S Cold Storage Market, By Warehouse Type, 2022 & 2030

4.2 Private & Semi-Private

4.2.1 Market estimates and forecasts, 2017 - 2030 (USD Billion)

4.3 Public

4.3.1 Market Estimates And Forecasts, 2017 - 2030 (USD Billion)

Chapter 5 U.S. Cold Storage Temperature Type Outlook

5.1 U.S Cold Storage Market, By Temperature Type, 2022 & 2030

5.2 Chilled

5.2.1 Market Estimates And Forecasts, 2017 - 2030 (USD Billion)

5.3 Frozen

5.3.1 Market estimates and forecasts, 2017 - 2030 (USD Billion)

Chapter 6 U.S. Cold Storage Construction Type Outlook

6.1 U.S Cold Storage Market, Construction Type, 2022 & 2030

6.2 Bulk Storage

6.2.1 Market Estimates And Forecasts, 2017 - 2030 (USD Billion)

6.3 Production Stores

6.3.1 Market Estimates And Forecasts, 2017 - 2030 (USD Billion)

6.4 Ports

6.4.1 Market Estimates And Forecasts, 2017 - 2030 (USD Billion)

Chapter 7 U.S. Cold Storage Application Outlook

7.1 U.S Cold Storage Market, Application, 2022 & 2030

7.2 Fruits & Vegitables

7.2.1 Market Estimates And Forecasts, 2017 - 2030 (USD Billion)

7.3 Dairy

7.3.1 Market Estimates And Forecasts, 2017 - 2030 (USD Billion)

7.4 Seafood

7.4.1 Market Estimates And Forecasts, 2017 - 2030 (USD Billion)

7.5 Processed Food

7.5.1 Market Estimates And Forecasts, 2017 - 2030 (USD Billion)

7.6 Pharmaceuticals

7.6.1 Market estimates and forecasts, 2017 - 2030 (USD Billion)

Chapter 8 U.S. Cold Storage Market: Country Outlook

8.1 U.S. Cold Storage Market Size & Forecasts, By State, 2017-2030

Chapter 9 Competitive Landscape

9.1 Company Profiles

9.1.1 Americold Logistics, Inc.

9.1.1.1 Company Overview

9.1.1.2 Financial Performance

9.1.1.3 Product Benchmarking

9.1.1.4 Recent Developments

9.1.2 Burris Logistics.

9.1.2.1 Company Overview

9.1.1.2 Financial Performance

9.1.2.2 Product Benchmarking

9.1.3 LINEAGE LOGISTICS HOLDING, LLC

9.1.3.1 Company Overview

9.1.1.2 Financial Performance

9.1.3.2 Product Benchmarking

9.1.3.3 Recent Developments

9.1.4 Wabash National Corporation

9.1.4.1 Company Overview

9.1.1.2 Financial Performance

9.1.4.2 Product Benchmarking

9.1.4.3 Recent Developments

9.1.5 United States Cold Storage

9.1.5.1 Company Overview

9.1.1.2 Financial Performance

9.1.5.2 Product Benchmarking

9.1.5.3 Recent Developments

9.1.6 Tippmann Group.

9.1.6.1 Company Overview

9.1.1.2 Financial Performance

9.1.6.2 Product Benchmarking

9.1.6.3 Recent Developments

9.1.7 NFI Industries

9.1.7.1 Company Overview

9.1.1.2 Financial Performance

9.1.7.2 Product Benchmarking

9.1.7.4 Recent Developments

9.1.8 Penske

9.1.8.1 Company Overview

9.1.8.2 Financial Performance

9.1.8.3 Product Benchmarking

9.1.8.4 Recent Developments

9.1.9 Seafrigo Group

9.1.9.1 Company Overview

9.1.9.2 Financial Performance

9.1.9.3 Product Benchmarking

9.1.9.4 Recent Developments

9.1.10 NewCold

9.1.10.1 Company Overview

9.1.10.2 Financial Performance

9.1.10.3 Product Benchmarking

9.1.10.4 Recent Developments

List of Tables

Table 1 Private & semi-private market size & forecasts and trend analysis, 2017 - 2030 (USD Million)

Table 2 Public market size & forecasts and trend analysis, 2017 - 2030 (USD Million)

Table 3 Chilled market size & forecasts and trend analysis, 2017 - 2030 (USD Million)

Table 4 Frozen market size & forecasts and trend analysis, 2017 - 2030 (USD Million)

Table 5 Bulk Storage market size & forecasts and trend analysis, 2017 - 2030 (USD Million)

Table 6 Production stores market size & forecasts and trend analysis, 2017 - 2030 (USD Million)

Table 7 Ports market size & forecasts and trend analysis, 2017 - 2030 (USD Million)

Table 8 Fruits & vegetables market size & forecasts and trend analysis, 2017 - 2030 (USD Million)

Table 9 Dairy market size & forecasts and trend analysis, 2017 - 2030 (USD Million)

Table 10 Fish, meat, & seafood market size & forecasts and trend analysis, 2017 - 2030 (USD Million)

Table 11 Processed food market size & forecasts and trend analysis, 2017 - 2030 (USD Million)

Table 12 Pharmaceuticals market size & forecasts and trend analysis, 2017 - 2030 (USD Million)

Table 13 States market size & forecasts and trend analysis, 2017 - 2030 (USD Million)

List of Figures

Fig. 1 U.S. Cold Storage Market Segmentation & Scope

Fig. 2 U.S. Cold Storage Market Size And Forecasts Analysis, 2017 - 2030 (USD Billion)

Fig. 3 U.S. Cold Storage Market- Value Chain Analysis

Fig. 4 Market Dynamics

Fig. 5 Market Driver Impact

Fig. 6 Market Restraint Impact

Fig. 7 Market Opportunity Impact

Fig. 8 Market Challenge Impact

Fig. 9 Porter’s Five Forces Analysis

Fig. 10 PEST Analysis

Fig. 11 U.S. Cold Storage Capacity Trends

Fig. 12 Benefits Of Insourcing And Outsourcing For Food Producers

Fig. 13 U.S. Cold Storage Market Share Analysis, By Warehouse Type, 2022 & 2030 (USD Million)

Fig. 14 U.S. Cold Storage Market Share Analysis, By Construction Type, 2022 & 2030 (USD Million)

Fig. 15 U.S. Cold Storage Market Share Analysis, By Temperature Type, 2022 & 2030 (USD Million)

Fig. 16 U.S. Cold Storage Market Share Analysis, By Application Type, 2022 & 2030 (USD Million)

Fig. 17 U.S. Cold Storage Market - Key Company Market Share Analysis, 2022

Fig. 18 U.S. Cold Storage Market - Market Position Analysis

Fig. 19 U.S. Cold Storage Market - Competitive Dashboard AnalysisWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- U.S. Cold Storage Warehouse Type Outlook (Revenue, USD Million, 2017 - 2030)

- Private & Semi-private

- Public

- U.S. Cold Storage Construction Type Outlook (Revenue, USD Million, 2017 - 2030)

- Bulk Storage

- Production Stores

- Ports

- U.S. Cold Storage Temperature Type Outlook (Revenue, USD Million, 2017 - 2030)

- Chilled

- Frozen

- U.S. Cold Storage Application Outlook (Revenue, USD Million, 2017 - 2030)

- Fruits & Vegetables

- Dairy

- Fish, Meat & Seafood

- Processed Food

- Pharmaceuticals

- U.S. Cold Storage State Outlook (Revenue, USD Million, 2017 - 2030)

- Maine

- Massachusetts

- Vermont

- New Jersey

- New York

- Pennsylvania

- Delaware

- Florida

- Georgia

- Maryland

- North Carolina

- South Carolina

- Virginia

- Illinois

- Indiana

- Michigan

- Ohio

- Wisconsin

- Alabama

- Kentucky

- Mississippi

- Tennessee

- Iowa

- Kansas

- Minnesota

- Missouri

- Nebraska

- North Dakota

- South Dakota

- Arkansas

- Louisiana

- Oklahoma

- Texas

- Arizona

- Idaho

- New Mexico

- Utah

- California

- Oregon

- Washington

- Others

U.S. Cold Storage Market Dynamics

Driver: Rising demand for temperature-controlled logistics

Due to microbial activity, respiration, and enzymatic breakdown, perishable goods are vulnerable to degradation. Temperature has a significant impact on the degradation process and the most perishable goods degrade at a rate that doubles every 10 degrees increase in temperature. A temperature-controlled environment offered by cold storage facilities is crucial for ensuring the quality of food delivered to consumers. Thus, cold storage facilities make storage and handling of perishable goods more convenient. Temperature-controlled storage facilities are typically required for items that people purchase frequently, such as fruits and vegetables, dairy products pharmaceuticals, and livestock. Businesses that offer FMCG products either own private cold storage facilities or outsource their cold chain logistics to a third-party provider.

Many drugs and vaccines are enormously sensitive to temperature variations, and slight variations in temperature can reduce their effectiveness. The cold chain includes storage and delivery services for goods that must be stored at a specific temperature. Generally, temperature-dependent products degrade even at 4°C, and hence it is advised to store them in a controlled environment. This has increased the demand for specialized cold storage and transportation solutions that can maintain the necessary temperature range for these products. The abovementioned factors are anticipated to bolster the demand for temperature-controlled logistics offered by cold storage facilities in the U.S

Driver: Increasing demand for frozen perishable foods

The frozen food sector relies heavily on cold storage as cold storage promotes superior product integrity, safety, and freshness. Frozen food businesses benefit from increased opportunities for imports and exports and access to new markets owing to a well-developed cold chain infrastructure. Consumers are increasingly looking for food products that are easy to prepare and can be stored for extended periods. The market for frozen foods is constantly expanding to meet the demands of restaurants, the retail sector, and cloud kitchens. Fruits and vegetables, dairy, confections, frozen desserts, bakery products, livestock, exotic imports, and ready-to-cook snacks are some of the products delivered to these facilities. There is a growing trend of purchasing perishable food products online by ordering from home. Frozen fruits and vegetables can be a convenient way to get essential nutrients without worrying about spoilage. These are often picked and processed at the peak of freshness, resulting in higher nutrient content compared to fresh produce that may have been stored for some days. Thus, the growing demand for frozen perishable food in the country has resulted in increased the demand for cold storage solutions.

Restraint: High operating costs

The cost of operating a cold storage facility is higher than that of a conventional warehouse due to the need for specialized equipment, infrastructure, and skilled personnel. These costs can impact the profitability of a cold storage facility, especially in times of intense competition. Cold storage facilities use considerable energy to maintain the right temperature and humidity levels to preserve perishable goods. It becomes challenging for cold storage providers to stay profitable while bearing high energy costs. Furthermore, temperature changes may make the product unfit for consumption. Due to spoilage, companies frequently suffer significant losses. To minimize damage and subsequent loss of frozen foods, temperatures are required to be maintained consistently during storage and transportation. Further, refrigeration units, temperature sensors, and other specialized equipment require regular maintenance and repair to ensure they function correctly.

The cost of labor, replacement parts, and repair services can rapidly surge, particularly in older facilities where equipment may be more prone to breakdowns. Labor costs also contribute significantly to high operating costs in cold storage facilities. Employees are required to perform a wide range of tasks, including loading and unloading products, monitoring and adjusting temperature and humidity levels, and conducting regular inspections to ensure that equipment is functioning appropriately. Moreover, hiring and training employees and providing benefits and other incentives incur additional costs while operating a cold storage facility.

What Does This Report Include?

This section will provide insights into the contents included in this U.S. cold storage market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

U.S. cold storage market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

U.S. cold storage market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the U.S. cold storage market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for U.S. cold storage market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of U.S. cold storage market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

U.S. Cold Storage Market Categorization:

The U.S. cold storage market was categorized into five segments, namely warehouse type (Private & Semi-private, Public), construction type (Bulk Storage, Production Stores, Ports), temperature type (Chilled, Frozen), application (Fruits & Vegetables, Dairy, Fish, Meat & Seafood, Processed Food, Pharmaceuticals), and state (Maine, Massachusetts, Vermont, New Jersey, New York, Pennsylvania, Delaware, Florida, Georgia, Maryland, North Carolina, South Carolina, Virginia, Illinois, Indiana, Michigan, Ohio, Wisconsin, Alabama, Kentucky, Mississippi, Tennessee, Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota, South Dakota, Arkansas, Louisiana, Oklahoma, Texas, Arizona, Idaho, New Mexico, Utah, California, Oregon, Washington)

Segment Market Methodology:

The U.S. cold storage market was segmented into warehouse type, construction type, temperature type, application, and state. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The U.S. cold storage market was analyzed at a regional level. This region is further divided into the U.S.

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

U.S. cold storage market companies & financials:

The U.S. cold storage market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-

Americold - Americold Logistics, Inc. is a temperature-controlled warehousing and transportation solutions provider. The company operates its business through three segments, including Warehouse, Third-party Managed, and Transportation. Its offerings include producer and retailer solutions.

-

Burris Logistics - Burris Logistics is a logistics and supply chain management service company. The company delivers temperature-controlled warehousing and transportation services. The solutions offered by Burris include custom retail distribution, refrigerated warehousing, freight management, and foodservice redistribution.

-

Lineage Logistics Holdings, LLC - Lineage Logistics Holding, LLC offers warehousing and logistics solutions to consumers in diverse industries. The company’s solutions consist of temperature-controlled public warehousing facilities for storing multiple food commodities, including fruits & vegetables, bakery, ice creams, poultry, products, pork, beef, and seafood. It also provides port-centric cold chain facilities on the East and West Coasts to serve containerized markets.

-

United States Cold Storage - United States Cold Storage is a temperature-controlled logistics and warehousing provider that provides cold storage logistics, facilities, and services. The company offers logistics and transport solutions for frozen and refrigerated food products. It specializes in public warehousing, distribution, transportation services, cold storage, layer picking, dry warehousing, blast freezing, consolidation programs, automation, and repacking solutions.

-

Wabash National Corporation - Wabash National Corporation offers advanced, connected, engineered solutions for the incumbents of the logistics, transportation, and distribution industries. The company operates through Transportation Solutions and Parts & Services business segments. Its product range includes tank trailers, refrigerated vans, dry vans, platform trailers, refrigerated truck bodies, and dry truck bodies.

-

Tippmann Group - Tippmann Group operates through two subsidiaries, including Interstate Warehousing and Tippmann Construction. Tippmann Construction specializes in the construction of cold storage and management of frozen and refrigerated distribution centers. Interstate Warehousing manages refrigerated and frozen warehousing needs and offers temperature-controlled and customized distribution solutions for the food industry.

-

NFI Industries - NFI Industries is a supply chain solution provider with food-grade and temperature-controlled capabilities, serving food & beverage businesses. The company's end-users include beverage producers, grocery retailers, and food manufacturers & processors. Its business lines include transportation management, brokerage, e-commerce fulfillment, distribution, and global logistics.

-

Penske - Penske provides supply chain management and logistics solutions worldwide. The company operates dedicated cold storage and ambient temperature facilities, driving operations through its expertise and technology. It majorly caters to convenience and grocery stores. It offers solutions including freight management, warehousing, distribution center management, and Transportation Management Solutions (TMS).

-

Seafrigo Group - Seafrigo Group is a temperature-controlled food logistics company, with 24 offices across five continents. The company specializes in business areas such as general cargo, fresh products, food industry, wine & spirits, and frozen products. It has over 125,000 square meters of dry storage facilities and 81,000 square meters of temperature-controlled facilities. The company has three offices, in Illinois, Florida, and New Jersey, in the U.S.

-

NewCold - NewCold is an advanced automated warehouse and cold-chain logistics provider. The company's supply chain solutions include automated warehouses and transport. It has presence in over 15 locations across three continents, including North America, Europe, and Australia. In the U.S., it operates in Indiana, Washington, Idaho, and Illinois.

Value chain-based sizing & forecasting

Supply Side Estimates

-

Company revenue estimation via referring to annual reports, investor presentations, and Hoover’s.

-

Segment revenue determination via variable analysis and penetration modeling.

-

Competitive benchmarking to identify market leaders and their collective revenue shares.

-

Forecasting via analyzing commercialization rates, pipelines, market initiatives, distribution networks, etc.

Demand side estimates

-

Identifying parent markets and ancillary markets

-

Segment penetration analysis to obtain pertinent

-

revenue/volume

-

Heuristic forecasting with the help of subject matter experts

-

Forecasting via variable analysis

U.S. Cold Storage Market Report Objectives:

-

Understanding market dynamics (in terms of drivers, restraints, & opportunities) in the countries.

-

Understanding trends & variables in the individual countries & their impact on growth and using analytical tools to provide high-level insights into the market dynamics and the associated growth pattern.

-

Understanding market estimates and forecasts (with the base year as 2022, historic information from 2017 to 2021, and forecast from 2023 to 2030). Regional estimates & forecasts for each category are available and are summed up to form the global market estimates.

U.S. Cold Storage Market Report Assumptions:

-

The report provides market value for the base year 2022 and a yearly forecast till 2030 in terms of revenue/volume or both. The market for each of the segment outlooks has been provided on region & country basis for the above-mentioned forecast period.

-

The key industry dynamics, major technological trends, and application markets are evaluated to understand their impact on the demand for the forecast period. The growth rates were estimated using correlation, regression, and time-series analysis.

-

We have used the bottom-up approach for market sizing, analyzing key regional markets, dynamics, & trends for various products and end-users. The total market has been estimated by integrating the country markets.

-

All market estimates and forecasts have been validated through primary interviews with the key industry participants.

-

Inflation has not been accounted for to estimate and forecast the market.

-

Numbers may not add up due to rounding off.

-

Europe consists of EU-8, Central & Eastern Europe, along with the Commonwealth of Independent States (CIS).

-

Asia Pacific includes South Asia, East Asia, Southeast Asia, and Oceania (Australia & New Zealand).

-

Latin America includes Central American countries and the South American continent

-

Middle East includes Western Asia (as assigned by the UN Statistics Division) and the African continent.

Primary Research

GVR strives to procure the latest and unique information for reports directly from industry experts, which gives it a competitive edge. Quality is of utmost importance to us, therefore every year we focus on increasing our experts’ panel. Primary interviews are one of the critical steps in identifying recent market trends and scenarios. This process enables us to justify and validate our market estimates and forecasts to our clients. With more than 8,000 reports in our database, we have connected with some key opinion leaders across various domains, including healthcare, technology, consumer goods, and the chemical sector. Our process starts with identifying the right platform for a particular type of report, i.e., emails, LinkedIn, seminars, or telephonic conversation, as every report is unique and requires a differentiated approach.

We send out questionnaires to different experts from various regions/ countries, which is dependent on the following factors:

-

Report/Market scope: If the market study is global, we send questionnaires to industry experts across various regions, including North America, Europe, Asia Pacific, Latin America, and MEA.

-

Market Penetration: If the market is driven by technological advancements, population density, disease prevalence, or other factors, we identify experts and send out questionnaires based on region or country dominance.

The time to start receiving responses from industry experts varies based on how niche or well-penetrated the market is. Our reports include a detailed chapter on the KoL opinion section, which helps our clients understand the perspective of experts already in the market space.

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationShare this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."