- Home

- »

- Medical Devices

- »

-

U.S. Continuous Renal Replacement Therapy Market Report, 2028GVR Report cover

![U.S. Continuous Renal Replacement Therapy Market Size, Share & Trends Report]()

U.S. Continuous Renal Replacement Therapy Market Size, Share & Trends Analysis Report By Product (CRRT System, Disposables, Liquids), By Modality (SCUF, CVVH, CVVHD, CVVHDF), And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-655-9

- Number of Pages: 90

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- Industry: Healthcare

Report Overview

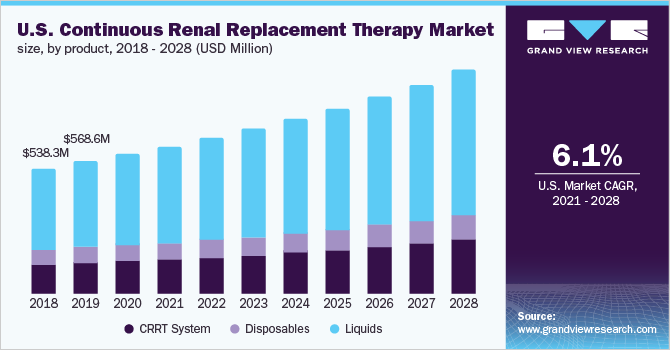

The U.S. continuous renal replacement therapy market size was valued at USD 601.7 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 6.1% from 2021 to 2028. The growth of the U.S. market can be attributed to the rising incidence of Acute Kidney Injury (AKI) and sepsis, rapid increase in the number of hospitals and urgent care centers, rising hospital admission rate, and constant product launches by prominent market players. In addition, the COVID-19 outbreak has resulted in significant demand for continuous renal replacement therapy (CRRT) in the U.S. Owing to this, the market has witnessed regulatory support from various government authorities and a rise in financial incentives. These factors are expected to contribute to the growth of the U.S. market during the forecast period.

The rising incidence of AKI is a key factor driving the demand for CRRT in the U.S. For instance, according to the National Kidney Foundation, Inc., 37 million people in the U.S., i.e., more than one in seven adults, are estimated to be affected with chronic kidney disease. Moreover, in the past several years, the incidence of AKI requiring Renal Replacement Therapy (RRT) has increased by about 10% annually.

Furthermore, according to another research study published in Wolters Kluwer Health, Inc., the rate of CRRT used in ICU patients in the U.S. is about 244/1,433 (17%). For such severely ill patients, CRRT is the preferred and most common form of acute RRT used in ICUs. Thus, owing to the aforementioned factors, the adoption of CRRT is expected to grow at a rapid rate in this country.

Current CRRT technology has enabled comprehensive technological data analysis and appropriate feedback. These advancements have led to a thorough analysis of prescription and delivery patterns, which has positively impacted clinical outcomes from a quality assurance perspective. Latest CRRT machines enable automated data collection and utilize uniform terminology that allows for cross-institutional comparisons.

Several key players operating in this market have launched advanced CRRT machines that feature these technologies. For instance, Prismaflex System developed by Baxter helps to provide automatic adjustments and instant visual feedback regarding the treatment. It is integrated with Electronic Medical Records (EMR) connectivity and eliminates manual recording and transfer of treatment data. Such technological advancements are likely to further accelerate the market growth in the U.S.

The growing investments in healthcare by the government and private sector in the U.S. are supporting the market growth. According to statistics published in CMS.gov, healthcare expenditure in the U.S. increased by 4.6% in 2019, reaching USD 3.8 trillion per person, which accounted for a 17.7% share of the nation’s GDP.

The current COVID-19 outbreak is expected to have a substantial impact on the U.S. market. The pandemic has significantly increased the demand for RRT across the U.S. In the pre-COVID-19 period, RRT was used to treat around 23,105 patients for AKI each year. The requirement for RRT among COVID-19 patients appears to be 5 times higher, i.e., 4.9%, than that in historical populations (0.9%). In community cohort datasets, 5%-15% of individuals hospitalized with COVID-19 required dialysis assistance. The population using CRRT increased by 370% in select U.S. locations compared to usual levels.

Moreover, several U.S. states are expected to face CRRT shortages during the COVID-19 pandemic. As per the same source, in the U.S., the shortage of 1088 CRRT machines was expected during the first 6 months of the pandemic, with demand outpacing supply in up to eight states. Thus, the growing demand for RRT imposed a burden on the delivery of all dialysis therapies across the U.S. healthcare system.

In addition, individual practitioners, hospitals, and local communities were able to respond to the growing demand and limited availability of RRT equipment and consumables owing to manufacturers' capacity to increase the supply. For instance, in April 2021, Baxter received the U.S. FDA Emergency Use Authorization (EUA) for its Oxiris Blood Purification Filter set for COVID-19 patients admitted to the ICU with confirmed/imminent respiratory failure in need of blood purification therapy.

Product Insights

In 2020, the liquids segment dominated the U.S. market with a revenue share of over 60.0%. The liquid segment comprises dialysates, renal replacement fluids, anticoagulants, and saline. Increasing demand for CRRT in the treatment of hemodynamically unstable patients and the growing number of manufacturers supplying dialysate and replacement fluids for RRT are among factors contributing to the segment growth.

Moreover, the growing number of manufacturers supplying dialysate and replacement fluids for RRT are other key factors fueling the segment growth. For instance, as per a research study published in Kidney360 journal, due to the COVID-19 pandemic, the demand for bagged dialysate fluid, which is most commonly utilized in the ICU environment, increased significantly by 38% and continues to grow. To satisfy the growing demand for dialysis fluids, manufacturers expanded the output of bicarbonate-based solutions.

In addition, key players are receiving EUA for their replacement fluids and solutions. This factor is contributing to the segment growth. For instance, in August 2020, Baxter received FDA EUA for its replacement solution used for adult patients undergoing CRRT during COVID-19 treatment. Regiocit can be used with patients who are at a higher risk of bleeding during continuous dialysis.

The disposables segment is projected to expand significantly during the forecast period owing to the increasing use of hemofilter, fluids, charcoal filters, and other consumables in CRRT treatments. The disposables segment mainly includes disposable treatment kits/infusion kits, hemofilter, and bloodlines. These products are low-priced, used frequently, and of high quality.

Furthermore, consumables used during CRRT must be replaced after each setup to minimize contamination. Contaminated consumables such as recycled fistula needles can endanger a patient's life. As a result of a large replacement rate of consumables owing to low pricing, their demand is likely to increase, thereby promoting segment growth. Moreover, factors such as the increasing prevalence of AKI and the growing emphasis on effective CRRT among ICU patients are boosting the demand for disposables.

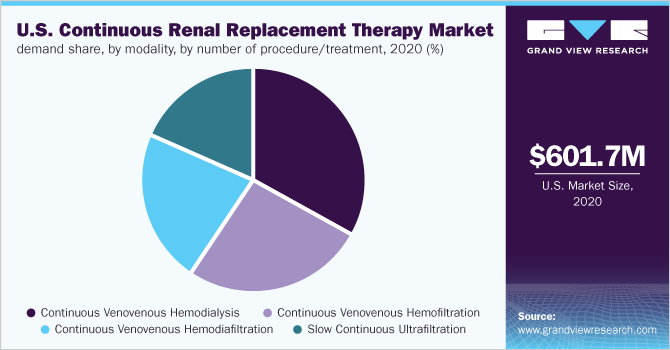

Modality Insights

In 2020, the continuous venovenous hemodialysis (CVVHD) segment dominated the market with a volume share of over 30.0% in terms of procedure/treatment. The CVVHD treatment modality has high efficacy with low blood flows.

Moreover, the U.S. CRRT market for CVVHD is expected to grow due to the use of smaller, less invasive catheters and longer filter running times compared to convective treatment modalities. For instance, Ci-Ca CVVHD with Ultraflux EMiC 2 filter developed and manufactured by Fresenius Medical Care is an advanced CRRT therapy, combining the advantages of CVVHD with better removal of middle molecules while retaining essential plasma proteins such as albumin and cellular blood constituents. Such developments are expected to support the segment growth over the forecast period.

The continuous venovenous hemodiafiltration (CVVHDF) segment is expected to expand at the highest volume-based CAGR of 6.25% from 2021 to 2028. The increasing prevalence of fluid overload cases, which is frequently found in AKI patients in critical care units, is expected to propel the growth of the CVVHDF segment over the forecast period. Moreover, according to an article published by the American Society of Nephrology, congestive heart failure, which accounts for approximately 8% of all-cause mortality in patients at stages 4 & 5 of CKD, is associated closely with fluid overload, which is likely to increase the application of CVVHDF treatment procedure. These factors are further expected to fuel the segment growth over the forecast period.

Key Companies & Market Share Insights

Key players are adopting various strategies to gain a greater market share such as new product launches and mergers and acquisitions. In May 2021, Baxter unveiled its PrisMax 2 System to advance critical care delivery for patients. It is the latest version of the company’s next-generation platform intended to streamline the delivery of CRRT and other organ support therapies.

In May 2020, Fresenius Medical Care North America's Renal Therapies Group (FMCNA), under FDA emergency use authorization, dispatched its first batch of multiBic dialysate solutions to the U.S. hospitals. These solutions are intended to provide CRRT to COVID-19-related patients with acute kidney injury. In December 2020, the company announced that it would be commercially launching Carpediem Cardio-Renal Pediatric Dialysis Emergency Machine in the U.S. This system is specifically designed to treat pediatric patients requiring renal replacement therapy. Some prominent players in the U.S. continuous renal replacement therapy market include:

-

Baxter

-

B. Braun Melsungen AG

-

Fresenius Medical Care AG

-

Medtronic

-

Asahi Kasei Medical Co., Ltd.

-

Nipro Corporation

U.S. Continuous Renal Replacement Therapy Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 631.2 million

Revenue forecast in 2028

USD 957.2 million

Growth Rate

CAGR of 6.1% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, modality

Country scope

U.S.

Key companies profiled

Baxter; B. Braun Melsungen AG; Fresenius Medical Care AG; Medtronic; Asahi Kasei Medical Co., Ltd.; Nipro Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the U.S. continuous renal replacement therapy market report on the basis of product and modality:

-

Product Outlook (Revenue, USD Million, 2016 - 2028)

-

CRRT System

-

Disposables

-

Liquids

-

-

Modality Outlook (Revenue, USD Million, 2016 - 2028)

-

Slow Continuous Ultrafiltration (SCUF)

-

Continuous Venovenous Hemofiltration (CVVH)

-

Continuous Venovenous Hemodialysis (CVVHD)

-

Continuous Venovenous Hemodiafiltration (CVVHDF)

-

Frequently Asked Questions About This Report

b. The U.S. Continuous Renal Replacement Therapy market size was estimated at USD 601.7 million in 2020 and is expected to reach USD 631.22 million in 2021.

b. The U.S. Continuous Renal Replacement Therapy market is expected to grow at a compound annual growth rate of 6.1% from 2021 to 2028 to reach USD 957.21 million by 2028.

b. Liquid’s segment dominated the U.S. CRRT market in terms of revenue with a share of 64.13%. The liquid segment comprises dialysates, renal replacement fluids, anticoagulants, and saline. Increasing demand for CRRT in the treatment of hemodynamically unstable patients and growing number of manufacturers supplying dialysate & replacement fluids for RRT are among factors contributing to segment growth.

b. Prominent key players operating in the U.S. Continuous Renal Replacement Therapy market include Baxter, B. Braun Melsungen AG, Fresenius Medical Care AG, Medtronic, Asahi Kasei Medical Co., Ltd., and Nipro Corporation.

b. Key factors that are driving the U.S. CRRT market growth include rising incidence of Acute Kidney Injury (AKI), and sepsis, rapid increase in the volume of hospitals & urgent care centers, growing hospital admissions rate, and constant product launches by prominent market players. In addition, the outbreak of the COVID-19 pandemic has resulted in significant demand for CRRT in the U.S.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."