- Home

- »

- Medical Devices

- »

-

U.S. & Europe Ambulatory Surgery Centers Market Report 2027GVR Report cover

![U.S. & Europe Ambulatory Surgery Centers Market Size, Share & Trends Report]()

U.S. & Europe Ambulatory Surgery Centers Market Size, Share & Trends Analysis Report By Specialty (Orthopedics, Dental), By Ownership (Physician, Hospital), By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-582-3

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry: Healthcare

Report Overview

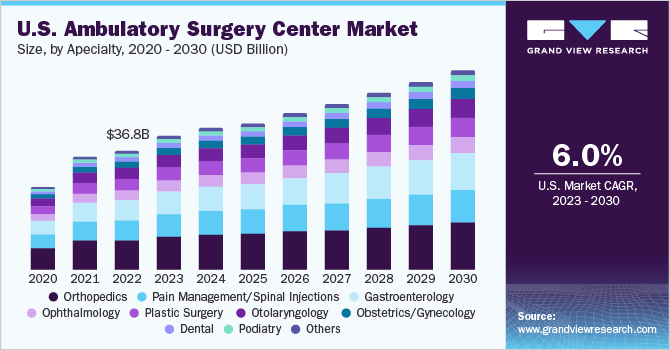

The U.S. and Europe ambulatory surgery centers market size was valued at USD 58.3 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 6.0% from 2020 to 2027. Increasing demand for minimally invasive surgeries (MIS), technological developments in surgical devices and equipment, and surgeons’ control over the choice of such equipment are some of the factors responsible for the market growth. Other factors such as an increase in the incidence of chronic diseases and a rise in geriatric population and thus rising requirement of cost-effective and efficient treatments also contribute to the growth. Rising healthcare costs is anticipated to play a vital role in increasing focus on ambulatory surgery centers (ASCs). These centers allow healthcare professionals to make healthcare services more affordable without having to compromise on the quality of care. This factor is expected to bode well for the market growth in the forthcoming years.

The Medicare-certified ambulatory surgery centers with registered doctors, nurses, and physical therapists at Medicare-certified offer surgical treatment at a low cost. Demand for ASCs is gaining traction for minimally invasive surgical procedures in several fields, including neurosurgery, otorhinolaryngology, and cosmetic surgery. The number of inpatient admissions has significantly decreased in the past years, due to the trend shifting toward ASCs.

In the U.S., more than 65% of total surgeries are performed in ambulatory surgery centers. This is primarily due to high inpatient hospitalization costs and a rise in the adoption of advanced technologies by the ASCs, enabling the provision of rapid and cost-effective treatment.

The use of robotic surgical systems for performing complex surgical procedures and the integration of advanced visualization systems at ASCs are the major factors driving the growth of the market. Rising numbers of mergers and acquisitions are projected to create growth opportunities for the key players operating in the market.

Specialty Insights

On the basis of specialty, the U.S. and Europe ambulatory surgery center market is segmented into ophthalmology, orthopedics, gastroenterology, pain management/ spinal injections, plastic surgery, podiatry, otolaryngology, obstetrics/ gynecology, dental, and others. The orthopedics segment held the largest market share of over 25% in 2019. This dominance of the segment is attributed to the large surgical case volume being handled on an outpatient basis and the addition of new procedures under ASC coverage.

More than 60% of the total orthopedic procedures are performed in the multispecialty ASCs in the U.S. With the addition of more complex procedures like total hip replacement under ASC coverage by CMS, the demand for orthopedic surgery in ambulatory surgery centers setting is expected to increase in the forthcoming years. The otolaryngology or ENT segment is expected to witness the highest CAGR during the forecast period followed by a gastroenterology segment.

In Europe, plastic surgery is expected to witness the highest CAGR during the forecast period. The number of plastic surgeries being performed each year is witnessing a rapid rise in the region, owing to the rising trend of body shaping and increasing number of cosmetic and aesthetic procedures. According to The International Association for Ambulatory Surgery (IAAS), Germany, Italy, Greece, Netherlands, and Spain perform the maximum number of plastic surgeries in a year, with around 40% procedures performed in ASCs.

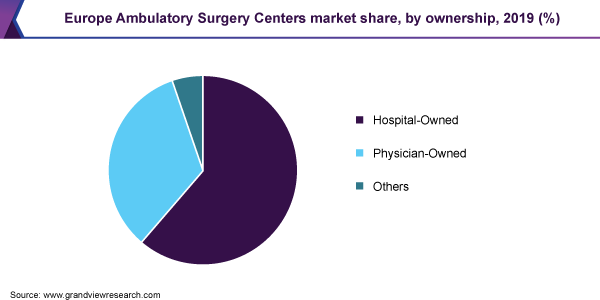

Ownership Insights

Based on ownership, the U.S. and Europe ASC market have been segmented into hospital-owned, physician-owned, and others. The physician-owned segment held the major market share of around 49% in 2019, which can be attributed to growing physicians’ interests towards standalone ambulatory surgery centers for increased profitability.

Out of the total ASCs in the U.S., more than 60% of the facilities are Medicare certified. Many ASCs are being operated by the largest chains such as AmSurg and Hospital Corporations of America (HCA). With increased emphasis on value-based care, along with more refined Managed Care Organizations (MCO) contracting practices, it is expected that more standalone practices will collaborate with management firms. In addition, to extend their community footprints, hospitals are increasingly looking to build or acquire ASCs.

In Europe, the majority of day surgery/ ambulatory centers are owned by hospitals and patients can be directly referred to the parent hospital for inpatient admissions. Hospitals are the main facilities providing health care services and have a significant share in terms of healthcare spending. In countries like England, Germany, and France, ambulatory surgery centers are mainly owned by physicians.

Regional Insights

The U.S. dominated the market with a revenue share of over 55% in 2019. Presence of sophisticated healthcare facilities, availability of highly advanced equipment and skilled neuro as well as bariatric surgeons, increase in the number of ASCs, rise in the preference for outpatient settings for MIS procedures, and supportive reimbursement framework for medical treatments are among the factors driving the growth of the market in the region.

The Europe ambulatory surgery centers market is anticipated to grow significantly over the forecast period. High incidence of ophthalmic disorders and rising number of cosmetic surgical procedures in day surgery/ ambulatory centers are among the major factors driving the market in the region. In addition, favorable government policies to improve the healthcare system and rapid economic development in many countries are some of the factors anticipated to boost the market over the forecast period.

Key Companies & Market Share Insights

In terms of services, Tenet healthcare is one of the major players in the U.S. offering wide range of ASC services. Mergers and acquisitions and partnerships for facility expansion are the key strategies followed by the market leaders. For instance, in May 2018, Surgical Care Affiliates, LLC (SCA) partnered with Massachusetts Avenue Surgery Center (MASC) to deliver high-quality outpatient surgical options to patients. MASC offers a full range of outpatient surgical procedures.

The Ghent University Hospital offers a wide range of medical services on an outpatient basis in Europe. Its UZ Gent Surgical Day Hospitals unit offers treatment for all the specialties as ambulatory surgery with same-day discharge. Technological advancement and facility expansion are the key strategies followed by hospitals. For instance, in October 2019, the Ghent Hospital opened its first outpatient clinic in Oosterzele. The clinic offered outpatient cardiac care along with other high-quality services to patients. Some of the prominent players in the U.S. ambulatory surgery centers market include:

-

Envision Healthcare Corporation

-

Tenet Healthcare Corporation

-

MEDNAX Services, Inc.

-

TeamHealth

-

UnitedHealth Group

-

Quorum Health Corporation

-

Surgery Partners

-

Surgical Care Affiliates (SCA)

-

Community Health Systems, Inc.

-

HCA Healthcare, Inc.

-

Surgical Center Development, Inc.

Some of the prominent players in the Europe ambulatory surgery centers market include:

-

Chelsea & Westminster Hospital

-

Zudecche Day Surgery

-

The Alan Cumming Day Surgery Unit

-

London Day Surgery Centre

-

Ghent University Hospital

Recent Development

- In September 2021, Tenet Healthcare Corporation extended their agreement with Cigna Corporation. With this agreement, Cigna’s customers gained in-network access to Tenet’s hospitals, physician clinics, and outpatient centers until 2025, including ambulatory facilities by United Surgical Partners International

U.S. & Europe Ambulatory Surgery Centers Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 61.6 billion

Revenue forecast in 2027

USD 91.9 billion

Growth Rate

CAGR of 6.0% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD Million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Specialty, ownership, region

Regional scope

U.S.; Europe

Key companies profiled

Envision Healthcare Corporation; Tenet Healthcare Corporation; MEDNAX Services, Inc.; TeamHealth; UnitedHealth Group; Quorum Health Corporation; Surgery Partners; Surgical Care Affiliates (SCA); Community Health Systems, Inc.; HCA Healthcare, Inc.; Surgical Center Development, Inc. in U.S. and Chelsea & Westminster Hospital; Zudecche Day Surgery; The Alan Cumming Day Surgery Unit; London Day Surgery Centre; Ghent University Hospital in Europe

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at regional levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the U.S. and Europe ambulatory surgery center market report based on specialty, ownership, and region:

-

Specialty Outlook (Revenue, USD Million, 2016 - 2027)

-

Ophthalmology

-

Orthopedics

-

Gastroenterology

-

Pain Management/Spinal Injections

-

Plastic Surgery

-

Podiatry

-

Otolaryngology

-

Obstetrics/Gynecology

-

Dental

-

Others

-

-

Ownership Outlook (Revenue, USD Million, 2016 - 2027)

-

Hospital-Owned

-

Physician-Owned

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

The U.S.

-

Europe

-

Frequently Asked Questions About This Report

b. The U.S. and Europe ambulatory surgery center market size was estimated at USD 58.3 billion in 2019 and is expected to reach USD 61.6 billion in 2020.

b. The U.S. and Europe ambulatory surgery center (ASC) market is expected to grow at a compound annual growth rate of 6% from 2020 to 2027 to reach USD 91.9 billion by 2027.

b. The physician-owned segment held the major market share of around 49% in 2019, which can be attributed to growing physicians’ interests towards standalone ambulatory surgery centers for increased profitability.

b. Some key players operating in the U.S. and Europe Ambulatory Surgery Center (ASC) market include Envision Healthcare Corporation; Tenet Healthcare Corporation; MEDNAX Services; Inc., TeamHealth; UnitedHealth Group; Chelsea & Westminster Hospital; Zudecche Day Surgery; The Alan Cumming Day Surgery Unit; and London Day Surgery Centre.

b. Key factors that are driving the market growth include increasing demand for Minimally Invasive Surgeries (MIS), technological developments in surgical devices and equipment, and surgeons’ control over the choice of such equipment.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."