- Home

- »

- Consumer F&B

- »

-

U.S. Flavors Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Flavors Market Size, Share & Trends Report]()

U.S. Flavors Market Size, Share & Trends Analysis Report By Nature (Natural, Synthetic), By Form (Powder, Liquid/Gel), By Application (Food, Beverages, Others), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-984-5

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Consumer Goods

U.S. Flavors Market Size & Trends

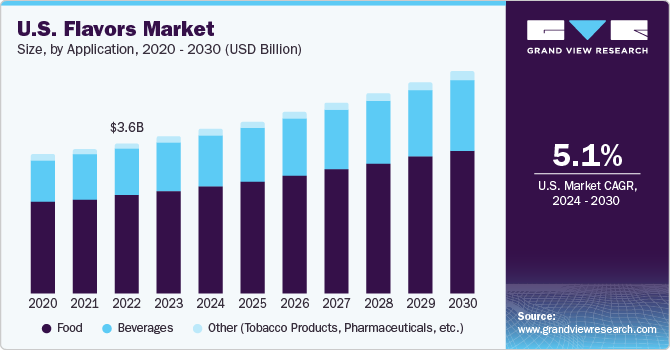

The U.S. flavors market size value was estimated at USD 3.71 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.1% from 2024 to 2030. The growth can be attributed to increasing number of people consuming packaged foods & beverages, growing percentage of residents choosing convenience and affordability over cooking and time-consuming activities associated with it. The amount of time spent in work and professional function in the country has been growing since many decades. Busy work days, time spent in travel, numerous products offered by the companies, easy access to processed and packaged foods through hypermarkets and supermarkets, increasing usage of food delivery applications, increased market penetration of ready-to-eat, ready-to-make foods, changing dietary preferences that are tending towards consumption of gluten-free, vegan food products are some of the key factors which are fuelling growth for the flavors market in the United States.

The U.S. market accounted for a share of over 19% of the global flavors market in 2023. The increased awareness about the role of food consumption in human health has been driving food & beverages industry like never before. Growing information accessibility, stringent regulations regarding the labelling in the country, influence of social media campaigns and rising research revelations about different food ingredients are some of the factors which impact choice of food now. These aspects are encouraging businesses to provide products that are aligned with consumer expectations and equipped with features which can survive the changes consumer behaviour and generate revenue in stipulated time. For instance, natural and products that have clean labels are generating very high demand in market as these features develop sense of trust between consumers and manufacturers. The nature of food & beverages industry is highly trend-driven which often results in growth or reduction in demand of particular food type, but never creates ill effect on entire industry. However, the health-conscious consumers of 21st century have been developing a noteworthy trend in the market which has resulted in availability of products such as vegan meals, plant-based meats, sugar free beverages, protein bars, sustainably sourced foods and more. These innovative products are also contributing to growing demand for flavors.

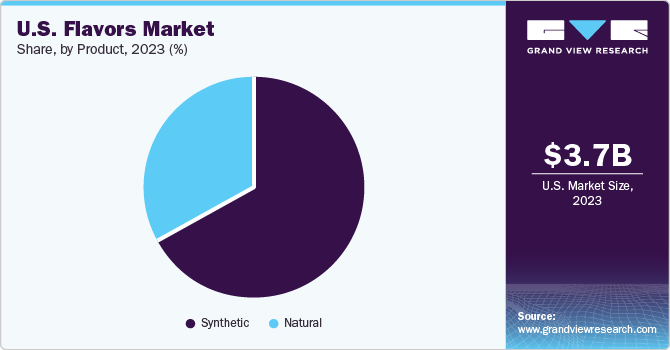

However, the cost factor associated with natural flavors creates difficulties for manufacturers. The higher cost of natural flavors is mainly due to limited nature of the sources. To resolve this issue, the synthetic flavors were invented by the industry. The synthetic flavors are considerably less costly and easily available. The constant prices, undisrupted supply, and lower production costs have generated increased adoption for synthetic flavors.

In addition, the diverse nature of the population living in the country develops influence on the industry. Numerous commercial food producers, restaurants, cloud kitchen operators have been using flavors to cater to variety of customer expectations who prefer and like different cuisines from across the world. Sauces, dressings and condiments are widely used by these businesses to deliver enhanced cuisine experience. Other specialised categories such as plant-based food, baby food also includes use of flavor upto certain extent.

Market Concentration & Characteristics

The U.S. flavors market is growing at an accelerating pace and the growth stage is identified as high. It is primarily characterised by the highly competitive market with presence of many established companies as well as a few noteworthy newly founded brands. These companies have been adopting innovation as one of their key strategies to keep up with highly competitive market. Use of cutting-edge technology, growing amount of funds made available for R&D departments and constantly changing consumer behaviour has been stimulating the need for innovation. For instance, in 2022, International Flavors & Fragrances Inc. launched a product by which they completely eliminated unavoidable need of citrus oil or any other product derived from it and yet delivered flavors such as grapefruit, mandarin, orange, lemon, and lime as well.

Mergers and acquisitions in the U.S. flavors market are principally undertaken with an intent to extend their portfolio into diversified version of it. In addition, these partnerships and acquisitions lead to enhanced operational capabilities. The partnerships also assist companies to establish or improve regional market presence as well. The level of mergers & acquisitions in flavors market is medium.

Threat of substitute is quite at low level, as flavors have gained significant role in manufacturing process of many products and service delivery businesses as well. This includes food & beverages companies, restaurants, local processed food manufacturers, pharmaceuticals, among others.

This market is highly impacted by regulations. U.S. Food and Drug Administration have regulated use of flavors in food products through code of federal regulations (CFR). These regulations state that all flavors must be manufactured in a way, which ensures that the products must be safe for consumption and properly labelled.

Application Insights

The use of flavors in food applications accounted for a revenue share of 65.3% in 2023. Flavors are used in food businesses such as dairy products, bakery & confectionery, supplements & nutrition products, meat & seafood products, snacks, pet foods, sauces, dressings & condiments, plant-based food, and baby food as well. The beverage businesses that use flavors include juices & juice concentrates functional beverages, alcoholic beverages, carbonated soft drinks, smoothies, coffee, tobacco products, and pharmaceuticals.

The demand for flavors in beverages is expected to grow at a CAGR of 5.5% from 2024 to 2030. As increasing number of customers are seeking alternatives for alcoholic beverages and exploring options such as no-alcohol, low-alcohol, CBD and THC-infused drinks which has been encouraging the manufacturers to develop innovative flavor offerings. For instance, in December of 2023, White Claw, known for its market disruptions claims through innovation, launched new beverages for adults that taste like alcoholic drinks and yet has no alcohol in the formulae.

Form Insights

The powdered flavors market accounted for a revenue share of 66% in 2023. Increasing demand for this form of flavors is often driven by versatility and ability to improve flavour content of various foods and beverages. The powdered flavors are in dry form, quite easy to store, convenient for the usage, generally suited for baking, cooking, and production of beverages. In addition, the powder form allows consumers to mix and use the desired flavors with regularly preferred test enhancers such as salt, sugar, and spices as well.

The liquid/gel flavors market is expected to grow at a CAGR of 4.5% from 2024 to 2030. Those who are willing to adopt this form of the flavour are such manufacturers or users who need to use it in large forms. This generally includes beverage manufacturers, nutrition product makers. The liquid is concentrated form of the flavour, which offers potent impact if compare with powdered form of the flavour.

Nature Insights

The natural flavors market accounted for a revenue share of 33.1% in 2023. Higher demand for the natural products and foods developed using natural flavors is often driven by perception of considering them as healthier and better alternative.

Global trends often start from the United States, and then are adopted in the other parts of the world. The current trends such as vegan diets, guilt-free beverages, food products made out of sustainably sourced ingredients are already popular in United States and have been helping the segment to grow a lucrative pace.

The U.S. synthetic flavors market is expected to grow at a CAGR of 4.2% from 2024 to 2030. Often, costs associated with naturally developed flavors is very high. To deal with this, manufacturers tend to adopt use of synthetic flavors. These flavors are artificially developed in laboratories through processes such as chemical synthesis.

Key U.S. Flavors Company Insights

The U.S. flavors market is fragmented, housing many established as well as newly formed brands. The market is constantly infused with newer products as flavors are used as key ingredient in various application industries. Innovation and product differentiation are two main strategies adopted by the market participants to develop competitive edge over other companies. Some of the market leaders are also adopting global or regional expansion strategies through mergers and acquisitions while extending their portfolio as well.

Key U.S. Flavors Companies:

- Givaudan

- International Flavors & Fragrances, Inc.

- Sensient Technologies

- ADM (Archer-Daniels-Midland Company)

- Corbion

- McCormick Flavor Solutions

- FCI Flavors

- Wixon, Inc.

- Target Flavors

- Synergy

Recent Developments

-

In December 2023, ADM (Archer-Daniels-Midland Company), one of the global leaders in human and animal nutrition, announced that the company would be adding to its flavor business capabilities by acquiring Revela Foods, developer and manufacturing company of dairy flavor ingredients, based in Wisconsin.

-

In August 2023, Synergy Flavors Inc., one of the top companies operating in sweet and savory flavors business opened its savory innovation center at US headquarters of the company in Wauconda, Illinois.

U.S. Flavors Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.89 billion

Revenue Forecast in 2030

USD 5.24 billion

Growth rate

CAGR of 5.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast; company ranking; competitive landscape; growth factors; and trends

Segments covered

Nature, form, application

Key companies profiled

Givaudan; International Flavors & Fragrances, Inc.; Sensient Technologies; ADM (Archer-Daniels-Midland Company); Corbion; McCormick Flavor Solutions; FCI Flavors; Wixon, Inc.; Target Flavors; Synergy

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Flavors Market Report Segmentation

This report forecasts revenue growth at the country level and offers a scrutiny of the most recent industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. flavors market report based on nature, form, and application:

-

Nature Outlook (Revenue; USD Million; 2018 - 2030)

-

Natural

-

Synthetic

-

-

Form Outlook (Revenue; USD Million; 2018 - 2030)

-

Powder

-

Liquid/Gel

-

-

Application Outlook (Revenue; USD Million; 2018 - 2030)

-

Food

-

Dairy Products

-

Bakery & Confectionery

-

Supplements & Nutrition Products

-

Meat & Seafood Products

-

Snacks

-

Pet Foods

-

Sauces, Dressings & Condiments

-

Others (plant-based food, baby food, etc.)

-

-

Beverages

-

Juices & Juice Concentrates

-

Functional Beverages

-

Alcoholic Beverages

-

Carbonated Soft Drinks

-

Others (Smoothies, Coffee, etc.)

-

-

Other (Tobacco Products, pharmaceuticals, etc.)

-

Frequently Asked Questions About This Report

b. The U.S. flavors market size was estimated at USD 3.71 billion in 2023 and is expected to reach USD 3.89 billion in 2024.

b. The U.S. flavors market is expected to grow at a compound annual growth rate of 5.1% from 2024 to 2030 to reach USD 5.24 billion by 2030.

b. Powdered flavors dominated the U.S. flavors market with a share of 66% in 2023. Increasing demand for this form of flavor is often driven by versatility and the ability to improve the flavor content of various foods and beverages.

b. Some key players operating in the U.S. flavors market include Givaudan, International Flavors & Fragrances, Inc., Sensient Technologies, ADM (Archer-Daniels-Midland Company), Corbion, McCormick Flavor Solutions, FCI Flavors, Wixon, Inc., Target Flavors, and Synergy.

b. Key factors that are driving the market growth include the increasing number of people consuming packaged foods & beverages and the growing percentage of consumers choosing convenience & affordability over cooking and the associated time-consuming activities.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."