- Home

- »

- Medical Devices

- »

-

U.S. Freestanding Emergency Department Market Report, 2027GVR Report cover

![U.S. Freestanding Emergency Department Market Size, Share & Trends Report]()

U.S. Freestanding Emergency Department Market Size, Share & Trends Analysis Report By Ownership (OCED, IFSED), By Service (Emergency Department, Imaging, Laboratory), And Segment Forecasts, 2020 - 2027

- Report ID: GVR-3-68038-207-5

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry: Healthcare

Report Overview

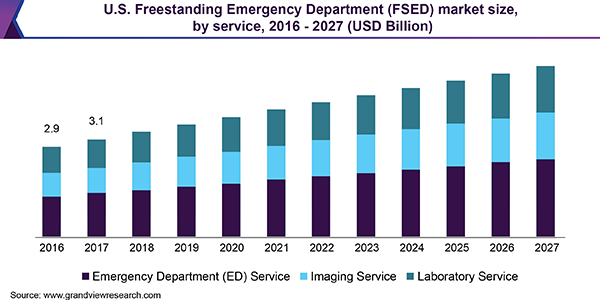

The U.S. freestanding emergency department market size was valued at around USD 3 billion in 2019 and is expected to expand at a CAGR of around 5% over the forecast period. The U.S. freestanding emergency department (FSED) market is majorly driven by overcrowding of the emergency departments at the hospitals, growing number of patients opting for immediate treatment options, and advanced healthcare infrastructure of the country.

Moreover, increasing number of injuries due to accidents and rising incidence of chest pain or disease like epilepsy and stroke, which require immediate attention, are driving the need for FSED in the country. With the provision of immediate care to the patient in urgent need, the number of deaths can be reduced, which generally happens while transferring a patient to the appropriate hospital.

Convenience care represents a spectrum of care delivery models including retail clinics, urgent care centers, and freestanding emergency departments. These departments represent a budding opportunity within healthcare services space. Increasing number of freestanding emergency departments can be attributed to location accessibility and treatment cost concerns by both public officials and consumers.

There are accessibility concerns due to overcrowding in hospital-based emergency rooms and a lack of convenient hospital locations. Cost pressure has resulted in the shift from inpatient, hospital-based care to less expensive outpatient settings. In general, these care centers are staffed by nurse practitioners and physician assistants and have the resources to provide basic screening and diagnostic services and treat low complexity conditions.

Services Insights

On the basis of services, the U.S. freestanding emergency department market is segmented into emergency department (ED) services, imaging services, and laboratory services. In 2019, ED services held the largest share in the service segment. Rising volume of injury-related visits, faster turnaround time, increasing preference for walk-in clinics among patients, and rising number of Medical Screening Exams (MSEs) recommended by the physicians to the ED visitors to determine the presence of any medical condition are some of the major factors driving the growth.

However, the imaging service segment is expected to witness the highest growth during the forecast period. Factors such as increased awareness about medical screening for concluding on the urgency of a medical condition, rise in the incidence of chronic but manageable diseases, and sufficient economic resources are contributing to the growth of the market for imaging service in the forthcoming years.

Ownership Insights

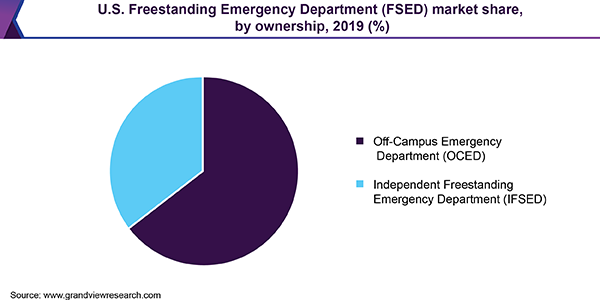

On the basis of ownership, the U.S. FSED market has been segmented into off-campus emergency departments (OCED) and independent freestanding emergency market (IFSED). The OCEDs are owned by the hospitals and independent IFSED are privately owned. OCEDs held the largest market share in 2019. Factors such as overcrowding of the hospital emergency department, rising burden of trauma cases, and increasing prevalence of stroke and other neurological disorders that need immediate attention are contributing to the growth.

Moreover, being designated under the CMS, high reimbursement is available for treatment being offered at the OCEDs. These facilities usually refer the patients back to the hospital, which it is affiliated to, for inpatient care. It is mandatory for OCEDs in the U.S. to comply with all federal regulations regarding emergency department operations, which include The Emergency Medical Treatment and Labor Act (EMTALA). Thus, it becomes compulsory for OCEDs to screen and stabilize medical emergencies of all patients, without taking their financial condition (patient’s ability to pay) into consideration. The OCED can be inspected voluntarily by the Joint Commission/CMS, but this inspection is not mandatory.

U.S. Freestanding Emergency Department Market Share Insights

Some of the key players operating in the market are Health Inc.; Adeptus Health; Tenet Healthcare Corporation; Universal Health Services, Inc.; HCA Healthcare, Inc.; Community Health Systems, Inc.; Ascension Health; Legacy Lifepoint Health, Inc.; Ardent Health Services; and Emerus.

The market witnessed facility expansion through mergers and acquisitions by the key players, which combined various services together and thus, increased the overall market revenue. In February 2019, HCA Healthcare, Inc. completed the acquisition of Mission Health with which HCA planned to build a hospital for inpatient behavioral health in Asheville with 120 beds. In addition, the company planned to build a new replacement hospital Franklin, N.C. for Angel Medical Center and also plans to invest USD 232 million in the capital in Mission Health facilities.

In January 2020, HCA Healthcare, Inc. announced the acquisition of Valify, a technology company that offers a web-based platform to reduce the overall costs of health services. Valify’s technology platform is expected to help HCA in identifying opportunities to decrease costs.

U.S. Freestanding Emergency Department Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 3.7 billion

Revenue forecast in 2027

USD 5 billion

Growth Rate

CAGR of 4.9% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments covered

Ownership, service, region

Regional scope

The U.S.

Key companies profiled

Adeptus Health Inc.; Tenet Healthcare Corporation; Universal Health Services, Inc.; HCA Healthcare, Inc.; Community Health Systems, Inc.; Ascension Health; Legacy Lifepoint Health, Inc.; Ardent Health Services; Emerus

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth on the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For this study, Grand View Research has segmented the U.S. freestanding emergency department market report based on ownership and service:

-

Ownership Outlook (Revenue, USD Million, 2016 - 2027)

-

Off-Campus Emergency Department (OCED)

-

Independent Freestanding Emergency Department (IFSED)

-

-

Service Outlook (Revenue, USD Million, 2016 - 2027)

-

Emergency Department (ED) Service

-

Imaging Service

-

Laboratory Service

-

-

Region Outlook (Revenue, USD Million, 2016 - 2027)

-

The U.S.

-

Frequently Asked Questions About This Report

b. The U.S. freestanding emergency department market size was estimated at USD 3.3 billion in 2019 and is expected to reach USD 3.7 billion in 2020.

b. The U.S. freestanding emergency department market is expected to grow at a compound annual growth rate of 5% from 2020 to 2027 to reach USD 5 billion by 2027.

b. The hospital-based off-campus emergency department (OCED) dominated the ownership segment in 2019. This is attributable to the overcrowding of the hospital emergency department, and availability of high reimbursement for the treatment at OCED when compared with independent freestanding emergency department (IFSED)

b. Some key players operating in the U.S. freestanding emergency department market include Adeptus Health Inc.; Tenet Healthcare Corporation; Universal Health Services, Inc.; HCA Healthcare, Inc.; Community Health Systems, Inc.; Ascension Health; Legacy Lifepoint Health, Inc.; Ardent Health Services; and Emerus

b. Key factors that are driving the U.S. freestanding emergency department market growth include overcrowding of the emergency departments at the hospitals, a growing number of patients opting for immediate treatment options, advanced healthcare infrastructure of the country, rising number of injuries due to accidents, and rising incidence of chest pain or disease like epilepsy and stroke, which require immediate attention.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."