- Home

- »

- Medical Devices

- »

-

U.S. Home Infusion Therapy Market Size, Share Report 2030GVR Report cover

![U.S. Home Infusion Therapy Market Size, Share & Trends Report]()

U.S. Home Infusion Therapy Market Size, Share & Trends Analysis Report By Product (Infusion Pumps, Needleless Connectors), By Application (Anti-Infective, Endocrinology), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-956-2

- Number of Pages: 116

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Healthcare

Market Size & Trends

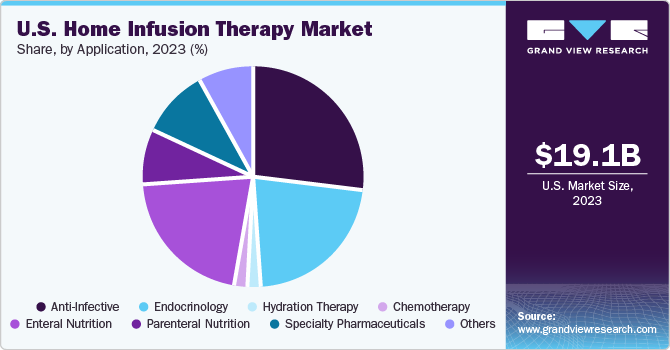

The U.S. home infusion therapy market size was estimated at USD 19.1 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 7.7% from 2024 to 2030. The growing elderly population prone to various severe disorders is one of the major drivers of the market growth. In addition, the growing prevalence of disorders, such as cancer, diabetes, chronic pain, and gastrointestinal diseases is also expected to fuel the U.S. market growth. Home infusion therapy offers various benefits to the patient. Some of the benefits comprise cost-effectiveness, better outcomes, better convenience, and higher safety standards.

As compared to hospital treatment, home infusion therapy is cost-effective since it eliminates hospital stays and ultimately saves the patient’s money. Home infusion therapy also allows the patient to maintain higher safety due to less risk of hospital-acquired infections at home. This augments the demand for home treatment, thereby driving the market growth.

Increasing patients’ preference for home therapy is also driving the market growth. Home healthcare supports the daily life activities of patients and provides better access to skilled medical care. In addition, geriatric patients with chronic disorders and individuals recently discharged from hospitals and other healthcare settings are expected to be at high nutrition risk and can get home-cooked meals. These factors are expected to drive the market growth over the forecast period.

The growing advancements in the home healthcare industry are also expected to fuel the U.S. market growth in the coming years. The availability of Point-of-care (POC) diagnostics that help in faster patient care and the provision of telehealth programs for patients suffering from chronic disorders and who need to be admitted frequently is trending.

The growing prevalence of chronic disorders in the geriatric population is also affecting the growth of the U.S. market. As per the National Council on Aging, approximately 80 percent geriatric population is affected by at least one chronic disorder, while 68 percent suffer from two disorders. Some of the common disorders prevalent in the elderly comprise arthritis (42%) and diabetes (20%).

According to McKinsey, emergency room visits in the U.S. were down by half or more and faced an accelerated decline throughout the year. This led healthcare practitioners to prescribe patient home infusion treatments to monitor them remotely, which is safe for the patient, and also reduces the burden on a healthcare facility.

Smiths Medical stated that demand for items such as ventilators, airway management products, and infusion pumps increased substantially during the pandemic. The company’s revenue from the infusion system was up by 4%, driven by COVID-19-related demand. The safety of immune-compromised and critically ill patients, effectiveness and low cost of home infusion services, and the low risk of transmission of the COVID-19 virus, are factors that will drive the market growth over the forecast period.

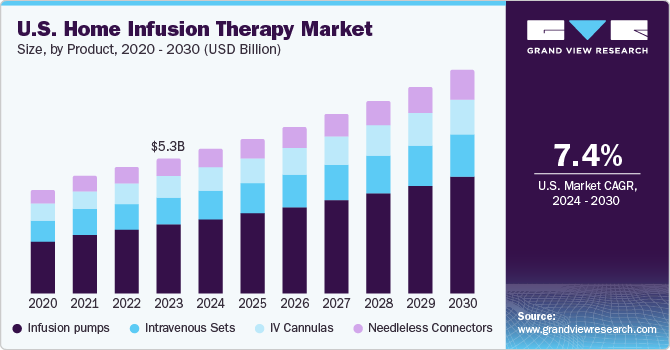

Product Insights

In terms of product, the infusion pumps segment held the largest revenue share of 51.3% in the market in 2023. The infusion pumps segment is further categorized into ambulatory infusion pumps, elastomeric pumps, syringe pumps, insulin pumps, patient-controlled analgesics (PCA), and volumetric pumps. This can be attributed to their increasing use and efficiency in delivering nutrition, medications, and other required fluids in required amounts. In addition, modernized infusion pumps are equipped with alert systems to avoid the risk of adverse drug interaction or when the pump parameters are indifferently set. These factors are expected to drive the segment growth in the forthcoming years, thus driving the market growth.

The needleless connectors segment is anticipated to be the fastest-growing owing to various benefits, such as less risk of bacterial contamination and higher protection against needlestick injuries. Moreover, needleless connectors reduce the risk of health-care associated bloodstream infections (HA-BSIs). Owing to these features, the demand for needleless connectors is predicted to augment over the forecast period.

Application Insights

The anti-infective segment held a significant share of 27% in 2023 of the U.S. market. Based on application, the market is categorized into anti-infective, endocrinology, hydration therapy, parenteral nutrition, enteral nutrition, chemotherapy, specialty pharmaceuticals, and others. The anti-infective segment registered a significant share in 2023 owing to its extensive use as an antifungal, antibiotic, and antiviral agent in-home care. Moreover, growing efforts for reducing hospital stays are also increasing the demand for anti-infective therapy, thereby driving market growth.

Endocrinology is projected to be the fastest-growing segment owing to the growing number of conditions associated with the endocrine system. Thyroid is one of the most common disorders prevalent in the U.S., sometimes resulting in death. The American Association of Clinical Endocrinologists (AACE) is increasing its focus on implementing training programs to create awareness about the benefits of using insulin pumps. Insulin pumps are highly convenient for proper insulin delivery and help maintain the blood glucose level. Hence, growing cases of thyroid along with metabolic disorders in the U.S. are expected to drive the segment growth.

Regional Insights

Owing to the increasing number of chronic disorders prevalent in individuals and growing initiatives by the government for the advantages of home infusion therapy, the U.S. market is expected to grow considerably. Moreover, increasing demand for long-term therapies by patients is also expected to fuel the U.S. market in the future.

Major factors driving market growth include an increase in the geriatric population and a rise in disease burden. In addition, growing awareness has led to a higher inclination of patients, especially the geriatric population, to require long-term care toward home infusion therapy. It has been estimated that the administration of medications at home costs from USD 150 to USD 200 per day, much less than the cost of a typical inpatient stay, which costs from USD 1,500 to USD 2,500 per day.

The well-established healthcare industry, easy access to healthcare needs, faster adoption of advanced technologies, and high disposable income of consumers are a few other drivers of the U.S. market. The availability of superior-quality home infusion products to patients is also propelling the market growth.

Key Companies & Market Share Insights

Some of the players profiled in the U.S. home infusion therapy industry focus on adopting growth strategies, such as mergers and acquisitions, new product launches, innovations in existing technologies, and more.

For instance, In March 2022, B. Braun acquired Intermedt Medizin & Technik GmbH to integrate a comprehensive range of products and services for dialysis therapy.

Key U.S. Home Infusion Therapy Companies:

- B. Braun Melsungen

- Baxter International,

- Caesarea Medical Electronics Ltd.

- CareFusion

- Fresenius Kabi

- ICU Medical

- JMS CO., LTD.

- Smiths Medical, Inc.

- Terumo Corporation

- Coram LLC

- Option Care Enterprises, Inc.

- BioScrip, Inc.

- BriovaRx Infusion Services

- Paragon Healthcare

U.S. Home Infusion Therapy Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 31.8 billion

Growth rate

CAGR of 7.7% from 2024 to 2030

Base year for estimation

2023

Historic data

2018 - 2022

Forecast period

2024 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application

Country scope

U.S.

Key companies profiled

B. Braun Melsungen; Baxter International; Caesarea Medical Electronics Ltd.; CareFusion; Fresenius Kabi; ICU Medical; JMS CO., LTD.; Smiths Medical, Inc.; Terumo Corporation; Coram LLC; Option Care Enterprises, Inc.; BioScrip, Inc.; BriovaRx Infusion Services; Paragon Healthcare

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Home Infusion Therapy Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. home infusion therapy market report based on product and application:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Infusion pumps

-

Insulin pumps

-

Syringe pumps

-

Elastomeric pumps

-

Patient Controlled Analgesics (PCA)

-

Volumetric Pumps Market

-

-

Intravenous Sets

-

IV Cannulas

-

Needleless Connectors

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Anti-Infective

-

Endocrinology

-

Diabetes

-

Others

-

-

Hydration Therapy

-

Athletes

-

Others

-

-

Chemotherapy

-

Enteral Nutrition

-

Parenteral Nutrition

-

Specialty Pharmaceuticals

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. home infusion therapy market size was estimated at USD 19.1 billion in 2023 and is expected to reach USD 20.4 billion in 2024.

b. The U.S. home infusion therapy market is expected to grow at a compound annual growth rate of 7.7% from 2024 to 2030 to reach USD 31.8 billion by 2030.

b. Anti-Infective segment dominated the U.S. home infusion therapy market with a share of 27% in 2023. This is attributable to extensive use as antifungal, antibiotics, and antiviral agent at-home care.

b. Some key players operating in the U.S. home infusion therapy market include B. Braun Melsungen; Baxter International; Caesarea Medical Electronics Ltd.; CareFusion; Fresenius Kabi; ICU Medical; JMS CO., LTD.; Smiths Medical, Inc.; Terumo Corporation

b. Key factors that are driving the market growth include rise in elderly population prone to various severe disorders and increasing preference for home therapy.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."