- Home

- »

- Consumer F&B

- »

-

U.S. Hot Drinks Market Trends, Size, Share, Industry Report 2018-2025GVR Report cover

![U.S. Hot Drinks Market Size, Share & Trends Report]()

U.S. Hot Drinks Market Size, Share & Trends Analysis Report, By Product (Coffee, Tea, Others), Competitive Landscape, And Segment Forecasts, 2018 - 2025

- Report ID: GVR-2-68038-361-4

- Number of Pages: 55

- Format: Electronic (PDF)

- Historical Range: 2014 - 2016

- Industry: Consumer Goods

Industry Insights

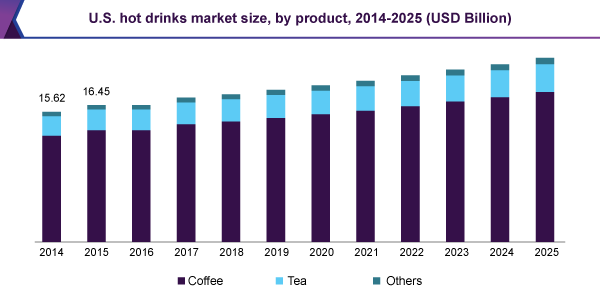

The U.S. hot drinks market size was estimated at USD 17,356.6 million in 2017. The increasing usage of the products as gourmet beverages with attributes such as specially crafted as per the non-commercial consumer segment requirements is anticipated to drive growth. Changing consumer preferences towards the consumption of nutritious hot beverages over carbonated drinks is likely to drive the growth.

The industry is likely to grow on account of increasing awareness among the emerging young population regarding the health benefits of tea and coffee to reduction of lifestyle-related diseases such as obesity, blood pressure, diabetes, and others.

The U.S. is a developed economy with a high amount of investment noted in research & development for processing and manufacturing of the raw materials used for the production of beverages. The established industry players are engaged in establishing a roastery along with the distribution center for attracting a larger pool of customers.

Factors such as growing awareness about the sustainable sourcing of products and creating shared value for the industry players are expected to drive the production. Producers are adopting various regulations and certifications namely FSSC 22000, GRAS, USDA Organic, Fairtrade, Kosher, HACCP, GMP, to ensure quality and selling ability of products in an attempt to lure large base of customers.

The industry is characterized by the presence of large number of substitutes, namely fruit juices, toddy, and other beverages. However, with the lesser advertisement of the substitute products and diminished propensity of the buyer towards the consumption of substitutes, the products are likely to lose share to hot beverages.

The rising number of commercial industry players and increased demand for hot beverages among the population is expected to create an increased risk of labor exploitation in the plantations. The exploitations include lesser pay, unhygienic conditions, abuses, and reduced resources along with non-existent work contract increasing the apathy of the workers which is presumed to hamper the U.S. hot drinks market growth over the forecast period.

The increasing market demand for hot beverages among the millennials populations is leveraged by the growing demand for artificial sweeteners. The market of artificial sweeteners is expected to be growing at a CAGR of 3.5%, in terms of revenue over the forecast period with consumer base shifting from naturally sourced sugar and corn syrup to artificial flavors for perceived health benefits.

The major industry players in the U.S. hot drinks market are engaged in extensive and robust supply chain operations with a large number of distributors, namely grocery stores, mass merchandisers, supermarkets, dollar shops, retail stores, food brokers, and online stores constituted in the country for the growing demand.

The companies present in the U.S. hot drinks market use innovative technologies for roasting of the beans to enhance the flavor and to reduce the holding times which is presumed to increase the customer base. These technologies process the ingredients at lower temperatures, avoiding the evaporation of volatile components and increasing the demand among the consumers in the country.

The coffee consumption in the U.S. is expected to step up the prices of coffee beans with massive changes registered in the demand-supply balance of the commodity. In addition, there is a setback in the coffee plantations, restricting the supply and elevating the price pressure on the industry players. The tightening of the coffee market is presumed to hamper market growth over the forecast period.

Product Insights

Tea is the fastest growing hot beverage in the U.S. on account of the rising awareness among the population regarding the health benefits offered by the beverage in place of the substitutes. The segment is expected to grow at a CAGR of 4.1% from 2018 to 2025. Major tea players are likely to capitalize on the health benefits offered by the product enhancing the U.S. hot drinks market growth.

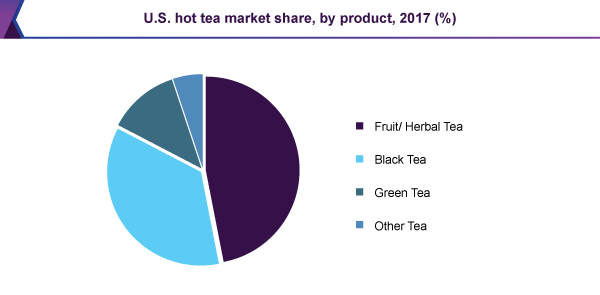

Herbal/Fruit-based tea is presumed to be the fastest-growing segment on account of growing number of investments and research recorded. Natural offerings such as fruit teas are fueled by the demand of the consumers for variations in flavors and crossovers improving the market growth of the product over the forecast period.

According to the Tea Association of the U.S.A., of the 80 billion servings of tea, 85% of the population drinks black tea. This is fueled by the growing demand exhibited by the millennials and of tea retailers engaged in premiumization of the product, by offering variations to cater to the rising demand of the population of the country.

Green tea is estimated to be the second-largest market in the tea segment driven by the rising popularity of green tea among youth. Green tea offers large number of medicinal benefits including balancing of blood sugar, reduction of cardiovascular diseases, prevention of prostate cancer, and boost in immunity. The antioxidants and polyphenols present in green tea provide the health benefits which is presumed to drive the U.S. hot drinks market growth over the forecast period.

The increased production of coffee is driven by the rising usage of organically and sustainably sourced coffee beverages. The vast number of big industry players, engaged in offering new products. abide by the regulations and certifications, which is anticipated to drive the growth of the hot drinks among the aware consumers over the span of the next seven years.

The instant coffee segment is gaining prominence in the U.S. on account of easier preparation. In addition, the growing innovations in the instant coffee segment are likely to increase the demand over a span of seven years. The segment is expected to reach a value of USD 1,182.9 million by 2025. The development of single-serve systems offering increased convenience at homes, offices is anticipated to benefit the U.S. hot drinks market.

Country Insights

The presence of large number of major players in the U.S. coupled with high disposable income and changing consumer preferences towards the consumption of healthy beverages is likely to drive the product growth over the next seven years. A large number of companies are focusing on using innovative techniques for the manufacture of products customized exclusively for the end-users, which is likely to drive the U.S. hot drinks growth.

The industry players position themselves as the conscious manufacturers observing the concept of shared value by adhering to the belief of growth of partners to bring positive effects in the long term development of the company. These companies rely on the utilization of minimal resources limiting the degradation of the environment.

The commercial end-users form a bigger percentage of the market share with restaurants and café being the highest consumers. These food outlets primarily offer coffee and tea as hot beverages, positioning themselves as the prime players in the market. There is also a rising market witnessed for the non-commercial end-users with the strategically integrated distribution channel across the country.

U.S. Hot Drinks Market Share Insights

The competition is characterized by a large number of public companies as well as domestic players engaged in offering the products as a segment of food and beverages. Major players in the industry include Starbucks Corporation, The J. M Smucker Company, Cargill Inc, Nescafe USA, Mondelez International Inc., The Hain Celestial Group Inc, Associated British Foods plc, Tate & Lyle Plc, among others contribute to the large market share of the production.

The companies operate through unique brands offering coffee, tea, hot chocolate, and other hot beverages with niche compositions including cider, and others. A large number of players are based in the U.S. with an organized distribution network to supply the products to customers across the country.

The distribution channels contribute to increased availability of the product to the customers. They include wholesalers, retailers, food brokers, mass merchandisers, dollar shops, superstores, supermarkets, and e-commerce platforms.

Report Scope

Attribute

Details

Base year for estimation

2017

Actual estimates/Historical data

2014 - 2016

Forecast period

2018 - 2025

Market representation

Revenue in USD Million and CAGR from 2018 to 2025

Country scope

The U.S.

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analysts working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the reportThis report forecasts revenue growth at country levels and provides an analysis of the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the U.S. hot drinks market on the basis of product and its sub-segments:

-

Product Outlook (Revenue, USD Million; 2014 - 2025)

-

Coffee

-

Fresh

-

Instant

-

-

Tea

-

Herbal

-

Black

-

Green

-

Others

-

-

Others

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."