- Home

- »

- Electronic & Electrical

- »

-

U.S. Household Appliances Market Size, Share Report, 2030GVR Report cover

![U.S. Household Appliances Market Size, Share & Trends Report]()

U.S. Household Appliances Market Size, Share & Trends Analysis Report By Product (Water Heater, Dishwasher, Refrigerator, Washing Machine, Air Conditioner), By Distribution Chanel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-146-7

- Number of Pages: 96

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Consumer Goods

U.S. Household Appliances Market Trends

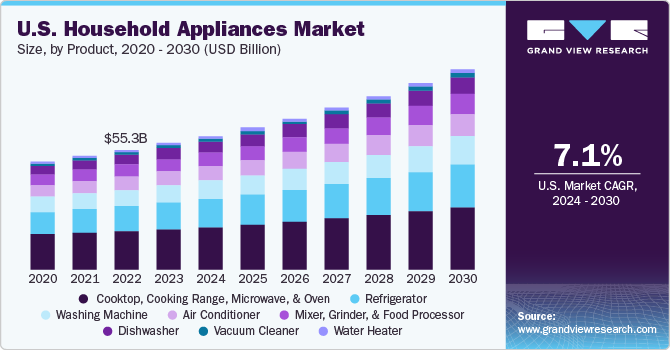

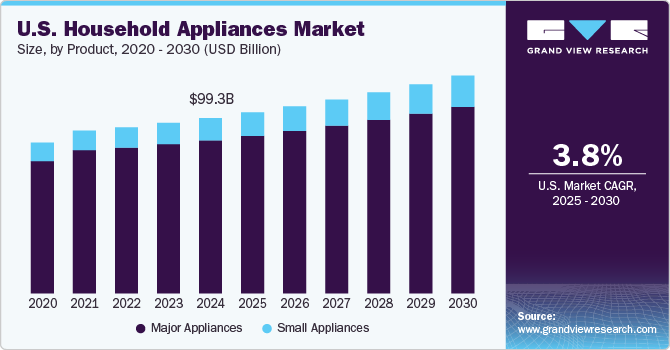

The U.S. household appliances market size was valued at USD 58.33 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 7.1% from 2024 to 2030. The rise in people's disposable income levels is expected to be a driving force in the market's expansion. The pace of urbanization is rapidly expanding, which is projected to have a beneficial impact on the household appliances market. COVID-19's rapid spread across the globe posed major issues in the form of supply chain disruptions for most manufacturers, including large home appliances in the United States. Limited component availability, labor shortages, and other supply chain-related issues are some of the primary challenges that most industry players are currently focused on.

Furthermore, consumers were compelled to reconsider their priorities, adjust their buying patterns, and develop new habits. Consumers are increasingly buying appliances online, according to various reports, as they adopt social distancing. In the case of larger home appliances like refrigerators, stoves, dishwashers, dryers, and the like, the pandemic has had an impact on purchasing behavior. Do-it-yourself pursuits, such as decorating, cooking, sewing, and arts and crafts, have gained popularity among stay-at-home moms.

The market will grow due to various growth drivers such as an increase in single-person households, an increase in disposable income, an increase in the number of smart homes, an increase in the millennial population, an increase in online sales of small household appliances, an increase in the demand for smart sensors, an increase in the demand for energy optimization, and so on.

Various market trends, such as cloud technology, rising artificial intelligence technology, accelerating adoption of the Internet of Things (IoT), growing social media influence, and the introduction of innovative small household appliances, will all contribute to the growth of the US household appliances market. For instance, In October 2020, Spring USA launched new LoPRO induction range series of lightweight and designed for durability. This product features high-grade polymer housing and tempered glass on top.

Few companies penetrated the U.S. market by strengthening their supply chain. This strategy enhanced operations smoothly. The transportation of raw materials to manufacturers and the final products to the customer is expected to attract more customers. For Instance, In April 2021, Panasonic Corporation acquired the U.S. Supply chain software company, Blue Yonder, for USD 7.1 billion. This acquisition will help Panasonic to expand in the U.S.

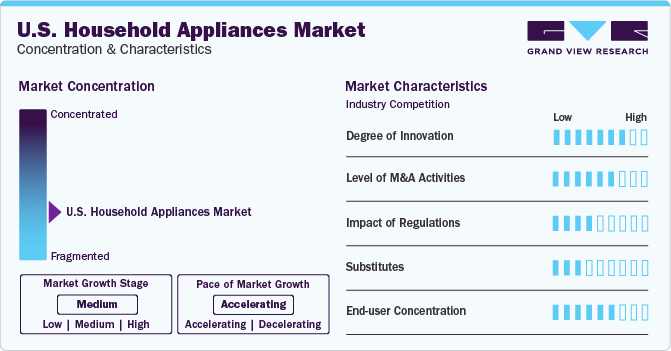

Market Concentration & Characteristics

The growth of this market can be attributed to increased focus on energy-efficient appliances to meet sustainability goals and reduce environmental impact. Furthermore, personalized cooking and cleaning settings, adaptive technology, and tailored user interfaces for a more user-friendly experience is propelling the market growth over the forecast period.

Strategic acquisitions are anticipated to fuel growth in the U.S. Household Appliances Market by enabling companies to expand their product portfolios, enhance technological capabilities, and establish stronger footholds in both domestic and international markets. This proactive approach allows businesses to capitalize on synergies, streamline operations, and stay competitive in the evolving landscape of household appliance innovation and consumer preferences.

Regulations play a significant role in shaping the U.S. Household Appliances Market by influencing product standards, energy efficiency requirements, and safety guidelines. Stringent regulatory frameworks can drive innovation, encouraging manufacturers to develop energy-efficient and environmentally friendly appliances..

Product Insights

The cooktop, cooking range, microwave, and oven segment is accounted for a share of 31.6% U.S. revenue in 2023. The U.S. real estate market is expected to witness a growth in demand for kitchen appliances, owing to the desire to save time and effort. Furthermore, increased disposable income and improved living standards are some of the other factors that would drive the demand for cooktops, cooking ranges, microwaves, and ovens in the U.S. during the forecast period.

The air conditioner segment is anticipated to grow at a CAGR of 7.8% from 2024 to 2030. Rising temperatures and rising middle-class income levels are expected to propel the growth of the air conditioner product sector upward during the projection period. Construction operations, together with rising people's living standards, will provide growth prospects for the category.

Distribution Channel Insights

The brick & mortar segment made the largest contribution to the market with a revenue share of over 77.3% in 2023. Most consumers prefer brick & mortar stores when buying household appliances due to the exclusive offerings by product specialists and after-sale services. There are many brick & mortar stores such as Target, Walmart, and Old Navy in the U.S. regarding household and kitchen appliances. These are more likely to be experienced stores that provide the consumers with a hands-on experience of how the product works.

These stores provide various options to the customers as well. Many brands have opened their experienced stores in the U.S. to gain the attention of customers. For instance, in February 2019, Samsung Electronics Co. Ltd launched its first-ever experience retail stores for the U.S. market in three locations which are New York, California, and Texas. This strategy allowed the customers to try out new products and experience them.

The e-commerce channel is projected to grow at a CAGR of under 8% from 2024 to 2030. Rising internet penetration and target marketing done by companies to reach all customer touchpoints are likely to fuel the growth of this segment. The rapid expansion of e-commerce, along with growing digitalization, especially among the young and millennial population at a global level, is driving the online sales of household appliances in the U.S. Additionally, easy payment transactions and busy lifestyles of consumers are driving the online sales of the products.

Regional Insights

The growth of the housing sector across the Southeast U.S. region is expected to increase the demand for various household appliances, which will further drive the U.S. household appliances market’s growth. The region is expected to hold. For instance, according to Florida Realtors’ Chief Economist Dr. Brad O’Connor, 528,000 homes in Florida were sold in 2021, registering a 19% increase as compared to sales in 2020.

A rise in consumer spending across the Southeast U.S. region is expected to boost the growth of the household appliances market. Furthermore, according to Phoebe Fleming, Director of Research, Orlando Economic Partnership, consumer spending in Florida increased by 22.9% in 2021 as compared to 2020. The region is expected to accelerate at a CAGR of 8.2% during the forecast period.

Key Companies & Market Share Insights

The market includes both international and domestic participants. Key players focus on strategies such as innovation and new product launches in retail about household appliances in the U.S. to enhance their portfolio offerings in the market. For instance, in September 2022, the most sophisticated robot vacuum and mop, the Roomba ComboTM j7+, was launched by Robot Corporation, a pioneer in consumer robots, coupled with smart iRobot OS 5.0 upgrades. This robot vacuum is intended for active families with a variety of carpets, rugs, and hard floors as well as those looking for a robot vacuum that can also mop.

Key U.S. Household Appliances Companies:

The following are the leading companies in the U.S. household appliances market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these U.S. household appliances companies are analyzed to map the supply network.

- Whirlpool Corporation

- Electrolux AB

- Fisher & Paykel Appliances Holdings Ltd.

- Frigidaire

- GE Appliances

- Haier Group

- LG Electronics

- Panasonic Corporation

- Robert Bosch GmbH

- Samsung Electronics Co., Ltd.

- SMEG S.p.A.

- Miele & Cie. KG

- iRobot Corporation

Recent Developments

-

In March 2022, Samsung Electronics launched a new model of its Bespoke French Door refrigerator at CES 2022. The new line combines unique and customizable designs with Samsung's latest storage and cooling innovations to provide consumers with the refrigerator they've always wanted with the convenience they truly require. Families can choose from 12 stylish glass and steel finishes to complement their kitchen, while the SpaceMax technology ensures they can comfortably store all of their groceries for all types of cooking.

-

In February 2022, Spectrum Brand Holdings Inc., a leading global branded consumer products and home essentials company, announced that it had signed a definitive agreement to acquire the home appliances and cookware categories of Tristar Products, Inc. (the “Tristar Business”) for USD 325 million

-

In February 2022, LG Electronics launched a new device in the dishwashing category, with features like QuadWash Pro and Dynamic Heat Dry technologies, designed with a multitude of engineering enhancements to offer consumers smarter cleaning innovation and the ultimate convenience.

-

In January 2022, DaanTech, a new startup launched The Bob at the CES 2022. It is a countertop space-saving dishwasher. A UV-C cleaning cycle is an optional extra feature on the Bob. In this mode, the washer does not use water, but rather UV-C rays to disinfect items that cannot be wet, such as phones, keys, and wallets. Consumers would be thrilled to see it presented as a tabletop appliance rather than a separate machine.

-

In January 2022, with its new LG WashTower and washer and dryer pair, LG Electronics (LG) demonstrated a smarter, more seamless way to do laundry. LG's enhanced Artificial Intelligence Direct Drive (AI DD) technology, proven steam technology, and an array of functions make washing and drying clothes more convenient than ever before. The new laundry pair delivers customized performance with LG's enhanced AI DD technology, which can sense load size, fabric type, and the level of soiling of a clothing article, automatically adding the appropriate amount of detergent and adjusting the wash style for optimal cleaning.

-

In December 2021, FOTILE, a global leader in household appliances, launched a new flagship series of combination countertop ovens called “ChefCubii”. The product features three steam modes: bake mode, air fryer mode, and dehydrator mode.

-

In May 2021, Bespoke Home 2021, a new virtual platform and global showcase for Samsung Home Appliances, was launched by Samsung Electronics. The event celebrated the global expansion of the Bespoke refrigerator lineup, as well as the upcoming global launch of the Bespoke Kitchen package, new lifestyle appliances, and integrated IoT solutions—all of which can be more personalized, flexible, and intelligent.

-

In May 2021, Whirlpool Corporation collaborated with VTEX, a multinational tech company that provides a global, fully integrated end-to-end commerce solution, to play a key role in Whirlpool’s digital commerce strategy.

-

In April 2021, Panasonic Corporation acquired Blue Yonder, the leading end-to-end, digital fulfillment platform provider, for USD 7.1 billion. This acquisition was aimed at helping Panasonic expand in the U.S.

-

In February 2021, Whirlpool Corporation virtually displayed its latest appliance innovations in kitchen and laundry appliances at the 2021 NAHB International Builder’s Show (IBSx).

U.S. Household Appliances Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 93.04 billion

Growth Rate (Revenue)

CAGR of 7.1% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, and region

Regional scope

Northeast; Southeast; Southwest; Midwest; West

Country scope

U.S.

Key companies profiled

Whirlpool Corporation; Electrolux AB; Fisher & Paykel Appliances Holdings Ltd.; Frigidaire; GE Appliances; Haier Group; LG Electronics; Panasonic Corporation; Robert Bosch GmbH; Samsung Electronics Co., Ltd.; SMEG S.p.A.; Miele & Cie. KG; and iRobot Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Household Appliances Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. household appliances market report on the basis of product, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Water Heater

-

Dishwasher

-

Refrigerator

-

Cooktop, Cooking Range, Microwave, and Oven

-

Vacuum Cleaner

-

Mixer, Grinder, and Food Processor

-

Washing Machine

-

Air Conditioner

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Brick & Mortar

-

E-commerce

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Northeast

-

Southeast

-

Southwest

-

Midwest

-

West

-

Frequently Asked Questions About This Report

b. The U.S. household appliances market size was estimated at USD 55.34 billion in 2022 and is expected to reach USD 58.33 billion in 2023.

b. The U.S. household appliances market is expected to grow at a compound annual growth rate of 6.7% from 2023 to 2030 to reach USD 93.04 billion by 2030.

b. Cooktops, cooking ranges, microwaves, and ovens dominated the U.S. household appliances market with a share of 31.6% in 2022. This is attributable to the swift pace of urbanization. rising income levels and spending power of consumers

b. Some key players operating in the U.S. household appliances market include Electrolux, Fisher & Paykel Appliances Holdings Ltd, Frigidaire, GE Appliances, Haier Group Corporation, LG Electronics, Panasonic Corporation, Philips Electronics, Robert Bosch GmbH, SAMSUNG, SMEG, and Whirlpool Corporation

b. Key factors that are driving the U.S. household appliances market growth include such as an increase in single-person households, an increase in disposable income, an increase in the number of smart homes, an increase in the millennial population, and increase in online sales of small household appliances

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."