- Home

- »

- Medical Devices

- »

-

U.S. Laboratory Disposable Products Market Size Report, 2026GVR Report cover

![U.S. Laboratory Disposable Products Market Size, Share & Trends Report]()

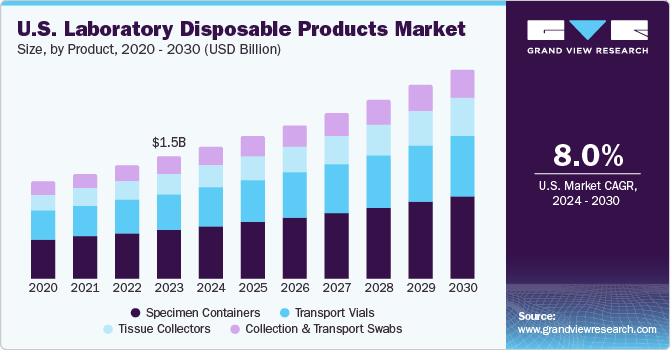

U.S. Laboratory Disposable Products Market Size, Share & Trends Analysis By Product (Specimen Containers, Tissue Collectors), By Material (Plastic, Glass), By End Use (CROs, Hospitals), And Segment Forecasts, 2019 - 2026

- Report ID: GVR-3-68038-814-5

- Number of Pages: 72

- Format: Electronic (PDF)

- Historical Range: 2015 - 2017

- Industry: Healthcare

Report Overview

The U.S. laboratory disposable products market size to be valued at USD 1.09 billion by 2026 and is expected to grow at a compound annual growth rate (CAGR) of 8.1% during the forecast period. The rising demand for plastics in healthcare industry owing to its advantages, such as light-weight, cost-effectiveness, biocompatibility, and versatility is projected to drive the market. Favorable laboratory insurance policies are expected to further fuel growth.

Use of disposable products in laboratories avoids contamination of medical products and offers better safety to patients. Moreover, use of disposable products instead of reusable products eliminates the reprocessing procedure. This factor is also expected to augment the demand for laboratory disposable products from the U.S. healthcare industry.

Introduction of novel technologies and trends are expected to fuel the growth of the laboratory disposables market in the U.S. Some of the most popular trends include automation, cloud technology, compact equipment, and eco-friendly products. Automation is not a new trend in laboratories, but it is witnessing increasing adoption in various fields including robotics, primary screening, genomics, and proteomics. Automation tools allow researchers to perform the entire process efficiently.

Lab equipment is integrated with cloud technology for data recording and storage. The use of cloud technology is anticipated to witness significant growth in laboratory settings as the labs seek advanced data storage options that offer optimum accessibility to the advanced laboratory equipment. With cloud integration, technicians can get updates and alerts on their smartphones about cycles and lab processes. These alerts allow technicians to monitor laboratory procedures and respond to emergencies more efficiently.

In addition, rising use of disposable products to avoid infectious diseases and product contamination, is also expected positively influence growth of the U.S. laboratory disposable products market. Single-use medical plastics prevent the spread of serious infectious diseases. However, improper recycling of these materials could increase the risk of infection. This encourages the use of glass, metal, and other such alternatives. Having said that, availability, transportation, and inability to decontaminate are some of the basic challenges with these alternatives.

Rise in research studies and advancements in chemical, life science, and food and beverage industries to meet the growing demand are anticipated to augment the demand for laboratory disposables, thereby driving the growth of the U.S. market.

U.S. Laboratory Disposable Products Market Trends

The growing cases of diseases like HIV / Aids, TB, Ebola, and others are propelling the market forward. As per the World Health Organization, approximately 10 million people had tuberculosis (TB) by 2020. Furthermore, there is a growing demand for equipment like homogenizers and spectrometers. These factors are set to drive growth during the forecast period.

Furthermore, technological developments in laboratory products, a rise in several clinical medical testing, and a surge in commercial and governmental healthcare investments all contribute to the industry expansion. Similarly, increased diagnostic facilities are raising the demand for laboratory products, which is driving the market growth.

According to a rise in degenerative illnesses, emerging economies provide the lucrative potential for the laboratory disposable equipment industry. Global players are focusing on providing unique products and technologies to address the requirements of healthcare professionals. To take benefit of such opportunities, leading players prioritize research and development and participate in acquisitions, mergers, and alliances.

The increased cost of advanced technology laboratory products is expected to hinder the expansion of the market. Furthermore, the market is anticipated to face challenges due to a scarcity of clinical laboratories.

Product Insights

Specimen containers segment held the largest market share of 40.8% in 2018, due to an increase in a number of patients in the U.S. Rise in geriatric population in the U.S. is one of the major factors fuelling the product demand. Moreover, high prevalence of chronic disorders and rising geriatric population is also expected to drive the demand for laboratory disposable products. Growing incidence of various diseases demand pathological examination of urine, blood, stool, and sputum, which requires different disposables to confirm the diagnosis and to carry out a treatment plan.

Tissue collectors segment, on the other hand, is anticipated to register the highest CAGR of 9.6% over the forecast period. High prevalence of different types of cancer is anticipated to drive the segment growth. A high prevalence of cancer is expected to drive the product demand in the near future. Tissue examination is widely used for detecting different types of cancer. According to the National Cancer Institute, approximately 1,735,350 new patients were diagnosed with cancer in 2018, of which 609,640 cases resulted in death. Some common types of cancer reported in the country are lung and bronchus, prostate, breast, melanoma, bladder, colon, and rectal cancer.

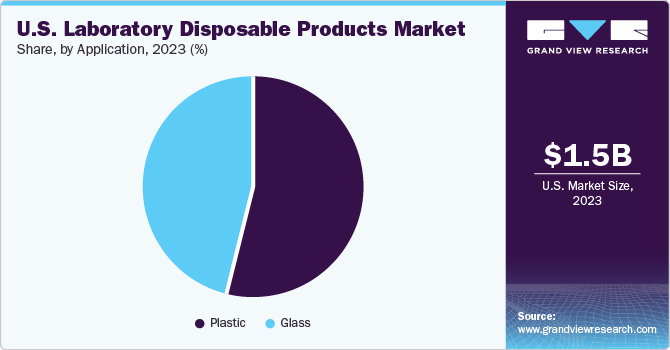

Material Insights

The plastic segment is anticipated to continue holding the leading market share over the forecast period. The physical properties of plastic, easy availability, and increasing use of medical plastic disposables is projected to drive the growth of the segment. Glass segment is anticipated to expand at the fastest CAGR of over 9.0% over the forecast period. A large amount of medical plastic waste is generated in the U.S., which is leading to a shift in usage from plastic to glass laboratory disposable products. Rising preference for eco-friendly products is expected to bode well for the segment growth. For instance, in 2016, Greenhealth Exchange, an online marketplace, was launched by four major healthcare companies and two NGOs in the U.S. to promote green products, ranging from IV tubes to cafeteria food.

According to a research article published by the National Center for Biotechnology Information (NCBI) in 2015, 20 pounds of plastic waste is produced from a single hysterectomy procedure in U.S. According to the Center for Chronic Disease Prevention (CDC), six in every 10 adults in U.S. suffer from a chronic disease. Increasing prevalence of chronic diseases is projected to boost the demand for hospital treatments and procedures. High demand for laboratory disposables in healthcare centers for diagnosis and other medical purposes on a daily basis is expected to fuel the growth in the near future.

End-Use Insights

The CROs segment is expected to hold the largest market share owing to an increase in outsourcing by companies to save their time and to reduce investment. The hospital segment is expected to expand at a lucrative CAGR over the forecast period. The rapid growth can be attributed to increasing prevalence of cancer and chronic diseases in the U.S.

According to the Agency for Healthcare Cost and Utilization Project, in 2014, 10.1 million patients in hospital stay, underwent operating room procedures. As per the Leukemia and Lymphoma Society, in 2019, one person is diagnosed with blood cancer every 3 minutes in the U.S. Thus, there has been a rise in the number of hospitals stays and the prevalence of cancer and other chronic diseases in the country. Presence of a large patient pool is anticipated to increase the number of diagnostic tests performed, thereby driving the demand for laboratory disposables.

Key Companies & Market Share Insights

Some of the key market players include Cardinal Health; Thomas Scientific; Medicus Health; Therapak; Dynarex Corporation; Thermo Fisher Scientific Inc.; McKesson Corporation; Medline Industries, Inc.; and Becton Dickinson. These players focus on adopting various growth strategies, such as partnerships, mergers and acquisitions, and expansion of product portfolio among others.

AngioDynamics, Inc., a leader in offering advanced minimally invasive devices, recently announced the agreement to sell NAMIC fluid management business line to Medline Industries, Inc., a prominent manufacturer, and distributor of healthcare supplies. The agreement includes NAMIC’s widely offered manifolds, closed fluid systems, contrast management systems, disposable transducers, interventional accessories, and guidewires.

Some of the prominent players in the U.S. laboratory disposable products market include:

-

Cardinal Health

-

Thomas Scientific

-

Medicus Health

-

Therapak

-

Dynarex Corporation

-

Thermo Fisher Scientific Inc.

-

McKesson Corporation

-

Medline Industries, Inc.

-

Becton Dickinson

Recent Developments

-

In April 2023, Medline Industries Inc. announced its agreement with Wellstar Health System, a healthcare system in Georgia. This helped to strengthen its cooperation and promote functional effectiveness, cost savings, and standardization.

- In May 2022, Thomas Scientific teamed up with Foxx Life Sciences. This helped them to form a unique channel for customized made-to-order (MTO) sterile media bottles.

U.S. Laboratory Disposable Products Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 1.22 billion

Revenue forecast in 2026

USD 1.99 billion

Growth Rate

CAGR of 8.1% from 2019 to 2026

Base year for estimation

2018

Historical data

2015 - 2017

Forecast period

2019 - 2026

Quantitative units

Revenue in USD million and CAGR from 2019 to 2026

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, end-use, region

Country scope

The U.S.

Key companies profiled

Cardinal Health; Thomas Scientific; Medicus Health; Therapak; Dynarex Corporation; Thermo Fisher Scientific Inc.; McKesson Corporation; Medline Industries, Inc.; Becton Dickinson

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Laboratory Disposable Products Market Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2015 to 2026. For the purpose of this study, Grand View Research has segmented the U.S. laboratory disposable products market report on the basis of product, material, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2015 - 2026)

-

Specimen Containers

-

Transport Vials

-

Collection and Transport Swabs

-

Tissue Collectors

-

-

Material Outlook (Revenue, USD Million, 2015 - 2026)

-

Glass

-

Plastic

-

-

End-Use Type Outlook (Revenue, USD Million, 2015 - 2026)

-

Hospitals

-

Ambulatory Surgical Centers

-

CROs

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. laboratory disposable products market size was estimated at USD 1.15 billion in 2019 and is expected to reach USD 1.22 billion in 2020.

b. The U.S. laboratory disposable products market is expected to grow at a compound annual growth rate of 8.1% from 2019 to 2026 to reach USD 1.99 billion by 2026.

b. Specimen containers segment dominated the U.S. laboratory disposable products market with a share of 40.9% in 2019. This is attributable to an increase in the number of patients in the U.S. due to the high prevalence of chronic disorders and the rising geriatric population.

b. Some of the key market players include Cardinal Health; Thomas Scientific; Medicus Health; Therapak; Dynarex Corporation; Thermo Fisher Scientific Inc.; McKesson Corporation; Medline Industries, Inc.; and Becton Dickinson.

b. Key factors that are driving the market growth include a shift towards disposable devices to reduce the risk of contamination, an increase in demand for disposable medical products, and an increasing number of research studies.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."