- Home

- »

- Healthcare IT

- »

-

U.S. Medical Billing Outsourcing Market Size Report, 2030GVR Report cover

![U.S. Medical Billing Outsourcing Market Size, Share & Trends Report]()

U.S. Medical Billing Outsourcing Market Size, Share & Trends Analysis Report By Component (In-House, Outsourced), By End-use (Hospitals, Physician Offices), By Service (Front-end, Back-end), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-824-4

- Number of Pages: 90

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Healthcare

Market Size & Trends

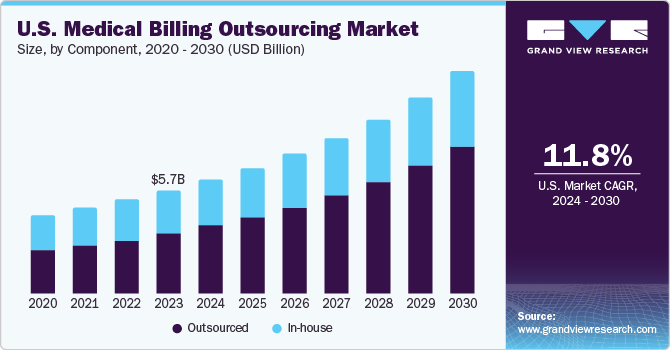

The U.S. medical billing outsourcing market size was estimated at USD 5.7 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 11.78% from 2024 to 2030. Medical billing involves revenue cycle management (RCM), which comprises very crucial and sophisticated components of the healthcare IT business. Healthcare service providers face numerous challenges in managing a large volume of claims and reimbursements, resulting in major revenue losses. Owing to this, demand for medical billing outsourcing services is increasing in the U.S. Rising patient load and the need to address ever-growing records and bills are creating a burden on medical practitioners. To counter such a situation, hospitals are outsourcing the medical billing process, which is expected to drive the market's growth.

For instance, in October 2021, American Physician Partners (APP), a major player in emergency and intensive care management services, extended its contract with R1 RCM Inc. till 2031. The partnership was established in 2019 and extended to streamline operations and scale performance.

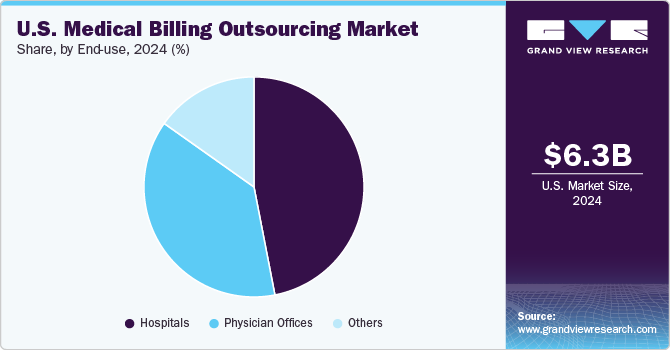

End-use Insights

Based on end-use, the hospital segment accounted for the largest revenue share of 47.0% in 2023. Hospitals are prime users of outsourcing services due to the high claim volume. Consolidations of hospitals further increase the complexity of billing and reimbursement procedures. This is fueling segment growth. Most hospitals and healthcare facilities are shifting towards RCM services to minimize errors and find a cost-effective solution. For instance, in December 2021, Allied Digestive Health, a Northeast-based gastroenterology treatment provider, selected Athenahealth Inc. for its patient engagement service and medical billing.

Physician offices segment is projected to witness substantial growth during the forecast period. Soaring needs to build more cost-effective and efficient processes and manage increased emphasis on compliance and risk management by regulatory authorities are supplementing the segment's growth.

Market Dynamic

Regulations governing health insurance in the U.S. keep changing, which leaves hospitals struggling to keep up with updated reimbursement environments. Current practices in revenue cycle management are becoming obsolete due to a lack of expertise in new payment models and RCM tools. To keep up with the industry's rapid changes, businesses need to remain updated with the expanding knowledge base, which is a time-consuming and tedious process. Therefore, hospitals and medical institutions should consider outsourcing RCM services.

In the U.S., hospitals outsource to companies that have end-to-end knowledge of the Affordable Medical Care Act, Medicaid, and other healthcare and insurance programs. RCM practices require high technological sophistication as well as trained expertise. The increasing implementation of several healthcare IT platforms has positively influenced the market's growth.

Hassle-free claims settlement processes, with features such as accounts receivable management and claims management, and the availability of professional coders acquainted with the latest medical codes are the primary reasons why practices opt to outsource their billing services. However, high threats of data breaches associated with medical billing in the US are expected to hinder market growth during the forecast period. For instance, in November 2022, the Department of Health and Human Services website reported 595 breaches, affecting over 40 million individuals.

The pandemic had both positive and negative effects on the market. Introducing new ICD, Current Procedural Terminology (CPT), and diagnosis codes for COVID-19 billing and telehealth billing has posed a greater challenge for medical billing service providers. However, the adoption of RCM increased in the US. As per a survey conducted by AKASA, nearly 75% of health systems in the US deployed RCM solutions during the pandemic.

Component Insights

Based on component, the market is bifurcated in-house and outsourced. The outsourced segment held the largest revenue share of over 57% in 2023 and is expected to register the fastest growth over the forecast period. According to a 2018 study in the Journal of Medical Practice Management, practices that outsource their billing had higher rates of claims paid on the first submission (80%) and within 30 days (88%) compared to practices that handle their own billing (68% and 72%, respectively).

Outsourcing medical billing services can significantly reduce costs and make it easier for small and medium practices to manage their finances. Many hospitals and independent physicians are opting to outsource these services to reduce healthcare costs, increase profit margins, and improve patient-physician relationships. According to a survey by the Medical Group Management Association (MGMA), in 2021, practices that handled their own billing incurred an average cost of 13.7% to collect a dollar from payers, while those that outsourced their billing incurred a lower cost of 5.4%.

Furthermore, a doctor cannot provide the best possible care to patients if he/she is engaged in managing administrative processes, such as recovering claims and managing bills. Hence, to enhance focus on medical care, large hospitals started outsourcing these services.

Service Insights

Based on service, the market is segmented into front-end services, middle-end services, and back-end services. The front-end services segment dominated the market with a revenue share of over 38% in 2023. It consists of scheduling, pre-registration, registration, eligibility, insurance verification, and pre-authorization. Managing front-end services well remains important for reducing repetitive work and improving the patient experience with faster service. Therefore, demand for outsourcing these services is robust. Middle-end services are anticipated to witness maximum growth in coming years due to entry of new market players, growing awareness among healthcare practitioners, and increasing adoption of services.

The rising number of claim denials due to inefficient claim management and increasing burden on front-end service providers is likely to propel demand for back-end services. Back-end services minimize the burden of front-end services. For instance, according to a report from the advisory board of RevCycle Intelligence, around 90% of denial of claims can be prevented and can be corrected for payment but are never resubmitted to payers due to lack of focus.

Key Companies & Market Share Insights

Companies operating in the market are focused on streamlining their offerings and identifying areas that would lead to higher cost savings. This will result in more healthcare practitioners outsourcing their revenue management process for better returns. Furthermore, partnerships and acquisitions are major business strategies undertaken by key companies to expand their geographical reach and service offerings.

-

In February 2023, Experian Health launched AI Advantage, a product specially designed to tackle the growing issue of healthcare insurance claims denials. This new system leverages artificial intelligence and Experian's expertise in big data solutions to provide a seamless and comprehensive solution for claims management in the healthcare industry.

-

In January 2022, R1RCM Inc. entered into a definitive agreement for the acquisition of Cloudmed. The deal was worth USD 4.1 billion and is expected to enter an 18-month lock-up agreement.

Key U.S. Medical Billing Outsourcing Companies:

- R1RCM Inc.

- Veradigm LLC (Allscripts Healthcare, LLC)

- Oracle (Cerner Corporation)

- eClinicalWorks

- Kareo, Inc.

- McKesson Corporation

- Quest Diagnostics

- Promantra Inc.

- AdvancedMD, Inc.

U.S. Medical Billing Outsourcing Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 12.3 billion

Growth rate

CAGR of 11.78% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion, CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Component, service, end-use

Country scope

U.S.

Key companies profiled

R1RCM Inc.; Veradigm LLC (Allscripts Healthcare, LLC); Oracle (Cerner Corporation); eClinicalWorks; Kareo, Inc.; McKesson Corporation; Quest Diagnostics Incorporated; Promantra Inc.; AdvancedMD, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Medical Billing Outsourcing Market Report Segmentation

This report forecasts revenue growth at the regional & country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. medical billing outsourcing market report based on component, service, and end-use:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

In-house

-

Outsourced

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Front-end services

-

Middle-end services

-

Back-end services

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Physician Offices

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. medical billing outsourcing market size was estimated at USD 5.7 billion in 2023 and is expected to reach USD 6.3 billion in 2024.

b. The U.S. medical billing outsourcing market is expected to grow at a compound annual growth rate of 11.78% from 2024 to 2030 to reach USD 12.3 billion by 2030.

b. Outsourced segment dominated the U.S. medical billing outsourcing market with a share of 57.68% in 2023. This is attributable to reduced cost & administrative burden, increasing profit margins, and improving the physician-patient relationship.

b. Some key players operating in the U.S. medical billing outsourcing market include R1RCM Inc., Allscripts Healthcare, LLC, Oracle (Cerner Corporation), eClinicalWorks, Kareo, Inc., McKesson Corporation, Quest Diagnostics, Promantra Inc., and AdvancedMD, Inc.

b. Key factors that are driving the U.S. medical billing outsourcing market growth include an increase in stringent government regulatory requirements and debt & uncollectible accounts.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."