- Home

- »

- Medical Devices

- »

-

U.S. Medical Thermometer Market Size & Share Report, 2030GVR Report cover

![U.S. Medical Thermometer Market Size, Share & Trends Report]()

U.S. Medical Thermometer Market Size, Share & Trends Analysis Report By Device (Mercury-based, Mercury-free), By Patient Demographics (Pediatric, Adults), By Point Of Measurement (Ear, Forehead), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-799-5

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

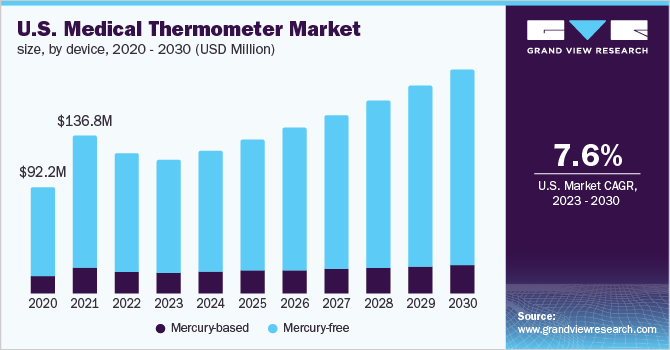

The U.S. medical thermometer market was valued at USD 121.38 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 7.60% from 2023 to 2030. The presence of significant players, the rising prevalence rate of infectious illnesses, the growing R&D efforts, technological advancement, and the rising individual concerns about self-healthcare management all contribute to the growth of the market. The U.S. has the highest proportion due to supporting healthcare legislation, a large number of patients, and a developed healthcare sector. According to the CDC, in April 2020, about 15.5 Million people in the U.S. visited physicians' offices with infectious and parasitic disorders as the major diagnosis. Furthermore, according to MedAlertHelp statistics from 2022, 5-20% of Americans get influenza each year. Besides, the CDC said that the 2019-2020 flu season resulted in 35 Million illnesses, 380,000 hospitalizations, 20,000 fatalities, and 16 Million physician visits.

Moreover, the increasing prevalence of other diseases, such as dengue, swine flu, and malaria, further drive demand for these devices for the assessment of precise body temperature. According to the CDC, every year, approximately 2,000 cases of malaria are diagnosed in the country. Thus, the increasing prevalence of infectious illnesses in the population coupled with an upsurge in patient visits to healthcare facilities, are foreseen to fuel demand for medical thermometers, subsequently adding to the market growth.

Additionally, novel product introductions are projected to boost market growth in this country. For example, in February 2022, Calera launched a wearable thermometer. Enabled with a tiny sensor and an AI-based system. Similarly, in October 2020 GreenTEG introduced Core medical as a clinical thermometer in the U.S. In addition, Masimo launched the Radius T Continuous Thermometer for customers in October 2020. Wireless Radius T detects body temperature by continually transferring data and customizable temperature notifications to the User's smartphone. Such innovative and expanding product introductions are likely to contribute to the medical thermometer market’s growth throughout the forecast period.

COVID-19 had a substantial positive influence on the growth, owing to an increase in body temperatures among COVID-19-infected patients. Since high fever is a major symptom of COVID-19 and other infectious diseases, there had been a sudden surge in demand for thermometers due to the need for temperature screening and monitoring. With the community spread of the infection across the globe, including the U.S., over-the-counter sales of thermometers in the consumer market are rising. Citizens were informed to self-screen and monitor themselves at regular intervals. Thus, rising awareness about the significance of body temperature monitoring as an effective way to identify illnesses before clinical diagnosis drives product demand.

In addition, increasing operations by emerging and small-sized players and rapid technological advancements are also contributing to the market growth. COVID-19 also paved the way for the development of novel thermometers, helping to market expansion throughout the pandemic. For instance, Kinsa, Inc., distributed around 7,500 Bluetooth-enabled smart thermometers to community-based organizations and underserved individuals. This thermometer can pair up with a smartphone app, and allow tracking of real-time COVID-19 hot spots across the U.S. Such novel product advancements for monitoring patients' temperatures are projected to contribute to market growth.

Moreover, the ban on traditional mercury in-glass fever thermometers in 13 states of the U.S. California, Connecticut, Illinois, Indiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, New Hampshire, Rhode Island, Oregon, and Washington, boosts the sale of non-contact thermometers. The government has passed laws banning the production and sale of mercury thermometers. Through various initiatives, such as the mercury pollution prevention program, the United States Environmental Protection Agency (USEPA) has been spreading awareness about the harmful effects of mercury. Currently, infrared thermometers are being widely used for screening body temperature in public places, given their non-contact benefit.

Instant patents have been provided to many companies that are developing infrared sensors for temperature measurement, to avoid cross-contamination, which is also likely to support market growth. Furthermore, the presence of key manufacturers and a number of research and academic institutes using thermometers for laboratory purposes along with rising concerns regarding self-healthcare management are expected to boost the market growth.

Device Insights

The mercury-free segment led the overall market in 2022 accounting for the highest share of over 60% and is expected to grow at the fastest CAGR over the forecast period. The segment is further divided into infrared radiation, digital, and other thermometers.

Among these, the digital segment is anticipated to hold a major share. The segment is expanding at a significant pace since more people are becoming aware of the advantages of digital thermometers. Mercury-free digital thermometers are safer, easier to use, and more precise. They provide various benefits including quicker results, improved accuracy, and safer use, over conventional glass mercury thermometers, according to research published by Southern Trading Company in July 2022. In addition, the rising incidence of infectious disorders is further propelling segment growth.

Launches of novel products are also anticipated to fuel this segment’s expansion. For instance, DT09, a digital thermometer from Detel Pro, was introduced in July 2020. The calibrating mode of this intelligent digital thermometer, for example, allows for temperature adjustment in response to the surrounding conditions. As a result, the aforementioned reasons are anticipated to fuel the segment's expansion, throughout the projected period.

Point Of Measurement Insights

The oral segment led the overall market in 2022 accounting for the highest share of over 60%. It has been observed that the oral cavity is the most accessible and is strongly thought to offer the greatest assessment of the core body temperature. Therefore, it is the most common site for measuring body temperature using local sensors. The segment is growing at an exponential rate owing to an increase in flu cases.

For instance, between September 28, 2020, and May 22, 2021, in the US, 1,675 (0.2%) of 818,939 respiratory specimens examined by US clinical laboratories were positive for influenza virus, according to the Centers for Disease Control and Prevention 2021. These figures suggest that there is a high need for body temperature monitoring equipment. Additionally, the period from February to April 2020 saw an increase in main admission diagnoses of more than 20%, according to a report published in Health Affairs 2021. This enormous figure represented the need for thermometers and, as a result, was a market-driving force.

Additionally, there are advantages related to oral thermometers. The benefits that these technologies provide are said to include accessibility and convenience. Thus, it is anticipated that the market will continue to rise steadily as a result of all the aforementioned factors.

The forehead segment is expected to witness the fastest growth in the forecast period. The increasing awareness of the benefits of digital forehead thermometers and rising demand due to COVID-19 are the main factor driving the segment's exponential trend. These thermometers provide various advantages mainly over the armpit. Aside from the benefits, the rising incidence of infectious illnesses, for which precise temperature monitoring is essential for diagnosis is the key growth driver of this segment.

Moreover, ground-breaking product launches are also likely to drive the growth of this segment. For instance, in May 2020, CDN launched a new Non-Contact Forehead Thermometer (THD2FE) that can be used to scan the temperatures of employees, rapidly and safely. Thus, the above-mentioned factors are anticipated to drive segment growth during the forecast period.

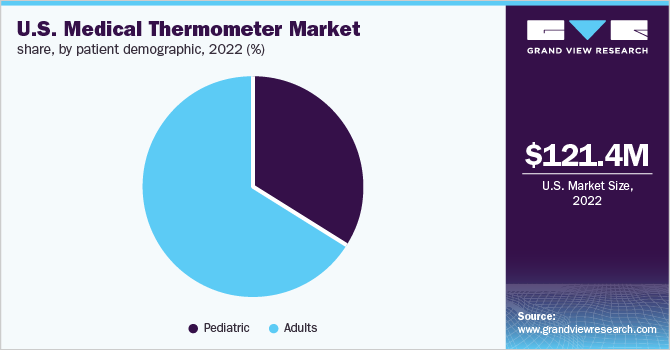

Patient Demographic Insights

The adult segment led the overall market in 2022 accounting for the highest share of over 65% and is expected to grow at the fastest CAGR over the forecast period. This growth can be attributed to the rising prevalence of infectious diseases comparatively higher in the adult population. For instance, as per the CDC (2019) data:

-

Number of new tuberculosis cases: 8,916

-

Number of new salmonella cases: 58,371

-

Number of new Lyme disease cases: 34,945

-

Number of new meningococcal disease cases: 371

-

Number of emergency department visits with infectious and parasitic diseases as the primary diagnosis: 3.2 million

-

Number of emergency department visits resulting in hospital admission with a principal hospital discharge diagnosis of infectious and parasitic diseases: 765,000

Thereby, the rising prevalence of infectious illnesses in the population, as well as the increase in patient visits to healthcare facilities, are likely to boost demand for medical thermometers, fueling the market growth.

The pediatric segment is expected to witness moderate growth in the forecast period. The leading causes of mortality in children differ depending on their age. Children under the age of five are particularly prone to infectious illnesses such as malaria, pneumonia, diarrhea, HIV, and TB. Noncommunicable illnesses, accidents, and conflict all represent considerable risks to older children. Despite being fully preventable and treatable, common infectious illnesses continue to prove fatal to a high number of young infants.

Pneumonia, diarrhea, and malaria accounted for almost 30% of global mortality among children under the age of five in 2019. Thus, the rising incidence of infectious diseases in children and infants is expected to boost the demand for thermometers, thereby, propelling the segment growth. In addition, rectal thermometers are advised for babies by the American Academy of Pediatrics (AAP) as they provide the most accurate data on a baby's core temperature. Moreover, according to Cleveland Clinic.org, the temperature of the eardrum is measured using digital ear thermometers using infrared technology. These are commonly used for children between the age group one to six.

Key Companies & Market Share Insights

The U.S. medical thermometer market is moderately competitive and comprises global as well as local players. Major companies in the market are stressing R&D to develop technologically advanced products to gain a competitive edge. For instance, in June 2022, Exergen Corporation launched the TAT-2000 for professionals and TAT-2000C for consumers at the medical fair in Mumbai, India. Similarly, in October 2021, Telli Health launched a new contactless connected 4G digital thermometer. According to reports, the Verizon-certified thermometer is compatible with all significant cellular carriers in more than 191 countries and on more than 655 cellular networks worldwide. Some prominent players in the U.S. medical thermometer market include:

-

Baxter (Hillrom Holdings Inc.)

-

Cardinal Health

-

3M

-

McKesson Corporation

-

Mediaid, Inc.

-

Innovo Medical

-

Microlife Corporation

-

American Diagnostic Corporation

-

Exergen Corporation

-

Kinsa Inc.

-

Braun Healthcare

-

Amsino International, Inc.

-

Medline Industries, Inc.

U.S. Medical Thermometer Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 193.91 million

Growth Rate

CAGR of 7.60% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Device, patient demographic, point of measurement

Country scope

U.S.

Key companies profiled

Baxter (Hillrom Holdings Inc.); Cardinal Health; 3M; McKesson Corporation; Mediaid, Inc.; Innovo Medical; Microlife Corporation; American Diagnostic Corporation; Exergen Corporation; Kinsa Inc.; Braun Healthcare; Amsino International, Inc.; Medline Industries, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Medical Thermometer Market Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. medical thermometer market report based on device, patient demographic, and point of measurement:

-

Device Outlook (Revenue, USD Million, 2018 - 2030)

-

Mercury-free

-

Infrared Radiation Thermometer

-

Digital Thermometers

-

Others

-

-

Mercury-based

-

-

Patient Demographic Outlook (Revenue, USD Million, 2018 - 2030)

-

Pediatric

-

Adults

-

-

Point Of Measurement Outlook (Revenue, USD Million, 2018 - 2030)

-

Ear

-

Forehead

-

Oral

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. medical thermometer market size was estimated at USD 121.38 million in 2022 and is expected to reach USD 116.12 million in 2023.

b. The U.S. medical thermometer market is expected to grow at a compound annual growth rate of 7.60% from 2023 to 2030 to reach USD 193.91 million by 2030.

b. Mercury-free thermometer segment dominated the U.S. medical thermometer market with a share of 83.09% in 2022. This is attributable to technological advancements, increasing product launches by the key market players, and the increasing prevalence of diseases such as fever and flu.

b. Some of the key players operating in the U.S. medical thermometer market include Medline Industries, Inc., 3M (Nexcare), Welch Allyn (Hill-Rom Holdings, Inc.), America Diagnostics Corporation, A&D Medical (A & D Company Ltd.), Exergen Corporation, Microlife Corporation, Easywell Biomedicals, Inc., Cardinal Health, Terumo Corporation, Medical Indicators Inc., Mediaid, Inc, and McKesson Corporation.

b. Key factors that are driving the market growth owing to an increase in the prevalence of diseases such as COVID-19, Influenza, Norovirus, and other medical conditions, and rising awareness about the importance of body temperature monitoring.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."