- Home

- »

- Paints, Coatings & Printing Inks

- »

-

U.S. Paints & Coatings Market Analysis Report, 2020-2027GVR Report cover

![U.S. Paints & Coatings Market Size, Share & Trends Report]()

U.S. Paints & Coatings Market Size, Share & Trends Analysis Report By Product (High Solids/Radiation Curing, Powder, Waterborne, Solvent-borne), By Material, By Application, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68039-105-9

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry: Bulk Chemicals

Report Overview

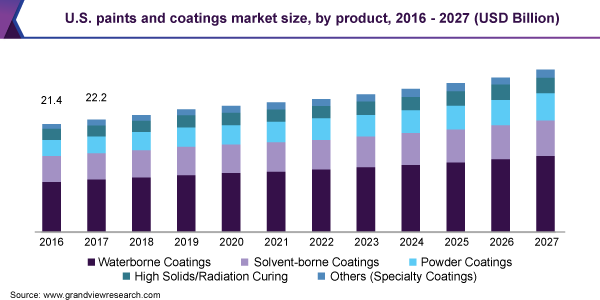

The U.S. paints and coatings market size was valued at USD 24.2 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 3.7% from 2020 to 2027. The market is expected to be driven by increasing commercial construction activities and rising demand for the product from the automotive sector in the country. Paints and coatings are used to perform a wide range of functions in various end-use industries. Their functions differ depending on the type of environment that they are used on. They are applied to different equipment to ensure resistance to wear and tear, anticorrosion, aesthetic, durability, and operational efficiency. The growing construction sector in the country owing to positive market fundamentals for commercial real estate and a strong economy, along with rising state and federal funding for institutional buildings and public works, is expected to support the demand for paints and coating in the country over the forecast period.

For instance, in February 2018, the U.S. government released USD 200 billion to rebuild its crumbling infrastructure and raise a projected USD 1.5 trillion in states, local governments, and private sector investments. In addition, in March 2020, the U.S. government announced an investment worth USD 2 trillion as a part of coronavirus response for the development of infrastructure, including hospital buildings and roads. All these steps were taken by the U.S. government to boost the construction industry in the county, which, in turn, is expected to drive the demand for paints and coatings over the forecast period.

However, lockdown imposed by the government to contain the spread of COVID-19 has led to a decline in the consumption of paints and coatings in the U.S. Order cancellations, restrictions on exports and imports, and shipping complications are further hampering the market growth. End-use industries such as automotive, construction, and general industries are witnessing a sharp decline in terms of demand and production owing to the reducing discretionary spending and increasing spending on essential items, such as food and medical supplies. This is anticipated to hamper the U.S. paints and coatings demand in the last two quarters of 2020.

Product Insights

The waterborne segment led the market and accounted for more than 46.0% share of the overall revenue in 2019. Rising adoption by the end-use industry of eco-friendly paints and coatings and growing strictness in environmental regulations in the country are expected to fuel the demand for waterborne paints and coatings over the forecast period. Water-based paints and coatings are primarily used where solvent-based coatings are expected to react with the substrate. They are ideal primers as they possess excellent thermal and corrosion resistance. In addition, they are flame-resistant and have low toxicity owing to their low VOC content and low hazardous air pollutant emissions.

Powder-based paints and coatings are projected to witness the highest growth over the forecast period as they are more durable and eco-friendly as compared to their counterparts. They have negligible VOC content due to the absence of solvents, and thus they comply more efficiently and economically with the environmental protection regulations. Increasing demand for low VOC or zero-emission coatings in the U.S. is expected to propel the demand for powder-based U.S. paints and coatings over the forecast period.

Application Insights

The architectural and decorative segment led the market and accounted for more than 57.0% share of the overall revenue in 2019. Rising infrastructure spending in the U.S. is expected to potentially fuel the growth of the construction industry over the forecast period. Furthermore, other upcoming construction projects include the construction of the South California Civic Center campus, the O’Hare Airport Construction Project, LaGuardia Airport Construction Project, and the Second Avenue Subway Construction Project. This is expected to further propel the demand for U.S. Paints and Coatings in architectural and decorative applications in the coming years.

The U.S. has witnessed significant growth in automobile production in the recent past. For instance, in March 2017, an automotive manufacturer, Ford, announced the production expansion of trucks and SUVs in three of its facilities located in Michigan, the U.S. The overall cost of the expansion was approximately USD 1.2 billion. Capacity additions and expansion of plants by automotive companies in the U.S. are further expected to augment the demand for paint and coatings. In January 2018, Toyota Motors and Mazda Motors jointly announced the expansion of their production plant in Alabama, U.S. This expansion is anticipated to fuel the use of architectural U.S. Paints and Coatings.

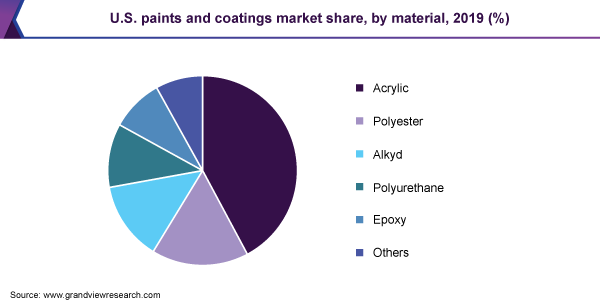

Material Insights

The acrylic segment led the market and accounted for more than 42.0% share of the overall revenue in 2019. This is attributed to its high demand from infrastructure, automotive, paints and varnishes, and paints and metal coating applications. They offer excellent physical and chemical properties, such as fire resistance, UV light resistance, abrasion resistance, vapor permeability, high weathering resistance, and gloss retention, which make them highly suitable for the application in various end-use industries.

Epoxy is another material segment that is widely used in construction, shipbuilding, and wastewater treatment plants owing to its excellent properties, such as resistance to stains, cracking, extreme temperatures, and blistering. Increasing demand for epoxy-based paints and coatings in home appliances, such as refrigerators and washing machines, to protect them from food acids, corrosive gases, and humidity, extend the service life and improve the aesthetics of appliances is expected to fuel the segment growth over the forecast period.

Key Companies & Market Share Insights

The companies are adopting various operational, product, pricing, and distribution strategies to achieve optimum business growth and a strong market position. Production capacity expansions, new product development, acquisition, collaboration, partnership, and investments in research & development are some strategies adopted by companies to reach maximum potential customers at optimum distribution cost. These strategies enable them to cater to increasing demand, ensure competitive effectiveness, enhance sales and operations planning, and expand their customer base.

For instance, in December 2018, Rust-Oleum Group, a subsidiary of RPM International, Inc. acquired Siamons International, Inc., a provider of specialty mold cleaners under the Concrobium brand. The acquisition provides the company with an opportunity to improvise its brand building and expand its distribution network and logistics infrastructure in the paints and coatings market by reaching out to the maximum potential customers at optimum distribution cost. The U.S. market for paints and coatings is found to be significantly fragmented owing to the presence of a large number of manufacturers across the globe. Some of the prominent players in the U.S. paints and coatings market include:

-

The Sherwin Williams Company

-

Axalta Coating Systems, LLC

-

PPG Industries, Inc.

-

RPM International, Inc.

-

BASF SE

-

3M

-

Sika AG

U.S. Paints & Coatings Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 24.8 billion

Revenue forecast in 2027

USD 32.0 billion

Growth Rate

CAGR of 3.7% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Volume in kilotons, revenue in USD million and CAGR from 2020 to 2027

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

Segments covered

Product, material, application

Country scope

The U.S.

Key companies profiled

The Sherwin Williams Company; PPG Industries, Inc.; Nippon Paint Holdings Co., Ltd.; Axalta Coating Systems, LLC; BASF SE; RPM International Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue and volume growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the U.S. paints and coatings market report on the basis of product, material, and application:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Waterborne Coatings

-

Solvent-borne Coatings

-

Powder Coatings

-

High Solids/Radiation Curing

-

Others (Specialty Coatings)

-

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Acrylic

-

Polyester

-

Alkyd

-

Polyurethane

-

Epoxy

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Architectural & Decorative

-

Non-architectural

-

Automotive & Transportation

-

Wood

-

General Industrial

-

Marine

-

Protective

-

Others

-

-

Frequently Asked Questions About This Report

b. The U.S. paints & coatings market size was estimated at USD 24.2 billion in 2019 and is expected to reach USD 24.8 billion in 2020.

b. The U.S. paints & coatings market is expected to grow at a compound annual growth rate of 3.7% from 2020 to 2027 to reach USD 32.0 billion by 2027.

b. Architectural and decorative dominated the U.S. paints & coatings market with a share of 57.4% in 2019. This is attributable to rising reconstruction activities coupled with infrastructure development in the country as a result of rapid industrialization.

b. Some of the key players operating in the U.S. paints & coatings market include 3M, Axalta Coating Systems, LLC, Nippon Paint Holdings Co., Ltd., The Sherwin Williams Company, PPG Industries, Inc., RPM International, Inc., and BASF SE.

b. Key factors driving the U.S. paints & coatings market growth include increasing government initiative for reconstruction activities, increasing awareness regarding environmentally friendly and sustainable alternatives.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."