- Home

- »

- Animal Health

- »

-

U.S. Pet Daycare Market Size, Share, Demand Industry, 2030GVR Report cover

![U.S. Pet Daycare Market Size, Share & Trends Report]()

U.S. Pet Daycare Market Size, Share & Trends Analysis Report By Pet Type (Dogs (Large Breeds, Medium Breeds, Small Breeds), Cats), By Service Type (Day Boarding, Pet Sitting), By Delivery Channel, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-943-2

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Healthcare

Report Overview

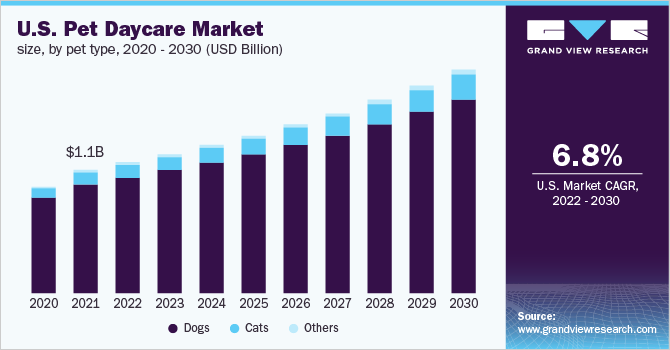

The U.S. pet daycare market size was valued at USD 1.12 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 6.8% from 2022 to 2030. Increasing pet population, pet humanization, expenditure, the number of pet service providers, and initiatives by market players are some of the key growth drivers. For instance, in April 2021, Dogtopia Enterprises-a leading dog daycare, boarding, spa, and training services provider in the U.S.-reported that it secured 31 new franchise agreements during the first quarter of 2021. Pet ownership increased during the COVID-19 pandemic. Pet parents are seeking a safe place to send their pets for exercise, fun, and socialization is expected to drive the market growth.

The COVID-19 pandemic adversely impacted the U.S. pet daycare market. Pet daycare centers were either closed temporarily or faced a slowdown in business due to lockdowns and movement restrictions. For instance, over 50% decrease in business was reported by about 85% of Pet Sitters International members at the peak of the pandemic. Wag Labs, headquartered in the U.S., experienced more than 60% decline in gross bookings during 2020.

However, the demand gradually recovered as business activities resumed in 2021. Rover, for instance, registered 4.2 million bookings in 2021. The company reported about a 75% increase in bookings compared to the previous year. Rover also reported continued recovery in bookings despite the impacts of COVID-19 variants ahead of return to travel.

The growing number of pet services facilities and expenditure on pets are expected to fuel the market growth. In 2019, there were a total of 20,413 facilities offering pet care services as per the U.S. Census Bureau. Furthermore, according to APPA, pet parents in the U.S. spent about USD 103.6 billion on their pets in 2020. This number was significantly greater than pet expenditure in 2019 (estimated at USD 97.1 billion) and in 2018 (estimated at USD 90.5 billion).

Pet parents are also increasingly opting for pet services including daycare instead of relying on friends, family, and neighbors. As per a July 2020 survey by Rover, 67% of its users previously relied on friends, family, and neighbors for pet care such as boarding, sitting, drop-in visits, dog walking, and daycare. Since the Rover app launched in the U.S. in 2013, over 3 million parents have booked the services and more than 57 million services have been delivered.

The growing popularity of large and small breed dogs is estimated to increase demand for custom pet services. According to the American Kennel Club, Inc. (AKC), the top 10 most popular dog breeds in the U.S. were found to be large breeds such as Labrador Retriever, Golden Retriever, German Shepherd Dog, and Rottweiler, and small breeds including French Bulldogs, Poodles, Bulldogs, Beagles, and Dachshunds.

Labrador Retrievers, for instance, have a thick, water-repellant double coat that sheds. The AKC thus recommends occasional baths and nail trimming to keep them clean. The breed also has notable physical strength and high energy level hence the AKC also recommends socialization activities, puppy training classes, and regular exercise to prevent hyperactive and/or destructive behavior. Similar pet care needs are anticipated to propel the demand for pet daycare services in the U.S.

Pet Type Insights

The dogs segment held the largest revenue share of the market in 2021. The others segment is projected to grow at the fastest CAGR of over 8% over the forecast period. This segment comprises birds, small mammals, fish, and other pets. The dog segment is further divided by the size of the breed into large breeds, medium breeds, and small breeds. The key factors contributing to the market growth include the increasing pet population, pet humanization, expenditure on pets, and the number of pet service providers.

For instance, Paradise Ranch Pet Resort in the U.S. provides dog boarding, daycare, grooming, and training services. The resort charges about USD 39 a day for doggie daycare and also provides transportation services starting at USD 75. Smilin Dogs is another facility that offers daycare, boarding, and chauffeur service with indoor and outdoor spaces.

Service Type Insights

The day boarding segment represented over 40% revenue share in 2021. The pet-sitting segment, on the other hand, is expected to grow at the fastest CAGR of over 7% during the forecast period. The key factors contributing to this growth include pet parents returning to the office post-COVID, a high proportion of pet parents among millennials and Gen Z, and the use of technology to increase awareness and adoption of pet services.

Rover-a leading pet services provider in the U.S.-connects pet care providers to pet parents via its mobile app. The company has a presence in 50 states across the U.S. and has 96% of the population covered. 41% of the company’s pet parent users in 2020 were millennials, 15% were Gen Z, while the rest were Gen X and baby boomers. Most of the company’s customers also come from affluent households with about 45% belonging to households having an income of USD 100,000 and more.

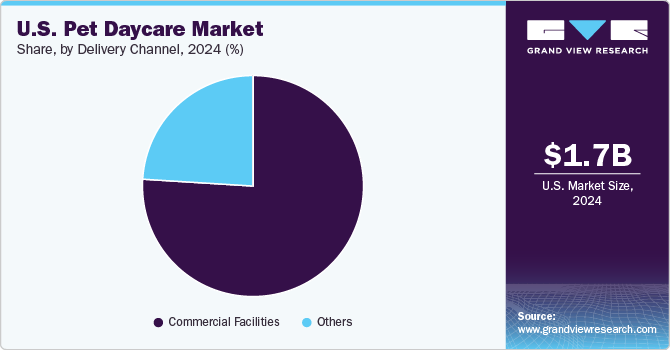

Delivery Channel Insights

Commercial facilities dominated the market in 2021. The factors contributing to this share include a growing number of pet daycare franchises, a wide portfolio of services, and the capability to expand service offerings to include both indoor and outdoor services. For instance, Dogtopia offers pet daycare services at its facilities averaging between 6,000 to 8,000 square feet. Some facilities also include outdoor space. In March 2022, Dogtopia secured the largest franchise agreement that will add about 60 new locations across the U.S. over the next few years.

The others segment is anticipated to register the fastest growth of over 7% from 2022 to 2030. It consists of mobile/ outdoors and in-house delivery channels. Queen City Petsitting Productions offers a variety of pet sitting services that include in-house pet care and pet sitting in hotel rooms, among others. These services are offered mainly for dogs but also include cats, gerbils, fish, rabbits, ferrets, etc.

Key Companies & Market Share Insights

The U.S. market for pet daycare is fragmented and competitive. Key participants are implementing strategic initiatives such as competitive pricing strategies, service expansion, partnerships, sales & marketing initiatives, and mergers & acquisitions. For example, in November 2020, Walmart partnered with Rover to expand its service portfolio by launching Walmart Pet Care. This boosted Rover’s customer base.

Dogtopia Enterprises provides franchising opportunities to interested individuals and business owners as a means to grow its market presence and regional reach. According to Dogtopia the pet care industry is recession-proof, has good margins, and is a growing market. Dogtopia estimates initial investment ranging between USD 543,193 and USD 1,489,801 for a dog daycare facility. This is inclusive of the initial franchise fee, costs associated with construction, training, payroll, equipment, and working capital for initial operations. Some prominent players in the U.S. pet daycare market include:

-

A Place for Rover, Inc.

-

Dogtopia Enterprises

-

Paradise 4 Paws, LLC

-

Come Sit Stay

-

Fetch! Pet Care

-

Barkley Ventures, Inc.

-

PetSmart LLC

-

Housecarers

-

Camp Run-A-Mutt Entrepreneurial Resources

-

Camp Bow Wow

U.S. Pet Daycare Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 1.18 billion

Revenue forecast in 2030

USD 2.02 billion

Growth Rate

CAGR of 6.8% from 2022 to 2030

Base year for estimation

2021

Actual estimates/Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million & CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Pet type, service type, delivery channel

Country scope

U.S.

Key companies profiled

A Place for Rover, Inc.; Dogtopia Enterprises; Paradise 4 Paws, LLC; Come Sit Stay; Fetch! Pet Care; Barkley Ventures, Inc.; PetSmart LLC; Housecarers; Camp Run-A-Mutt Entrepreneurial Resources; Camp Bow Wow

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this report, Grand View Research has segmented the U.S. pet daycare market report based on pet type, service type, and delivery channel:

-

Pet Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Dogs

-

Small Breeds

-

Medium Breeds

-

Large Breeds

-

-

Cats

-

Others

-

-

Service Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Day Boarding

-

Pet Sitting

-

Others

-

-

Delivery Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Commercial Facilities

-

Others (Mobile/ Outdoors, In-house)

-

Frequently Asked Questions About This Report

b. The U.S. Pet Daycare market size was estimated at USD 1.12 billion in 2021 and is expected to reach USD 1.18 billion in 2022.

b. The U.S. Pet Daycare market is expected to grow at a compound annual growth rate of 6.87% from 2022 to 2030 to reach USD 2.02 billion by 2030.

b. Day Boarding represented over 40% share of the U.S. Pet Daycare market by Service Type in 2021. The key factors contributing to this growth include pet parents returning to office post-COVID, high proportion of pet parents among millennials and genZ, and use of technology to increase awareness and adoption of pet services.

b. Some key players operating in the U.S. Pet Daycare market include A Place for Rover, Inc.; Dogtopia Enterprises; Paradise 4 Paws, LLC; Come Sit Stay; Fetch! Pet Care; Barkley Ventures, Inc.; PetSmart LLC; Housecarers; Camp Run-A-Mutt Entrepreneurial Resources; and Camp Bow Wow.

b. Key factors that are driving the U.S. Pet Daycare market growth include increasing pet population, pet humanization, pet expenditure, number of pet service providers, and initiatives by market players.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."