- Home

- »

- Sensors & Controls

- »

-

U.S. Pet Wearable Market Size & Share Report, 2030GVR Report cover

![U.S. Pet Wearable Market Size, Share & Trends Report]()

U.S. Pet Wearable Market Size, Share & Trends Analysis Report By Technology (RFID, GPS, Sensors), By Application (Medical Diagnosis & Treatment, Identification & Tracking), And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-534-2

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2018 - 2020

- Industry: Semiconductors & Electronics

Report Overview

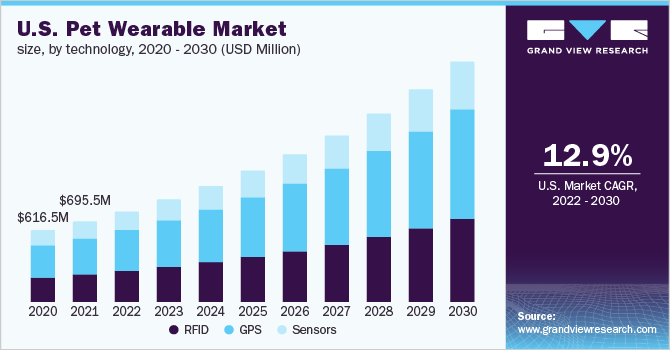

The U.S. pet wearable market size was valued at USD 695.5 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 12.9% from 2022 to 2030. The rising concern regarding pet safety and well-being is one of the prime factors contributing to market growth. Further, rising disposable income and increasing demand for advanced features in pet wearables for monitoring pets’ health are expected to drive the adoption of pet wearables in the U.S. Additionally, the U.S. has witnessed a growing trend in pet adoption in the past few years, which is expected to continue, which bodes well for market growth.

Pet wearables offer advanced features such as controlling, tracking, monitoring, treatment, medical diagnosis, security, and safety; facilitating the well-being of pets. Several veterinary professionals in the U.S. rely on technologies such as telehealth. This helps them remotely observe their patient’s health while also gaining health-related data stored in wearables, which can be used for medical diagnosis. The ability of pet wearables to monitor and record various animal behavior such as vital signs, sleep patterns, licking, resting, scratching, and more is expected to increase the adoption of these devices among pet owners.

The market experienced a minor setback during the COVID-19 pandemic due to the shortage in supply of semiconductor chips caused by the suspension of manufacturing and logistic activities. According to data published by the American Veterinary Medical Association, pet adoption from shelters in the U.S. fell by 15% in 2020 compared to 2019. Although the market experienced a decline in pet adoption, the veterinary practices saw an uptick in consultations from several new and existing pet owners. These consultations were virtual and highly relied on technology such as pet wearables for gaining animal behavioral insights. As such, several pet owners opted for pet wearable devices, which kept the market stagnant during the pandemic.

The increase in spending on pet products is expected to drive market growth. According to data published by the American Pets Products Association (APPA), spending on pet products amounted to USD 123.6 billion in 2021, an increase of 19.3% over 2020. Pet owners are expected to invest in smart technologies such as wearables to secure their pets’ health. As such, companies are investing heavily in introducing feature-loaded products offering multiple functionalities such as voice commands, vibration, sound alerts, and gentle electric shocks, which help keep the pets within a specified zone. Such technological advancements are anticipated to appeal to pet owners and drive them to purchase pet wearables, thereby contributing to market growth.

The high cost and power consumption of pet wearables are expected to pose a challenge to the market growth. These devices usually fall in the range of USD 90 to 150, with an additional subscription charge levied by the company between USD 5 to 10, which is an expensive affair for an average consumer. Additionally, the advanced features in these devices draw a lot of power, leading to high frequency in charging cycles. However, with the increasing demand, several new players are expected to enter the market with newer and cheaper products and technologies, which is anticipated to upkeep the demand for these products.

Technology Insights

The GPS segment accounted for the largest share of more than 40% of the U.S. pet wearable market in 2021. GPS tags can be easily mounted on pet collars, which help the pet owners to track the whereabouts of their pets in real-time anywhere across the country. GPS allows pet owners to set geofenced areas and alerts them when the pets step out of that area. Further, the technology can be easily connected to devices like smartphones and smartwatches, which display the pet's location. Such technology integrated into devices is expected to trigger consumer interest, thereby driving its adoption in the future.

The RFID segment is expected to register healthy growth over the forecast period. According to a survey conducted by the APPA in 2021, approximately 154.3 million households in the U.S. own different pets, that include cats, dogs, fishes, reptiles, small animals, and horses. RFID tags help owners and veterinary professionals identify their pets while also getting their medical history and health-related parameters such as pulse rate, heartbeat, body temperature, and calorie intake, which help judge pets' health conditions. As such, the increasing need to monitor pets’ health conditions in real-time to ensure pet well-being is anticipated to increase the adoption of RFID-based wearables.

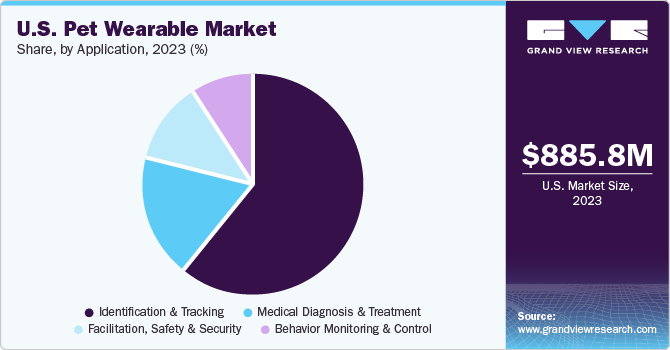

Application Insights

The medical diagnosis and treatment segment is anticipated to register the highest CAGR of more than 15% over the forecast period. The large market share is attributed to the increasing demand for devices to track pets’ physical activity and health conditions and detect any health issues to ensure their safety. Several pets suffer from common health issues like skin allergies, infections, obesity, arthritis, chronic kidney disease, excessive thyroid syndrome, and other issues, which deteriorate pets’ health and incur heavy veterinary expenses. As such, wearables enable pet owners to monitor and keep track of their pet’s health in real-time, which helps in maintaining pet health and cutting down medical expenses.

The identification and tracking segment held the highest market share in 2021 and is expected to retain dominance over the forecast period. According to the data published by the American Humane Association, as of 2021, there were approximately 135 million cats and dogs in the U.S., and around 10 million of these get lost or stolen every year. Out of all the missing pets, more than 80% of pets are never found. As such, pet wearable devices prevent pets from getting lost by providing a real-time location to the pet owners, which is anticipated to drive the adoption of these devices over the forecast period.

Key Companies & Market Share Insights

The market is characterized by the presence of several players introducing innovative products to maintain a competitive edge in the market. With the increasing demand for pet wearables, several new players are emerging to capitalize on the emerging trend in the pet market. As of 2022, there are about 284 pet wearable companies globally. Some prominent players are investing heavily in R&D to introduce new and improved products to stay competitive. For instance, in February 2022, Garmin Ltd. introduced two new dog tracking devices, TT 15 X and T5X. These devices have a long battery life of up to 80 hours and improved tracking functions, which enable pet owners to track dogs from a distance of nine miles. Some prominent players in the U.S. pet wearable market include:

-

Konectera Inc.

-

Datamars

-

Allflex USA Inc.

-

Avid Identification Systems, Inc.

-

Garmin Ltd.

-

Link AKC

-

Invisible Fence

U.S. Pet Wearable Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 784.9 million

Revenue forecast in 2030

USD 2.07 billion

Growth Rate

CAGR of 12.9% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD Million/Billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application

Country scope

The U.S.

Key companies profiled

Konectera Inc.; Datamars; Allflex USA Inc.; Avid Identification Systems, Inc.; Intervet Inc.; FitBark; Garmin Ltd.; Link AKC; Invisible Fence

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Segments Covered in the Report

The report forecasts growth in terms of revenue at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. pet wearable market report based on technology and application:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

RFID

-

GPS

-

Sensors

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Identification & Tracking

-

Behavior Monitoring & Control

-

Facilitation, Safety & Security

-

Medical Diagnosis & Treatment

-

Frequently Asked Questions About This Report

b. The U.S. pet wearable market size was estimated at USD 695.5 million in 2021 and is expected to reach USD 784.9 million in 2022.

b. The U.S. pet wearable market is expected to grow at a compound annual growth rate of 12.9% from 2022 to 2030 to reach USD 2.07 billion by 2030.

b. GPS segment dominated the U.S. pet wearable market with a share of 44.5% in 2021. The growing demand for pet wearable devices for monitoring and security purposes has been driving the growth of the segment

b. Some key players operating in the U.S. pet wearable market include Allflex USA Inc.; Datamars; Avid Identification Systems, Inc.; FitBark; Intervet Inc.; Garmin Ltd.; Invisible Fence; Konectera Inc.

b. Key factors that are driving the U.S. pet wearable market growth include growing awareness among pet owners about ensuring the wellbeing of their pets. Individuals are increasingly adopting pets for various purposes, including entertainment, companionship, fitness, and mental wellbeing.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."