- Home

- »

- Medical Devices

- »

-

U.S. Pharmaceutical Sterility Testing Market Size Report, 2030GVR Report cover

![U.S. Pharmaceutical Sterility Testing Market Size, Share & Trends Report]()

U.S. Pharmaceutical Sterility Testing Market Size, Share & Trends Analysis Report By Type (In-house, Outsourcing), By Test Type, By End-use, By Sample (Sterile Drugs, Biologics & Therapeutics), And Segment Forecasts, 2022 - 2030

- Report ID: GVR-2-68038-403-1

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2020

- Industry: Healthcare

Report Overview

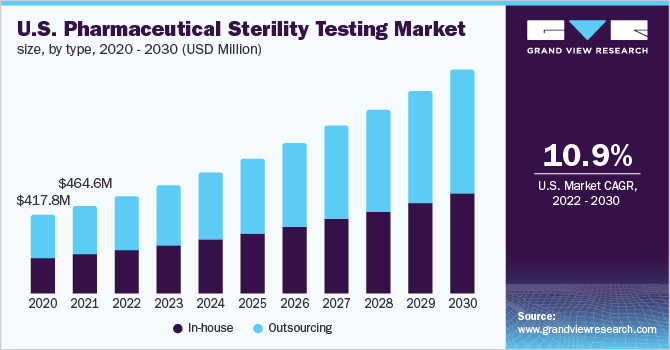

The U.S. pharmaceutical sterility testing market size was valued at USD 464.6 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 10.9% from 2022 to 2030. An increase in R&D activities and the number of drug approvals in the country is one of the major factors supporting the growth. Also, the demand for medicines and effective treatment options is constantly growing due to the high prevalence of arthritis, asthma, diabetes, and other chronic diseases in the country, which is further contributing to the growth of the U.S. market.

During the COVID-19 pandemic, the majority of clinical trials in the U.S. were focused on treating and diagnosing COVID-19. The change in the variant of the coronavirus is increasing the demand for safe and effective therapeutics for treating the coronavirus in the country. For instance, a clinical trial on improving COVID-19 Vaccine Uptake Among Latino and Black Youth is in the recruiting stage in the U.S. Such studies are expected to support the growth of the market in the post-pandemic period.

The U.S. FDA is actively involved in improving R&D funding in healthcare. For instance, in March 2022, the U.S. FDA requested the government to increase healthcare funding by 34.0%. It had requested the U.S. government to increase funding by USD 5 million to improve the safety and security of medical devices. Such initiatives are likely to have a positive impact on the U.S. pharmaceutical sterility testing market.

Rising R&D investment by pharmaceutical and biopharmaceutical companies is expected to increase the number of product launches over the forecast period. This, in turn, is anticipated to drive the demand for sterility testing solutions in the U.S. For instance, Pfizer, Inc.’s R&D budget accounted for USD 11,597 million in 2020, and in the year 2021, the R&D investment of the company increased by 9.5% and reached USD 12,703 million

U.S. medicine spending is expected to rise in the coming years. The IQVIA report on U.S. medicine spending stated that in 2020, U.S. medicine spending accounted for USD 359 billion, and this number is expected to grow to USD 380–400 billion in 2025. This is expected to improve the market's growth in the post-pandemic period.

Type Insights

The outsourcing segment held the largest market share of 54.8% in 2021. The growing demand among pharmaceutical companies to concentrate on core activities such as marketing, and research is one of the key factors supporting the segment's growth. In the case of in-house sterility pharmaceutical testing, pharmaceutical companies must hire and train new employees. This increases the company's costs. This is expected to further improve the demand for outsourcing sterility testing services among pharmaceutical and medical device companies in the U.S.

The in-house segment is expected to grow at a CAGR of 10.8% across the forecast period. Small and medium-sized outsourcing service providers may lack experienced personnel and advanced equipment for conducting sterility testing. This can lead to improper testing of products, which can lead to drug recalls. These factors are supporting the demand for in-house sterility testing, especially among the big pharmaceutical and medical device companies in the U.S.

Product Type Insights

The kits and reagents segment held the highest industry share of 59.7% in 2021. Sterility testing of pharmaceuticals and medical devices is a mandatory requirement. For performing sterility testing, a new, fresh kit is required each time. This increases the consumption rate of kits and reagents used in sterility testing and thus supports its demand. Growing demand for new therapeutics in the country is expected to further support the demand for kits and reagents used in sterility testing.

The service segment is expected to grow at a CAGR of 11.0% during the forecast period. The presence of a significant number of sterility testing service providers such as Laboratory Corporation of America Holdings, Boston Analytical, Charles River Laboratories, and STERIS among others, in the U.S., is one of the key factors supporting the segment’s growth. These service providers are known for their high service quality. The increase in the number of recalls for drugs and medical devices is expected to improve the number of collaborations and partnerships with these service providers. This is likely to support the growth of the segment.

Testing Type Insights

The bacterial endotoxin testing segment accounted for the highest share of 40.2% in 2021. Bacterial endotoxin testing is done for all pharmaceuticals, and the growing demand for pharmaceuticals in the U.S. is supporting the segment’s growth. These tests are also done for medical devices which are used for contact with cerebrospinal fluid or the heart. The high burden of diseases linked with the brain and heart is expected to improve the demand for bacterial endotoxin testing. For instance, the WHO in 2021, stated that cardiovascular diseases are one the major cause of death worldwide accounting for the deaths of 17.9 million every year. This is expected to support segment growth over the forecast period.

Sterility testing is expected to grow at the fastest CAGR of 11.3% during the forecast. The sterility testing segment is further segmented into three main types: membrane filtration, direct inoculation, and product flush. Membrane filtration and direct inoculation are the two main primary tests that are conducted for testing the sterility of pharmaceuticals. The regulatory authorities, such as the U.S. FDA also recommend using these tests for testing the sterility of pharmaceuticals and biopharmaceuticals. This further supports the growth of the segment.

Sample Insights

Pharmaceuticals held the largest market share of 38.5% in 2021. Pharmaceuticals include products such as parenteral, aerosols, ointments, eye drops, and others. There is a growing demand for the aforementioned dosage forms in the U.S. owing to the high disease burden. The U.S. makes a significant investment in pharmaceuticals. According to the Pharmaceutical Research and Manufacturers of America (PhRMA) trade group, pharmaceutical companies in the United States spent USD 102 billion on R&D in 2021. This is expected to increase the adoption of new drugs in the country and thus support the demand for sterility testing of pharmaceuticals.

The biopharmaceuticals segment is expected to grow at a CAGR of 11.2% over the forecast period. There is a growing demand for biologics and biosimilar drugs in the U.S. as they are highly effective in treating serious diseases like cancer, neurological disorders, autoimmune diseases, and others. The COVID-19 pandemic has increased the demand for vaccines in the country, due to this in July 2022, the U.S. government secured 3.2 million doses of the Novavax COVID-19 Vaccine. Such initiatives further support the demand for biopharmaceutical sterility testing in the country.

End-use Insights

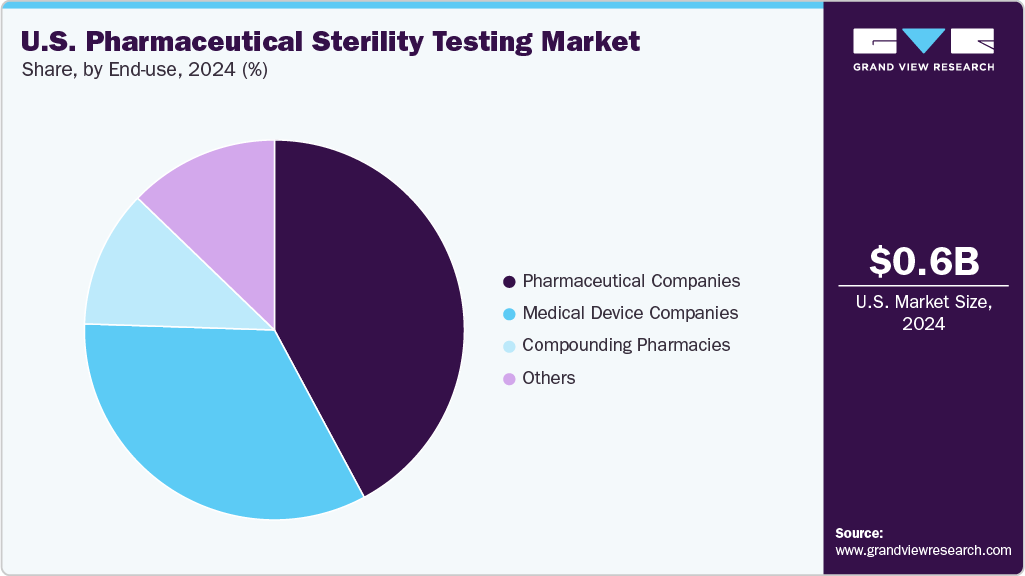

The compounding pharmacies segment is projected to grow with a CAGR of 11.4% over the forecast period. The high demand for customized medicines in the U.S. is one of the major factors supporting the growth of the segment market. Moreover, people in the U.S. are seeking compounded medications as they provide them with a personalized route of administration, and alternative ingredients to avoid allergies. Thus, supporting the segment market of compounding pharmacies.

The pharmaceutical companies segment held the largest share of 42.9% in 2021. The presence of a significant number of pharmaceutical companies such as Pfizer, Biogen, Johnson & Johnson, and others located in the U.S. that are required to conduct sterility testing is one of the key factors supporting the segment’s growth. The growing number of drug recalls by the USFDA due to lack of sterility is further increasing the demand for sterility testing among pharmaceutical companies in the U.S.

Key Companies & Market Share Insights

The market is fragmented due to the presence of a significant number of players. Expansions, digitalization of service delivery for sterility testing, and M&A activities are key strategies undertaken by most of these companies. For instance, in July 2022, Eurofins Scientific expanded its facility for sterility testing in the U.S. with the addition of a new, state-of-the-art clean room facility. This facility will be dedicated to conducting sterilization validations, routine sterility tests, and for performing quarterly dose audits. Some prominent players in the U.S. pharmaceutical sterility testing market include:

-

SGS SA

-

Laboratory Corporation of America Holdings

-

Boston Analytical

-

Charles River Laboratories

-

Pacific Biolabs

-

STERIS

-

Pace Analytical

-

Nelson Laboratories, LLC

-

Infinity Laboratories

-

Thermo Fisher Scientific, Inc.

U.S. Pharmaceutical Sterility Testing Market Report Scope

Report Attribute

Details

Market Size value in 2022

USD 515.7 million

Revenue forecast in 2030

USD 1.18 billion

Growth Rate

CAGR 10.9% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 – 2020

Forecast period

2022 – 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, product type, test type, sample, end-use

Country scope

U.S.

Key companies profiled

SGS SA; Laboratory Corporation of America Holdings; Boston Analytical; Charles River Laboratories; Pacific Biolabs; STERIS; Pace Analytical; Nelson Laboratories, LLC; Infinity Laboratories; Thermo Fisher Scientific, Inc.

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Pharmaceutical Sterility Testing Market Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018-2030. For this study, Grand View Research has segmented the U.S. pharmaceutical sterility testing market report based on type, test type, product type, sample, and end-use:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

In-house

-

Outsourcing

-

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Kits and Reagents

-

Instruments

-

Services

-

-

Test Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Sterility Testing

-

Membrane Filtration

-

Direct Inoculation

-

Product Flush

-

-

Bioburden Testing

-

Bacterial Endotoxin Testing

-

-

Sample Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceuticals

-

Medical Devices

-

Biopharmaceuticals

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Compounding Pharmacies

-

Medical Devices Companies

-

Pharmaceutical Companies

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. pharmaceutical sterility testing market size was estimated at USD 464.6 million in 2021 and is expected to reach USD 515.7 million in 2022.

b. The U.S. pharmaceutical sterility testing market is expected to grow at a compound annual growth rate of 10.9% from 2022 to 2030 to reach USD 1.18 billion by 2030.

b. The outsourcing segment dominated the U.S. pharmaceutical sterility testing market with a share of 54.8% in 2021. This is attributable to the increasing outsourcing of sterile pharmaceutical testing services.

b. Some key players operating in the U.S. pharmaceutical sterility testing market include SGS SA; Laboratory Corporation of America Holdings; Boston Analytical; Charles River Laboratories International, Inc.; Pacific Biolabs; STERIS; Pace Analytical; Nelson Laboratories, LLC; Infinity Laboratories; and DYNALABS LLC.

b. Key factors that are driving the market growth include increasing R&D activities and rapid approval and launch of safe products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."