- Home

- »

- Healthcare IT

- »

-

U.S. Practice Management System Market Size Report, 2030GVR Report cover

![U.S. Practice Management System Market Size, Share & Trends Report]()

U.S. Practice Management System Market Size, Share & Trends Analysis Report By Product (Integrated, Standalone), By Component, By Delivery Mode, By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-193-1

- Number of Pages: 90

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Healthcare

Market Size & Trends

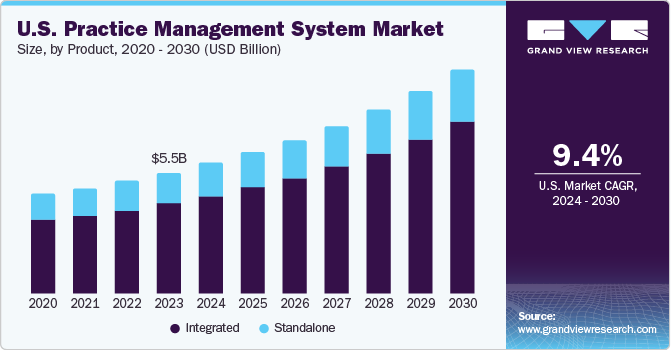

The U.S. practice management system market size was estimated at USD 5.5 billion in 2023 and is expected to grow at a CAGR of 9.40% from 2024 to 2030. The rising need to achieve operational efficiency, enhanced documentation with minimal errors, and financial viability for physicians' practice are the key facilitators for the adoption of practice management systems. Moreover, rapid penetration of IT and a rising number of supportive federal initiatives in the U.S. to amalgamate health records on a single platform are further anticipated to provide lucrative growth opportunities to the market.

Increasing pressure to curb healthcare costs along with changing dynamics of hospital/healthcare settings is fueling the demand for practice management systems in the U.S. Factors such as a rise in focus on implementation of high-quality care and cost-effectiveness are also likely to contribute to the market development. Healthcare institutes are witnessing a paradigm shift as a result of the changing dynamics of the business models in the U.S.

Strategic initiatives such as partnership agreements, collaborations, and mergers by the key players to provide cloud-based solutions to their customers are expected to drive market growth. For instance, in November 2023, Thoma Bravo acquired NextGen Healthcare, a cloud-based healthcare technology solutions provider, for USD 1.8 billion. This move was expected to strengthen Thoma Bravo’s position in the software investment industry.

The development of new value-added services such as integration of practice management systems with other healthcare IT solutions, such as laboratory information systems and Computerized Physician Order Entry (CPOE), is anticipated to propel the market demand in the U.S. over the next few years. For instance, in Apri 2023, eClinicalWorks announced integrating ChatGPT and AI models into its practice management system and EHR solutions. This integration brings several advancements that are expected to improve workflow efficiencies and enhance the point-of-care experience for clinicians. By leveraging AI technology, eClinicalWorks aims to reduce clicks and enable clinicians to access relevant data seamlessly.

Market Concentration & Characteristics

The industry is experiencing a high level of innovation, as multiple market participants roll out new products to enhance their market presence. For instance, in May 2022, Epocrates, under Athenahealth, launched a Long COVID-19 Tool and added late-breaking updates to its growing Library of Clinical Decision Support Guidelines.

The market players are leveraging the strategies such as collaborations and partnerships, to promote reach of their offerings and increase their product capabilities in the country. For instance, in September 2023, Veradigm LLC partnered with On Belay Health Solutions, Inc., a primary care provider. This collaboration would help primary care providers with improved patient health results and enhance their practices.

Health Insurance Portability and Accountability Act (HIPAA) specifies the patient data privacy standards in healthcare. Healthcare IT providers and vendors of electronic health record, telemedicine, and mHealth must disclose where they are transmitting patient data and obtain patient consent for it. For instance, in August 2021, the federal government proposed the Federal IT Strategic Plan 2020-2025, which focuses on improvising the access, exchange, and usage of electronic health information.

Market players leverage the strategy of product expansion to increase their product capabilities and promote the reach of their product offerings. For instance, in March 2022, Allscripts Healthcare, LLC launched a new application-Expo-an EHR technology-providing a broad range of integrated solutions for practice management.

The level of geographical expansion is moderate. Some prominent companies are implementing various strategies to strengthen their market position in the country. For instance, in May 2023, P1 Dental Partners selected Henry Schein, Inc.’s software: Dentrix Ascend, a cloud-based dental practice management software, and Jarvis Analytics, a dental analytics tool. Selection aims to provide P1 Dental Partners dentists with a seamless practice management workflow across over 40 practices, helping elevate patient care and drive practice success.

Product Insights

The integrated segment dominated the market with a revenue share of over 74% in 2023 and is expected to witness the fastest CAGR from 2024 to 2030. Integrated systems are gaining popularity due to the trend of centralization in healthcare. Integrated segment is further bifurcated into Electronic Health Records (EHR), e-Rx, patient engagement, and billing systems.

Standalone systems prioritize the billing and administrative aspects of an organization, especially scheduling. Practice management systems, on the other hand, can seamlessly integrate with other software to improve efficiency and communication among various departments. This integration is particularly favored in large-scale facilities, as it reduces administrative and medical errors.

Component Insights

The software segment dominated the market with a revenue share of over 66% in 2023, owing to increasing adoption aided by government reforms and rising technological advancements in the field of healthcare IT.

The services segment is expected to experience the fastest CAGR during the forecast period. Constant product launches along with improvements in the existing versions are also supporting the segment development. For instance, in November 2023, Veradigm LLC launched Veradigm Intelligent Payments to help improve payment time, increase payment rates, and reduce reconciliation time for healthcare provider practices. The solution was included in Veradigm Payerpath through a partnership with RevSpring, a provider of healthcare payment and engagement solutions.

Delivery Mode Insights

The web-based practice management systems segment accounted for the largest revenue share of over 47% in 2023, owing to their benefits, such as affordability, quick Return on Investment (RoI), and ease of deployment.

The cloud-based segment is expected to witness the fastest CAGR over the forecast period, due to enhanced reliability and faster processing compared to other delivery models. Additionally, cloud-based delivery provides easily accessible information that can be retrieved from remote locations. This technology is being widely adopted nationwide.

Although the adoption of cloud-based solutions is currently sluggish in rural areas, it is anticipated to improve in the coming years. Practice Studio, one of the leading practice management solutions, offers both web- and cloud-based versions to enhance usability in both urban and rural settings across the country.

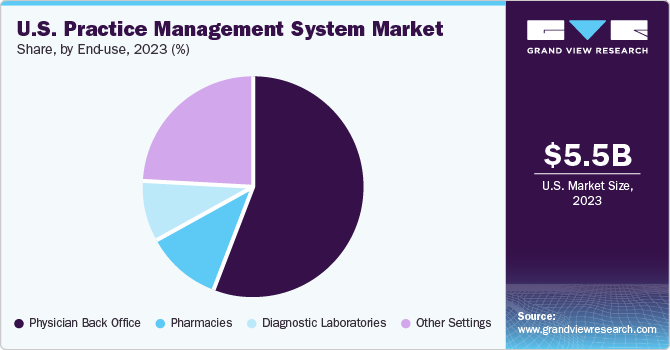

End-use Insights

The physician back office segment held the largest revenue share of over 56% in 2023 and is projected to witness remunerative growth during the forecast period. The growth is attributed to the rising need for assistance in managing change, effective revenue cycle management, and implementation of a well-defined organizational structure within medical practice enhances productivity and operations.

The other settings segment is expected to witness the fastest CAGR over the forecast period owing to factors such as increased investments by healthcare centers, hospitals, and clinical workstations in centralizing and digitalizing workflows. Practice management systems that incorporate revenue cycle management, patient portals, and clinical intelligence systems contribute to this centralization. Moreover, an expected increase in the number of these facilities is likely to result in higher revenue generation.

Key U.S. Practice Management System Company Insights

The market is fragmented, with the presence of multiple major players. Some of the emerging companies operating in the U.S. include ABELMed, ACOM Health, Aprima, ClinicTracker Connect, First Medical Solutions, and MDSuite.

Key U.S. Practice Management System Companies:

- Henry Schein, Inc.

- Veradigm LLC (Allscripts Healthcare, LLC)

- AdvantEdge Healthcare Solutions

- Athenahealth, Inc.

- Cerner Corporation (Oracle)

- GE Healthcare

- McKesson Corporation

- EPIC Systems Corporation

- NXGN Management, LLC.

- eClinicalWorks

- CareCloud, Inc.

- Kareo, Inc.

- AdvancedMD, Inc.

- DrChrono, Inc. (EverCommerce)

- CollaborateMD Inc. (EverCommerce)

- OfficeAlly Inc.

Recent Developments

-

In January 2024, CareCloud, Inc. partnered with Kovo HealthTech Corporation, a healthcare technology and billing-as-a-service company. This partnership aims to empower healthcare providers with the latest technology and streamline their operations for improved patient care with advanced PM software, EHR solutions, and other solutions.

-

In December 2023, Veradigm LLC launched a conversational AI agent for Practice Fusion Billing Services. The AI can help answer questions in a conversational format and simplify the billing process for independent healthcare providers. This enhancement aimed to optimize financial management for healthcare providers and meet their needs.

-

In August 2023, Henry Schein, Inc. acquired majority shares of Large Practice Sales (LPS) LLC, a leading consultant to individual dental practices. LPS aids practices in their sales or partnerships with larger general practices & dental specialists.

U.S. Practice Management System Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 10.1 billion

Growth rate

CAGR of 9.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, component, delivery mode, end-use

Country scope

U.S.

Key companies profiled

Henry Schein, Inc., Veradigm LLC (Allscripts Healthcare, LLC), AdvantEdge Healthcare Solutions, Athenahealth, Inc., Cerner Corporation (Oracle), GE Healthcare, McKesson Corporation, EPIC Systems Corporation, NXGN Management, LLC. (Thoma Bravo), eClinicalWorks, CareCloud, Inc., Kareo, Inc., AdvancedMD, Inc. (Global Payments Inc.), DrChrono, Inc., CollaborateMD Inc., OfficeAlly Inc., Accumedic Computer Systems, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Practice Management System Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. practice management system market report based on product, component, delivery mode, and end-use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Integrated

-

Integrating Software

-

EHR/EMR

-

e-Rx

-

Patient Engagement

-

Others

-

-

Standalone

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

-

Delivery Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

On Premise

-

Web-Based

-

Cloud-Based

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Physician Back Office

-

Pharmacies

-

Diagnostic Laboratories

-

Other Settings

-

Frequently Asked Questions About This Report

b. The U.S. practice management systems market size was estimated at USD 5.5 billion in 2023 and is expected to reach USD 5.9 billion in 2024.

b. The U.S. practice management systems market is expected to grow at a compound annual growth rate of 9.40% from 2024 to 2030 to reach USD 10.1 billion by 2030.

b. The integrated segment dominated the U.S. practice management systems market with a revenue share of over 74% in 2023. This can be attributed to benefits such as improved efficiency and communication across different departments, as well as decreased administrative and medical errors.

b. Some key players operating in the U.S. practice management systems market include Henry Schein MicroMD; Allscripts Healthcare Solutions, Inc., AdvantEdge Healthcare Solutions, Inc.; Cerner Corporation, GE Healthcare, and McKesson Corporation

b. Key factors that are driving the U.S. practice management systems market growth include the Increasing pressure to curb healthcare costs along with changing dynamics of hospital/healthcare, rising focus on implementing cost-effective and high-quality care.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."