- Home

- »

- Advanced Interior Materials

- »

-

U.S. Resilient Flooring Market Size, Industry Report, 2020-2027GVR Report cover

![U.S. Resilient Flooring Market Size, Share & Trends Report]()

U.S. Resilient Flooring Market Size, Share & Trends Analysis Report By Product (Luxury Vinyl Tiles, Vinyl Sheet & Floor Tile, Linoleum), By End Use (Residential, Commercial), And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-867-1

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry: Advanced Materials

Report Overview

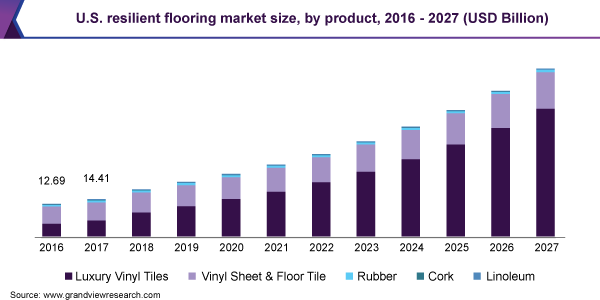

The U.S. resilient flooring market size was valued at USD 21.04 billion in 2019 and is expected to grow at a compounded annual growth rate (CAGR) of 6.4% from 2020 to 2027. Rising awareness regarding insulation, owing to increasing energy costs and growing importance for energy conservation is expected to drive the market growth.

The surging demand for flooring in the construction industry and the demand for insulation are expected to boost industry growth. The increased availability of innovative construction solutions with attributes, such as low maintenance and high durability, is anticipated to impact the market favorably.

The U.S. accounts for highest consumption in terms of volume. This can be attributed to the high penetration of the product in the residential sector, with an increasing number of single-family houses as well as the strengthening of residential replacement market across the country.

Technological advancements in the production of vinyl products have provided the manufacturers with an ability to develop realistic tiles duplicating natural looks of other flooring products such as stone and wood. Furthermore, manufacturers offer customized products having decorative and unique looks that are unavailable in different flooring types.

The market for resilient flooring is highly competitive in nature and companies can grab a larger share of the market only by innovating products they have and by further developing new products. Majority of the companies in the market spend a significant amount of money on R&D to develop new products that will be better than any other product available in the market.

The NSF/ANSI 332 Sustainability Assessment Standard for Resilient Floor Coverings offers means to evaluate the sustainability profile of resilient floor coverings, which aids in providing a thorough communication of information which is accurate, accurate, and not misleading about the social and environmental aspects associated with the production and use of resilient floor coverings

Product Insights

Luxury vinyl tiles (LVT) led the U.S. resilient flooring market and accounted for more than 56.0% share of the total revenue in 2019, attributed to the durability and low-cost benefits of LVT. The product can be used to create exceptional visual appeal replicating concrete, natural stone, metal, wood, and several other unique finishes in both designs and texture.

Linoleum is a natural ingredient-based floor covering, comprising all-natural ingredients including linseed oil, which is 100% biodegradable and obtained from flax plant; wood flour; limestone; and jute resin. Rising awareness toward the use of biodegradable materials in the U.S. on account of increasing importance of waste management and recycling is expected to open new growth opportunities for linseed oil-based linoleum in resilient flooring market.

Vinyl sheets and floor tiles are expected to witness a CAGR of 7.2% over the forecast period, owing to their cost-effectiveness, high durability, and low maintenance cost. In addition, water resistance property of vinyl sheets and floor tiles makes them the most preferred flooring material for use in bathroom, kitchen, laundry rooms, and moisture-prone areas in homes.

Rising demand for eco-friendly flooring materials is expected to drive the demand for cork resilient flooring over the projected period. Cork flooring is a natural product and shows the natural variations occurring in the bark obtained from the tree. However, the flooring is not suitable for bathrooms and other such moisture-prone areas as it absorbs moisture.

End-use Insights

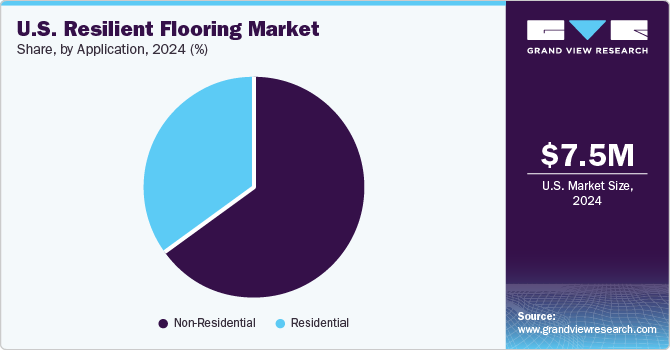

Residential construction led the market and accounted for 58.0% of the total revenue share in 2019. This can be attributed to its wide use in residential applications on account of their low cost, highly durable nature, and resistance to shock, stain, and dirt. The growing housing sector in the U.S. in light of regulatory support is expected to increase the product demand owing to their high anti-slip and scratch resistance properties.

The growth in the number of single-family houses in the country along with rising disposable income of the consumers are among the various factors that are projected to drive product demand in residential application sector. Favorable growth of housing sector in the country on account of easy availability of home loans to individuals is expected to have a strong impact on the market growth over the projected period.

Use of resilient flooring for the non-residential sector is estimated to reach 778.1 million square meters by 2027, owing to rising demand for highly durable and cost-efficient resilient flooring for use in high-traffic commercial and industrial sectors. The development of new products and hassle-free installation techniques has considerably driven the commercial flooring market.

The industry is projected to witness growth over the forecast period in various sectors including healthcare, office, institution, retail, and other commercial areas with the rising demand for flooring solutions having anti-bacterial, anti-slip, and water-resistant properties that will also be cost-effective and eco-friendly.

Key Companies & Market Share Insights

The market is characterized by strong competition by prominent players operating across the U.S. A high degree of integration is observed between the prominent players to achieve optimum business growth in the market. Contracts, agreements, mergers and acquisitions, and joint ventures are undertaken in order to extend the business portfolio and reduce the overall costing of the product.

Key players primarily compete on the basis of product quality, customer service, and product pricing. However, product quality is considered a minimum competing for factor by the industry players. Customer service is estimated to be the most influencing factor for the industry players to maintain the competition. Some of the prominent players in the U.S. resilient flooring market include:

-

Mohawk Industries, Inc.

-

Armstrong Flooring, Inc.

-

Tarkett S.A.

-

Gerflor

-

Polyflor Ltd

-

Shaw Industries Group, Inc.

-

Beaulieu International Group

-

Trelleborg AB

-

Forbo Flooring Systems

-

Interface, Inc.

U.S. Resilient Flooring Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 24.29 billion

Revenue forecast in 2027

USD 65.2 billion

Growth Rate

CAGR of 15.2% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Volume in Thousand Square Meter, Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use

Country scope

The U.S.

Key companies profiled

Mohawk Industries, Inc.; Tarkett S.A.; Armstrong Flooring, Inc.; Shaw Industries Group, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts volume and revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the U.S. resilient flooring market report on the basis of product and end use:

-

Product Outlook (Volume, Thousand Square Meters; Revenue, USD Million, 2016 - 2027)

-

Luxury Vinyl Tiles

-

Vinyl Sheet & Floor Tile

-

Linoleum

-

Cork

-

Rubber

-

-

End-use Outlook (Volume, Thousand Square Meters; Revenue, USD Million, 2016 - 2027)

-

Residential

-

Commercial

-

Frequently Asked Questions About This Report

b. Some of the key players operating in the U.S. resilient flooring market include Mohawk Industries, Inc., Armstrong Flooring, Inc., Tarkett S.A., Gerflor, Polyflor Ltd., Shaw Industries Group, Inc., Beaulieu International Group, Trelleborg AB, Forbo Flooring Systems, and Interface, Inc.

b. The key factors that are driving the U.S. resilient flooring market include growing construction industry in the country, coupled with rising product penetration, and growing awareness regarding the insulation

b. The U.S. resilient flooring market size was estimated at USD 21.04 billion in 2019 and is expected to reach USD 24.29 billion in 2020.

b. The U.S. resilient flooring market is expected to grow at a compound annual growth rate of 15.2% from 2019 to 2027 to reach USD 65.2 billion by 2027.

b. Luxury vinyl tiles dominated the U.S. resilient flooring market with a share of 56% in 2019, which can be attributed to its durability and low-cost benefits

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."