- Home

- »

- Consumer F&B

- »

-

U.S. RTD Organic Tea Market Size Report, 2021-2028GVR Report cover

![U.S. RTD Organic Tea Market Size, Share & Trends Report]()

U.S. RTD Organic Tea Market Size, Share & Trends Analysis Report By Distribution Channel (Supermarkets/Hypermarkets, Online), By Type (Black, Green), By Region (Southeast, Southwest), And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68038-388-1

- Number of Pages: 60

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- Industry: Consumer Goods

Report Overview

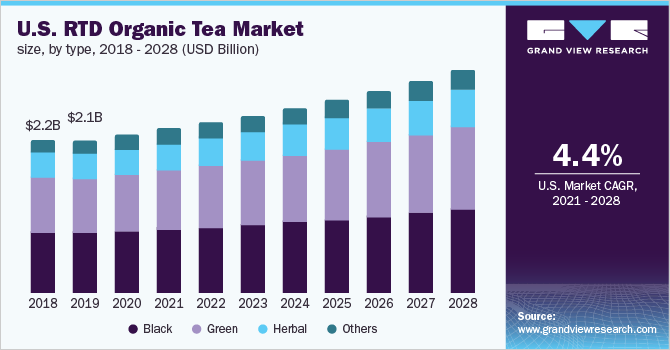

The U.S. RTD organic tea market size was valued at USD 2.19 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 4.4% from 2021 to 2028. The rising need for convenience is expected to boost the demand for various ready-to-drink (RTD) products over the forecast period. Rapidly changing consumer lifestyles that encourage on-the-go consumption of food and beverages and a growing trend to replace meals with smaller nutritional snacks have led to an increase in the adoption of ready-to-drink tea. The COVID-19 pandemic has reshaped the demand for healthy and organic drinks. Consumers have become more conscious of their health, and, thus, shifting their preference to more natural, organic, and immunity-boosting drinks. These market trends are creating new scope for RTD green and herbal tea products, owing to their excellent antioxidant properties.

In addition, the trend of being proactive in the prevention of chronic health problems is creating a staggering demand for ready-to-drink tea as it contains antioxidants and other essential ingredients. The rising importance of flavonoid-based food and beverages, which are known to have antioxidant properties, is expected to drive the market over the next few years. In addition, new market entrants, such as cafés, are launching their in-house products to target local customers before expanding their business across the country. For instance, in February 2019, North Carolina-based Tama Café introduced its line of RTD sparkling teas, which are made of organic green tea and other all-natural ingredients.

The Southeast region is one of the major regions contributing to the market growth, in terms of consumption as well as production. A high concentration of manufacturers including key players, such as Unilever and Coca-Cola Company, is the key factor contributing to region-level growth. Organic tea has multiple benefits. Through various studies, it has been found that it helps enhance digestive health by improving the activity of healthy bacteria in the gut. Furthermore, it contains theanine, which reduces anxiety. In addition, it intensifies body relaxation by decreasing drowsiness. The introduction of flavored ready-to-drink organic iced teas with low caffeine content is especially expected to witness high demand in the years to come.

Type Insights

The black RTD organic tea segment accounted for the largest revenue share of 38.6% in 2020. It is one of the most commonly consumed bottled tea in the U.S. The popularity of the product is fueled by new research into the possible health benefits and the growing demand for convenient products. It has a high concentration of antioxidants and polyphenols that help in reducing blood pressure, risk of diabetes, rheumatoid arthritis, and Parkinson’s disease. Furthermore, it might help in decreasing the development of cancer cells in the body, awareness of such benefits among people is expected to boost the segment growth.

The green RTD organic tea segment is expected to register the fastest CAGR of 4.7% during the forecast period. It has been recognized as a significant source of catechins. Studies have demonstrated that catechins can help in preventing Cardiovascular Diseases (CVDs) and cancer. Furthermore, various research-based backing of green tea benefits is expected to favor the product demand. For instance, a study from MDPI in the year 2019, proved that the bioactive compounds of green tea can be helpful in the prevention and treatment of CVDs. Several players operating in this market are introducing products in various flavors, such as jasmine, rose, and orange, for improved consumer experience.

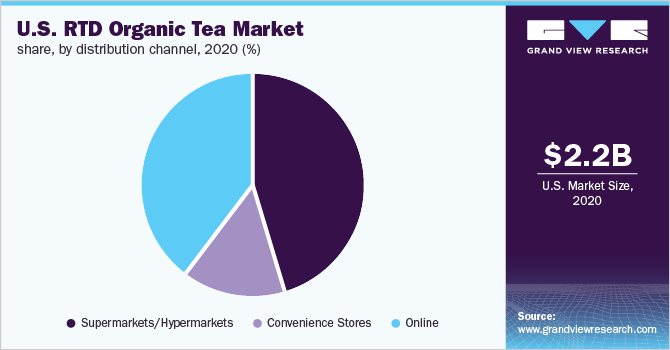

Distribution Channel Insights

The supermarkets/hypermarkets segment held the largest revenue share of 45.5% in 2020. Among the multiple retail outlets available, supermarkets/hypermarkets are favored in the U.S. because they have a wide variety of RTD teas from multiple brands, which is expected to fuel the segment growth. Most consumers prefer buying products after physically examining the product quality. Furthermore, membership programs offered by these stores include benefits, such as discounts and access to unlimited free delivery services, that enhance the shopping experience of the customers. Most of the products are available at big supermarkets, such as Walmart and Kroger.

The online distribution channel segment is expected to witness the fastest CAGR over the forecast period. The shift in consumer shopping behavior and increased penetration of technology and smartphones are major factors driving product sales through online distribution channels. Moreover, benefits offered by online platforms, including shopping from the comfort of one’s home, doorstep delivery, free shipping, subscription services, and discounts, are attracting millennials and the young generation, thereby resulting in increasing popularity and usage of online sites.

Regional Insights

The Southeast region held the largest revenue share of the global market of more than 29% in 2020. The growing demand for healthy organic drinks in states, such as North Carolina, Florida, Georgia, Mississippi, Tennessee, and Virginia, drives the market growth in this region. Moreover, an increased acceptance of RTD tea as a popular beverage among consumers, especially among millennials, is anticipated to increase the product demand. In addition, an increasing number of RTD organic tea product launches are contributing to the growth of the market.

The Southwest region is expected to register the fastest CAGR over the forecast period. Key players in the market are launching new beverages containing functional ingredients in various flavors. For instance, in July 2020, Tempo Beverages announced the launch of two new CBD-infused RTD beverages. These drinks are launched in two variants-green tea with ginger &turmeric and hibiscus tea with blackberry &lemon.

Key Companies & Market Share Insights

The market is fragmented with the presence of several local and international players. Manufacturers in the market are increasingly focusing on product & packaging innovation, labeling, and marketing campaigns as these factors play a vital role in the overall image of the brand and its products. Established players have been expanding their product portfolios by incorporating new and innovative beverages to extend their consumer base. For instance, in March 2021, Lipton, a renowned brand of Unilever USA, announced the launch of Lipton Herbal beverages. Some of the key players operating in the U.S. RTD organic tea market are:

-

Unilever

-

The Coca-Cola Company

-

AriZona Beverages USA

-

Tama Tea

-

Numi, Inc.

-

ITO EN (North America) Inc.

-

Teatulia, PBC

-

Harney & Sons Fine Teas

-

Guayakí Yerba Mate

-

Tejava

-

Hain Celestial

-

Zevia

U.S. RTD Organic Tea Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 2.27 billion

Revenue forecast in 2028

USD 3.09 billion

Growth rate

CAGR of 4.4% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million/billion and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Country scope

U.S.

Region scope

Southeast; Northeast; Midwest; West; Southwest

Key companies profiled

Unilever; The Coca-Cola Company; Numi, Inc.; ITO EN (North America) Inc.; Tama Tea; Harney& Sons Fine Teas; Guayakí Yerba Mate; Tejava; Hain Celestial; Zevia; Teatulia; PBC; AriZona Beverages USA

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the U.S. RTD organic tea market report on the basis of type, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2016 - 2028)

-

Black

-

Green

-

Herbal

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2016 - 2028)

-

Supermarkets/Hypermarkets

-

Convenience stores

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2028)

-

Southeast

-

Northeast

-

Midwest

-

West

-

Southwest

-

Frequently Asked Questions About This Report

b. The U.S. RTD organic tea market size was estimated at USD 2.19 billion in 2020 and is expected to reach USD 2.27 billion in 2021.

b. The U.S. RTD organic tea market is expected to grow at a compound annual growth rate of 4.4% from 2021 to 2028 to reach USD 3.09 billion by 2028.

b. The Southeast region held the largest share of 29.6% in 2020 for the market. The growing demand for healthy organic drinks in states such as North Carolina, Florida, Georgia, Mississippi, Tennessee, and Virginia drive the ready to drink organic tea market in this region.

b. Some key players operating in the U.S. ready to drink organic tea market include Unilever, The Coca Cola Company, AriZona Beverages USA, Tama Tea, Numi, Inc., Guayakà Yerba Mate, Tejava, Hain Celestial, and Zevia.

b. The rising demand for convenience is expected to boost the demand for various ready-to-drink products over the forecast period. Rapidly changing consumer lifestyles that encourage on-the-go consumption of food and beverages and a growing trend to replace meals with smaller nutritional snacks have led to an increase in the adoption of ready-to-drink tea

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."